A Post-CPI Yentervention?

The case for why the sharpest intraday drop on USDJPY since Oct’22 underway is yentervention - as well as why it is NOT, and why the distinction matters greatly for broad macro markets.

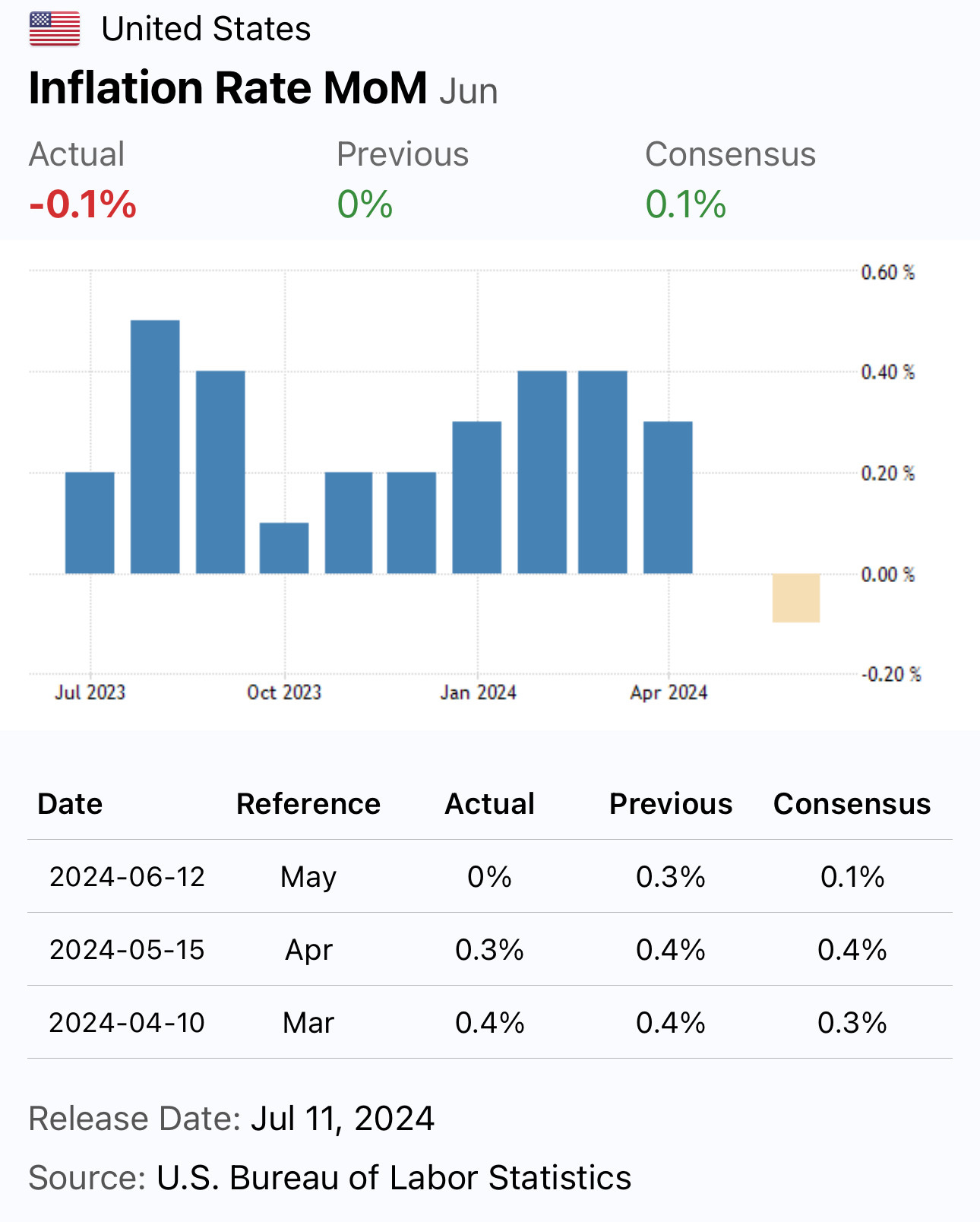

Following a softer than expected U.S. CPI print with a MoM decline…

USDJPY plummets (JPY surges) as much as -2.5% from an intraday high of 161.76 down to as low as 157.44 as of this writing, which puts the move on track for the biggest intraday decline in USDJPY since 2022’s yentervention.

And the talk across Tokyo (and globally) currently is - is this a yentervention?

Here is what Kanda, MOF’s Vice Minister of FX Meddling, says:

“We will not disclose whether Japan intervened in the foreign exchange market.

If we did intervene today, we will disclose the data at the end of the month.”

Let’s keep in mind that also at the end of this month, Mr. Kanda will no longer hold the seat of Japan’s official FX market meddler - as he will be replaced by MOF career veteran Atsushi Mimura (who also had a brief stint at BIS) effective July 31st. Note that Kanda is not getting fired, for setting fire to the yen or otherwise - this is just a routine end of a tenure / personnel rotation.

So, was/is this yentervention?

As of now - I do not know. And that should go for all of us who are not privy the institutional flow activity in real time. If you are one of those individuals who know, then you keep your mouth zipped shut lest you want to be unemployed if not jailed. For the rest of us, there is no definite way of knowing, and so any conviction calls made on either side are nonsense - and in time, should it be revealed that the outcome matched their current stance, by no means is that being correct. It’s a binary call - and you just purely lucked out.

I will lay out the case for why it may be yentervention, which is gaining broad consensus view. I will then make the far more difficult case to make for why it is not yentervention - which is completely absent from discussion at this moment. And I will finish up with why it matters if it is or isn’t yentervention, and what it means for broader markets - all of which needs to be taken in the context of this being me, a one-person “team” (as usual), working off of initial, and incomplete and changing information in real time.

The Case for a July 11th 2024 Yentervention Underway

Here is why it looks like official yentervention, rather than just a massive outsized market reaction to a softer than expected U.S. CPI data release.

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.