It’s “Official” - Nikkei: BOJ Rate Hike to 0.5% Friday

Nikkei drops “breaking news” headline at 🇯🇵7PM today- market outcomes now depend on Gov Ueda’s press conference. What to know heading into Jan’25 Bank of Japan meeting.

Last Friday after Japan market close, Nikkei dropped an exclusive leak for BOJ to hike rates at this Friday’s meeting - as flagged here:

Nikkei Leak: “BOJ Rate Hike Likely Next Week”

Nikkei, the official unofficial pre-meeting communication arm of Bank of Japan, just published an exclusive for a BOJ rate hike (likely) coming next week.

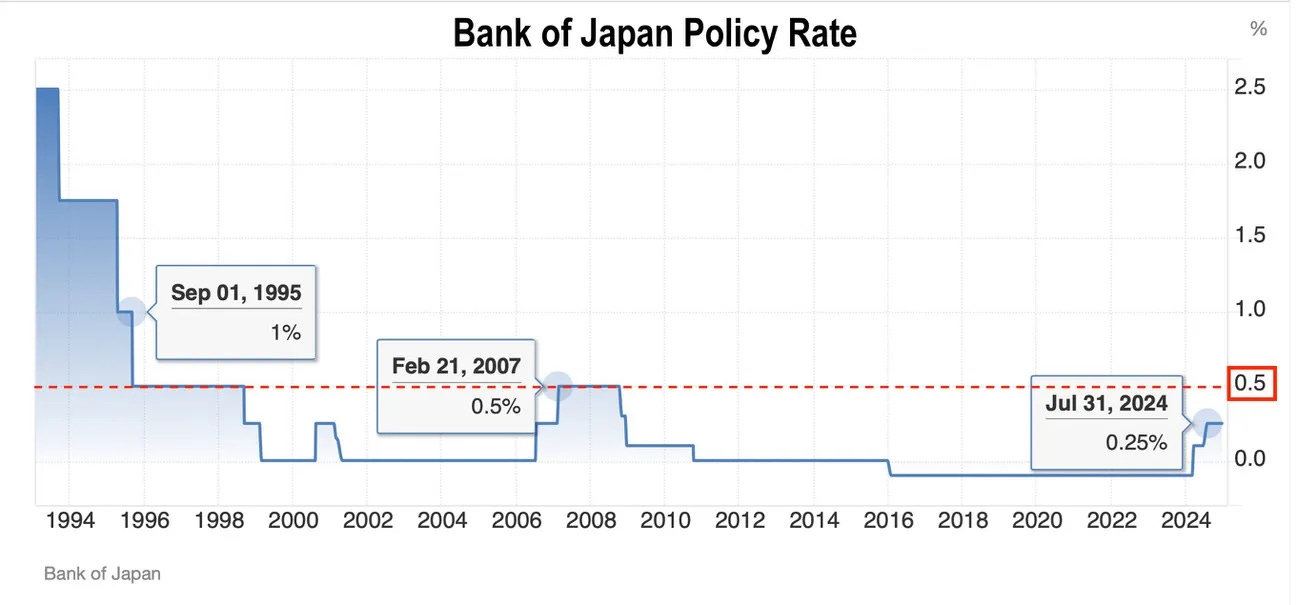

This 25bps hike to 0.50% on the policy rate is well priced into markets already - so the official policy release (and not the Nikkei policy release) at around noon Japan time tomorrow shouldn’t be a market mover in and of itself.

Nikkei: BOJ set to vote for rate hike to 0.5% on Friday

https://asia.nikkei.com/Economy/Bank-of-Japan/BOJ-set-to-vote-for-rate-hike-to-0.5-on-Friday

The real BOJ meeting, as far as markets are concerned, will be Gov Ueda’s press conference.

If BOJ has a dovish hike, JPY will sell off.

If BOJ has a “hawkish” hike, JPY will be flat ~ slightly stronger.

And if BOJ doesn’t hike at all, JPY will get crushed.

This hike to 50bps is significant, because of the perception of this “50bp ceiling” that exists with market participants - in which prior BOJ “hiking cycles” haven’t been able to get above 0.50%.

At the July 2024 shock rate hike press conference, Gov Ueda was explicitly asked about this “50bps ceiling” - for which he uncharacteristically gave a definitive response: there is no “50 bp ceiling.”

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.