JGB Vigilantes

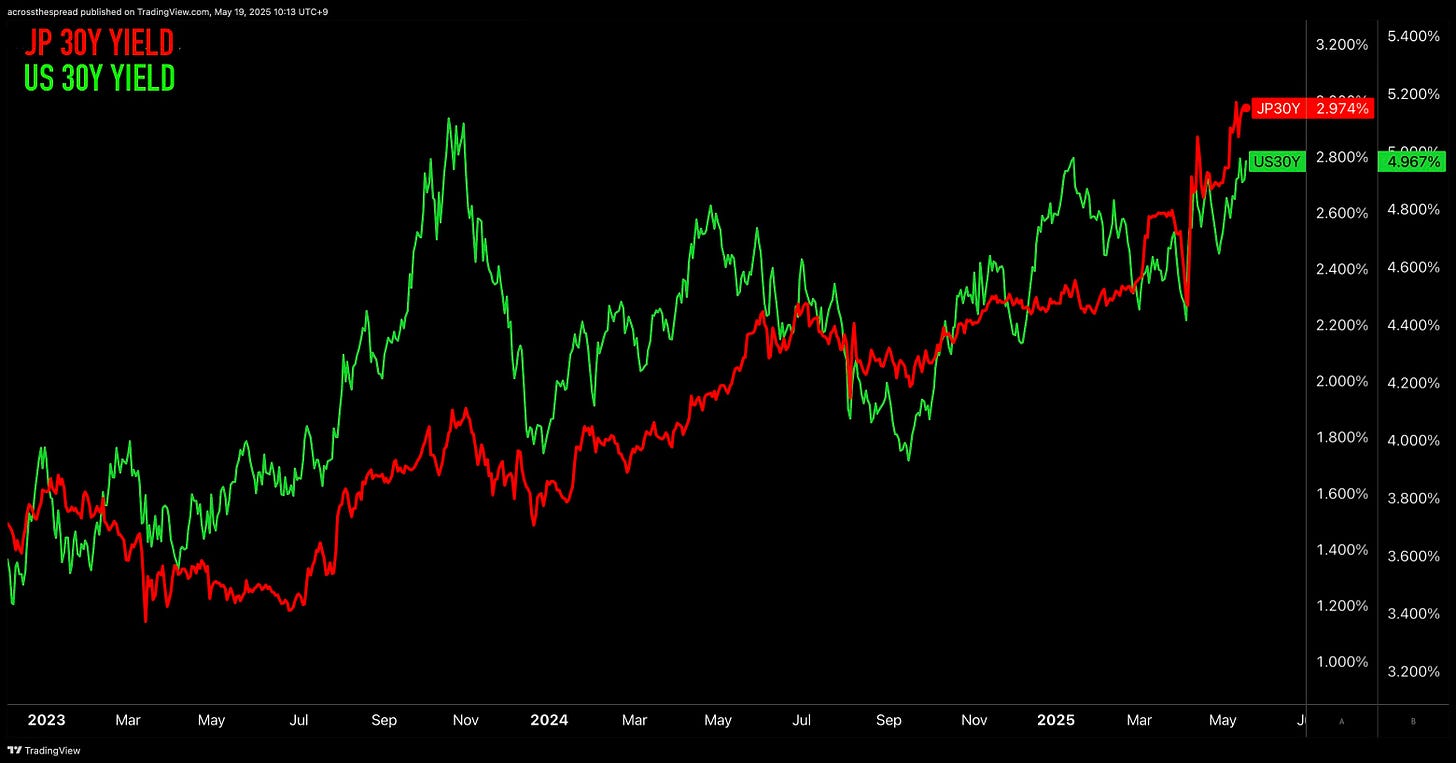

If you want an actual market-read on long-dated UST yields, watch what's going on in long-dated JGB yields - which are blowing up.

My quick comment from Monday regarding Moody’s downgrading US was really commentary on long dated JGB yields:

Moody’s finally joins its (fellow clown) ratings peers in downgrading US debt from Investment Grade → Investment Grade.

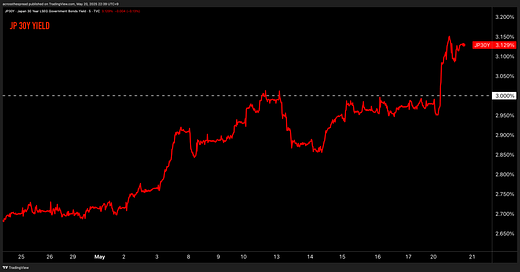

All eyes on US30Y yields - when they should be on JGB30Y, as both are +80bps in a month, but long-end JGBs are ripping thru 2000 highs, while US30Y isn’t even at YTD highs.

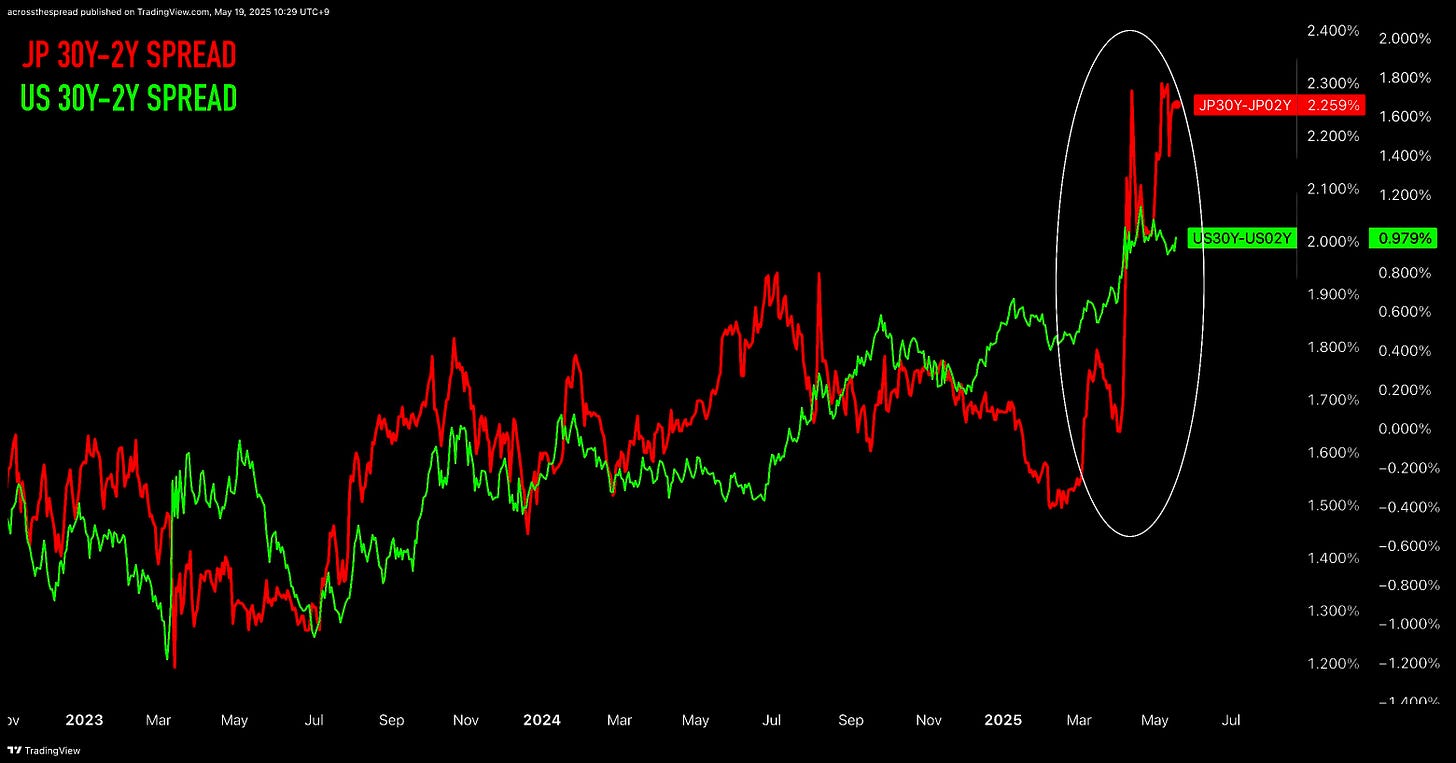

You wanna see a curve steepen? See JGB2s30s going vertical vs US2s30s steadily uptrend

Immediate-term price action aside- the “beauty” of having your largest foreign creditor be far more indebted than you are means Moody’s opinion doesn’t really mean shit for what’s deemed “creditworthy”

May 19 10:54 AM

On Tuesday, the long end of the JGB yield curve got absolutely crushed - with JGB 20Y yields +14.5bps to 2.55% highs not seen since 2000, 30Y yields +15.5bps breaking clear through 3.0%, and 40Y yields +14bps to 3.60%. These were all time record highs on JGB 30Y and 40Y yields. 10Y JGB futures were also crushed on heavy volume - then stabilizing, albeit lower, with 10Y yields back above 1.50%

The sell off in long-dated JGBs was the result of a terrible 20Y JGB auction result showing the weakest auction demand in decades. Ministry of Finance sold ¥750 billion in 20Y JGBs at an average yield of 2.453%, and the lowest accepted price (highest yield) at 2.54%. This price difference between average vs lowest in a primary bond auction is known as the “tail” - the greater the difference, the more the discrepancy in expected pricing. The tail on this latest 20Y JGB auction was ¥1.14 - which is not only a massive jump higher from ¥0.34 tail at previous auction, it was the highest tail in 25 years. Bid-to-cover ratio (¥ amount of buying demand vs ¥ amount offered for sale by MOF) came in at 2.50, sharply down from 2.96 at previous auction, and the lowest bid-to-cover since 2012.

Basically, the Japanese government tried to sell a non-abnormal amount of 20Y JGBs, and was met with a much smaller amount of capital bidding at a far lower price than expected. In other words, this is akin to the scenario that the so-called bond vigilantes of US Treasuries have been long calling for - a “failed” auction in which, one day, the US Treasury Department will attempt to sell a bunch of USTs at auction, and buyers will not show up, and those who do will demand a far higher yield to compensate for the heightened perceived risk of lending.

I am not saying that this particular 20Y JGB auction was a “failed auction” - any more than I am saying it was a “successful” one. What I am saying is the following:

This conceptual scenario of a “failed bond auction” is very ill-defined in general. If and when it should happen in the US (or anywhere, including Japan), it likely won’t be some sudden “buyer’s strike moment” where 30Y bonds that previously sold for 5% or whatever yield a few months prior is suddenly not finding any takers at 50%, 80%, 150% yield, and Earth implodes. Global investors aren’t some singular monolith who all just wake up one day and “decide” in simultaneous unison that a global reserve asset is suddenly no longer so - let alone the functional necessity of said assets that have structural systemic use and demand that won’t be abandoned in sudden agreement by all. Rather, it would be a longer series of stair-step processes, the starting point of which will be debated in history looking back. Perhaps we are already underway with the process.

If there is to be some “failed auction” for the US in particular - then it chronologically wouldn’t happen first among the G7 majors, most certainly not before Japan’s much more horrendous fiscal mess. US Treasuries getting scrapped into the dumpster of history’s failed societies doesn’t happen with JGBs still deemed worthy of value.

Meaning - if we really want to monitor and examine the state or status of long-dated US Treasuries and their credibility or demand by global investors, we must closely monitor and examine what is happening in Japanese Government Bonds as the key indicator. Not what Moody’s (or S&P and Fitch) ratings are (or “our opinions” as they’ve re-branded their “ratings” as during Congressional hearings in the aftermath of ‘08 with imploding Lehman paper stamped as “investment grade”), and not what talking heads on Wall Street or Capitol Hill say regarding the market’s assigned creditworthiness of US government bonds.

As I have been flagging publicly for years - watch the fucking JGB markets. Not because we give a shit about Japan or not (sorry/no offense Japan), but because the treatment of JGBs by both investors and the state / central bank lead the pathway for the rest. Not (just) “leading indicators” - leaders, as in: cause-and-effect.

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.