New PM Ishiba Meets BOJ, USDJPY Nears Support Levels

PM Ishiba makes market-moving dovish BOJ public comments when NKY sells off. The key JPY levels to be aware of in the immediate term.

Japan's new Prime Minister Ishiba met with Bank of Japan Governor Ueda for the first time since appointment earlier today.

Here's what Ishiba had to say after this “meeting of the minds.”

"I do not believe that we are in an environment that would require us to raise interest rates further," Ishiba told reporters Wednesday night, adding he was not in a position to instruct the central bank on monetary policy.

"I have told the governor that I expect the economy to continue to develop sustainably while maintaining its current easing trend, and that the economy will continue to move towards overcoming deflation."

And from BOJ Ueda following the meeting:

"I told the prime minister that we are supporting the economy with loose monetary conditions," Ueda said.

Ueda added the BOJ will raise interest rates if economic and price developments move in line with its forecast.

"But I said we will adjust the degree of monetary support cautiously, as we can afford to spend time scrutinizing (economic) developments," Ueda added.

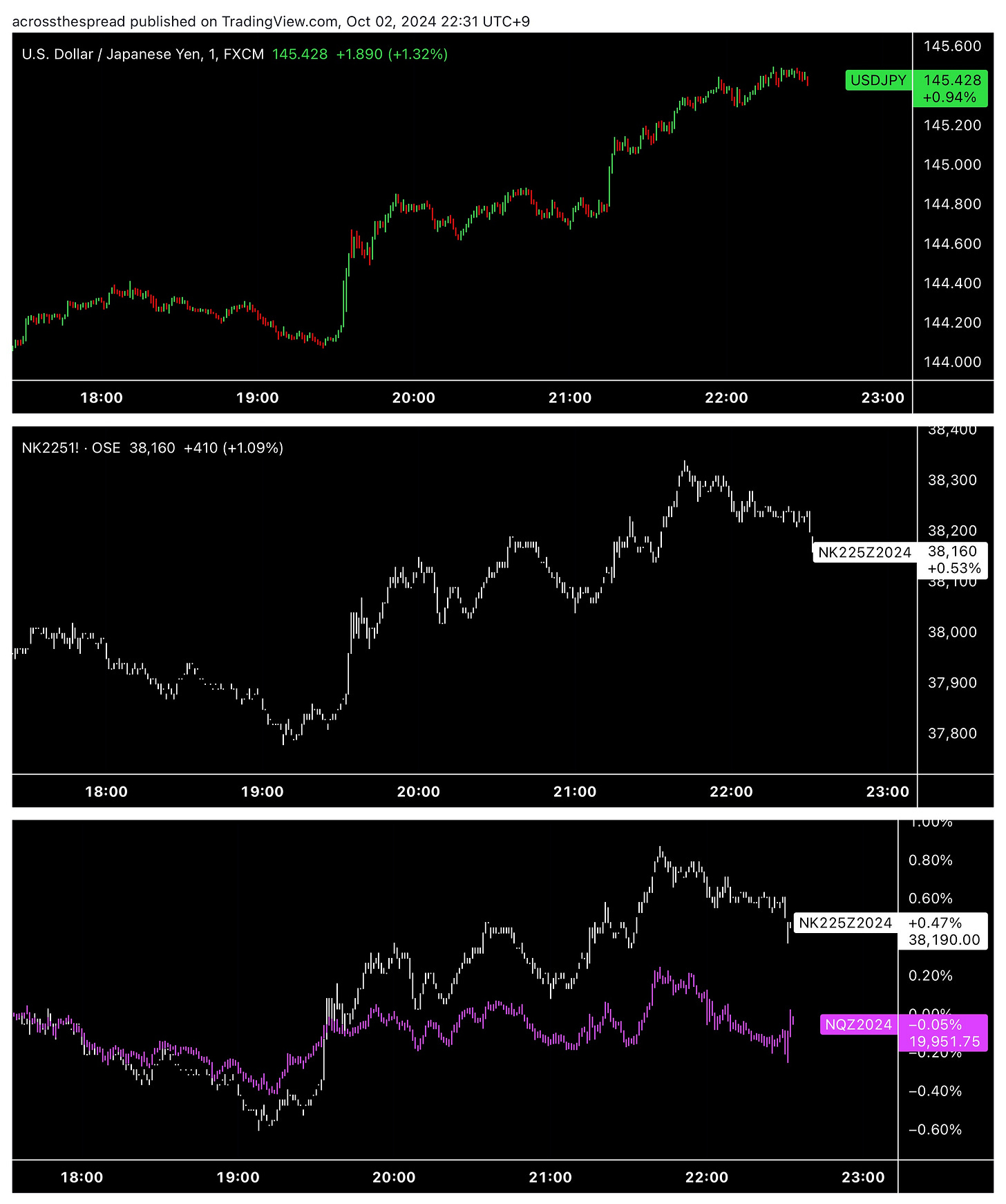

The market reaction was broad based JPY down (USDJPY +1.2%, EURJPY +1%, AUDJPY +1.3%, CNHJPY +1.25%, MXNJPY +2.5%), and NKY futures up:

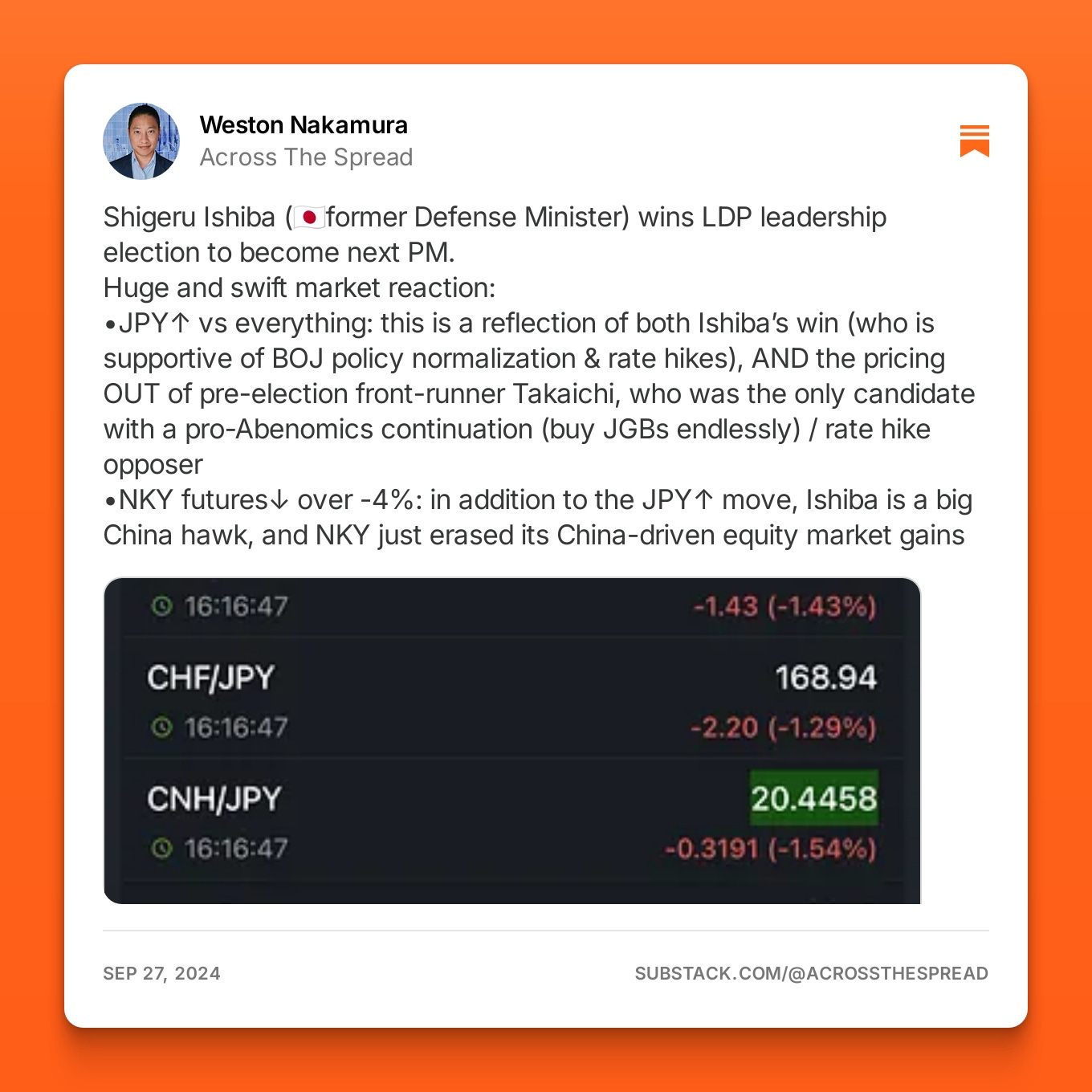

The market is reacting in this manner (particularly weaker JPY) because Ishiba, as prime minister, has completely flipped from his long-standing position of being a BOJ Kuroda easing critic, and a pro-policy normalization voice (not that this is any of his business anyway), as per my Note below:

In fact, the market is actually reacting as if Ishiba's runoff election opponent Takaichi (Abe's ideological clone), who's shock-loss had resulted in Friday's JPY surge and the sharp NKY futures drop, had ended up winning after all:

Ishiba's conversion is not just some general garden-variety “flip flopping” politician on whatever the issue of the day is - his (now apparently inauthentic) “hawkish stance” had been consistent throughout the years - and can even be pinpointed back to very recent times.

Here is then-potential-candidate Ishiba on August 7th, just 2 days following the Black Monday -12% single day drop in NKY, as BOJ was taking heat for the shock rate hike a few days prior.

"The Bank of Japan (BOJ) is on the right policy track to gradually align with a world with positive interest rates," ruling party heavyweight Shigeru Ishiba told Reuters in an interview.

"The negative aspects of rate hikes, such as a stock market rout, have been the focus right now, but we must recognize their merits, as higher interest rates can lower costs of imports and make industry more competitive," he said.

Aug 7 2024 Reuters: Japan premier candidate Ishiba endorses BOJ's rate hikes

The above sounds like a guy who appears to have consistency, and more importantly, strongly held, genuine beliefs. Willing to take short term (or perhaps even longer term) pain, for a greater good mission.

But when Ishiba finally becomes PM after 5 attempts over nearly 4 decades - all of that immediately goes out the window.

This past Sunday, after NKY futures plunged -5% upon Ishiba's election win, and before Monday Japan cash equity open, he interviews with NHK and says:

"From the government's standpoint, monetary policy must remain accommodative as a trend given current economic conditions.”

-incoming PM Ishiba

Additionally, we get his newly appointed minister of economic revitalization Ryosei Akazawa (among those who are first-time cabinet ministers and not carry-overs from Kishida's administration) telling the press earlier today:

"Ishiba's (previous) comments on the need for monetary policy normalization have conditions attached," said Akazawa, a close ally of Ishiba.

“I don’t believe that we have completely overcome deflation at this point, and I still cannot deny the possibility of falling back” into deflation, Akazawa said. “As long as I feel this way, I would like the BOJ to share our view that it needs to be cautious about raising interest rates.”

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.