USDJPY Breaks Into 130s Heading Into Fed & Bank of Japan (Preview)

Detailed market analysis and significance of USDJPY breaking sub-140: who and what is (and ISN’T) driving the move. Initial policy commentary heading into a pivotal FOMC, BOE & BOJ this week.

This week’s releases will (likely) be a continuous series of ongoing commentary updates on markets (FX: JPY, DM yields: JGBs + USTs, Equities: NKY + SPX/NDX) and the September Bank of Japan policy meeting to end the week of major policy decisions ahead.

And since the BOJ comes last (Friday) among the others (Wednesday FOMC, Thursday BOE), and is also the most shock-prone, as well as contrasting in policy direction (beginning of hiking “cycle” vs others’ cutting) - not only is it (near term market uncertainty) not “over” after the Fed by ANY means, as many have undoubtedly , but it renders the post-FOMC Powell press conference market reaction meaningless, as BOJ can flip global markets upside down, regardless of what the Fed ultimately does or doesn’t do. Which is another way of saying - markets at 4pm EST on Wednesday reflects only partial market participants’ activity, working off of partial information.

That also means that only upon BOJ’s press conference ending is when we will see the full market reaction TO FOMC. And since the BOJ press conference takes place AFTER Friday’s Japan market close, it actually won’t be until next Monday that we will get the full market reaction to the full global policy picture - when Japan markets have their own first chance to react to BOJ (post press conference) + FOMC + BOE.

And as I will explain below, as of this moment, even the voting board members of the Bank of Japan do not yet know what the Bank of Japan will (or won’t) do for Friday’s policy meeting, because it is heavily dependent upon the FOMC and subsequent (though again, partial) market reaction. So, given that BOJ doesn’t know what BOJ will do, I find it amusing that so many of the “professionals” out there seem to “know.” But then again, these are the same breed of folk that also “know” what FOMC + Powell will do and say, as well as BoE + Bailey will do and say, despite split markets for all of these respective policy releases.

That is why I will have to update my own outlook in real time on both BOJ’s policy decision, as well as my running market commentary throughout the week as these major developments occur, and why I will have to stay vigilant in doing so until the last minute heading into Friday’s official BOJ policy release. I know that BOJ doesn’t know, and therefore I know that I don’t know, and knowing that puts me at great advantage.

Not to mention that all of this is also barring some last minute BOJ press leak that has preceded every single BOJ policy change under Governor Ueda by T-12 hours of announcement - also noting that every BOJ policy change under Governor Ueda’s tenure has come as a shock decision vs consensus expectations with the exception of the March’24 lift-out-of-negative rates.

Lastly - should there be any, I will also include ongoing trading updates and commentary on a new long JPY futures position opened last week.

Lets first get to markets - by which I mean JPY & FX, given equities and rates markets were closed for Japan holiday today - which therefore gives us a very unique and critical angle on FX trading standalone, which we will dive into below.

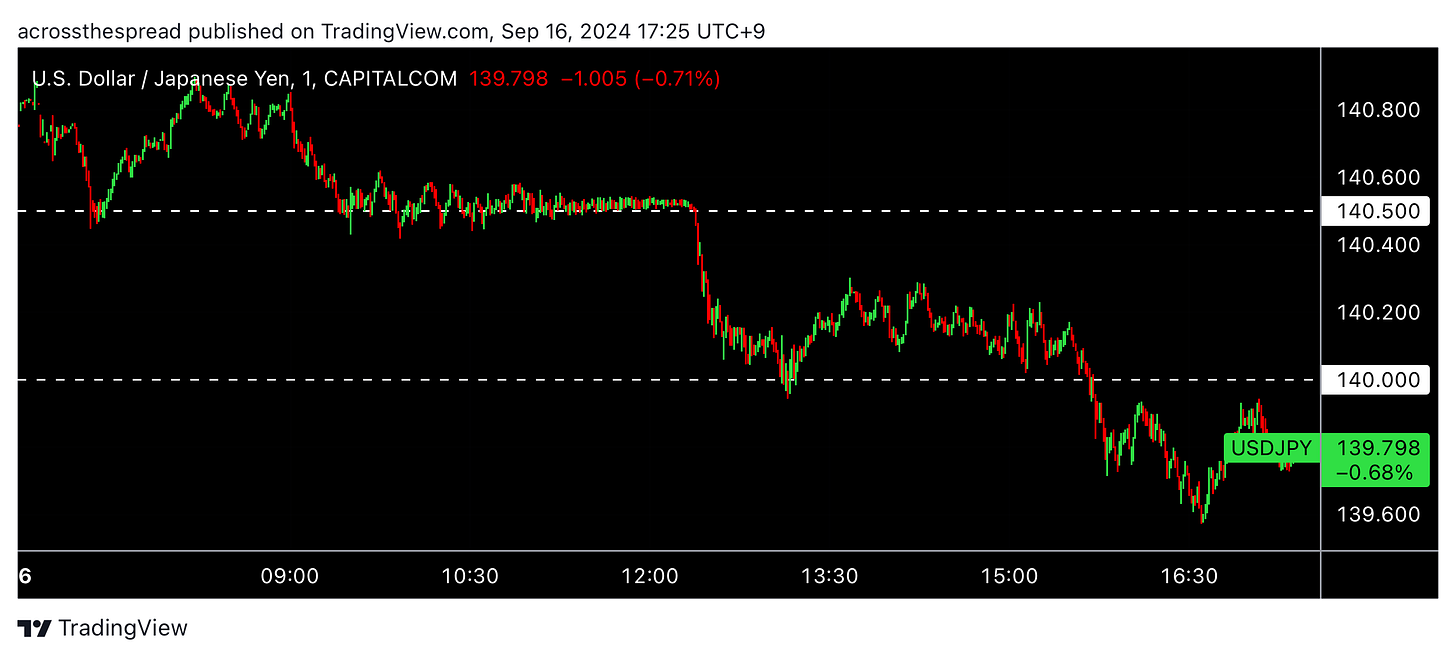

USDJPY breaks below 140 during Tokyo/Asia “market hours” today.

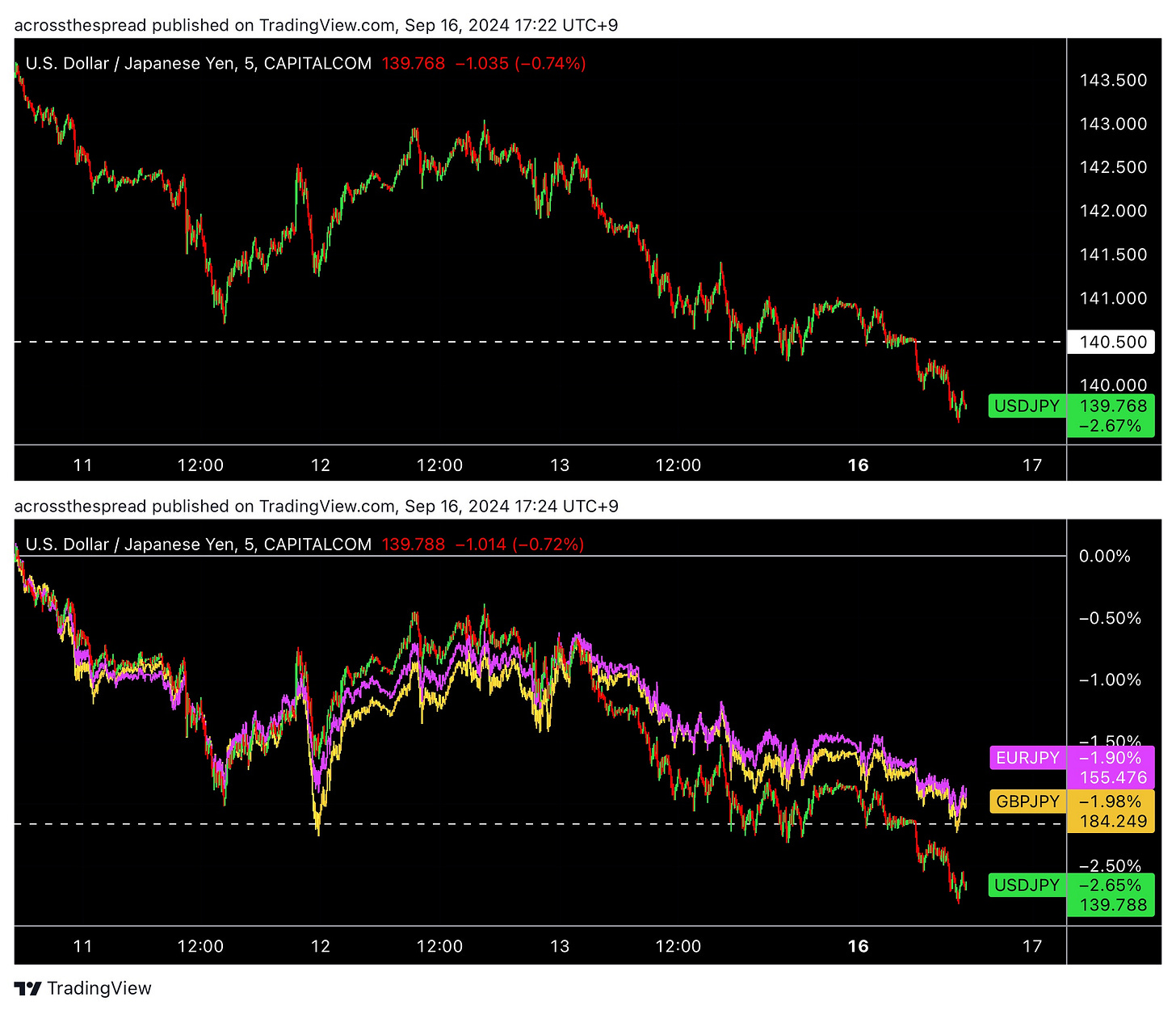

Indeed, this was/is a consequence of broad-based JPY strength (as opposed to simply “USD weakness”) - though, indeed, this was/is particular USD weakness when paired specifically against JPY strength (i.e. USDJPY pair hit relatively harder vs other major JPY pairs)

Significance of a sub-140 USDJPY print

On July 11th 2024, USDJPY was at 162 and on its way higher after a speedy recovery of being swatted down at 160 just 2 ½ months prior. Today, 2 months since 162, USDJPY prints 139 with a directionally downward trend.

The last time USDJPY spot rate had a 130’s-handle was July 28, 2023, or July ‘23 Bank of Japan policy day, when BOJ shock-lifted the upper band cap on 10Y JGB yields to double from 0.5% → 1.0% under YCC.

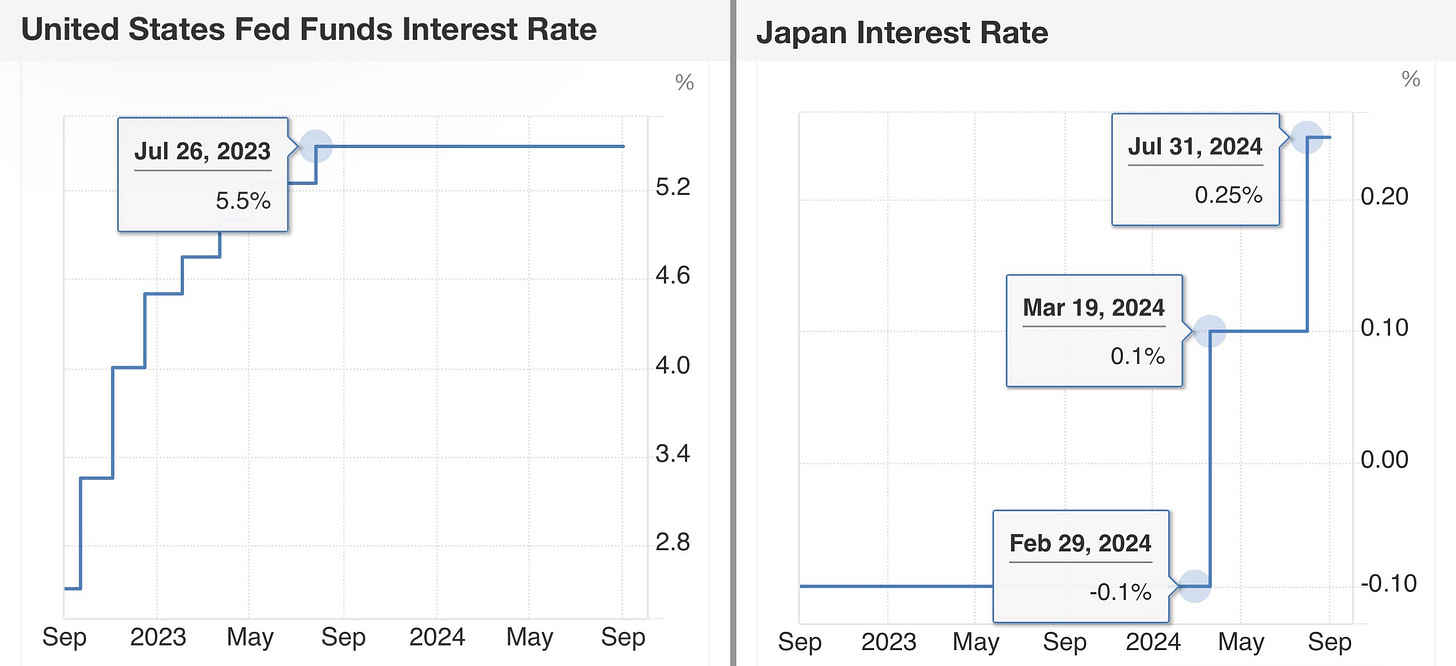

That July ‘23 BOJ move was the first policy change enacted under then-brand new Governor Ueda - the first of what has since become many subsequent policy changes enacted and still underway: the eventual vanishing of the explicit YCC upper band altogether, lifting the Japan policy rate out of negative, and then off the near-zero bound, the outlining of JGB buy-tapering and the path to balance sheet size reduction. Meanwhile, a few days prior to the July’23 BOJ YCC shock and last time USDJPY was sub-140 until today, the FOMC had hiked rates for the last time before remaining standstill on hold to this day (pre-September’24 FOMC this week).

I don't think many people realize that since the end of July 2023 to current, it’s been the Bank of Japan that has been incredibly active, and the Fed is the major central bank that has been completely unchanged - that is just a simple fact, as per the charts above. This is a 180 degree flip from the era preceding it, in which the Fed (and the rest of the world) was aggressively on the move, while BOJ was standalone standstill. One of the reasons that many people may find this “Fed = doing nothing while BOJ = most active” to be surprising is because of ongoing rhetoric about “the yen (dollar yen) is driven by the Fed (Fed policy) and not by Bank of Japan” echoing throughout this past year. This is not to say that I don’t agree with this notion of a Fed driven exchange rate - I do believe that Fed expectations can and indeed have driven USDJPY, while in other instances, BOJ took the wheel, and neither are the unconditional dictator of price direction, I am merely pointing out that in actual realized policy, Fed hasn’t done anything while the Bank of Japan has done more (in easing reversal) than it ever has within such a short period of time, and that active/inactive occurred in a single simultaneous moment in July’23.

So, with a very busy BOJ in the past year+, in contrast with a standstill Fed throughout, in a way, one can look at today’s return to sub-140 as USDJPY having “erased/negated” all that the BOJ had done in their policy normalization efforts (with the great help of MOF yenterventions, of course), and now back to square one of pre-normalization initiation.

Now, of course it’s not that simple, let alone a productive approach to take - but just strictly and straight-forward looking at FX price levels alone - yeah, we’re now back to the same levels as before all of what BOJ had done since July’23, and when FOMC stopped hiking. But we do need to remind ourselves how JPY got back to "square one,” what had driven it, and the insane 13 months JPY had gone through from 139 → 139.

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.