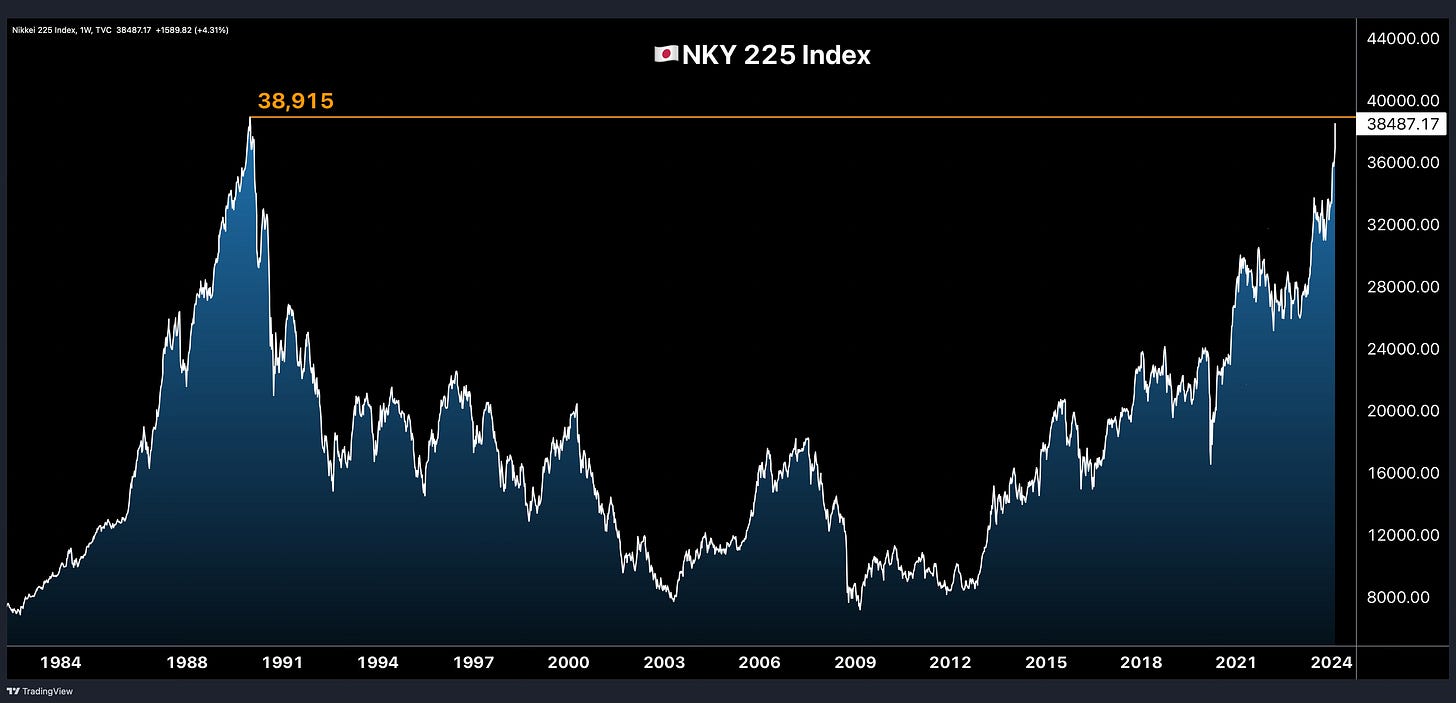

Global DM Equities Face One Last Resistance: Nikkei 225 Record Highs (Part 1)

Japan's NKY index is now just 0.1% away from its 1989 bubble peak: the only all-time-high remaining in major DM equities. Part 1: How NKY & JPY are impacting US markets, BTC and more

Remember less than a month ago on January 25th when I said “short the living daylights out of the NKY?”

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.