Heads up: Potential JPY Surge In Immediate

Flagging massive $1.6bn JPY call options open position

Hey all, I’m currently finishing up a (rather lengthy but) thorough deep dive on how the Bank of Japan (and not the Fed) had put the top in long dated yields (floor in bonds), which then led to momentum in short covering a massively crowded short JGB futures position that had been the key driver for global yields to flip and plummet from Nov 1 (and not this “Fed pivot” that’s the primary driver behind the Nov yield collapse) - so stay tuned for that coming soon.

In the immediate however, just need to flag current live markets in interest of time - namely JPY and to a lesser extent JGBs.

It’s currently just after Japan market close, USDJPY is at 146.30, -0.7% on the day. 146.23 is the recent lows - so that looks like it’ll be broken as London traders come in. Great- not flagging this move in itself.

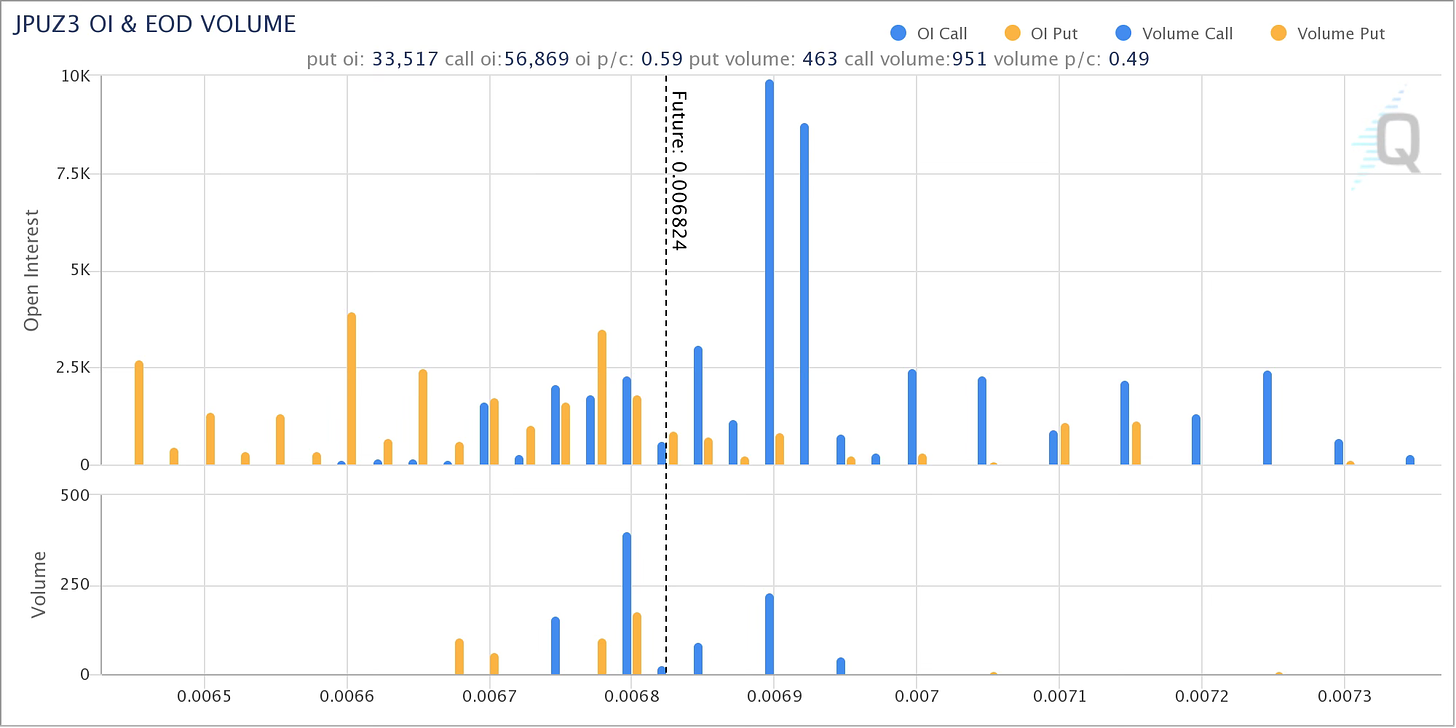

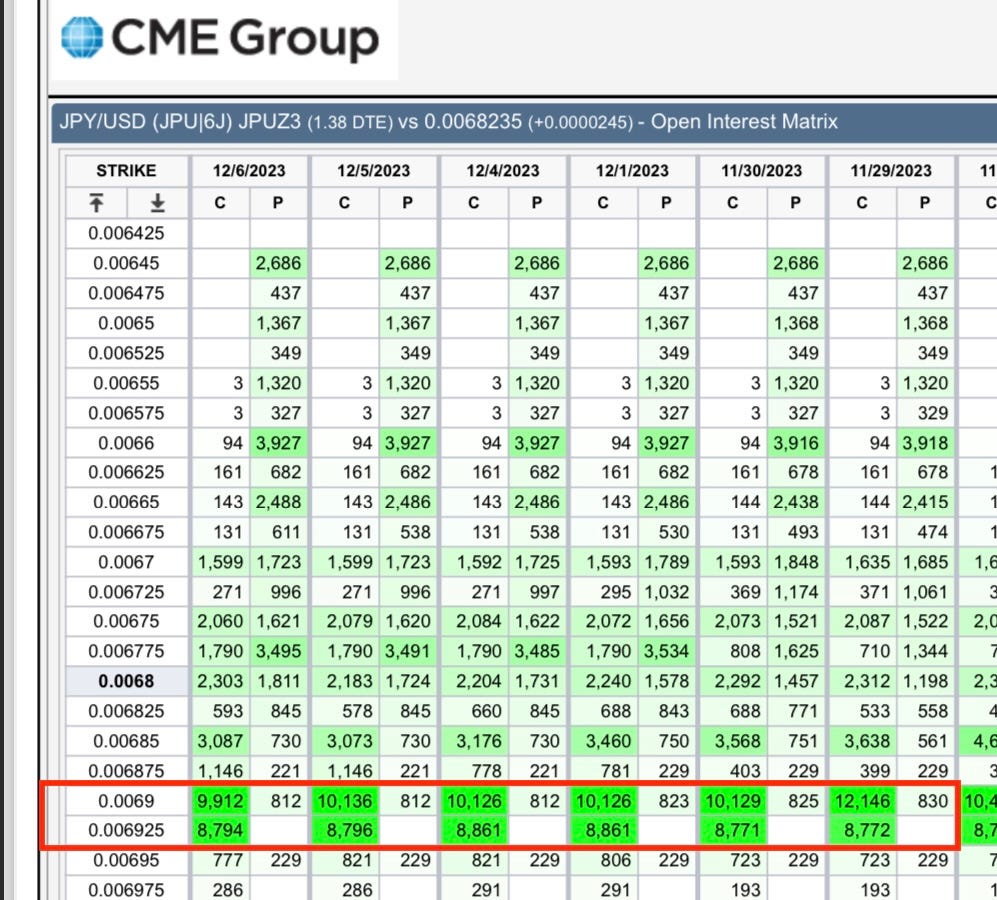

There is a massive $1.6 billion notional sized out-of-money call options position currently open on CME JPY futures that may be in play to go in the money in the immediate term.

As of last close on CME, monthly options for Dec23 JPY futures for which last trade date is Fri Dec 8th- there are (outstanding $ notional amounts are approximate)-

0.00685 CALLS: $250mn

..big, but not alarming.

THEN.. there are these two…

0.0069 CALLS: $850mn

0.006925 CALLS: $750mn

Essentially, if USDJPY continues to fall / JPY futures continue upside, and then breaks meaningfully thru the first strike at 685 (I’m leaving out the “0.00___” prefix on JPY futures pricing from here forward), that may trigger a relatively small gamma squeeze on the dealer side (market makers who are short these calls and need to hedge their position by buying futures).

But that small gamma squeeze at 685 can then push JPY futures right into the 69 level, where there is SERIOUS sized call open interest of nearly 10k contracts (approx $850mn notional) for a much larger potential gamma squeeze. And that will then surely trigger yet another layer of JPY call open interest a few ticks above at the 6925 strike price with nearly 9k contracts ($750mn notional).

This is one single trader, by the way. ive been following this position since mid Nov, when suddenly both positions were opened (from zero open interest prior).

For anyone who’s eyes are glazing over from options talk, my apologies, basically what i’m saying is that if JPY futures get through 0.00685, it can then get to 0.0069. If it does, JPY can seriously rip higher (USDJPY plunge) - and in an extremely violent, volatile manner - and not JPY appreciation a “good” way for anyone (or for most people) - because these are options that expire at end of day on Fri Dec 8th.

This can cause global, cross asset mayhem, though if it does, would likely be temporary (but, losses aren’t temporary). I don’t know what could happen, let alone THAT any of this would happen in the first place - but just off top of my head, a surge in JPY will first and foremost crush the broader dollar complex in a volatile way. It can also hit carry trades and force them to unwind long risk asset positions (stocks). And it WOULD usually bring a bid into bonds, BUT - we currently have a significant sell off in JGBs simultaneously underway. So on the rates front- just bond market volatility and erratic price action - which is also not good.

We also now have BOJ stepping in with an unscheduled JGB buying op just announced.

So, watch CME yen futures (6JZ23 - Dec23 JPY futures), rather than spot USDJPY - and watch for 0.0069 levels to breach.

And unless you know all of this already, I wouldn’t trade this. Just a heads up.

And stay tuned for my deep dive (written piece) on US yields in Nov thru the lens of BOJ and JGBs. If you haven’t seen my podcast episode on BOJ and JGBs behind the yield RISE from July - Oct, see below. Thanks as always.

Any views on where the USDJPY might be heading from here and why?