“Stealth Yield Curve Control?”

JGB yields are surging in an alarming way. Here is a critical (non-tariff-engulfed) macro market observation, and a quick trade idea to play it.

•Why Monday March 31 is a crucial macro day

•BOJ needs to taper its JGB tapering (needs to buy more JGBs) as JGB yields continue exploding higher, or Japan will be dead before Christmas. The 3 dates ahead that BOJ will take action.

•How to structure a widow maker trade (the continued surge higher in JGB yields) from US equity markets, without touching a single JGB

Yes, yes, April 2nd “liberation day” - when the REAL Trump tariffs come next Wednesday.

Do not forget about the two days prior to “liberation day” - Monday March 31st: Japan fiscal year 2024 end, and Tuesday April 1st: Japan fiscal year 2025 start. Japan FY end/start is when the world’s largest foreign investor and foreign subsidiary parent repatriates earnings and/or then redeploys for a massive capital migration that can not only move markets, but has also marked pivotal moments in global macro market direction.

Its not so much these exact March 31 FY-end / April 1 FY-start dates themselves that are “the days” that Japan Inc and Japan Asset Management takes balance sheet action (though it can be) - its more so leading into FY-end (throughout the month of March), and after FY-start (from beginning of April) that these cross-border flows flow. So, to the extent that Japan’s activity is impacting global markets, its not that March 31st will necessarily be some visibly clear day of Japan capital shuffling - rather, its that a given market trend underway throughout the month of March (particularly in fixed income and FX) may very well be Japan driven, and if so, will suddenly cease after March.

Just remember to keep the Japan fiscal year calendar in mind when “liberation day” comes (whatever may come), and markets do whatever it is that they do - we are not witnessing pure Trump tariff policy related market reactions (though I can already say with 100% confidence that that is exactly how major financial media will attribute any/all market price action solely to Trump “liberation day” - we all know already that’s exactly what will be happening).

JGB Yields

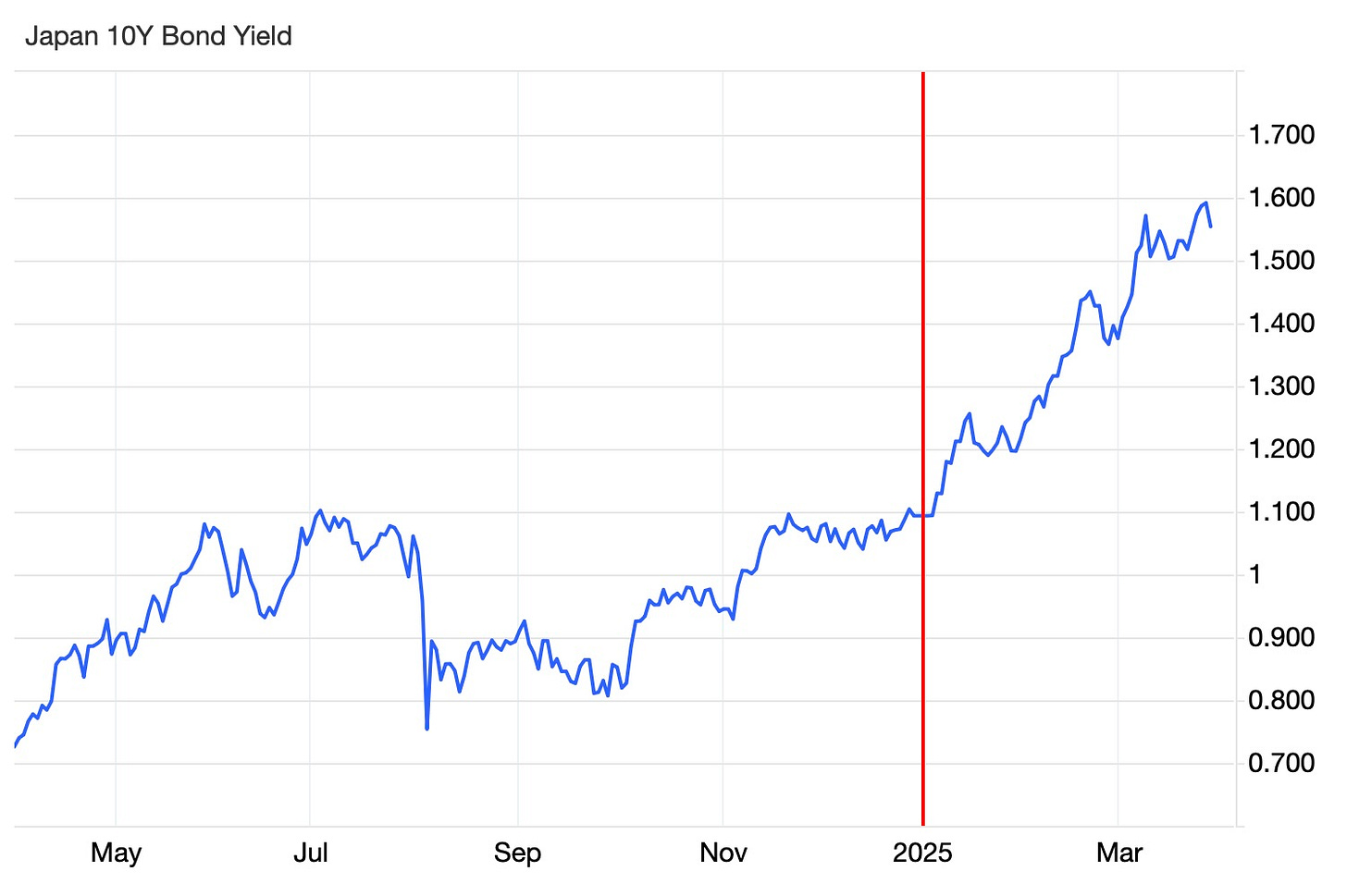

Starting in, and then subsequently throughout Q4 of Japan FY2024 (Jan - March 2025), JGB yields have broken out, and have been absolutely surging to new 2008 financial crisis highs day after day.

10Y JGB yields are up nearly +50bps over the course of Q4 FY24 (2025 year to date).

That is both an insane move and an alarmingly high level to yield itself - but the momentum throughout the quarter has been one-way.

Here’s what JGB futures price action looks like across Q3 FY24 (Sept - Dec 2024), and Q4 FY24 (Jan - Mar 2025). Yes, the former in an overall downtrend, but stair-stepping with periods of trading flat - whereas the latter being pretty decisively and relentlessly one-directional down.

But in this last week of the fiscal year, a strange thing happened…

Long-end JGB yields seemed to cap their relentless upside surge, plateau, and then actually see a fairly sharp drop to end the week (or end the fiscal year).

Here are 10Y UST yields over the same period of this past week, behaving pretty much the same as JGB 10s above (and therefore - why you should care about what JGBs are doing).

Is BOJ Conducting “Stealth YCC?”

If you look at a chart of 10Y JGB yields during this prevailing period of surging higher, you’ll notice something a bit peculiar - although 10Y JGB yields no longer have a yield curve controlled explicit upper band ceiling, 10Y JGB yields seem to trade or behave as if there is a ceiling - explicit or otherwise.

And these “ceilings” tend to be +10bps above these 0.50% increments of how previous YCC upper band policy levels were.

Now let me answer the question: is BOJ doing some sort of “stealth YCC?”

Not yet. But they will be doing so on June 17th at the latest, and potentially as early as this Monday March 31st at 5pm JST.

Aside from always reserving the ability to step into JGB markets at any time, any day, to buy any JGB for any amount (including “unlimited”) at any price (or yield level) they wish - BOJ will have to stray from their current, very specific, “tapering” schedule at the following time slots:

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.