Asia Driven Markets On US/China 90-Day Tariff Pause

An alternate take on why this US-China “pause” is very bad for risk assets. USDJPY resistance levels, JGB yields, and equities.

US and China officials emerge from their weekend-long talks with a joint statement agreement for each side to reduce their recently imposed tariffs by -115% for the next 90 days, bringing their respective tariff rates in the interim negotiation period to:

30% US tariffs on Chinese imports from 145% prior

10% China tariffs on American imports from 125% prior

I will present a differentiated take on this development that deviates from broad consensus in this article, for which you obviously don’t have to agree with, but is worthy of consideration - at the very least because it is an angle that is missing from the broader dialogue.

Essentially, this mutually agreed upon triple-digit percentage point drop on tariff rates that were imposed and now removed/postponed by US and China - this is not a positive for market prospects - rather, it is a negative for market prospects. In fact, having tariff rates get suddenly cut from well north of 100% down to 10~30% for the next 90 days is actually a worse setup for markets going forward in the near to mid-term compared to the state of markets at Friday’s close.

Why?

Because 100%+ tariff rates is an effective trade embargo between the world’s two largest economic powers - as Trump and Bessent (and the Chinese for that matter) have explicitly and accurately characterized them as. It’s mutually assured global economic destruction that those who “survive” it are those who wish they instead had a quick death vs the utter misery they’re now living with. Nobody wins, everybody loses, and it doesn’t matter who “loses less.” So, it was pretty obvious that these unsustainable (to directly quote Bessent himself) tariff rates weren’t / aren’t here to stay, and have only one direction to go: down.

Moreover, the manner in which tariff rates suddenly went from 54% on China, to 34% on US, to 104% on China, to 84% on US, to 145% on China and 125% on the US within 10 days - this sudden back and forth escalation that blew up in such a manner had gone to such extremes that increasing the number no longer makes any difference. I keep referring to as a childish economic dick-measuring contest between Trump and Xi, because it really is no different from kids on a playground yelling at one another - “I’ll kill you a hundred times!” “Well I’ll kill you a thousand times!” “Then I’ll kill you a bazillion times!” US and China tariff rates had gone far into being meaningless and pointless figures - which is why China eventually said “125% and were done with this nonsense” (and not because that’s “China exposing its relative weakness” as per some of the US nationalist narrative).

Essentially, both sides had used up all of their ammo in the heat of the moment when they went somewhere north of say 50%, and anything after that was just pulling triggers on empty chambered guns that did nothing but make clicking noises.

But when you drop tariffs from stupidly unrealistic 150% levels down -115% and reset them to a very realistic 10 ~ 30%, you’ve now just reloaded your guns on both sides, and can re-escalate them higher within the spectrum of reality, and levels that can actually stick.

That’s why idiotic 150% tariff levels, with markets having recovered and then exceeded pre-triple digit levels, is actually “better” than having this chance to reload with ammo. The following is not really an analogy as it is actual reality, but it’s like the VIX - a 60-handle on the VIX is more of a bullish prospect for markets going forward than a VIX coming down from those levels to crack sub-20 (as it did while Bessent/Greer were holding their press conference earlier in Switzerland). Tariff rates at 150% can go higher as a number, but can’t do too much more incremental damage if raised from there. But resetting them to 10~30% with a 90-day expiration has just (literally) reset the VIX lower, and set up to now rise again from here.

A further cynical take is - perhaps team USA and China had even discussed this, and cooperated to reset their ammo in mutual agreement this weekend. “Guys- these 125% and 145% rates are fucking pointless, we all know this. So let’s just reset and get real.”

Again, you don’t have to agree with this - I don’t even know if I do myself. But it is a thought that I had, and one that deserves consideration for market implications from here - these developments should not be unanimously taken as one-sided “positive” or “progress” as they are at this moment.

This angle aside, let’s be absolutely clear about the context from which this announcement is coming from, for the markets as well as this announcement itself:

This is not a “positive development” any more so than it would be a negative one - it is neither, as it is barely “a development” in and of itself. This is not “progress” by any means either. And most importantly as far as markets are concerned, this is not “certainty” or a “removal of uncertainty.”

Just take a simple look again at the recent situation vs these latest developments as it now stands:

US reduces the additional tariffs imposed in April on imports from China to 30%, from 145% previous. China reduces the additional tariffs imposed on US imports to 10%, from 125% previous.

US and China agreeing to temporarily halt an effective trade embargo from ridiculous levels is not a “reduction of tariffs,” it is still very much an increase on tariff levels from where they had very recently been - and a substantial increase at that. No importer on either side is celebrating +30% and +10% respectively - they just went from a clear existential threat on operations, to now getting repeatedly punched in the face for each order placed - and many of which still face an existential threat even under those conditions. Either way, instant death has been averted replaced by a slower suffering - and uncertainty prolonged.

As for the broader, general “progress” allegedly underway between US and China - again, lets just take a very simple look at where we were recently vs where we are now:

US and China officials agree to meet and talk, which they did.

Put aside the fact that those talks are still ongoing, and still remain absent any conclusive detail. The comparative context of what the situation was prior to these latest US-China talks were:

Donald Trump and Xi Jinping not even in agreement around the very simple facts of talking or not-talking to one another.

So, if you want to measure off of that absolutely ridiculous and also clearly non-permanent floor of “productivity” where the two heads of the largest economies aren’t even saying the same basic facts of discussion or not to the public, then sure - this is less-fucking-stupid than that.

But at the end of the day, what do we have? US and China have imposed mutually damaging tariffs on one another that, according to Bessent coming out of these discussions, are the floor levels (as good as it can get) for the next 90 days.

Hooray. “Risk-on” it is then.

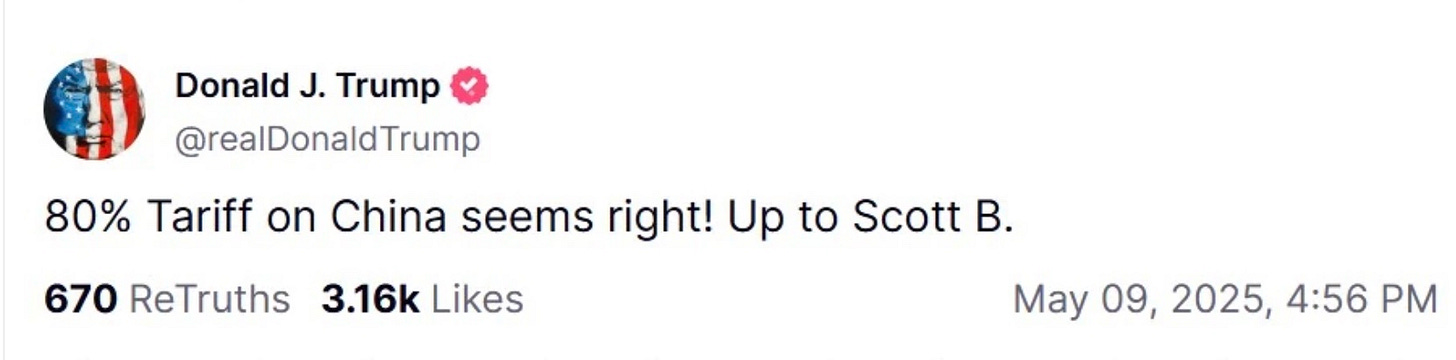

This isn’t pure sarcasm on my part, because incredibly, we already have sell-side institutions taking their calls for recession, inflation, stagflation etc, now off the table, in light of these developments. Because, going into these talks, this was the expectation for tariff levels that would come out:

And since it wasn’t an 80% level (which would really be no different in practice from a >100% tariff level), then, according to these headline-chasing “analysts” - hooray. “Risk-on” it is then.

Ok, onto green and red blinking ticker markets.

Broad based, cross-asset global market “risk-on” ensues: USD↑, equities↑, bond yields↑, gold↓. And among these major asset classes, the largest moves across the board are: Japan.

Note that this is being written / analyzed overnight, before Tuesday’s Asia market open - which is the first chance that Japan markets (and Asia as a whole) has to fully react to the 4PM post-close US-China announcement.

Upon announcement of the above via Secretary Bessent and Greer in Switzerland - here is the cross asset picture, again, with Japan assets exhibiting among the most prominent moves:

•FX: USDJPY +2.3% vs EURUSD -1.5% which is in-line with the broader DXY Index +1.5%, and also outperforming USDCHF +1.8% (CHF being JPY’s alternative “safe haven” from USD - even with the additional Swiss-positive commentary made by team USA for being gracious hosts of these talks).

•Equities: Among major DM equity index futures, NKY +3.5% (and this is with NKY cash index closing more or less flat +0.3% at 3:30PM, 30 mins prior to the breaking news), vs SPX EMINIS +3% (I don’t count NDX100 futures among the major DM indices here, as that is a sector-specific index - that said, NDX futures are only a quarter percent above NKY futures), European SX5E futures +2%, and Hang Seng futures +2.7%. Even Japan’s broad based TOPIX index futures +3% is keeping in-line with SPX futures.

•Bonds: In DM government bond markets, again - the US-China announcement drop came at the end of Japan cash trading hours, but just as EU cash bond markets opened (and UST cash trading is ‘round the clock), so we shall see just how much JGB yields will surge at open in a few hours. With that said, if we look and compare across the 10Ys, US 10Y yields are +8bps, or half of the +16 bps move higher in German 10Y yields that have just broken above their April 3 levels. But then again, German bunds didn’t experience the wild swings in the days that followed Liberation Day to the extent that USTs and JGBs did. 10Y JGB yields have now also broken out vs their post-Liberation Day highs after chopping off almost ⅓ of their nominal yields within 3 trading days - which would be the equivalent of a 10Y UST going from yielding 4.4% to 2.9% (instead of the 4.4% → 4.0% actual) in half-a-week, to then reverse and recover.

Also notably, 10Y JGB futures, which were/are trading throughout this announcement, have just plunged to break 2 key levels of support - which once again sets up for cash JGB yields to surge at Tokyo AM open.

•Gold: In commodities, gold futures are once again plunging -3% on the day. And surprise surprise - as readers know, gold price action to the downside is moving in absolute lockstep with JPY’s selloff.

This market move from the latest U.S.-China trade developments are impacting Japan assets the hardest - and Japan assets are by and large impacting the rest of the world’s respective asset classes. And at the heart of Japan asset classes is FX: JPY, which is not only dictating gold price action, but JPY price action (which is currently being held at previously flagged then-downside-support level 148.50) is also impacting multiple markets on a cross-asset basis.

So, we will take a closer look at JPY and its immediate ~ near-term directional prospects via the next key upside resistance levels and positioning, so that we can (attempt to) be better informed on various other macro market behavior than we otherwise would be.

USDJPY to surge if 148.50 resistance breaks

In the immediate wake of these latest US-China revelations, USD rips higher vs the majors, rallying against JPY the most, and by far.

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.