The “Sell Japan” Election Outcome?

Japan just blew up in political chaos with the LDP losing their majority - implications for markets and BOJ.

A “trigger warning” (if those still exist) - I may use and express “harsh” political language throughout this writing in reference to various individuals of elected office, public policy, and various political parties from around the world - this is not an expression nor a reflection of my own personal political preferences, and my intent is absolutely not to offend - so if you find yourself “offended,” then that’s absolutely your problem, as I couldn’t care less what your political opinion is, just as you shouldn’t mine.

On Sunday, Japan held general elections for the House of Representatives, and voters threw a grenade of immediate term uncertainty into one of (if not the single) last hold-outs of political stability and populism avoidance among the world’s major democracies. That is no more.

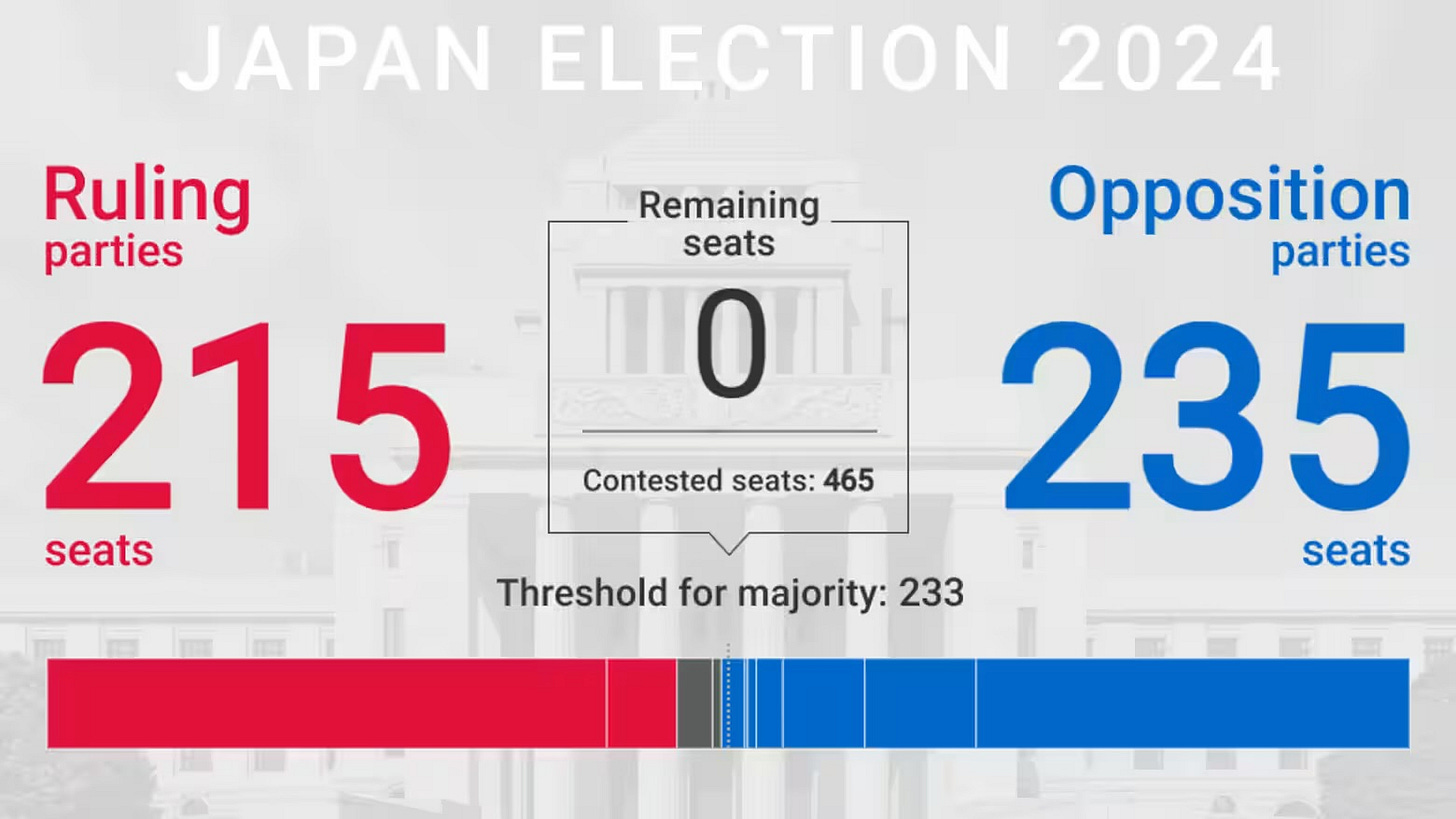

Japan’s ruling Liberal Democratic Party (LDP), as well as its coalition partner Komeito party, had lost their majority control of the legislatively powerful Lower House - marking the first time doing so since 2009. The combined coalition took 215 seats, well short of the 233 number needed to maintain its majority status.

The opposition parties have now won a combined 235 seats for majority, with the main opposition Constitutional Democratic Party (CDP) winning 148 seats vs its prior 98 seats held, and the opposition Democratic Party for the People took 28 seats vs its 7 seats prior to the dissolving of parliament earlier this month.

However, this doesn’t mean that the opposition parties have clear control over the legislative body either. With no clear majority party - ALL parties would need to try and form coalitions, which include the smaller, fringe parties and find agreements across the fractured legislature.

Nonetheless, this is a major blow to PM Ishiba, the absolute clown who finally took office on October 1st after this 5th attempt in becoming PM, which he may very well have to forfeit, as the constitution now calls for a special election for prime minister within the next 30 days, at which point Ishiba’s cabinet will be resigned.

But as of now, even in light of this major backfire of a move to dissolve parliament and call for a snap election at the earliest moment from becoming PM in the postwar era, clown Ishiba has unsurprisingly stated that he will remain on as prime minister - though his legacy may very well end up being Japan’s shortest stint as PM.

In the immediate term, coalition building with strange bedfellows takes place across parties in order to form a government. The opposition parties have already stated they either have no intention to join in with coalition, or may work on a policy by policy basis. And with clown Ishiba’s 4-decade long, 5 time attempted obsession to be Japan PM on clear display, for once, the leverage is not with the ruling LDP, and the PM can be easily compromised and succumb to flip on any issue.

This is the concern for market participants - the complete near term uncertainty, rather than the risk of a particular risk-off policy, because there is no policy in sight for which to react to and price in. As we market participants know, uncertainty is far worse than “bad news,” because at least the latter is a defined, known-known, and can then be priced in. Unknown-unknowns means volatility and taking chips off the table.

Markets

This is likely to be a “sell Japan” event - all Japan: Japan equities, JGBs, and the yen.

In fact, it already is a “sell Japan” event - this has been underway. From when this Japan election risk reflected in markets began is tough to gauge - but the cross-asset pricing-in seems to have started on October 23rd, when an already political scandal ridden LDP was found to have been involved in yet another political funding scandal on the Wednesday heading into the elections.

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.