Nikkei 40,000 is here

The real ceiling. Now its time for futures and options to drive the market into March expiry this coming week.

So it finally happened.

But remember- in my last 2 write-ups, I’ve been saying that the real resistance level for NKY is ~40,000.

I’ve been getting a few market notifications saying the Nikkei 225 cash index actually printed 40,000 just before market close today - in fact, I even see an article explicitly stating NKY225 → 40k.

Just to be clear, the Nikkei 225 cash index did NOT hit 40,000 today (or ever, yet).

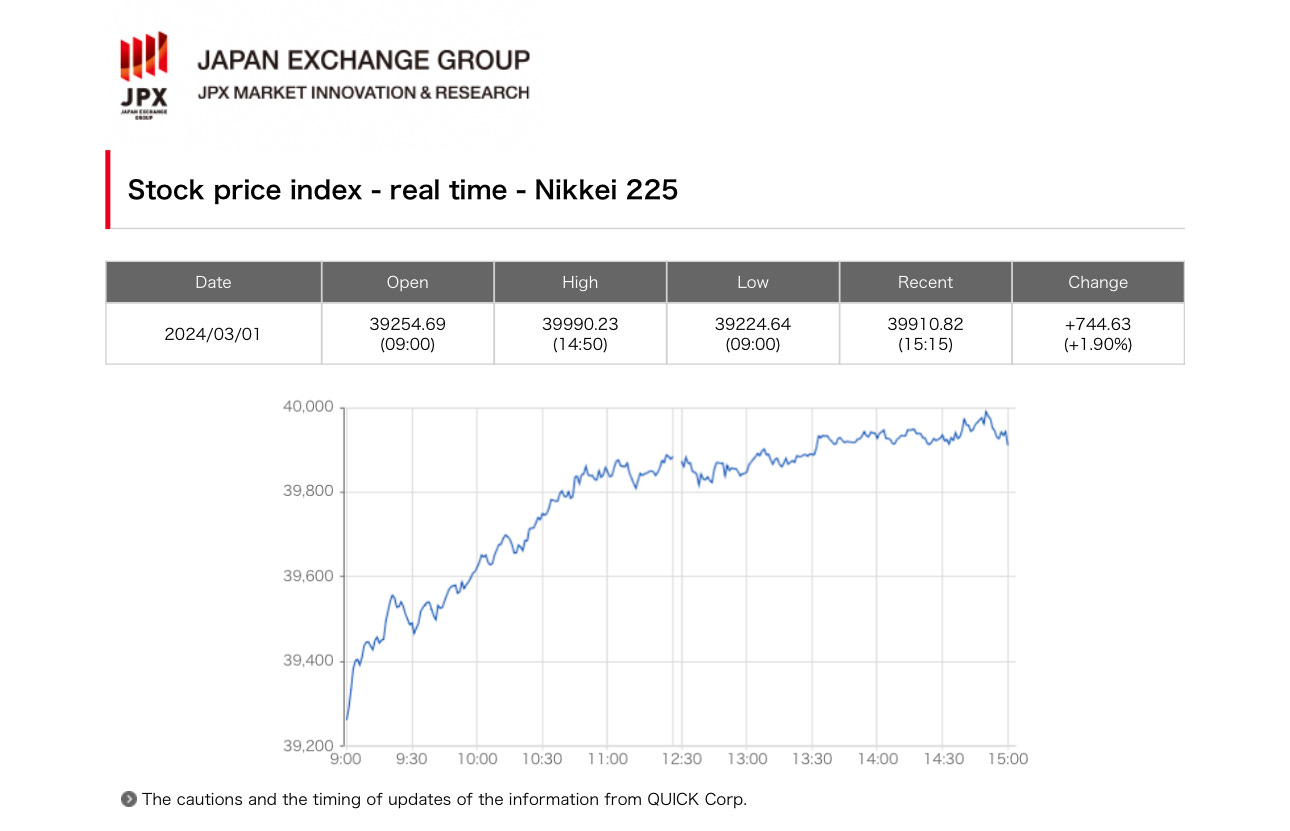

Here’s the official score from JPX at the close: 39990.23 highs, 10 minutes to PM session close.

You might be thinking- close enough, what difference does it make if it touched 40k or 10 points shy?

Normally for any major index, I agree - makes no difference. But since we are talking about the DM equity world’s very last real resistance level left, it does make a difference (and if your data feed is showing inaccurate price quotes, that’s another significant issue altogether).

Recall- the NKY index resistance level I’ve been highlighting and discussing isn’t that arbitrary 38,915, but rather, 40,000.

Last week I published 2 articles on NKY.

Part 1 of 2 was flagging NKY225 approaching its all time record highs set on New Year’s Eve 1989, when BOJ hiked rates and put an end to the ‘80s bubble - as the world’s last resistance level.

Part “1.5” of 2 was flagging NVDA earnings (pre announcement) as the potential catalyst to push the cash index through its all time highs, led by its heavyweight semiconductor components.

And as NKY cracked through 38,915 hours after NVDA earnings led by semiconductor names, and continued drifting higher, that made what I had pre-prepped for Part 2 of 2 in need of a shaking of the etch-a-sketch.

So, consider this a “Part 1.75” of 2.

Or you know what - let’s just scrap my stupidly predetermined “2-Part article” structure - because as always, market realities dictate flexibility. The NKY doesn’t give a single F about holding off while I write my explainers.

So, here is Nikkei index at all time highs commentary piece number 3 of infinite. Structure as such:

Part 1 was about the cross asset market mechanisms in which a weakening yen + a record high domestic equity market drives NISA (and other) Japanese capital flows into U.S. equities (i.e. the why you should care article).

Part 2 was flagging the bottom up single stock drivers that may push the NKY cash index to break a new record high.

And now for this Part 3 article, we are no longer “solely” in single stock constituent land- let’s discuss the market driver baton hand-off: top down index driven NKY futures and options.

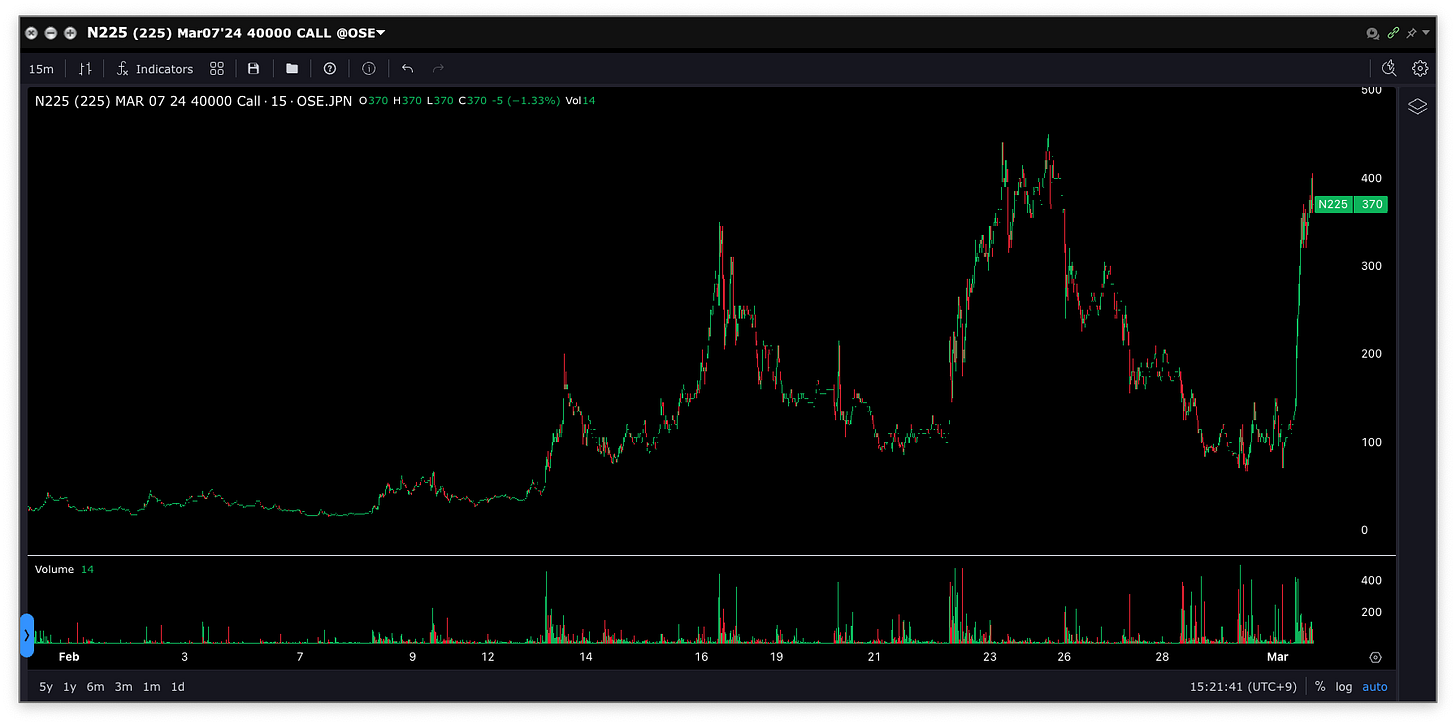

NKY March 40,000 Calls

I’ve been watching these options contracts in the manner of a predatory bird. You should too. Because for the next week ending March 8th, NKY index will be by and large driven by March quarterly expiry index futures and options - last trade date Thursday March 7th.

Now, although I did get these false alarms of NKY cash index printing 40,000 today - NKY March futures actually did print 40k minutes after PM cash close.

That’s a big deal- because that 40,000 level puts about ¥440 billion notional in NKY March 40k call open interest at the money.

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.