Deciphering the Bank of Japan - October Policy Meeting and Press Conference

The only Bank of Japan analysis piece you will need (seriously).

▷ Market Price Action: JPY driving NKY and NDX (down), USDJPY 152’s return

▷ Ueda explicitly retires the phrase “more/ample time” to assess for the next rate hike - this “ample time” was the dovish pivot from the previous BOJ meeting in September.

▷ Core CPI revision for FY2025 lowered to 1.9% from 2.1%

▷ “US economy risk” now added to the official text of the latest outlook report

▷ “If the outlook is realized, policy rates will be raised” - what this really means

I honestly cannot recall a Bank of Japan monetary policy meeting press conference that was more predisposed to be as bullshit as Governor Ueda’s October 2024 presser.

Note that I am not saying this was a “non-event” by any means - there are plenty of critical points to dissect and take away from this. I am saying that the setup going in made for a clearly foreseeable and predestined bullshit exchange between reporters and Ueda.

What is at the forefront of everyone’s mind right now in Japan?

Politics, and foreign exchange. As in the sudden, self-inflicted implosion of the LDP ruling coalition’s majority in the House of Representatives not even a month into PM Ishiba’s “term in office,” as well as the 6-week, +10% rally on USDJPY, now firmly back into the 150s.

And what are the topics that every major central banker will always steer clear of commenting on, and be forgiven for doing so (and rightly so) as per conventional protocol?

Politics, and foreign exchange.

Indeed, this was a press conference for a no-change decision that was littered with endless and useless questions related to Japan’s raging political dumpster fire set ablaze on Sunday, when Asia’s most stable major democracy shattered the ruling coalition’s status quo majority at the hands of the second lowest voter turnout in the postwar era.

I really don’t understand why these clowns in financial media, who are members of a tiny select group of extremely privileged direct press access to the Bank of Japan governor following an official policy decision, would throw away their question on topics that they (should) know will just result in some iteration of “no comment.” I suppose it could be chalked up to just another characteristically Japanese worker bee who is merely going about their day at work by unproductively going through the motions to collect a frozen base salary in exchange for job security - the byproduct of what a non-merit-based system produces. Still, they’re ceding and wasting immense responsibility.

To be fair, Governor Ueda didn’t actually convey his non commentary solely with a verbatim “cannot comment” - much of his almost unconditional responses to a spectrum of questions was bringing everything back to the Bank of Japan’s official slogan since July’s shock rate hike :

“…if the outlook is met, BOJ will raise rates accordingly.”

As in…

Q: Gov Ueda, how will you work with a non-majority ruling LDP coalition/fractured opposition government/leadership uncertainty? (or…) Gov Ueda, will the path of QT that BOJ has laid out have to now be altered upon an expected increase in fiscal deficit spending in the given state of parliament?

A: (After “I cannot comment on political matters, but…”) "It is important to explain and adhere to our stance that we will adjust the degree of easing if the economic and price outlook is realized." (This quote is Ueda verbatim in response to one of many political questions.)

And so, because Bank of Japan cannot actually say “we are on hold because of the domestic political turmoil that has exploded, as well as the consequential US elections” - for which, they know that everybody knows that this is what is very obviously behind today’s no change - they need to sprinkle in various other “reasons” and explanations to justify being on-hold.

After all, isn’t it so that “if the outlook is realized, rates will be raised?” And (redundantly and obviously), that BOJ will not hike rates while markets are in mayhem (as per Deputy Gov Uchida 2 days following NKY -12% single day Black Monday drop)?

Well, given Japan CPI has been north of 2% since May 2022, and equity markets are currently off their record highs by just -5%, compared to being -25% in a bear market plunge on Black Monday, there is a need to manufacture reasons why they aren’t following their own conditions that are being met.

I will go over those reasons, for which everybody is currently taking seriously at face value, reading into and extrapolating from (a huge mistake in approach), and I will provide you with the actual big picture underway.

Here are the key points from this meeting and press conference that are making the headlines, which I will give my take on for each:

Much like Powell and the term “transitory,” Ueda has explicitly retired the phrasing of “more/ample time” to assess for the next rate hike - this “ample time” was the dovish pivot from the previous BOJ meeting in September.

CPI revision for FY2025 lowered to 1.9% from

The heavily cited “US economy risk” has now been added to the text of this latest quarterly outlook report released with the October BOJ policy statement.

“If the outlook is realized, policy rates will be raised” - what this really means.

But before we get to those, let’s take a quick look at market price action on the day, as it appears NDX may have a down day - or not, but more importantly, is being driven by Japan in the immediate term.

Markets

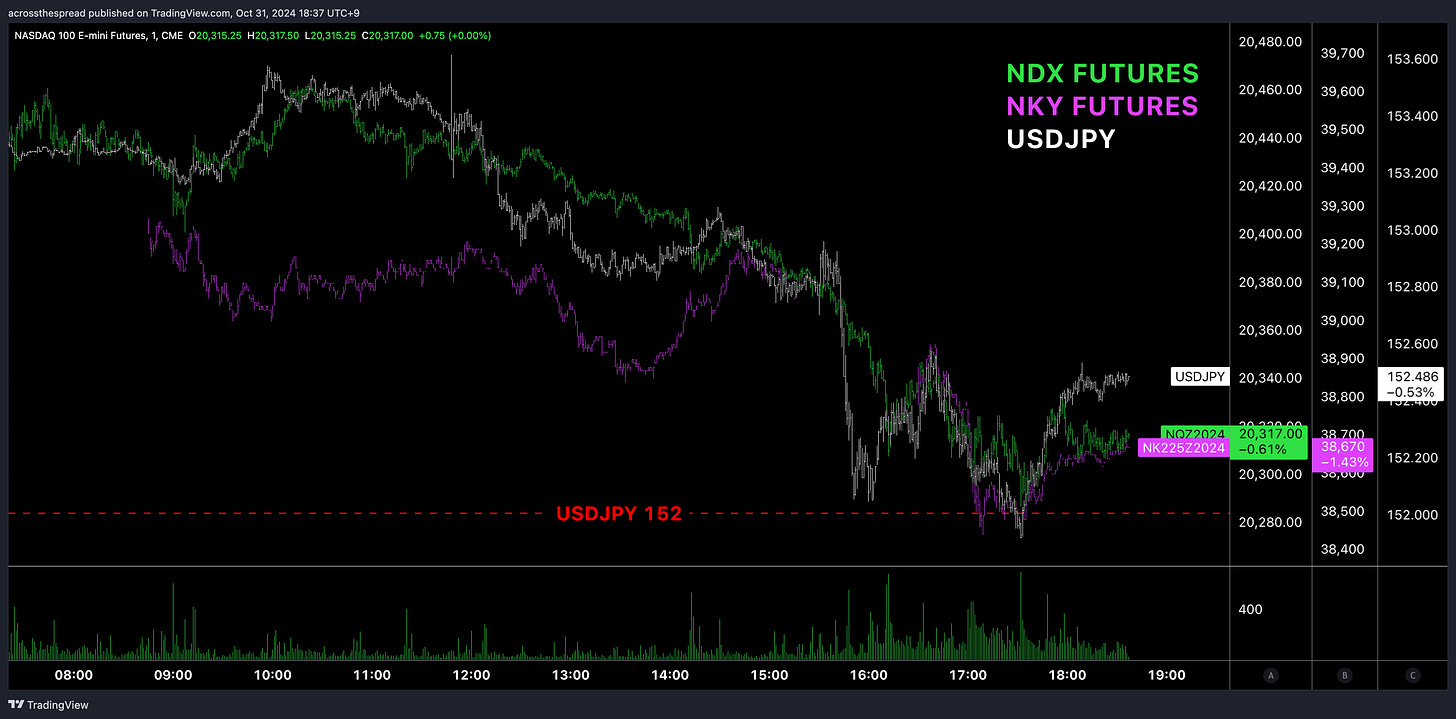

As per my mid-Ueda press conference Note:

Do not read into mid-press conf short term market movements - especially with a BOJ Gov who is once again providing nothing new to “price in,” and far more importantly - because we still have unsettled matters of: FOMC, as well as who will govern Japan & America.

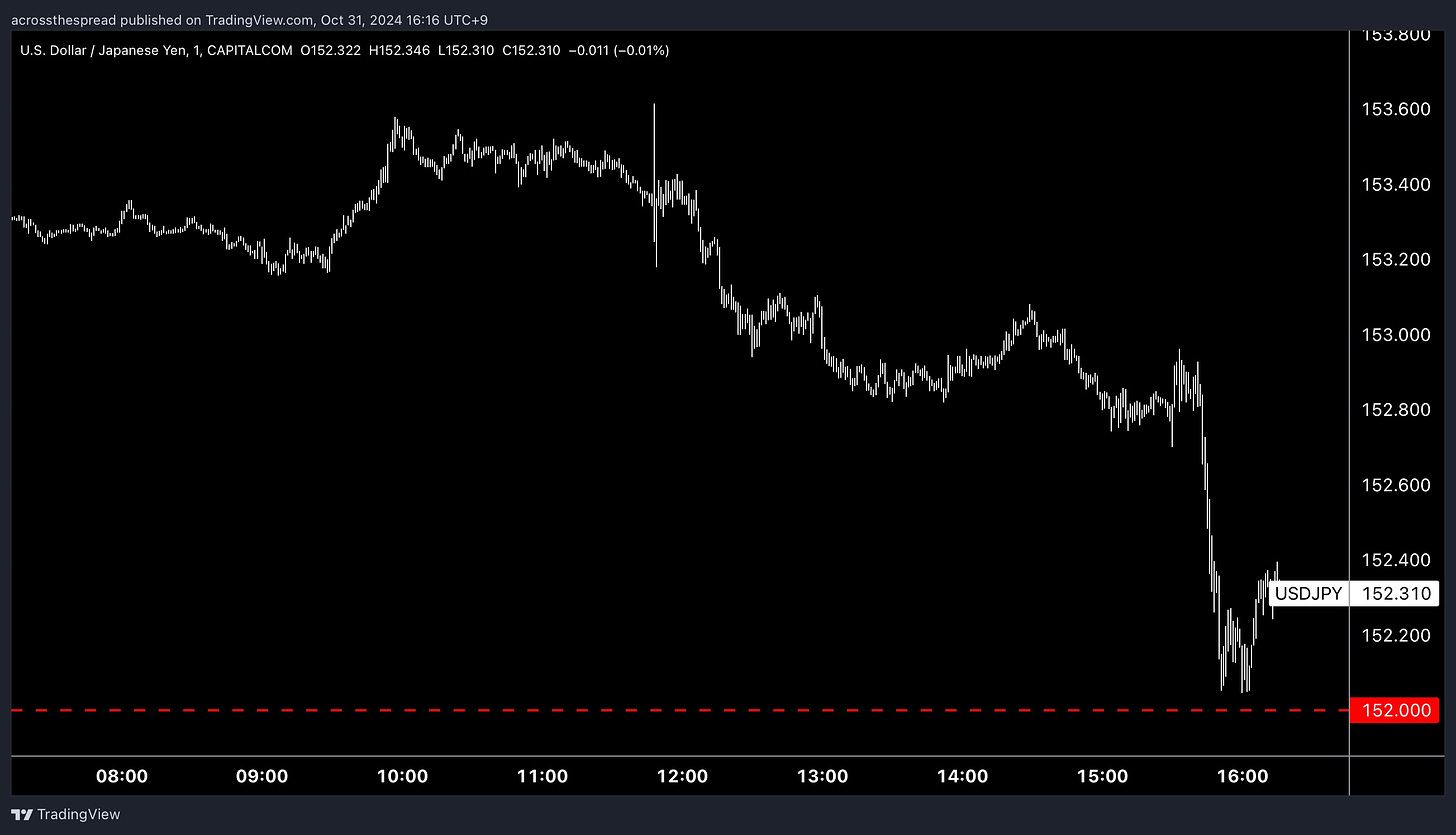

Nobody (human active manager) is trading JPY mid-press conf in such size to move spot rate right now based on Ueda’s word for word of saying nothing.

That absence of flow leaves the algos and bots’ (+🇯🇵retail) activities as more visibly pronounced in market impact.

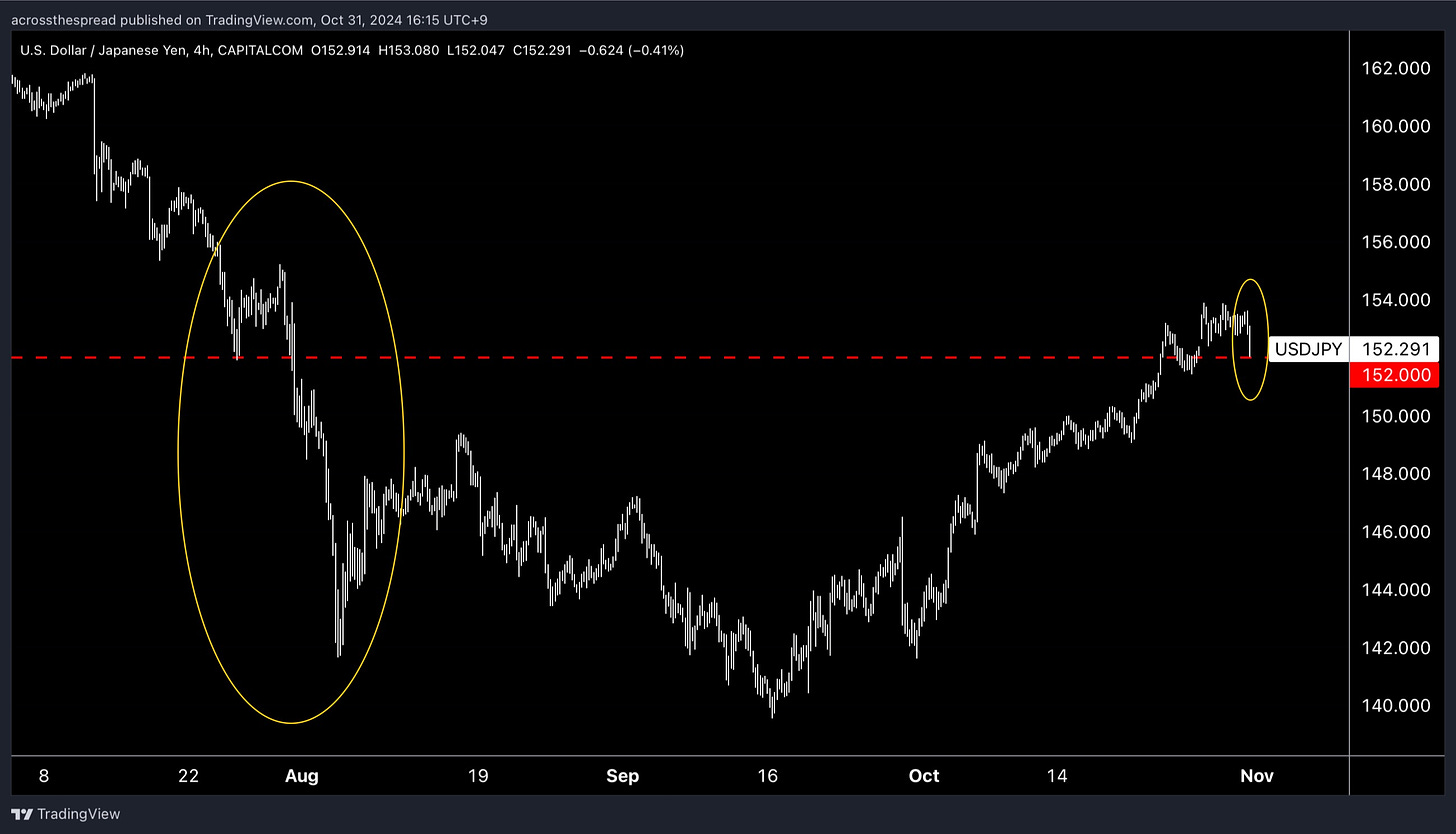

And it seems that there may be “PTSD support” at the 152 level to the downside in the immediate term.

(link to Note here)

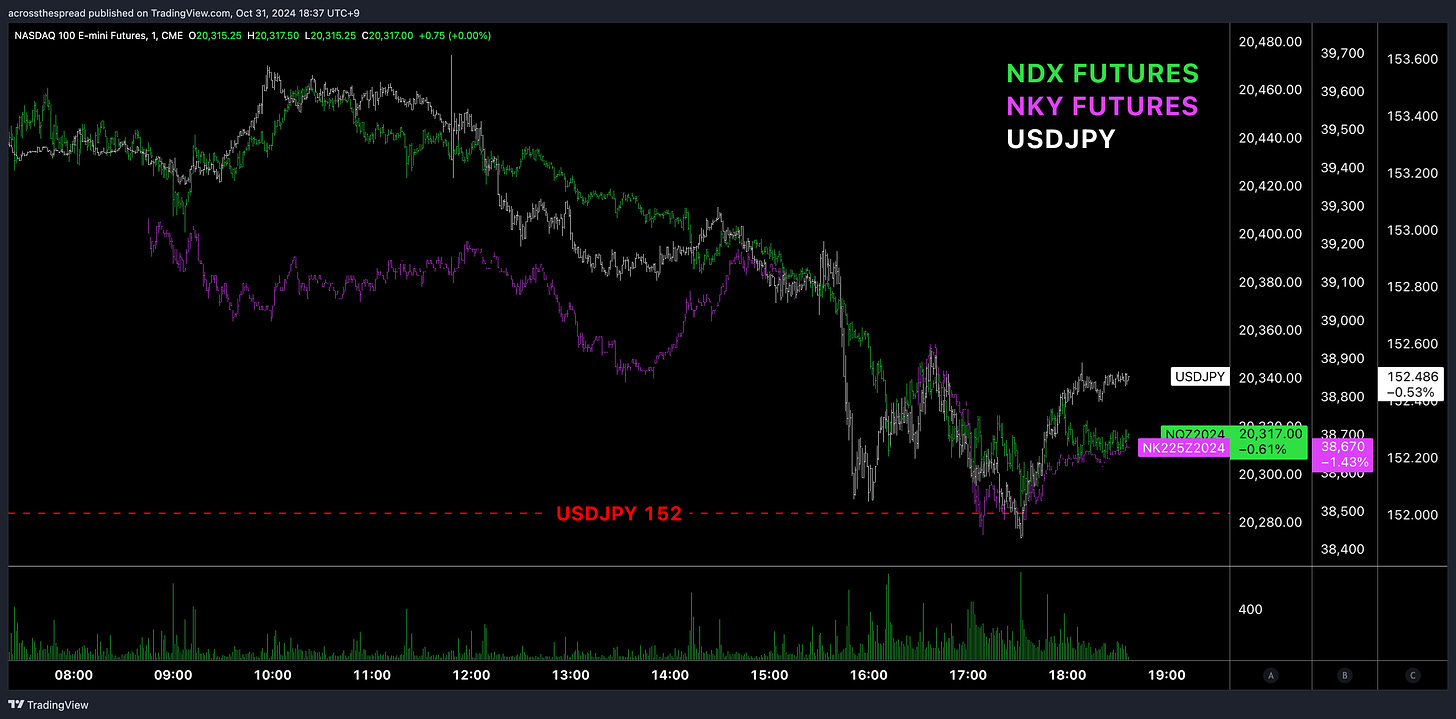

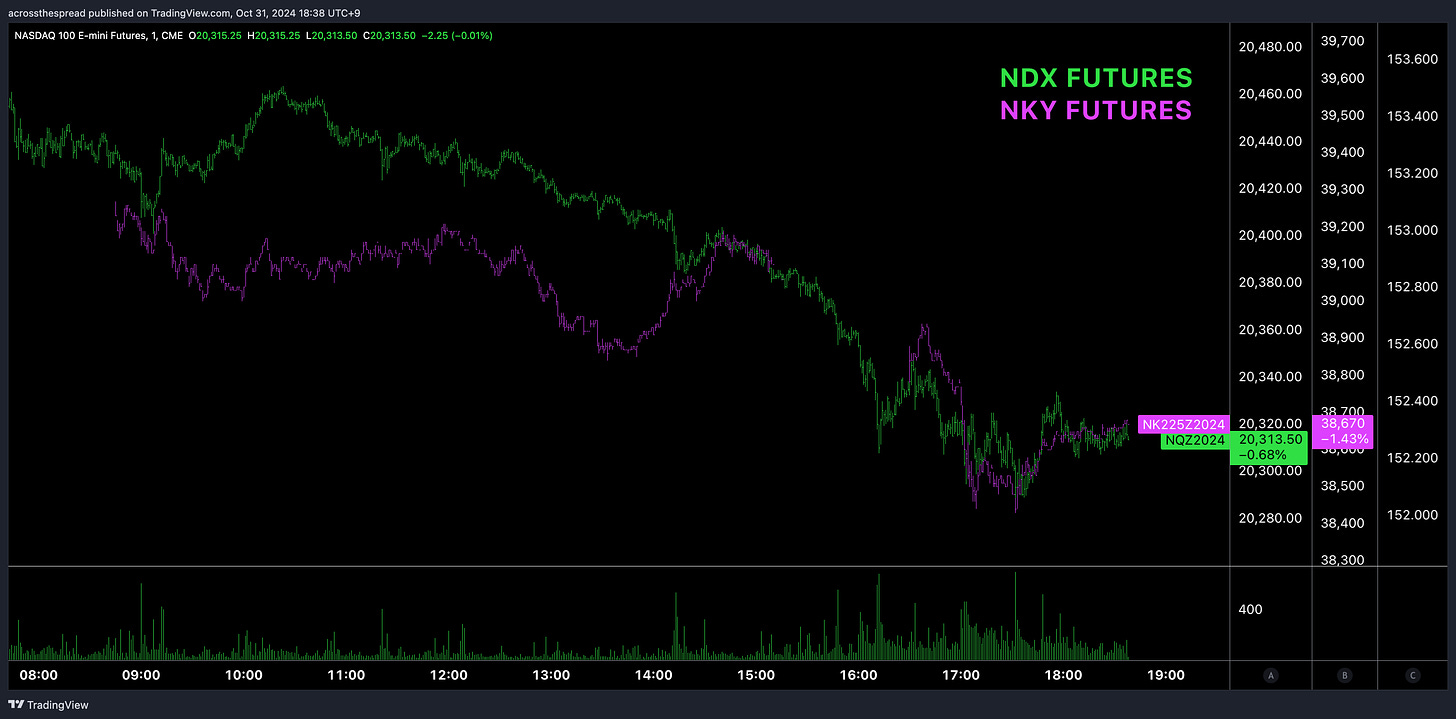

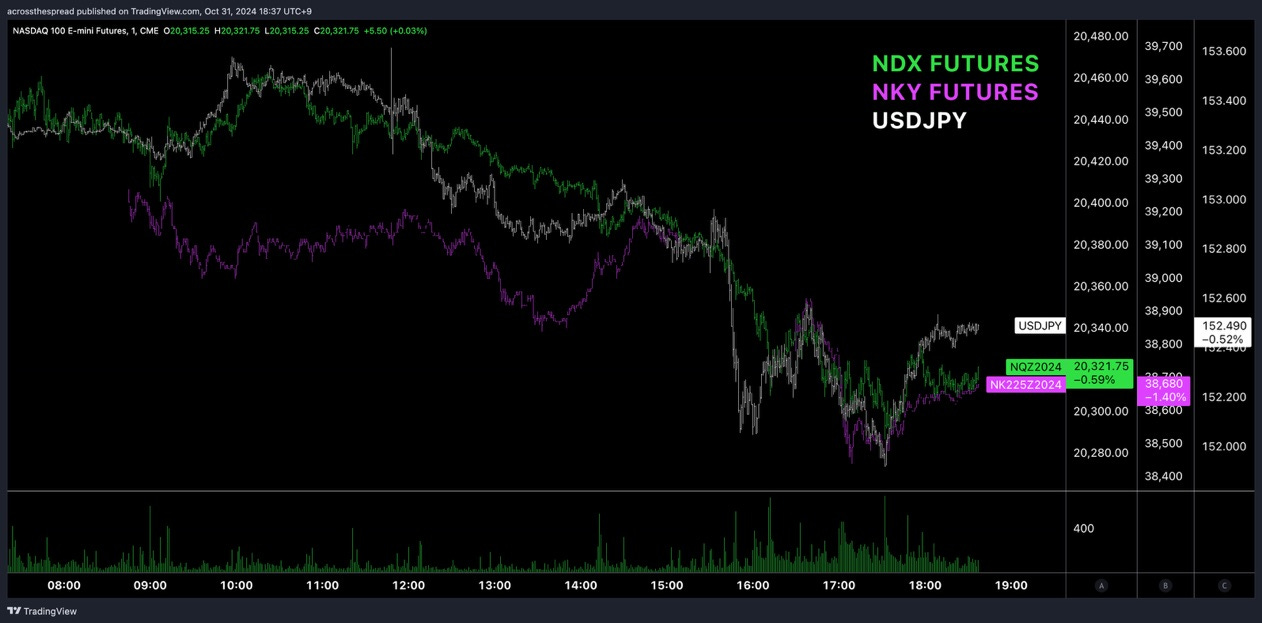

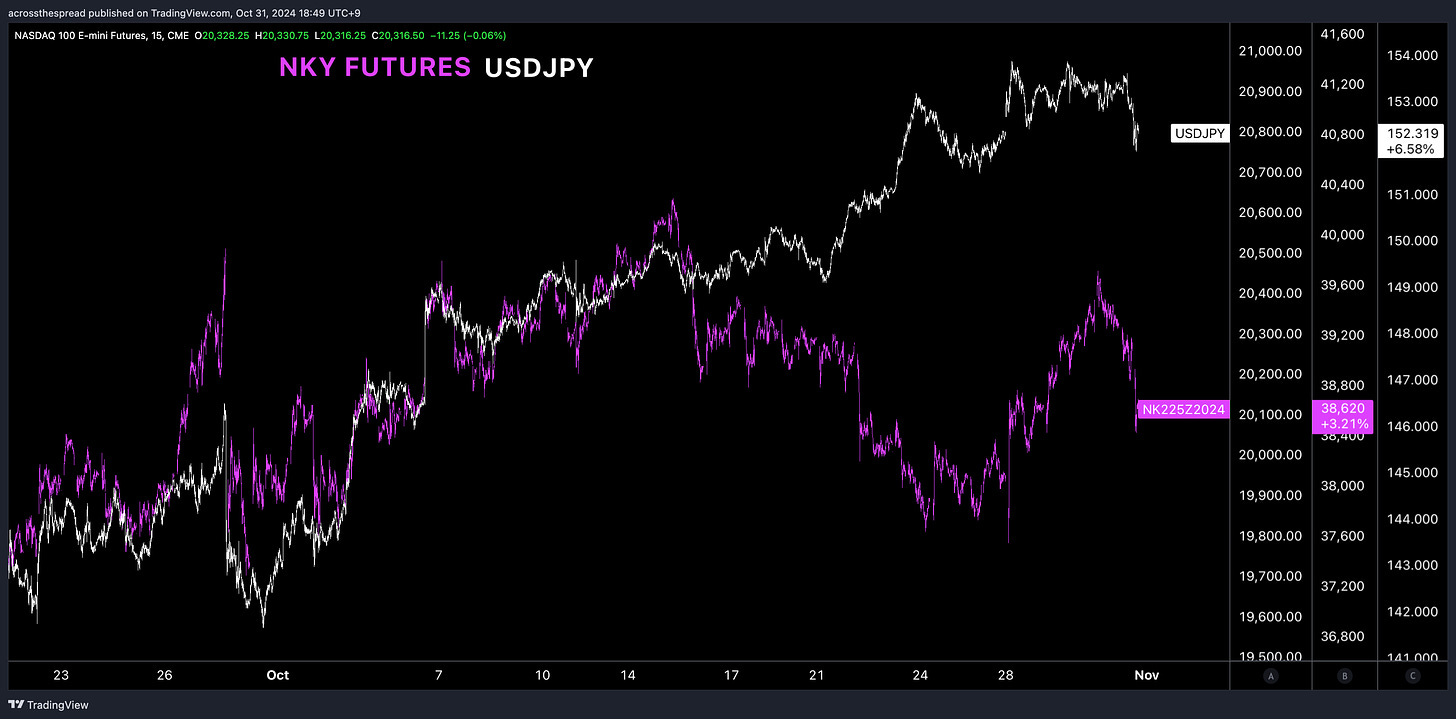

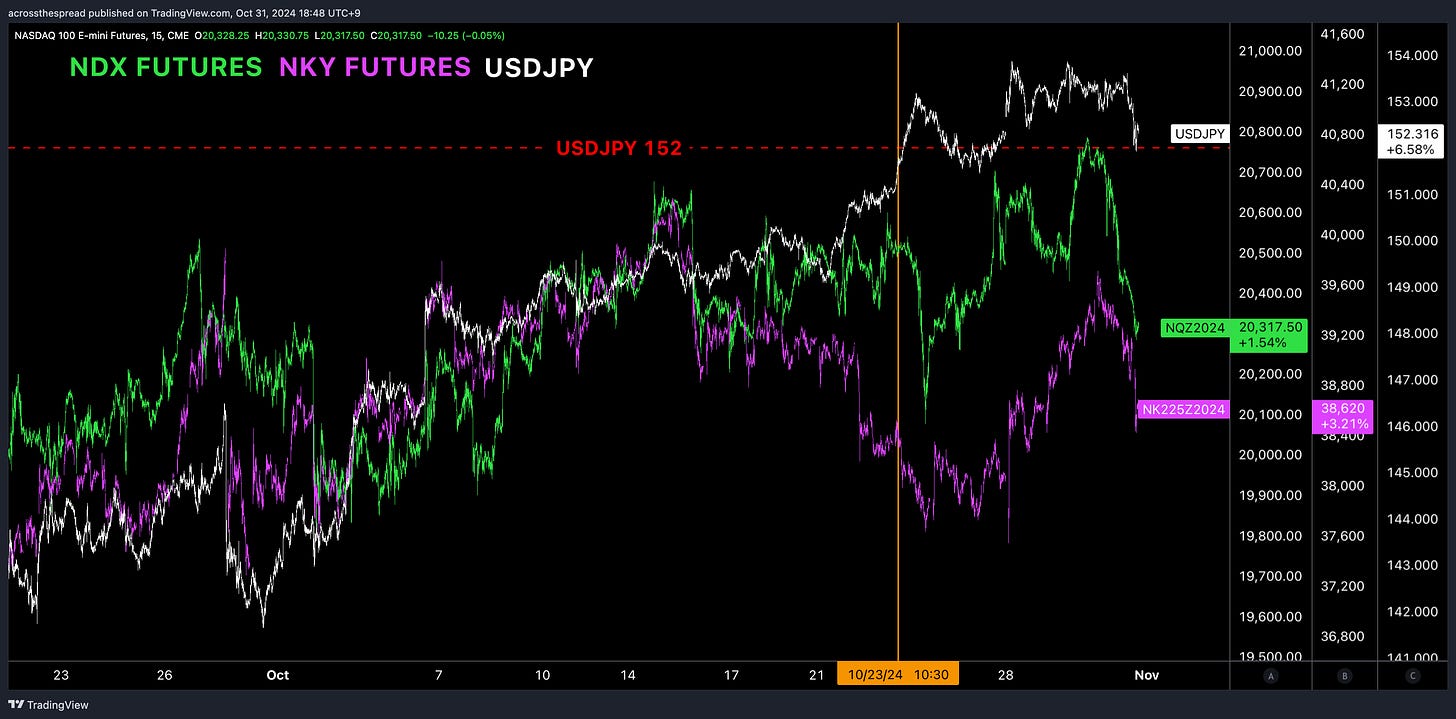

To follow up on this - USDJPY and NKY futures were moving directionally together intraday - and NDX futures were moving alongside as well, with all three abiding by USDJPY’s price action levels rather than its own - once again, testing USDJPY 152 to the downside, and exhibiting correlated behavior eerily reminicent of pre-Black Monday “Crowdstrike” USDJPY 152 support.

USDJPY puts an floor under NKY and NDX, but only after it had been a culprit in pulling the equity indices down alongside it in the first place.

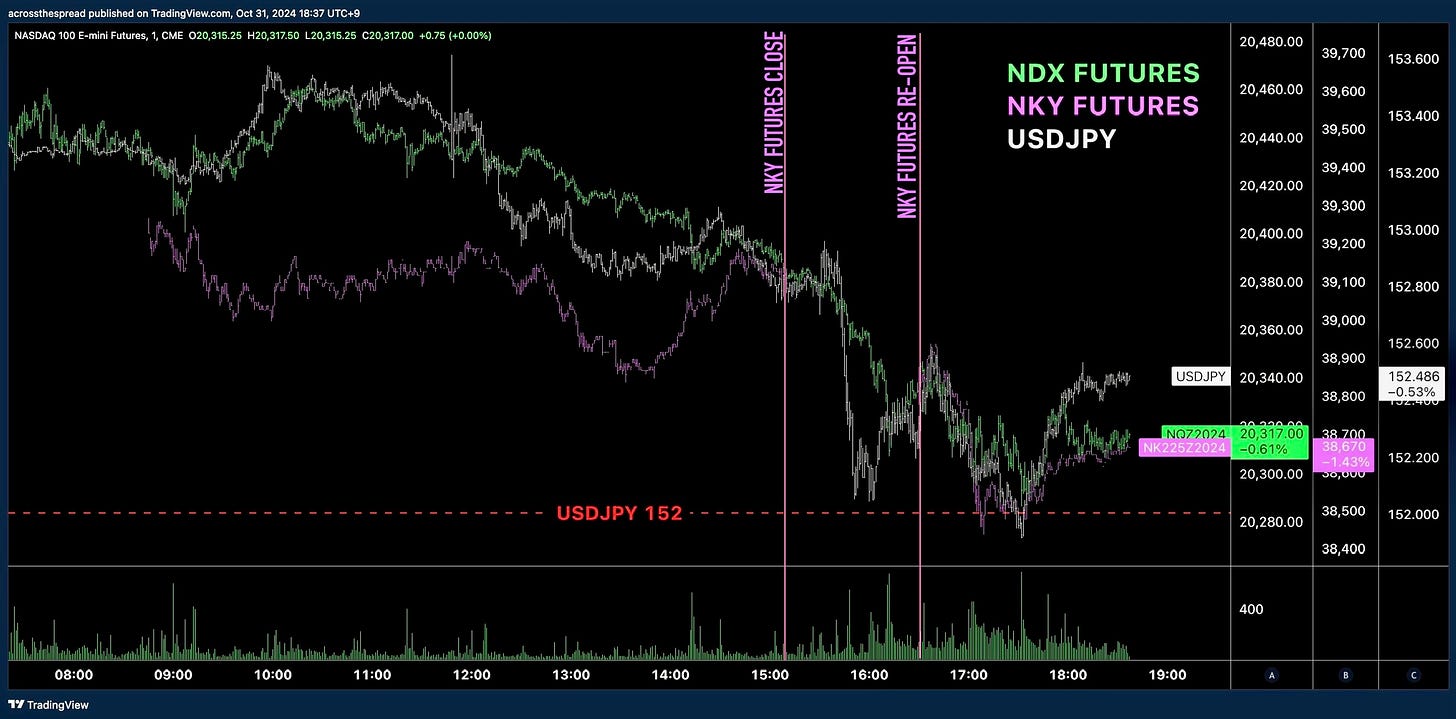

Yes, NDX was getting pulled down with NKY futures upon NKY futures session re-open at 16:30 Japan time - mid Ueda press conference.

But what was behind the NKY futures downside move? USDJPY. So, if NDX is getting pulled down alongside NKY futures, and NKY is getting pulled down by USDJPY, then one can assume that JPY is impacting NDX futures with or without the NKY middleman.

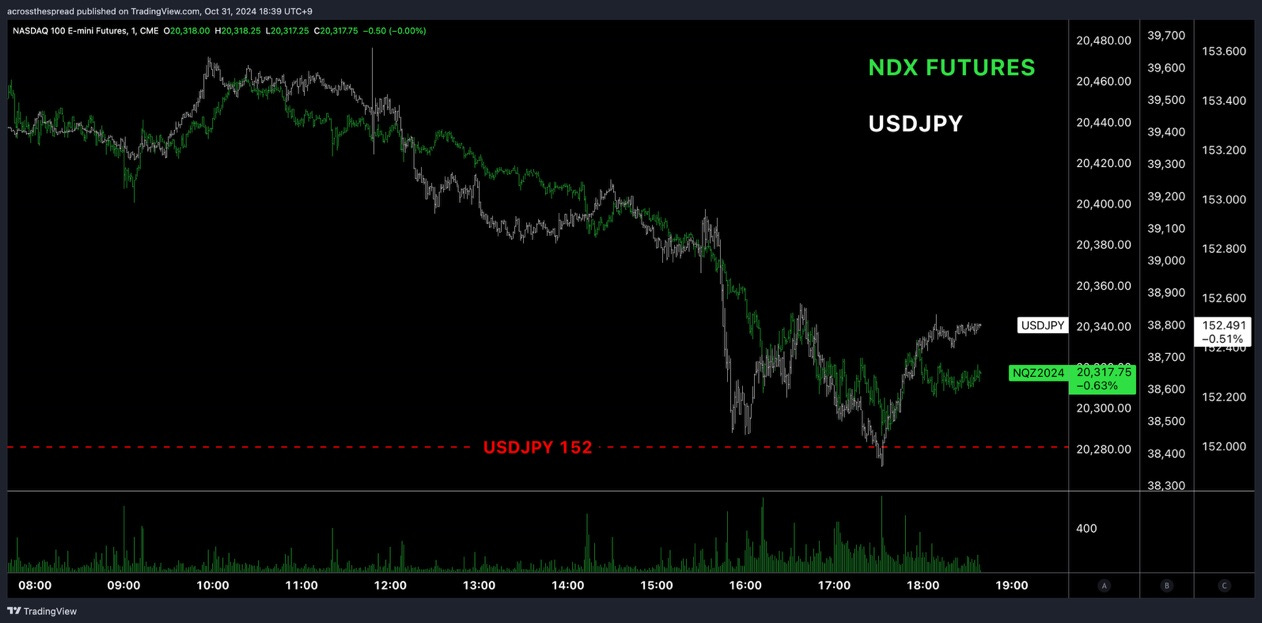

And indeed, that seems to be the case - as well as the USDJPY 152 support that NDX also traded alongside.

Note that in all of these charts within this group, I am also showing the trading volume panel on NDX futures (green) - and you can see NDX trading activity escalate into the sell-off. and intraday volatility swings:

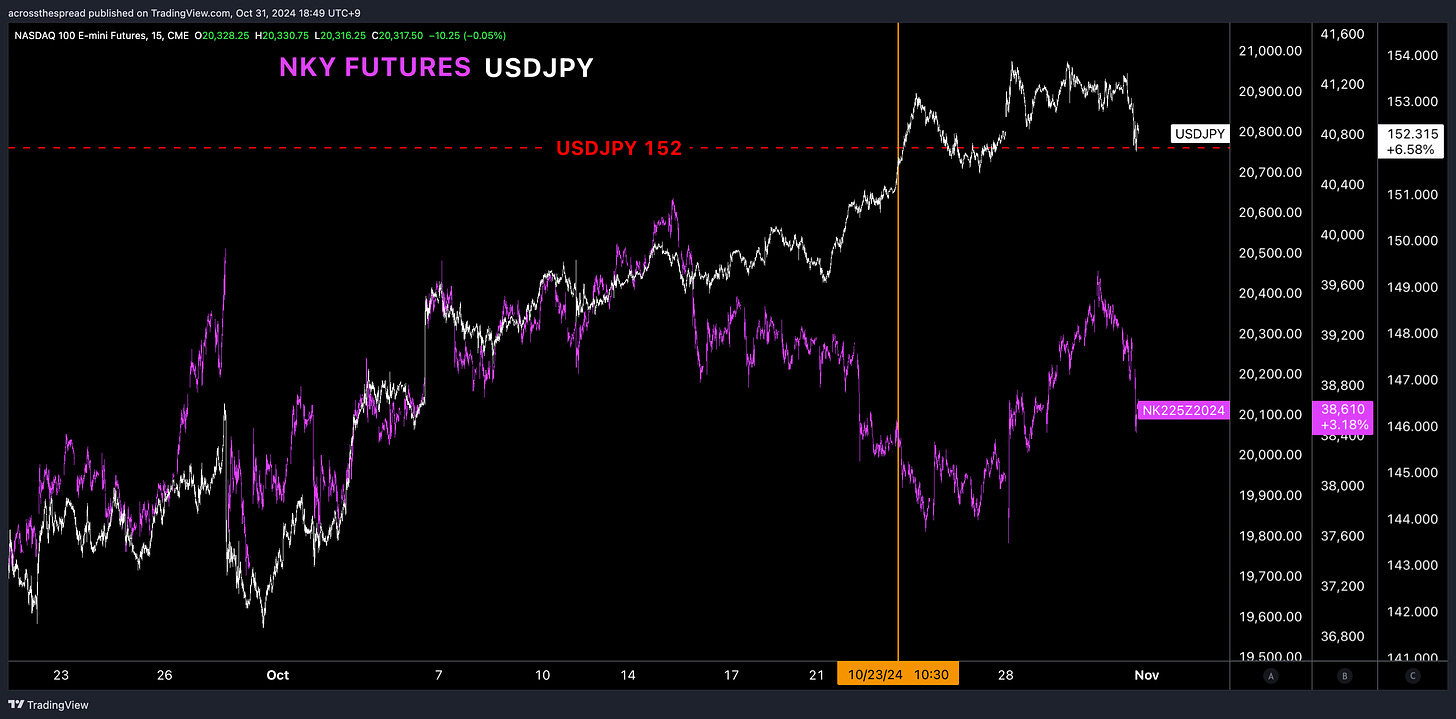

Furthermore, you can see NDX being driven directly by JPY strength, in the time frame between 3:15PM (JST) to 4:30PM - as that window of time is when NKY futures are in between trading sessions and are therefore not trading - and it was during this time when USDJPY fell rather sharply, followed by NDX futures.

As opposed to NDX indirectly tied into JPY via NKY futures.

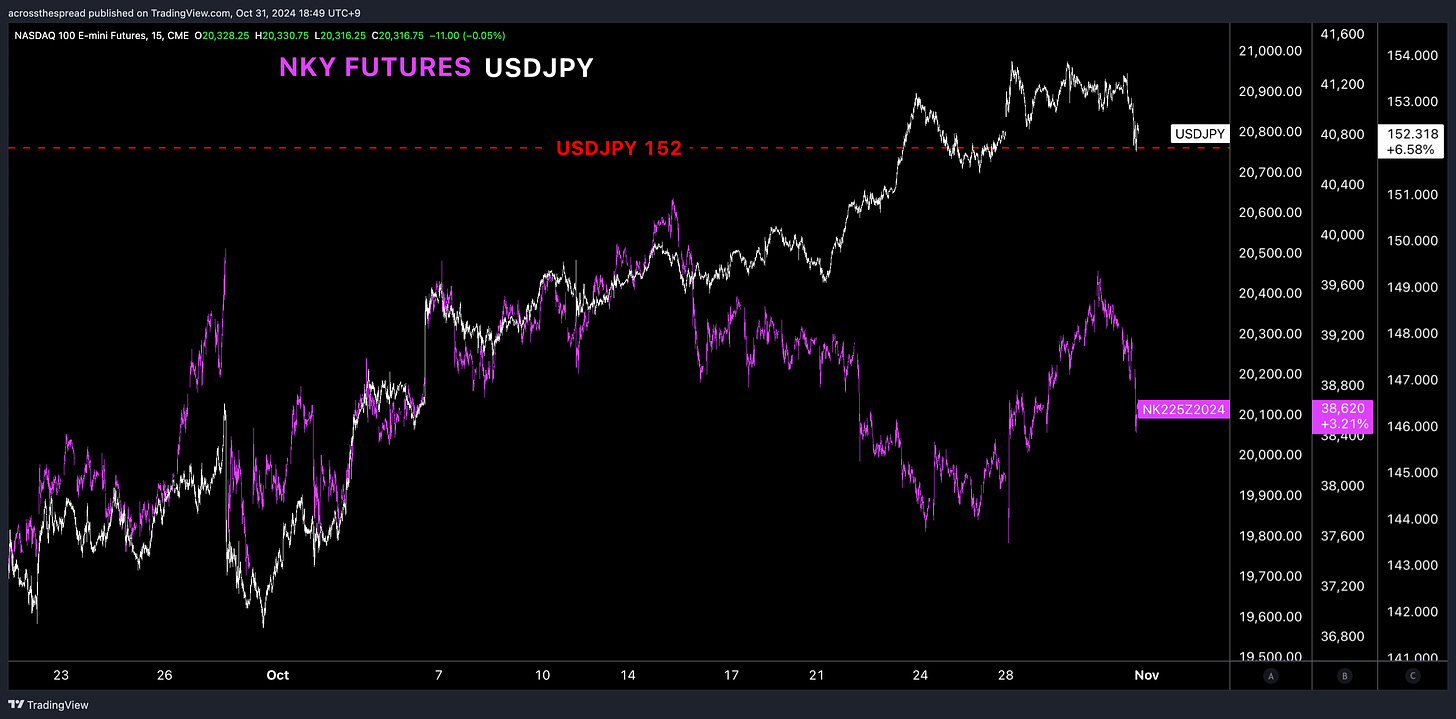

Zooming out a bit - there are two key levels of USDJPY that started to bring back something reminiscent of that late July - early August correlation of 1 to the downside were USDJPY upside resistance at 150 broken, and then upside resistance at 152 broken. Breaching these levels had cross-asset impact, namely on US and Japan index futures relative price action (for whatever reason - programmed flow likely).

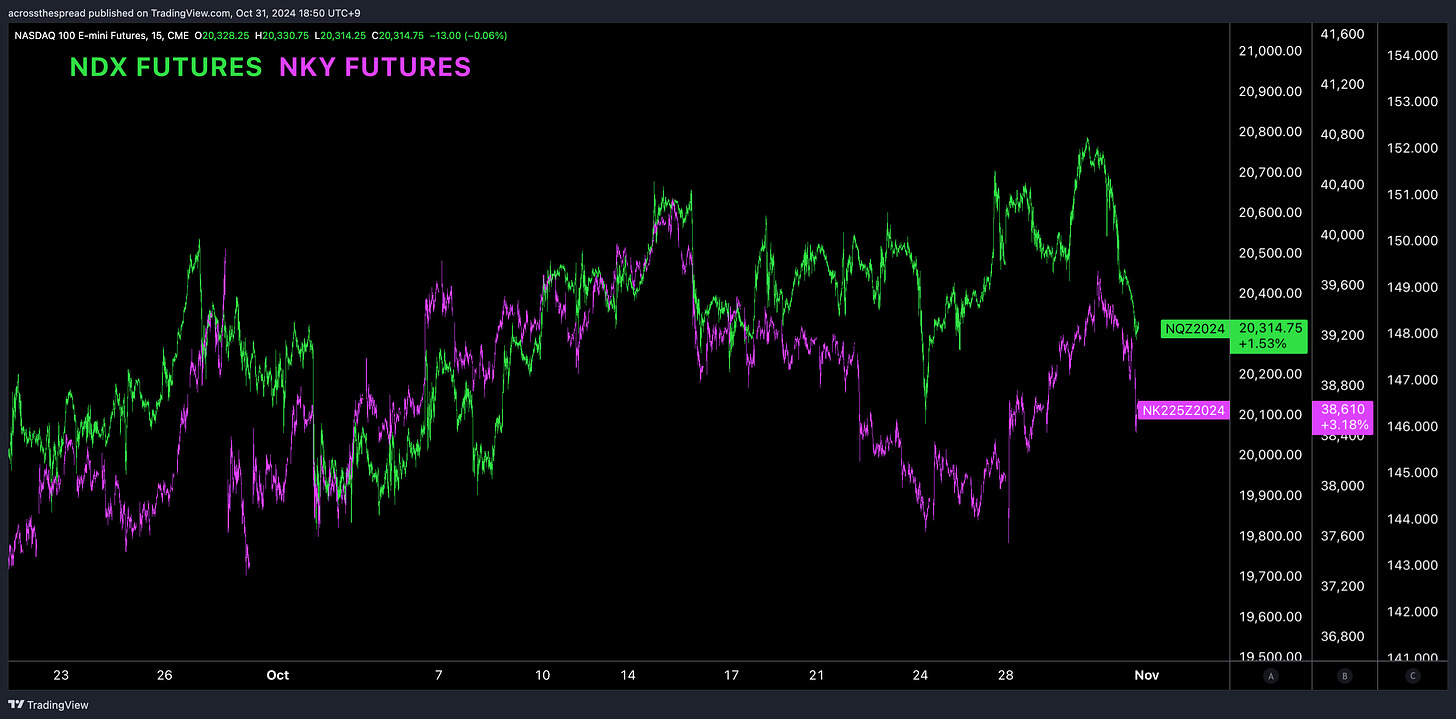

For much of September through mid-October, NDX and NKY were directionally parallel with one another- some of which was related to the China stimulus surge in the Hang Seng index in late September ~ early October. But in the back half of Oct, NDX and NKY began to diverge:

This is due to USDJPY breaching those key upside levels of 150 and 152.

Removing NDX from the picture, you can see that it was USDJPY that had diverged away from its prior correlation with NKY.

Here is USDJPY 152 marked (we are skipping over USDJPY > 150 breakout).

USDJPY through 152 put in another accelerated leg of NKY and USDJPY divergence - or, NKY down, JPY down convergence.

And as USDJPY cleared through 152, and NKY futures saw sharp downside, NDX futures followed thereafter.

That’s why this now matters - now that we are back above USDJPY 152, that level is now downside support - to either bounce off of (for all three - USDJPY, NKY and NDX), or to break down through. As of this writing and these charts (in the aftermath of the BOJ press conference) - it seems USDJPY 152 support held.

But as I had repeatedly said throughout crowdstrike yen 152 in late July - the important part here is not whether support holds or breaks, what matters is that cross-asset support has been identified at USDJPY 152, the cross asset pivot point in the immediate term.

And no, it will not be an exact repeat of late July - early August disaster in terms of the magnitude of the move. The positioning is far less crowded, as is the trading volume. These are not human beings, once again, these are algos/bots/systematics/lines of code trading flows. Human beings are not trading in such size as to visibly move markets on the heels of an ambiguous BOJ, a Japan government in turmoil, a US election around the corner, and an FOMC to follow. It is their absence that makes these algo flows far more easily visible with respect to their market impact.

So - I wouldn’t panic in anticipation of an early August repeat - this is low flow zero conviction green and red blinking tickers ticking away on servers somewhere. Not people, not the “real money” accounts.

Bank of Japan: October 2024

Here are the key points from this meeting and press conference that are making the headlines, which I will give my take on for each:

Much like Powell and the term “transitory,” Ueda has explicitly retired the phrasing of “more/ample time” to assess for the next rate hike - this “ample time” was the dovish pivot from the previous BOJ meeting in September.

Core CPI revision for FY2025 lowered to 1.9% from 2.1%

The heavily cited “US economy risk” has now been added to the text of this latest quarterly outlook report released with the October BOJ policy statement.

“If the outlook is realized, policy rates will be raised” - what this really means.

Retiring “ample time”

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.