Short France / Long USTs: Japan Institutions Moving Global Bond Markets

French bonds blow up Japan portfolios forcing a blind rush into USTs. This isn’t “demand” for Treasuries, or US-related at all - therefore USTs can be abandoned for any reason. What you need to watch.

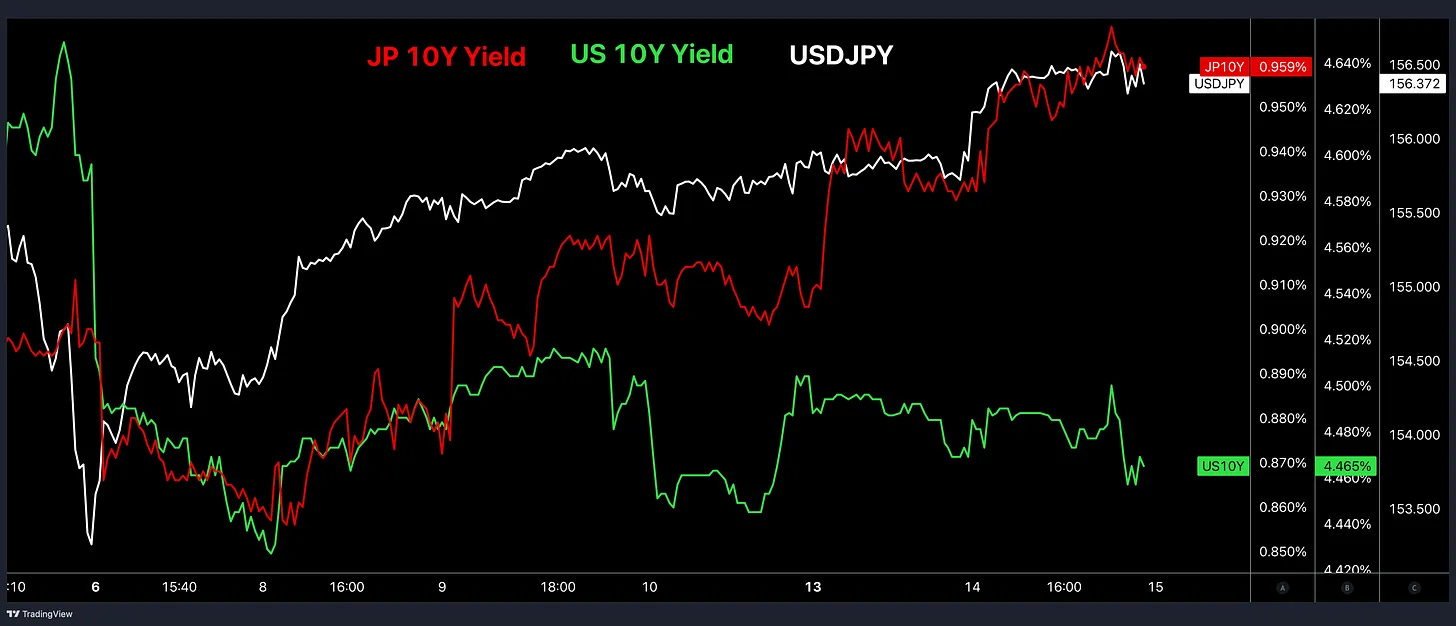

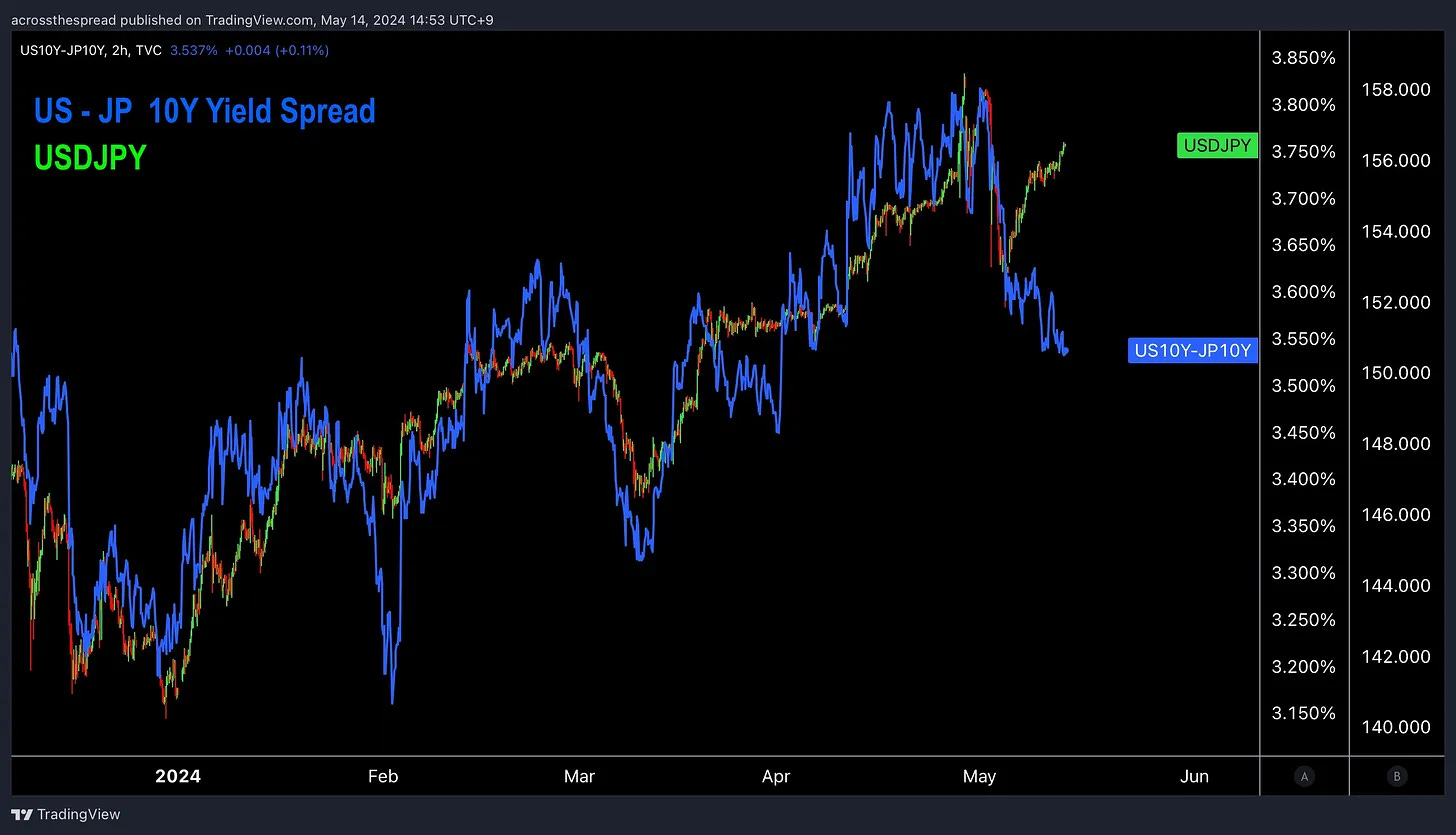

Last month, I had discussed extensively how JPY was weakening (USDJPY rising) despite US yields falling, JGB yields rising, and US-JP yield spreads narrowing, because - much to market consensus’ (mis)read/understanding of market fundamental behavior, as well as Japan officials at BOJ and MOF’s major dilemma - JPY was getting sold off in tandem with JGBs, much like a troubled emerging market would.

Heads Up: Japan's Dual Market War At A Critical Point

◆JGB 10s looking to breach 1% (last YCC upper band level) - what will BOJ do (or not)? ◆Japan is trading like an emerging market: contrary to broad belief, USDJPY is moving with JGB yields, not UST yields ◆JGBs and JPY at critically low levels - why this time BOJ & MOF will have to choose one over the other

Charts below from the section: Japan is trading like an emerging market (May 17th - just before JGB 10Y yields smashed through the 1% “ceiling”)

Then last week, I discussed how the turmoil exploding in French bond markets were not only hijacking the USDJPY upside driver from the hands of rising JGB yields, but that French OAT yields correlating with USDJPY was a function of institutional Japan’s massive foreign fixed income portfolio holdings selling down their exposure in French sovereign bonds, and switching their foreign bond allocations over to US Treasuries - and that this is what would explain the sudden U-turn flip in US Treasury auctions from weak to strong demand.

Is Japan Dumping French Debt?

French President Macron’s shock gamble for a snap election rattles French markets to start the week. Soaring French yields explains the sudden “demand” at 10Y UST auction, USD strength, weak EUR - as Japanese capital reallocates its foreign bond holdings. Don’t credit U.S. - blame Macron.

This market flow dynamic of Japanese institutional fixed income portfolio flight out of France and into the US is still largely going unnoticed and undiscussed - despite further evidence of this occurrence building up since I had initially flagged this.

This note is an update from last week’s observation on this critically overlooked global macro market theme underway of:

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.