JGBs Flash A New Type Of Warning Signal For Global Bond Markets

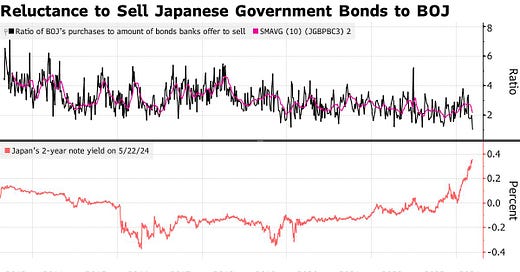

For the first time, Bank of Japan was not able to buy as many JGBs as offered to markets. This is concerning - here is why.

🔹Markets show a first-time ever potential “self-imposed” cap on JGB yields by selling less JGBs than BOJ was offering to buy, and thereby, revealing the only force left to effectively stop JPY downside.

🔹BOJ’s inability to buy as many JGBs as it had always assumed it could is far more significant than realized - as it signals a critical reminder to glo…

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.