Clarifying BOJ Rate Commentary & JPY Price Action (And They Are Unrelated)

USDJPY bounces off year-to-date lows. Bank of Japan commentary has absolutely nothing to do with it, despite media narrative nonsense.

USDJPY erased its massive 2024 YTD gains today, as JPY strengthened during the Tokyo trading session.

The reason that is being given is this:

And this is nonsense.

Later in this article I will hopefully put an end to what has been just an incredible misreading of both market price action and the Bank of Japan’s messaging that has been plaguing the narrative time and again in this post-JPY strength / BOJ shock rate hike era.

But first, we need to acknowledge and focus not on what strengthened JPY (downside on USDJPY), but the far more significant market development of the day - the reversal point and driver.

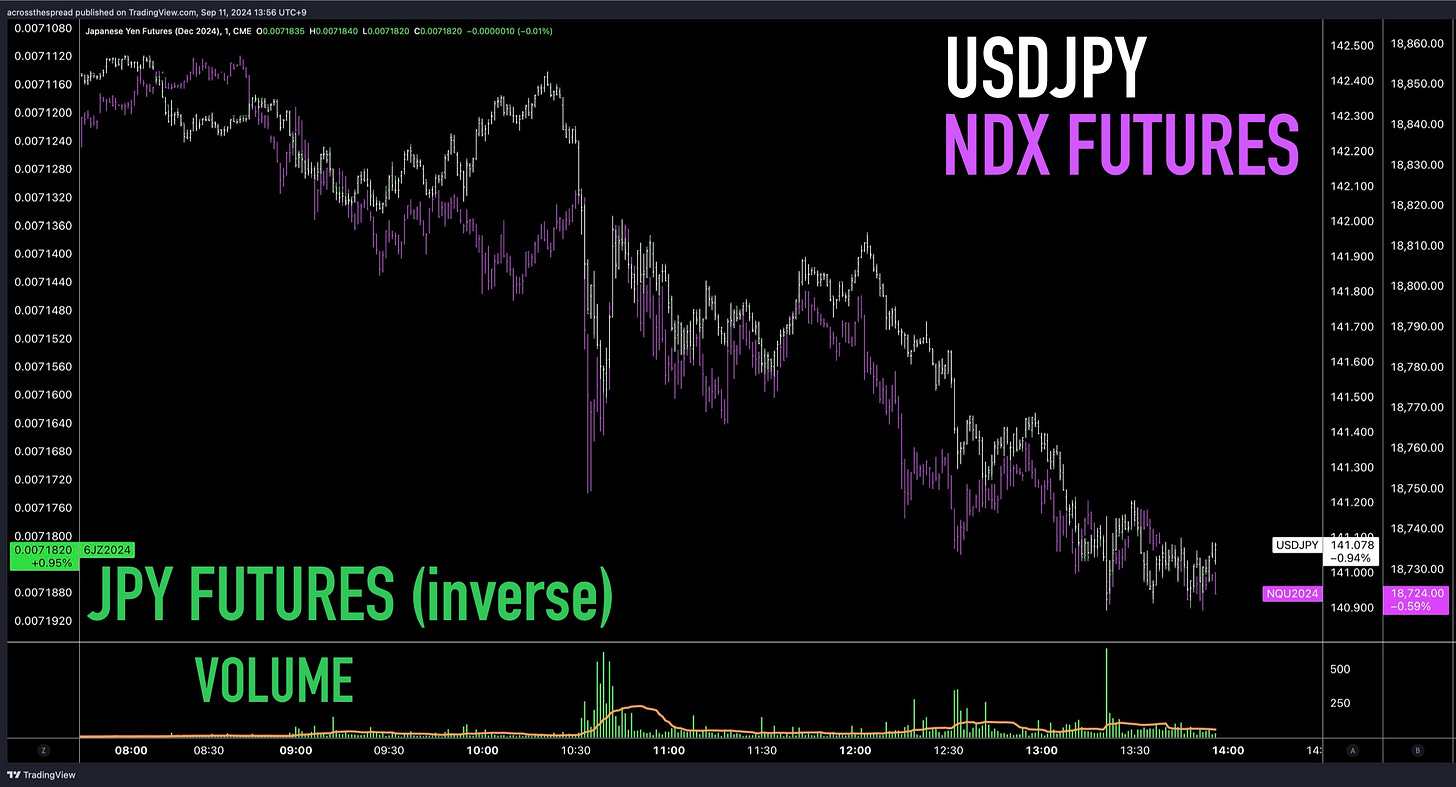

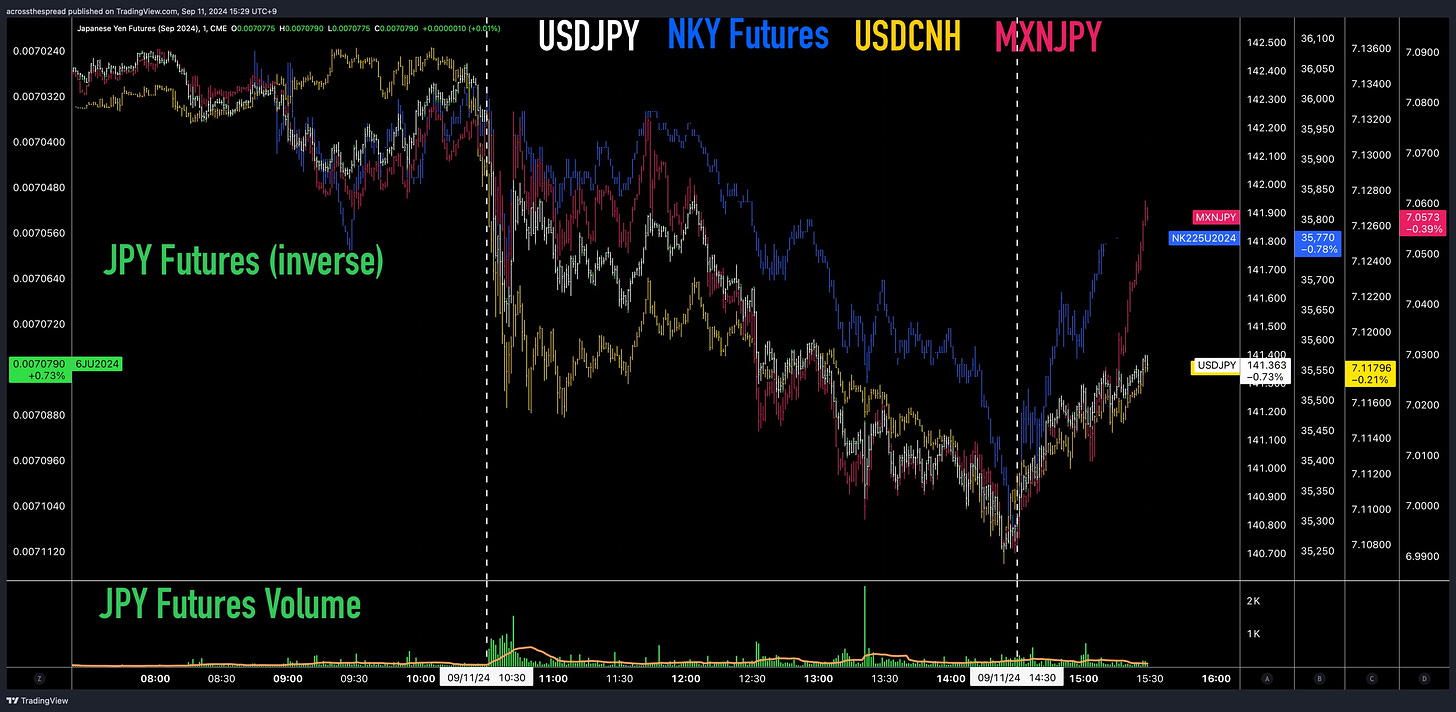

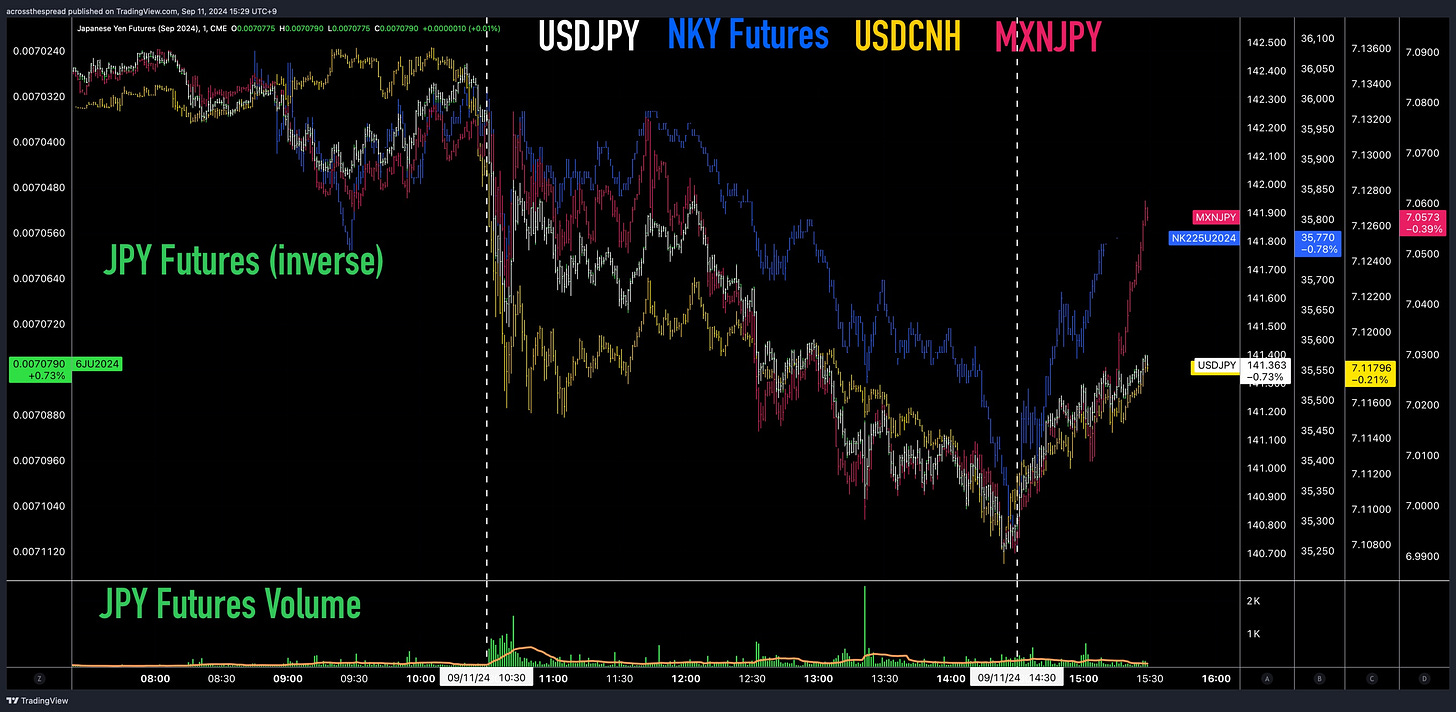

Let’s do this by looking at the timeline for today’s Tokyo trading session on a cross-asset basis:

🇯🇵10AM - 🇺🇸Trump vs Harris debate begins

🇯🇵10:15AM - 🇨🇳daily CNY fixing, PBOC cuts USDCNY rate to 7.1182, +19 pips stronger vs estimates. USDCNH & USDJPY top, and start to fall

🇯🇵10:30AM - 🇨🇳🇭🇰market open. 🇯🇵BOJ’s Nakagawa speech text released*

🇯🇵11:35AM - 🇺🇸Trump vs Harris debate ends

🇯🇵14:22 - MXNJPY breaks < 7.0

🇯🇵14:24 - *USDJPY HITS NEW YTD LOW* at 140.70 → Bottom tick & reversal point on USDJPY, USDCNH

🇯🇵14:26 - JGB 10Y Futures, US 10Y Futures top (yields bottom) & reverse

🇯🇵14:28 - MXNJPY bottom & reverse

🇯🇵14:29 - NKY, NDX Futures bottom & reverse. US 2Y Futures top (yields bottom at new 24 month lows) & reverse

The turning point cross-asset was at 🇯🇵14:24 upon USDJPY YTD bottom, as USDJPY turns NEGATIVE on the year.

USDJPY in ‘24: Open 140.98 (marking the ‘24 Lows until today), and took over 6 months to hit highs of 161.66 (+15% on the year) on Jul 11th yentervention, and then took less than 2 months to erase it all.

And, into the final 30 mins to Japan cash close and thereafter (as of this writing), we have a sharp rebound on MXNJPY +1.5%, NKY Futures +2%, USDJPY +0.7%.

So there is a clear support for USDJPY at YTD lows (~140.70), which once again then translates to other major global asset class pivot points respectively.

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.