How Asia Is Guiding Trump Tariff Policy & Markets

Japan & China: tariffs, and selling US Treasuries. The great JGB short squeeze that kicked off UST volatility.

First and foremost, thank you all for your patience and your kind support you’ve given me and my family over the past two weeks as I had spent much of my time bedside in hospital with my newborn, who is pulling through and doing better. Since I am not allowed to bring anything into the room other than my phone, I can only follow so much of the flood of developments happening - and probably a good thing, as it allows for me to see the big picture and not get the moment to moment whiplash. I am also unable to do anything other than write notes - so, here are my thoughts on Trump tariffs and market observations made over the course of the past week. Note that the charts in the final markets section are not the most up-to-date, as they were taken only when I had moments of access - but they still reveal the markets story as I see it.

Big picture takeaway regarding the UST story, as well as the tariff story (which are overlapping) - we MUST watch Japan and China.

China is very appropriately getting an enormous amount of the share of global market attention regarding tariffs - but it seems that Japan is not getting anywhere near enough eyeballs - and it absolutely should.

It’s clear that there are two broad categorizations that the Trump administration is filing each tariffed country under, and it’s not the traditionally grouped “allies” and “adversaries” of the United States - it’s:

Everyone ex-China

China

Japan

Among the 80-something non-China countries who now have 90 days and counting to work out some sort of new “trade deal” with the US, Japan is at the very front of the negotiation queue - those are the exact words of Treasury Secretary Bessent that he’s been repeating enthusiastically all over media. Speaking of the United States Department of Treasury, the world‘s most powerful fiscal authority, Secretary Bessent is personally taking the helm for the US’ head counterpart to Japan’s trade negotiation team, led by Minister Akazawa.

Basically, China will be made an example of for those who proceed with economic relations to the US in an adversarial manner, and Japan will be the example of countries who act in a cooperative manner with the US on economic matters. And since China is in its own category, Japan matters because it essentially sets the tone for the rest of the world in relation to the US.

This is not to say that every country will have a “deal” that mirrors that of Japan, nor that Japan’s “deal” will be successful, as the kick-off model for the rest, or otherwise. But among the non-China countries and market impact, Japan is the most significant at this moment - which is why Secretary Bessent himself is on it. If there is some sort of “successful deal” that emerges out of these negotiations, and emerges quickly at that (however such an announcement is made) - that can be a potentially massive risk-on catalyst to hit global cross-asset markets. Conversely, if the Japan negotiations hit setbacks and divergences, then that could re-shatter the market calm in the immediate aftermath.

Either way, Japan matters greatly for the rest of the world ex-China in this US trade and economic relationship review. Japan minister Akazawa is currently on his way to Washington to meet directly with Secretary Scott Bessent and Trade Representative Jamieson Greer.

Regarding these specific US-Japan negotiations, while everyone’s focus will primarily be on autos, I would say - watch for anything on rice tariffs for a potential “win-win,” or a lost opportunity. The White House is claiming Japan has an egrigious 700% tariff on US rice imports. Japanese commentators are saying that is clearly a ridiculously untrue figure. I haven’t looked into the depths of this (because its pointless to do so if basic realities aren’t agreed upon to start), but the truth seems to be somewhere in the middle - Japan does indeed tariff rice imports at 700%, but only tariffs a certain proportion of its imported rice, and those figures are based on past statistics for which the government doesn’t release (Nikkei says the current rice tariffs are “merely” 400%).

My view - who gives a shit about whether or not the 700% rice tariff is real - it sets up for an easy win-win, and one that the US may have intentionally teed up heading into these global “make-or-break” first negotiations.

Recall my January 2025 Bank of Japan “rice rate hike” coverage - in which BOJ cited soaring rice prices as a reason for hiking rates in January - as there is indeed a severe rice shortage currently in Japan, such that the government has to tap into its rice reserves to alleviate record high rice prices. Japan needs rice. US wants to export more rice to Japan without a 700% tariff. US knows Japan is facing a rice shortage. So, if the US is claiming there is a 700% tariff on rice imports to Japan, and the figure isn’t even real, then Japan just needs to pretend the figure is real and “drop” its rice tariffs down to whatever the current real figure it is - provided that it is indeed a far lower figure. Japan gets its much needed rice, Trump gets a big headline win on tariff negotiations, win-win.

The only loss here would be a symbolic one against Prime Minister Ishiba, who has this long standing reputation for always “fighting for the forgotten rural population” - farmers. Rice farmers. Japan’s long ruling LDP party has indeed held very protectionist trade policies for Japan’s rice farmers in particular - this was even a point where then-king-of-Trump-trading former PM Shinzo Abe had essentially begged Trump 1.0 to let the rice tariff issue go (and he did), because the domestic blowback from those constituents is perceived to be that politically critical. And given how generally incompetent PM Ishiba is, both in reading domestic politics as well as in international relations, I suspect that Ishiba may not see the bigger picture trade-offs of giving in on rice tariffs to save a broader trade deal that includes the likes of automobiles, and may very well miss this US-given layup. In which case, the headlines, both domestic and international, will read that Japan refuses to budge on “700% rice tariffs” and nukes the broader US-Japan trade negotiation. And Bessent moves on to South Korea.

Also regarding this “700% rice tariff” accusation / reality, I actually think that this may be an example of a broader tactic that is potentially being used within the Trump administration - one in which the US is potentially knowingly and purposely throwing out outlandishly nonsense figures of “unfairness” at each (or certain) countries that may or may not be rooted in fact (but which Trump himself is shown, and believes) - to then “negotiate down” from, and basically end up with some massive on-paper improvement that Trump can tout as the product of successful dealmaking, but doesn’t actually shake up the status quo of global trading, and thereby averts sudden and extreme breaks in global commerce.

Or not.

China

Donald Trump and Xi Jinping are currently caught up in a geopolitical and economic dick measuring contest, and one that neither side can back down from due to their respective, self-perceived domestic leadership credibilities on the line.

I will go through a few of common narratives out there regarding this US vs China face-off and either outright dispel, or offer a counter-argument for them as food for thought.

As of this writing, US tariffs on Chinese imports are at 145%, and China tariffs on American imports are at 125%. And Trump and Xi are both “waiting for a phone call” from one another - meaning no phones are ringing on either side of this kindergarten lunchroom behavior amongst two of the world’s most powerful political figures.

Some think that these rapid back-and-forth retaliatory escalations are now at such absurd levels of mutually assured destruction that they will both come to turning the temperature down, out of their own respective self interests and national standings. This is highly unlikely, at least how things are currently playing out. One of them will call for the call.

“US has more economic might than China, and therefore can outlast China in this standoff, forcing Beijing to be the first to blink.” Yes, the US has greater economic power over China in many ways - but by no means is China some tiny off-the-map island nation with a million dollar GDP economy that relies on exporting papayas. The phrase and concept of “mutually assured destruction” as used in context of nuclear war is very apt - if Pakistan has 500 nukes and India has 600, what good are those additional +100 Indian nukes when it takes less than 10 combined to completely obliterate each other? Even if India and Pakistan each fire off 500 at one another, and India were to somehow survive all 500 of Pakistan’s nukes leveling the peninsula, does India therefore “win” because it has 100 left (i.e. “has greater nuclear capabilities”)? Obviously not. China can, and will, seriously fuck up the US and global economy on its way down - no economy, including the mighty US economy can withstand a sudden cut-off of trade with China. Let alone while simultaneously cutting itself off from every other trading partner in the world. Americans need to stop with this self-delusional economic resilience that it does not wield but imagines it does out of empty nationalism - and also needs to understand the higher pain-threshold that the also self-delusional but nonetheless fierce nationalism that the Chinese can tolerate.

And on the other hand, there’s this notion of: “Trump has 4 years in office and is subject to limitations imposed by a souring American populous (even if traditional US government structures of checks and balances don’t apply), whereas Xi has absolute power, and forever - therefore Xi has time to wait it out, while Trump has an expiration date. Advantage: Xi.”

I think this is a flawed approach - not because it isn’t based in reality (it is), but because it doesn’t consider the downside of not having term limits. A trade war between the two largest economies which falls upon 350 million Americans and 1.2 billion Chinese is sociopolitically horrendous for both Trump and Xi. If it sustains, the wide scale domestic damage will reverberate for many years to come. At some point, the pitchforks (made in America and China respectively) will come down upon Washington and Beijing. And when that happens, Trump has a systemically imposed off-ramp in the form of term limits- an invaluable luxury that the self-proclaimed dictator/overseer of a destroyed Chinese economy does not have. Xi has to live with the severe consequences from 1 week of getting roped into a spur of the moment economic dick measuring contest for the rest of his increasingly paranoid days. Xi does not get to “step down” upon mismanagement (setting ablaze) the Chinese economic miracle and “choosing” (forcing) to drop the yuan to 9+ vs USD, lest he want to tragically slip on a fatal banana peel left by his successor. If you think I’m kidding, take a look at Premier Li Keqiang, China’s then-2nd most powerful leader who “had a heart attack” and died in Oct 2023, a few months after stepping down from his decade at the top of the CCP - a guy who had to handle China’s incredibly complex top-down economy and bureaucracy, who oversaw the burst of the housing and tech sectors, Zero-COVID policies, and much more - but I suppose couldn’t handle the stress of 6 months of retirement and died. Of “heart attack.” Here’s literally from the top of the Wikipedia page on Li’s death:

Former Chinese Premier Li Keqiang died in Shanghai on 27 October 2023, at 00:10 at the age of 68. He was the youngest premier to leave office and had the shortest post-premiership lifespan since the founding of the People's Republic of China in 1949.

So, Xi’s absolute power without term limits is not an advantage in escalating and fighting a trade war with a 2nd term Trump who gets to leave office regardless of the state of the economy for better or worse - Xi is trapped, and is at a severe disadvantage vs Trump.

Also, let’s just be very clear - Trump doesn’t give a fuck about US midterm elections or the Republican Party for that matter - the guy has been a Democrat for far longer than he is “a Republican,” and even stacked his cabinet with very recently former Democrats. And no, I’m not saying he’s a Democrat either - Trump is an incredibly fluid creature with no core consistent inner-ideology, except on one issue: tariffs. Anything and everything else - he’ll take the wins and brush off the losses as he wishes - while Xi wishes he could do just that as well.

Foreign US Treasury Holdings

Is Japan Selling USTs?

Maybe. But first, let me remind you of something that is always overlooked with these matters. When it comes to this whole “Japan is the largest foreign holder of US Treasuries, followed by China” - yes, this is true. “Japan” in this context does not refer to Japan, the sovereign. While institutions like the Bank of Japan do indeed hold US Treasuries (as all major central banks do), it is the Japanese private sector investors who are the major holders of USTs. Unlike “China” - which is indeed the sovereign’s holdings of USTs.

This is a massive night and day difference. Since it is the Chinese government’s holdings of USTs, said USTs can indeed be weaponized in economic war if the Chinese government wishes to do so. But in Japan’s case, it is private sector institutions who hold the bulk of these “largest foreign holdings of USTs.” Yes, there are state institutions like GPIF and Japan Post who own enormous sums of USTs, and I suppose they can be leveraged in a trade war vs the US. But an institution like Dai-Ichi Life Insurance and it’s hundreds of billions in UST holdings has no dog in this fight - what the hell do they care how many Toyotas vs Fords are driving around on American and Japanese roads. They have asset vs liabilities to not-mismatch. Or Japanese banks. Or Japanese asset managers and private pensions. They need yield, collateral, safety, diversification. They will buy and sell USTs as they see fit, and are not at the direction of Minister Akazawa.

So, back to the question - is “Japan” selling USTs? Maybe. Does it matter in context of "Liberation day?” Not really - because if “Japan” was selling USTs and had yields spike, it would be some private institution executing their order for market reasons (albeit in a very horrendous manner), and not to engage in some trade war on behalf of the Japanese government agains the Trump administration.

How about - is “Japan” BUYING USTs? Yes, this seems to be the case. Again, since “Japan” is not a single government monolith, “Japan” - as in, among the various private institutions within Japan can be buyers of USTs, while others can be sellers of USTs.

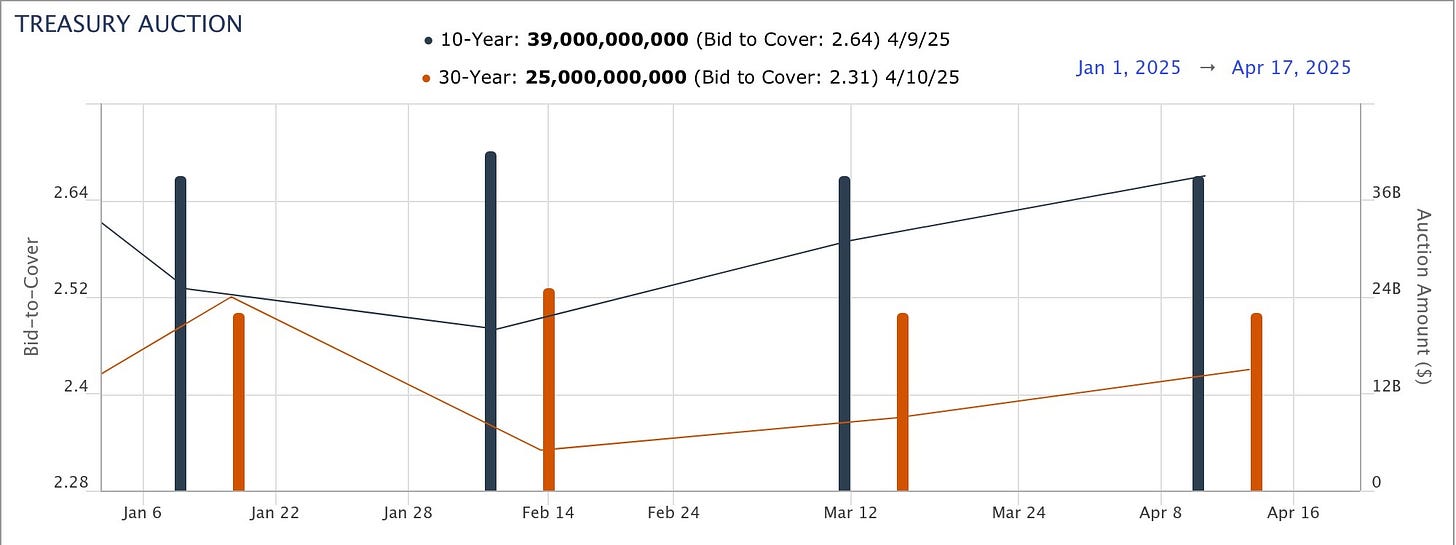

Take a look at the two UST auctions for 10Y and 30Y USTs held on 4/9 and 4/10 - both of which saw strong demand and record participation from overseas accounts.

So, “Japan” may or may not have been selling in the secondary market, but were buyers in the primary market for long dated USTs. Either way, Japan long only institutions likely weren’t the culprit behind the long-end yield volatility from tariff-flip-flop week. But the fact that they hold so much US debt and can liquidate (or support) their portfolios irrespective of sovereign trade negotiations adds an additional element of heightened importance to Japan in this America vs the world saga.

Is China Selling USTs?

No, they are not. We won’t ever know for sure, because the “data” is both very delayed, and very foggy - and therefore it’s useless. But it is my very strong view that this sharp rise in long-end UST yields is not due to China hitting the 30Y bid on purposefully disruptive size to intentionally spike US borrowing costs last week - and here is why.

First of all, let’s remember that China has very steadily been decreasing its UST holdings over the past decade - which is in large part why Japan is now the world’s largest foreign holder of USTs (and I will get into this below). But the argument making the rounds this week is that China is sharply accelerating its shedding of its massive pile of USTs.

See this passage from a Forbes article from April 9th of this week, which summarizes and encapsulates the widely suspected view:

Forbes: U.S. Rally At Risk As China May Be Dumping Treasuries

China has long been one of the largest holders of U.S. government debt, peaking at over $1.3 trillion a decade ago. Today, those holdings have fallen to just $759 billion, the lowest level since 2009. While that trend has been in place for years, recent events suggest an acceleration in sales — and the timing may not be coincidental.

Behind the scenes, U.S. Treasury yields have been rising sharply — not during the trading day, but overnight, when foreign markets are active. These overnight spikes are more than just market noise. They may be the clearest signal yet that China is quietly — but deliberately — selling U.S. Treasuries.

Just this week, the U.S. imposed a 125% tariff on Chinese goods, intensifying already fraught trade tensions. Hours later, the yield on the 10-year Treasury jumped from 4.1% to 4.5% — and it didn’t happen during U.S. trading hours. It happened in the dark, between 8 p.m. and 3 a.m. ET, when Beijing was open for business.

This is no ordinary market behavior. Yields typically fall ahead of recessions or during equity pullbacks, as investors seek safety. The fact that yields are rising in a period of economic uncertainty points to supply-driven selling — potentially from a foreign source. And China, with its enormous holdings and history of using its reserves as a geopolitical lever, is a natural suspect.

First - this “selling during overnight hours” - you know who else is in the “China daytime hours” time zone? Japan, the largest holder of USTs is. So to attribute a spike in long dated UST yields to China, who is silently and strategically attacking America for tariffs simply because there is “overnight selling” is an extremely oversimplified way of jumping to such a conclusion.

Second piece of “evidence” to dismantle are citations of “yields and FX price action in alignment” - you cannot merely look for yield spreads vs currency pair correlations when it comes to China and US, particularly during this moment of severe cross-asset volatility swings fueled by price-indiscriminate forced position exiting, where any such traditional cross-asset correlations will naturally deteriorate - and I will get to market price action at the end.

China manages its currency value specifically against USD, in which onshore CNY trades in a set range vs USD. The PBOC has allowed for the yuan to weaken vs USD earlier this week, to partially offset the newly increased Trump tariffs. But just the fact that the yuan is a managed currency with a daily midpoint fix makes it a non-pure market - so to then compare USDCNY / USDCNH to market-determined long end UST’s price action doesn’t tell us anything regarding China’s intraday UST selling activity.

Furthermore, if China sells USTs, then they are selling dollars and buying yuan, which would be downside for USDCNH - or yuan strength. But PBOC had set a weaker fix for 6 straight days on the yuan until Friday, during which onshore CNY and offshore CNH weakened by 1% and 2% respectively over just three trading days - which is massive. And long end UST yields rising all the while. So, I don’t see China dumping USTs evident in market behavior this past week, even if markets had been a solidly reliable source of displaying such behavior. Of course this dynamic of market visibility can change going forward - but it isn’t so for this week’s UST yield move being tied to China selling.

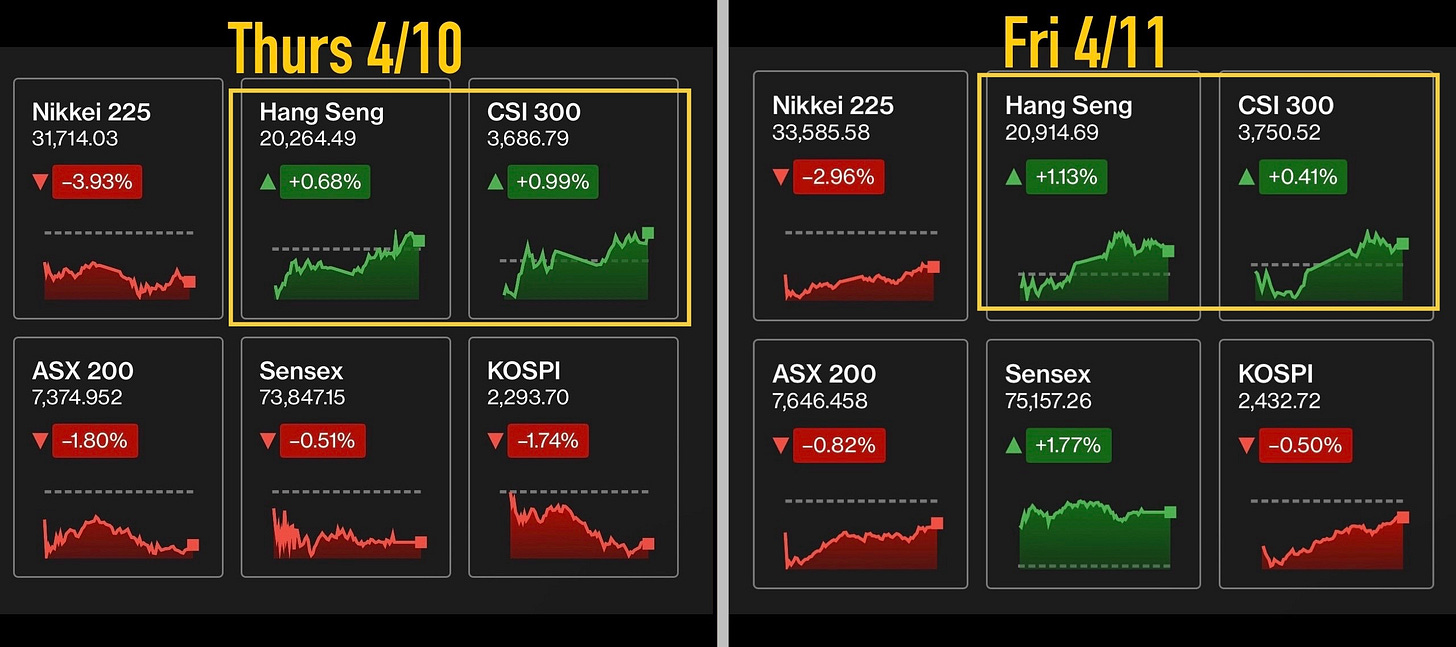

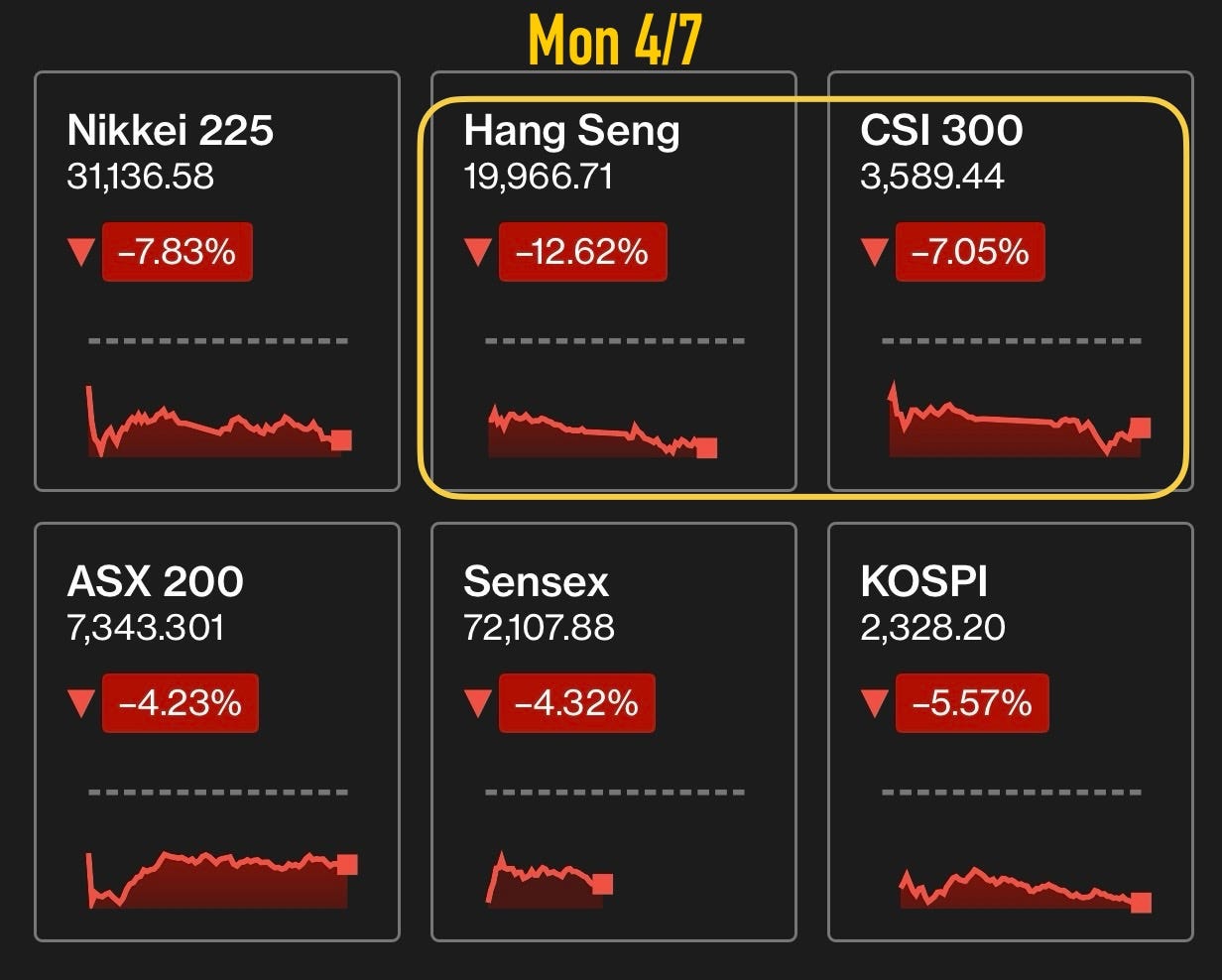

And just a side note - as far as equity markets are concerned, while US and global equities crash and the VIX stays afloat for days on end, China has its so-called National Team - state-backed buyers of domestic equity ETFs to support markets from downside - which is why you have days of China/HK outlier outperformance like this at Asia market close:

…as well as days like this when National Team is either not present, or not present enough:

Finally and most importantly - here is why I strongly believe China was not dumping USTs and spiking yields last week.

If you are China, sitting atop a fairly shitty and ever worsening overall domestic economic picture as is, and then Donald Trump’s United States is swinging its tariff fists at your face - yes, of course you swing back at Trump’s America with targeted tariffs, and in meaningful size, as I mentioned earlier. Because although imposing tariffs on imports is economically damaging to yourself, you are already economically damaged to begin with, and now taking further incoming - what do you have to lose to fight back? Further economic downside - BUT, you now have an external force in a clown-US President Trump to push off the blame for domestic economic misery, so you actually have a gain, and even an incentive to NOT work out a Trump-win “deal” at the end of the road.

But, as China, you also do have one very critical piece of leverage - your one and only silver bullet: you have almost a trillion dollars worth of US Treasuries at your disposal to fire-sale and bomb the US sovereign debt market - which which of course ripple far and wide, slamming every other green and red blinking ticker market, as well causing havoc in the real economy.

Now - to do that would be a very serious and drastic escalation to counter tariffs. It is the financial nuclear option.

Back to this passage from the aforementioned Forbes article:

Behind the scenes, U.S. Treasury yields have been rising sharply — not during the trading day, but overnight, when foreign markets are active. These overnight spikes are more than just market noise. They may be the clearest signal yet that China is quietly — but deliberately — selling U.S. Treasuries.

This is so very stupid - stupid for one to look at it this way, or if this is true, stupid for China to do it this way (which they’re not).

If you’re going to bomb the UST market and destroy Secretary Bessent’s self-proclaimed role as the U.S.’ “chief bond salesman,” you don’t just fire at will in the dark. You first flash your weapon as a threat, and do so as loudly and publicly as possible - so that markets will do the work of fire selling USTs and achieve the outcome of soaring US borrowing costs for you, without having to fire off a single shot of your own ammo. And you do that repeatedly, until markets either destroy themselves, or markets become desensitized to your threats without follow through. Then, you can fire off one shot and take out a pinky from the hand - and say there’s plenty more where that came from. That will add +100bps to the UST long end in half-a-week of trading. Or any combination of these Tarantino tactics.

What you absolutely do NOT do is to unload USTs in size, quietly, secretly and almost anonymously, working through offshore accounts in Belgium to show up on the official TIC data months from now - what the hell would that do other than deplete your ammo and not strike fear into markets / Treasury Department?

They may be the clearest signal yet that China is quietly — but deliberately — selling U.S. Treasuries.

No - that is ridiculous. If China chooses to go with the financial nuclear option and hit the UST market - believe me, we will know about it.

Bond Market Activity

According to Treasury Secretary Bessent and even President Trump himself, the most important green and red blinking ticker, as defined by what it is they keep a close eye on, is the 10Y US Treasury yield.

This is also being perceived as the most important market for global, cross-asset market participants and commentators, because the consensus narrative is that the 10Y UST yield, or the alarming behavior of it, was the key culprit behind Trump’s sudden 90-day postponing of tariffs (ex-China) hours after they were implemented.

Or rather, the behavior of long end yields relative to USD - in which USTs and USD was getting sold off simultaneously. So if that is the case, then we need to take a look at 10Y USTs and try to figure out what is moving them - because if US 10Y’s price action (and nothing else) is guiding and shaping tariff policies out of Washington, then that which is moving US bond yields is really what has been responsible for these extremely volatile tariff policy developments.

While most admit they don’t know exactly why long end UST yields are spiking, these are the most widely discussed potential reasons:

Long-end yields are reflecting tariff-induced expectations of higher inflation“American Exceptionalism” is no moreChina is selling UST holdingsJapan is selling UST holdingsForced position unwinding, deleveraging, and dash-for-cash liquidations

Of these five, it is really just the last one behind the yield moves, and the cross-asset dislocations.

The most significant market event that had occurred in this whole “Liberation Day” saga to date wasn’t Liberation day itself, nor was it the reversal -

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.