The Other Imminent Election Risk: Japan. JPY, JGBs, BOJ, Yenterventions

USDJPY’s impact on higher US yields, and the risk of Japan officials’ market meddling with JPY and JGBs selling off together.

USDJPY and US yields are moving higher in near-lockstep manner - so which is driving which?

A look individually at FX via JPY, 10Y UST yields, JGB yields, and US-JP yield spreads suggests that it may actually be FX that is driving yields higher, rather than the near-uniform consensus that US yields are pushing USD (vs JPY) sharply higher.

Why does this matter which is leading which?

Because if USDJPY and yields on USTs (and JGBs) are being driven by the US side, then in this current run, 10Y USTs can still have another +75bps left to go before reaching 5%, which are merely 2023 levels. 5% on US 10Y yield is still quite a distance away, given that a move only half of that size (+40bps) had already taken place this month, and the global market narrative is one of “US yields are relentlessly surging.” And it doesn't necessarily mean it would stop there either - 10Y US yields could reach and breach 5% upon a US election catalyst alone.

But if global yields are being driven by USD - specifically a rally in USDJPY, then we have another +10 big figures of USDJPY upside left before either markets have a self-imposed upside cap at ~162 out of fear of yentervention, or we get an actual yentervention, which - if executed and pulled off "successfully” by MOF, would put a floor under USTs / provide a pivot point to reverse lower on US yields.

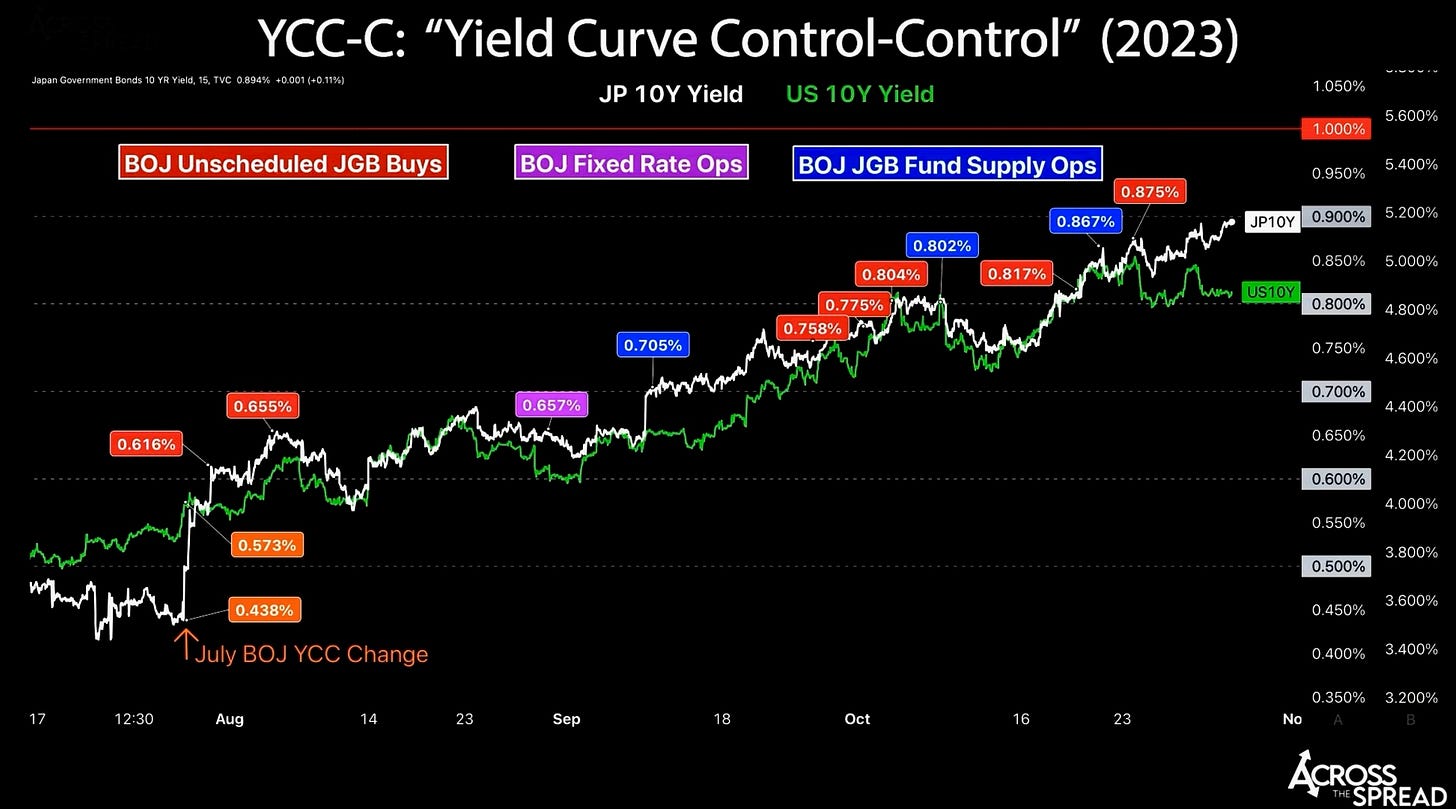

And if the move in higher global yields are (in part or otherwise) being exasperated by JGBs, then we are less than +10bps away from 1% on 10Y JGBs, and less than +20bps away from having BOJ potentially step in and actively attempt to manage the path and velocity of the JGB (and therefore global) yield ascent - as per the period starting from July ‘23 BOJ YCC shock, until end of Oct ‘23 BOJ YCC shock, culminating in a pivot and reversal downwards in yields from BOJ drawing a perceived line in the sand on Nov 1st 2023.

Literal top tick on yields (bottom tick on futures) at 1PM Nov 1st 2023, triggering the ensuing short cover:

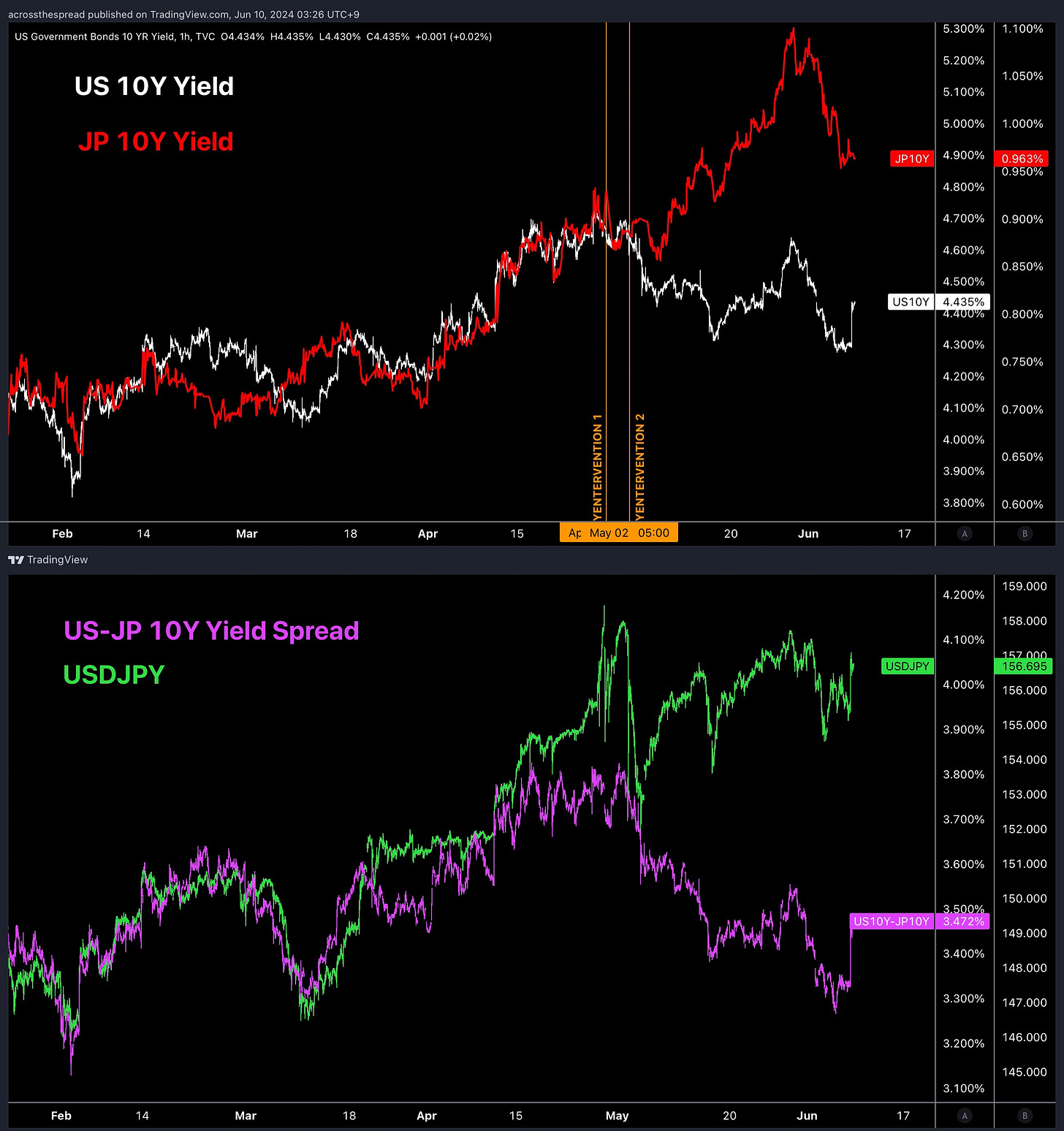

OR - BOJ allows markets to rip 10Y JGB yields higher through ~1.1%, and we see a potential return of crowding into the short JGB (the widowmaker) trade, and USDJPY “counterintuitively” blasts higher alongside domestic JGB yields, even if US yields fall. As per May ~ June 2024, post-yentervention week…

…when JGB yields detached from UST yields directionally, and USDJPY detached from U.S.-JP yield spreads directionally…

Either way, it’s critically important and useful to try and figure out what is leading and what is following alongside as we once again approach Japan officials’ “action levels” simultaneously on JGBs and JPY. If it’s UST driven, then this can continue to potentially much higher levels, without a state actor stepping into markets. If its USDJPY and/or JGB driven, then you have Japan state actors (MOF and BOJ respectively) to potentially step in and kill / reverse momentum.

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.