Warning For US & Europe - Japan Is Seriously Crashing Right Now

Dramatic and indiscriminate liquidations in Japan equities, the world's recent favorite foreign-capital driven market is underway. Expect vicious downside and volatility in NDX and global DM indices.

Important heads up - equities are seriously crashing in Tokyo - NDX to follow (if not already underway). This is an impromptu, time urgent market flagging for investors/traders in DM markets globally.

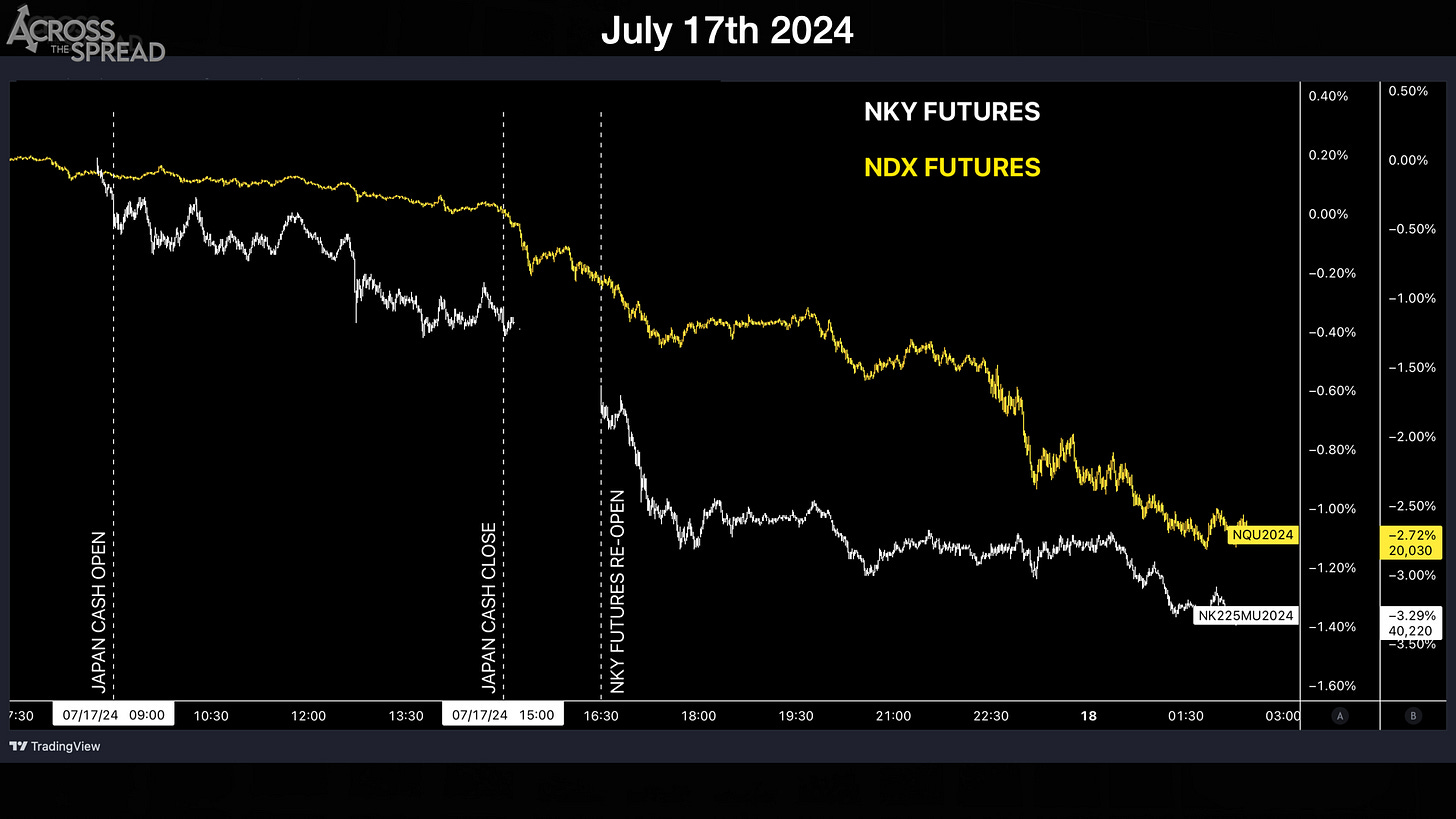

I'm not flagging (just) the NKY index - for which NKY futures full day session (from Asia open → US close) had a -6.7% day.

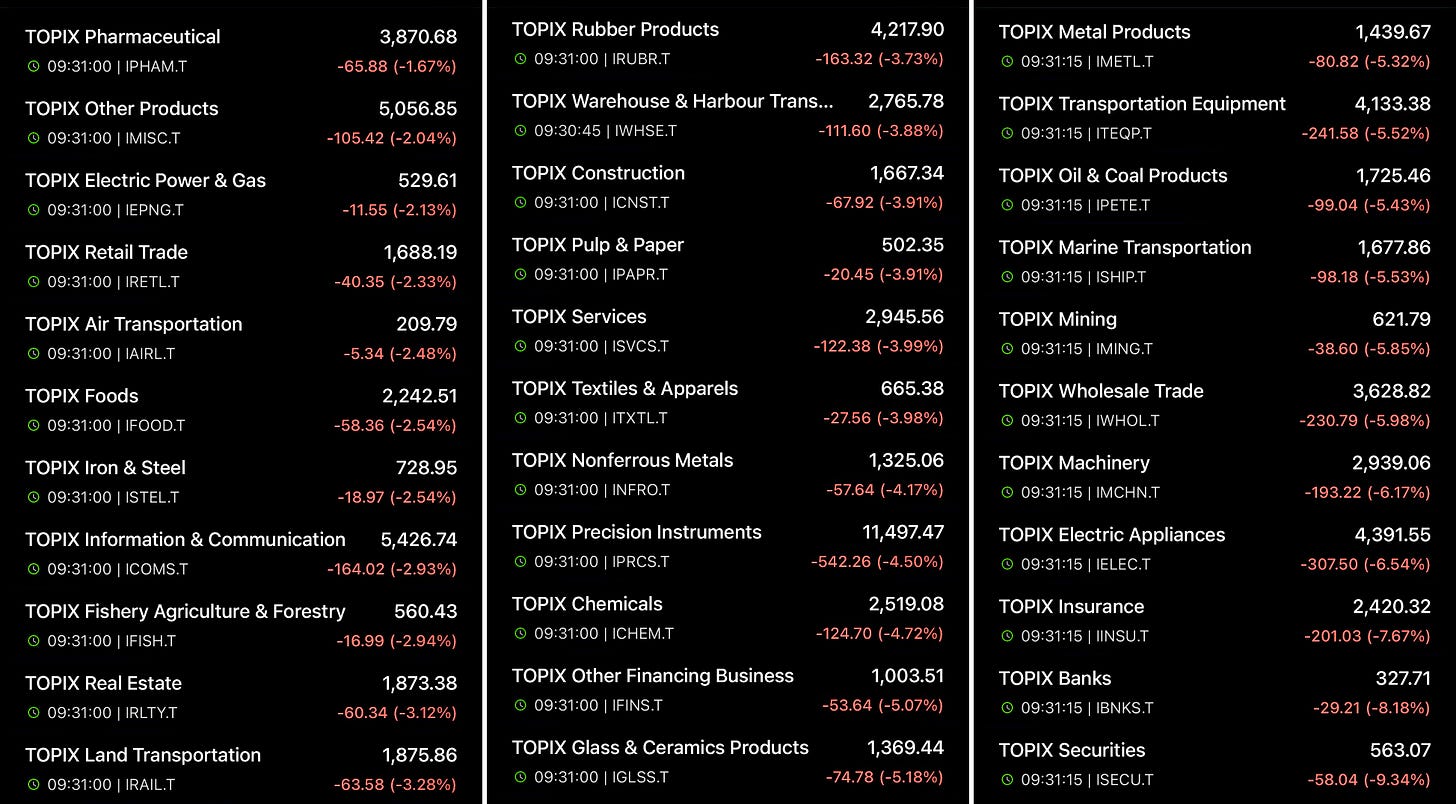

I'm flagging the much broader (thousands of constituents), cap-weighted TOPIX Index, which is currently -5.6% on the day. Since the July 11th yentervention / JPY strength moment that began this global equity outperformers → reverse and crash, tech heavy NDX had underperformed the relatively diverse TOPIX (as per usual global DM equity sell-offs, when the high flyers see the sharpest pullbacks).

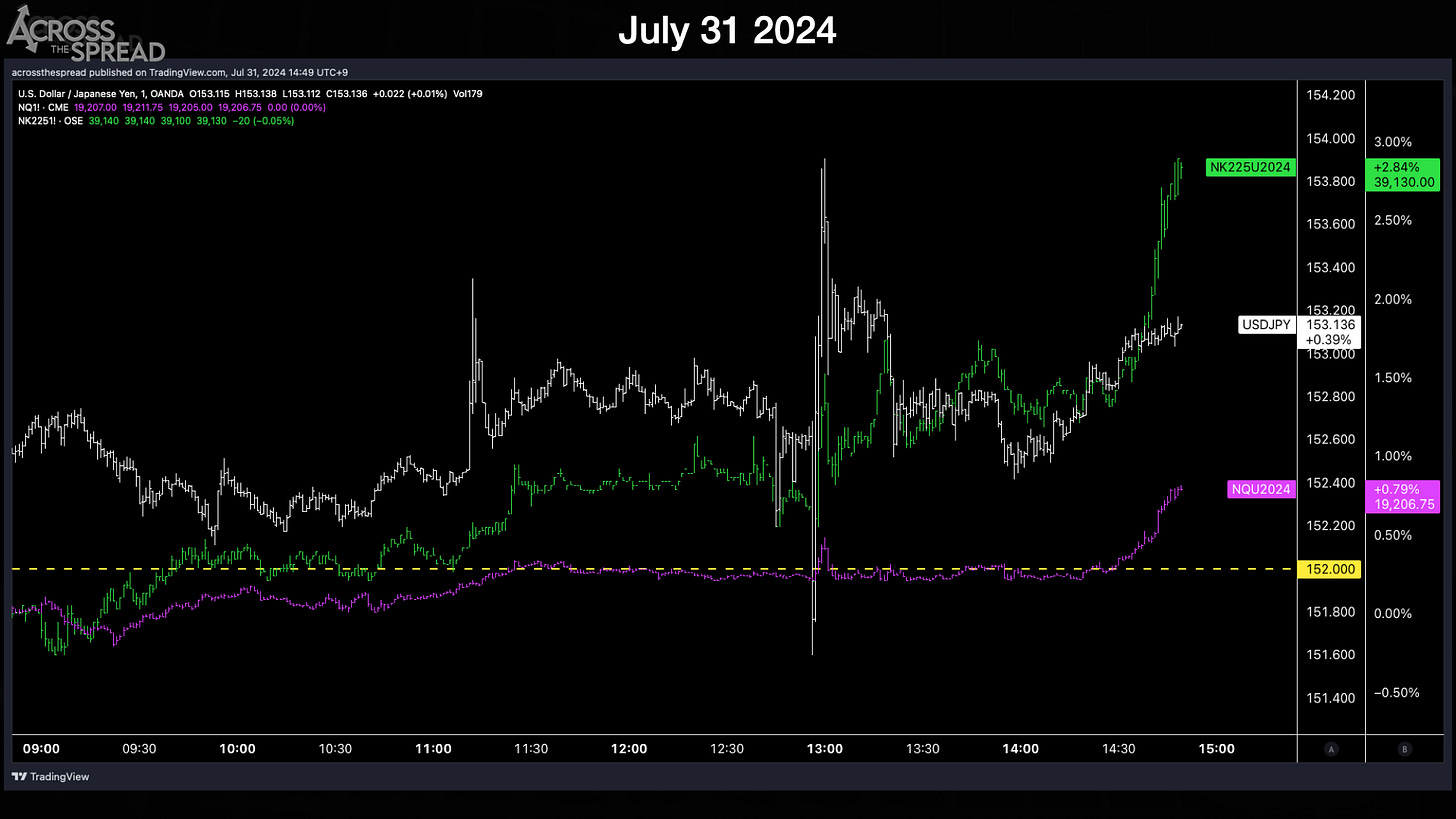

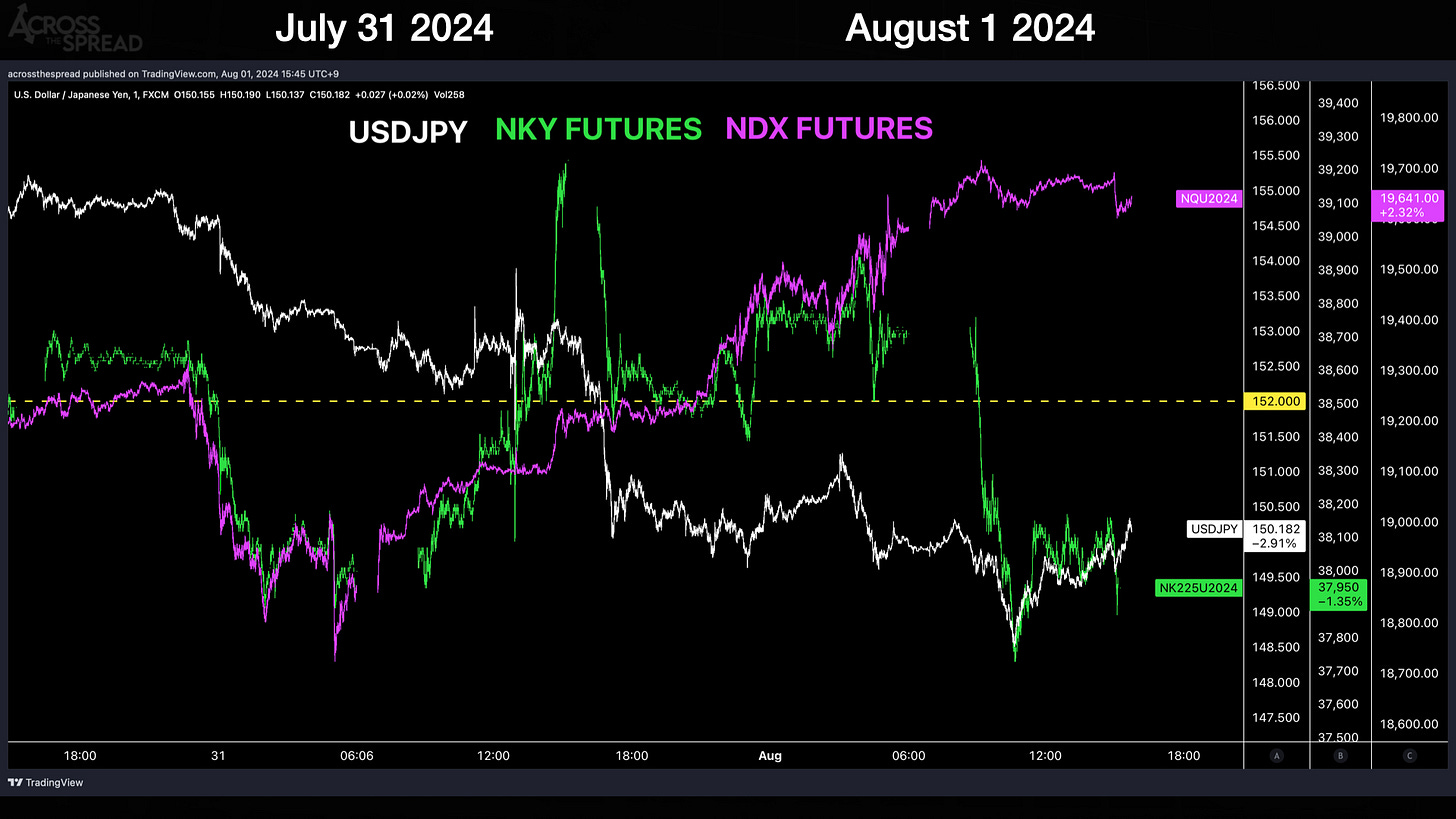

But as of the past day (post BOJ shock rate hike + QE plan laid out) and USDJPY breaking that 152 support into the 149, 148 handes - TOPIX futures have now surpassed NDX to the downside.

Everything is getting sold off. TOPIX Banks Sector is down almost -10% in the first half hour of cash trading. Names like Tokyo Electron (A.I. / semiconductor NKY heavyweight) is down double digits, as are the other tech related Japan large caps.

SO - if non-tech, value-cheap Japan is getting indiscriminately sold off (by foreigners - UK and US institutional), then tech-concentrated NDX, shitty as its own post July 11th yentervention performance has been, seems that it still has some potentially accelerated catching-down to do, and in the immediate term.

From the JPY carry trade unwind side - put aside USDJPY, and look at AUDJPY and MXNJPY. AUD itself is already taking a hit from weaker than expected Aussie CPI, so you’re getting simultaneous AUD ↑ and JPY ↓. But MXNJPY carry unwind is more concerning - having broken below 8 and now gapping down into the 7-handle.

MXNJPY, AUDJPY, USDJPY - these are directionally down - and NKY and TOPIX indices are down on serious trading volume.

I've been working on a comprehensive in-depth piece of what BOJ just did (yes, JAPAN shock HIKED rates + laid out the path to cut JGB buying / QE in half) because BOJ is clearly this week's most market-significant major central bank this week, followed by Bank of England cut, and then trailing behind BOJ and BOE is the FOMC and their doing of nothing, and promising of Sept cut that's been priced in for over a year - markets didn't move or care on Fed. Again, a shock hike, or rather, a shock lift off the zero bound out of Japan - THAT moves markets. And there is a ton to convey in analysis, and in price action on JPY's wild week, or wild 30 hours - all of which is coming. The purpose of this note is to give a time sensitive heads up in the meantime.

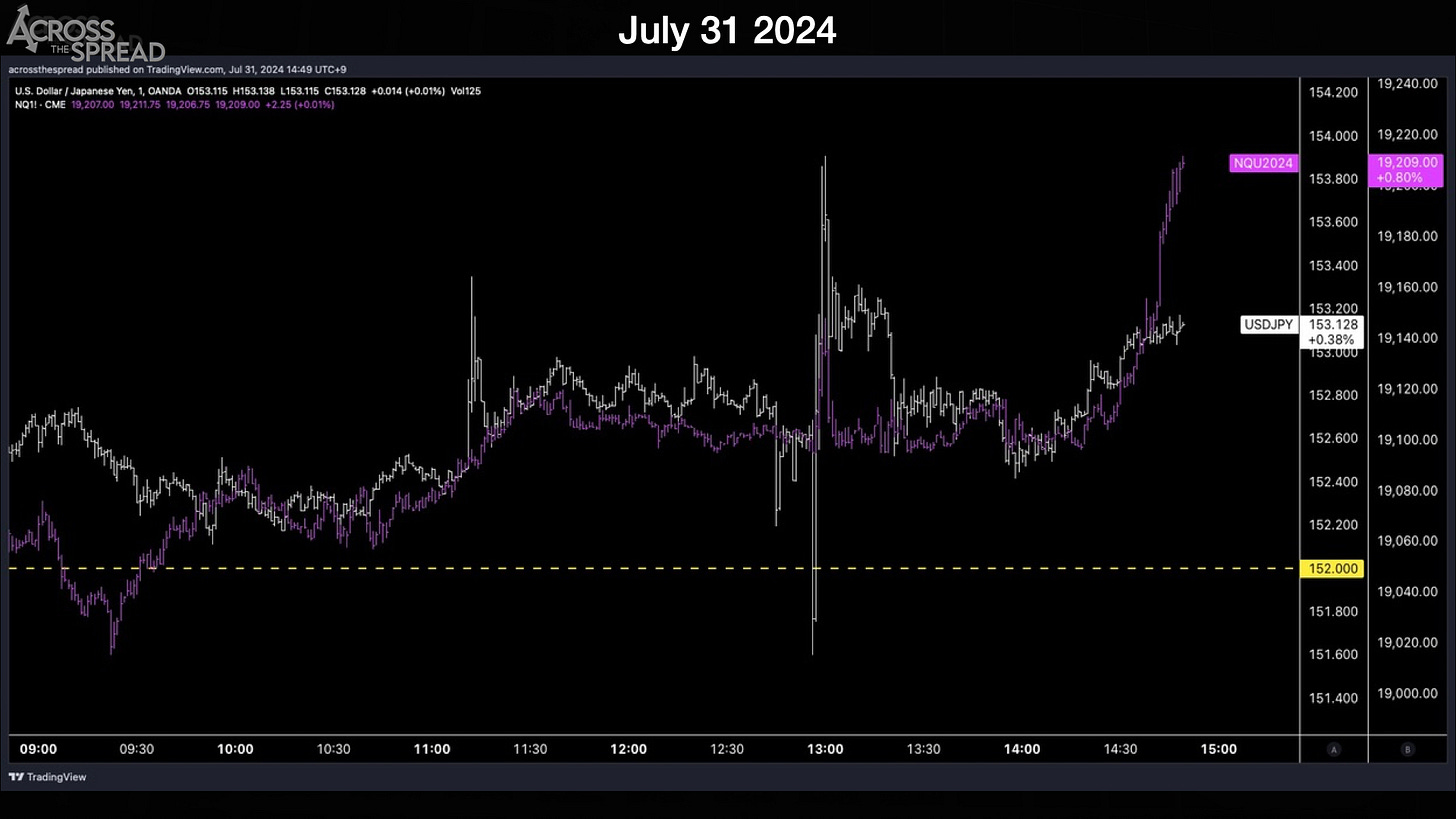

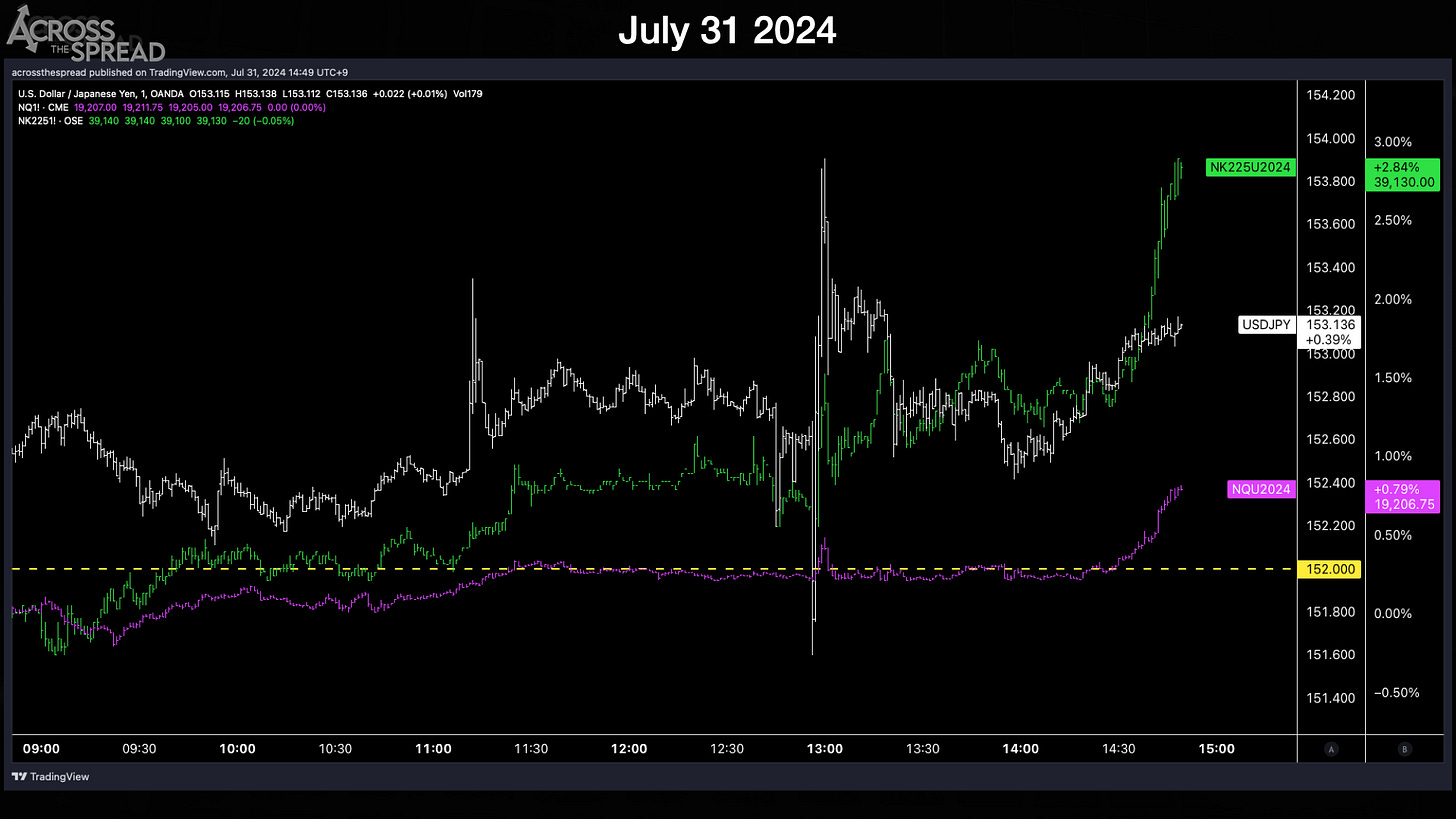

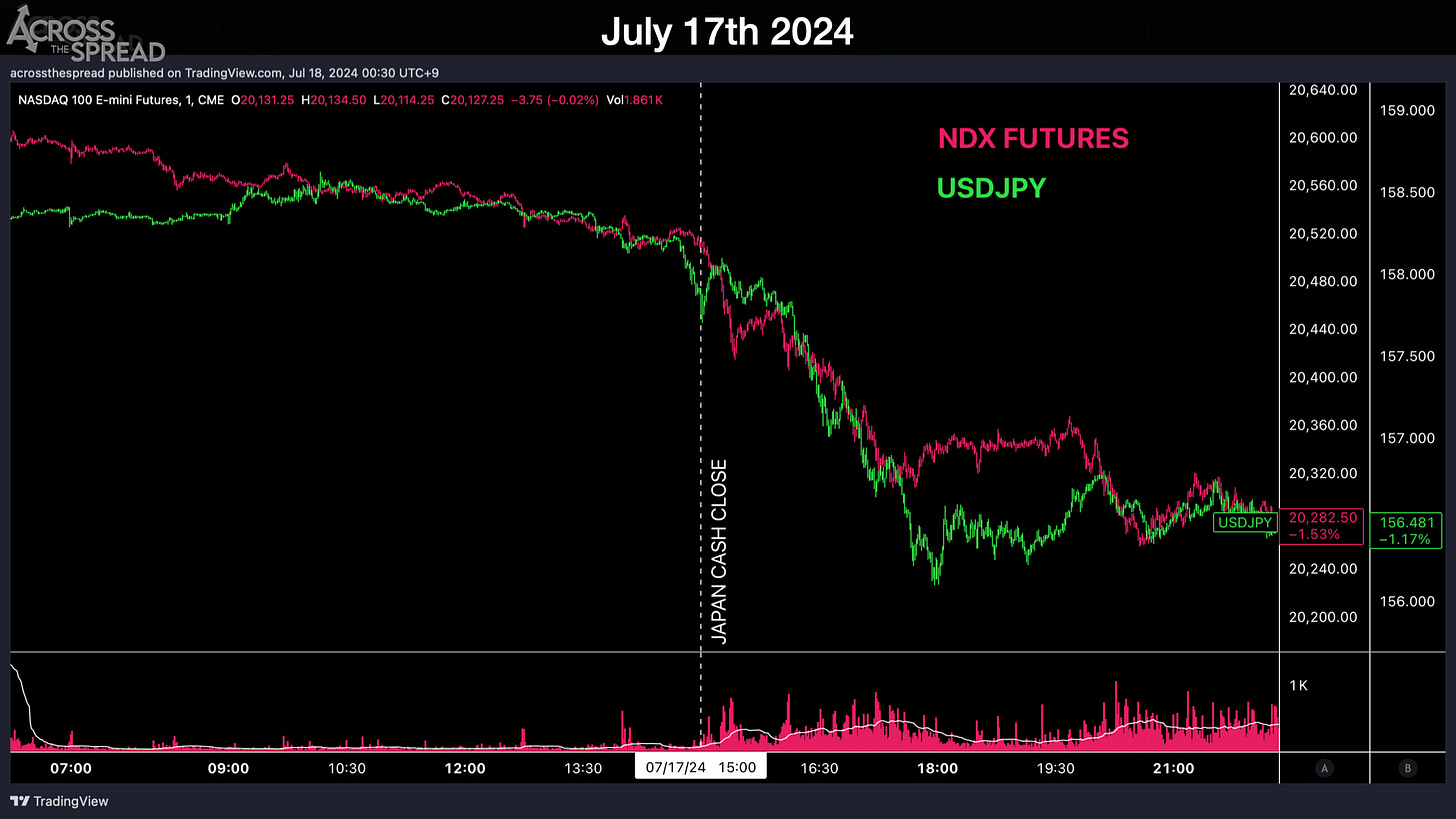

Here is a section / slides from that coming piece of current relevance (all of it is of current relevance but) - the NDX upside head fake into Japan cash close on BOJ day.

NDX got a flash-short squeeze jump that rode off of Japan market on close NKY upside on BOJ day, due to a 2:30PM headline 30 mins into Japan cash close by a completely buried headline.

Initially, USDJPY 152 support held (again) upon the BOJ policy release - and NKY really ripped into the close - as you can see the green chart shoot higher.

This took NDX higher - into 15:00 Japan cash close.

NKY's surge is what pulled NDX upward, kicking off a short lived NDX upside momentum put in action.

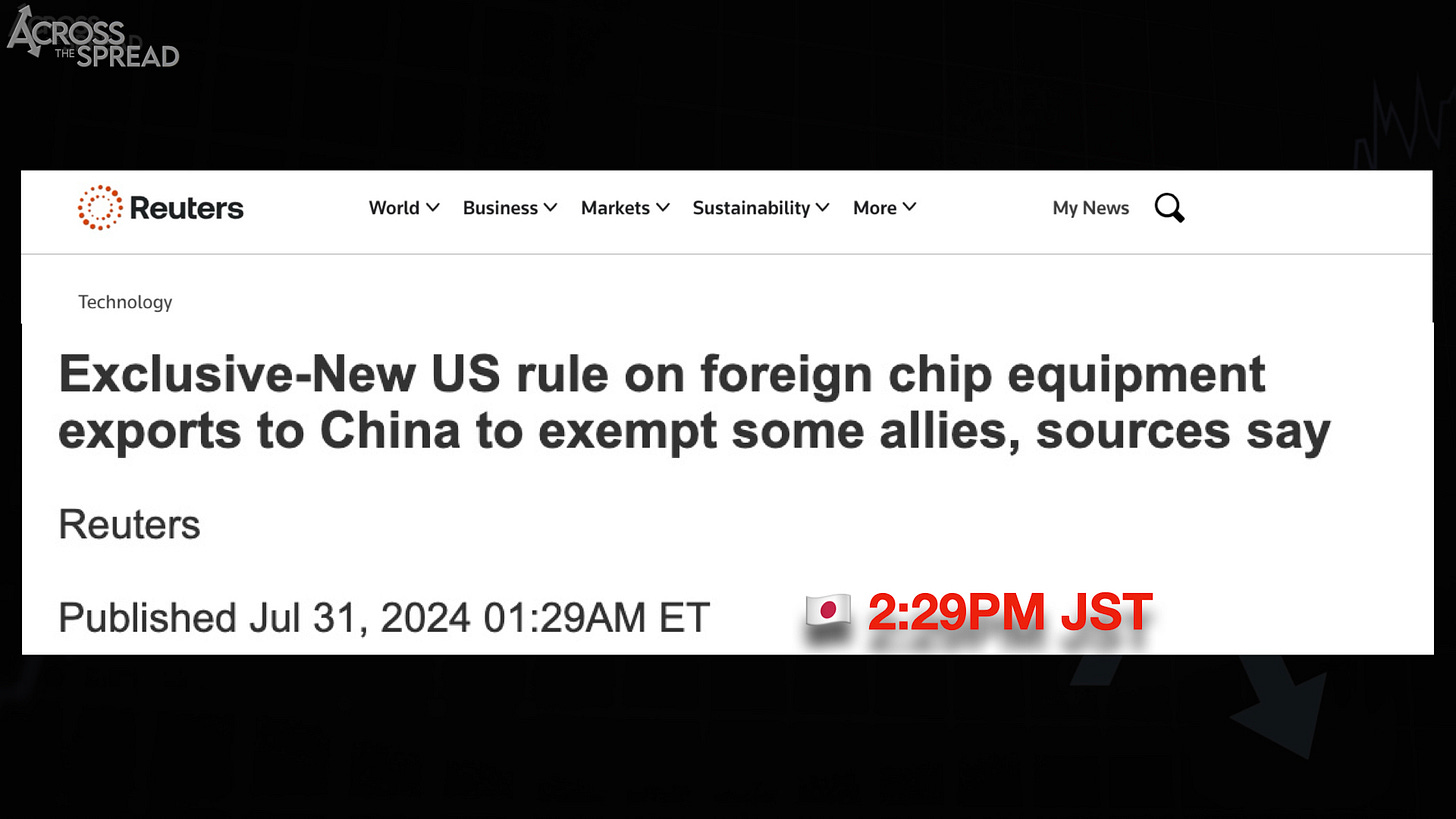

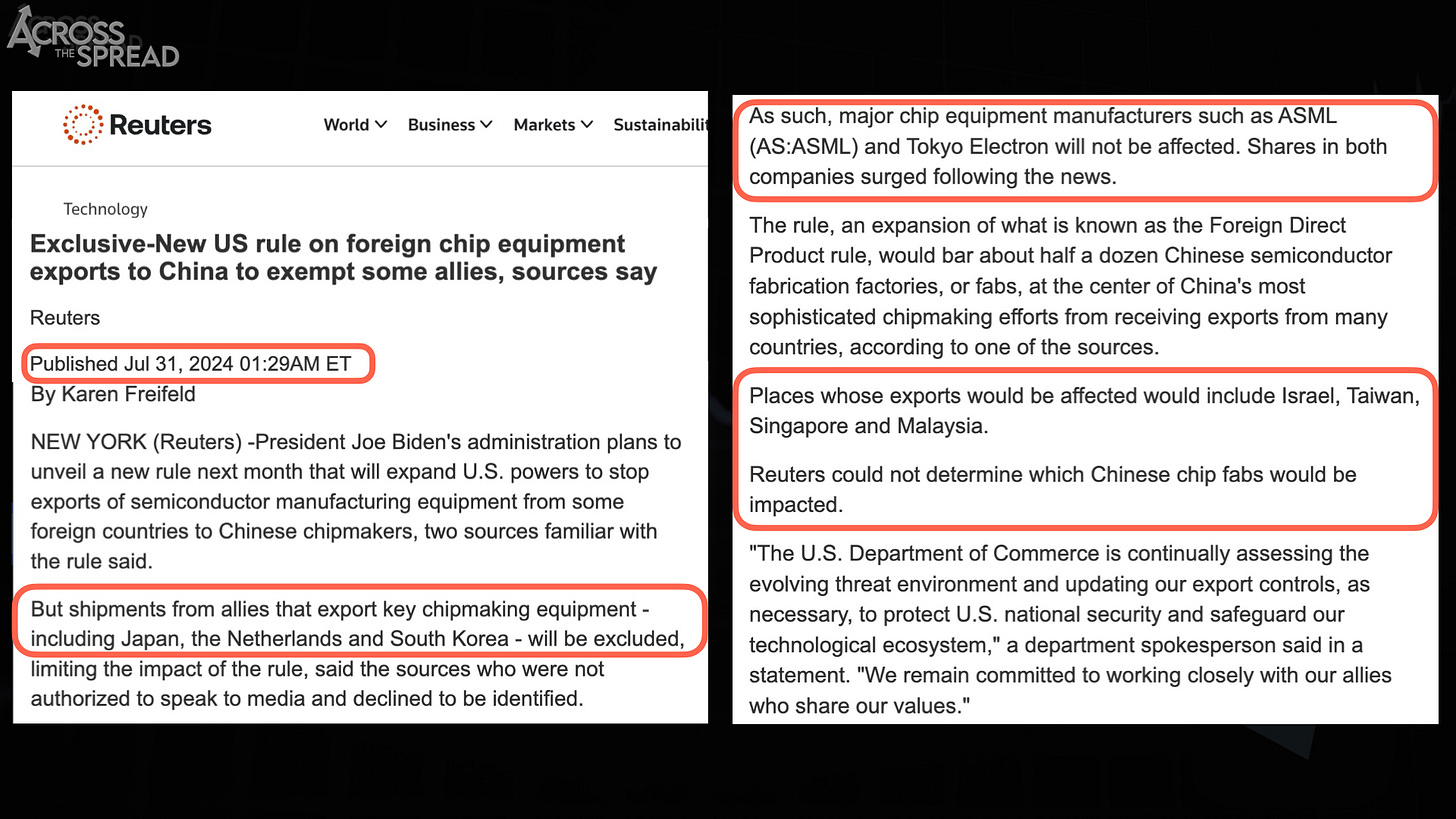

This happened because 30 mins prior to the close (after BOJ policy statement release, and before Gov Ueda press conference after the close) - Reuters drops the following headline:

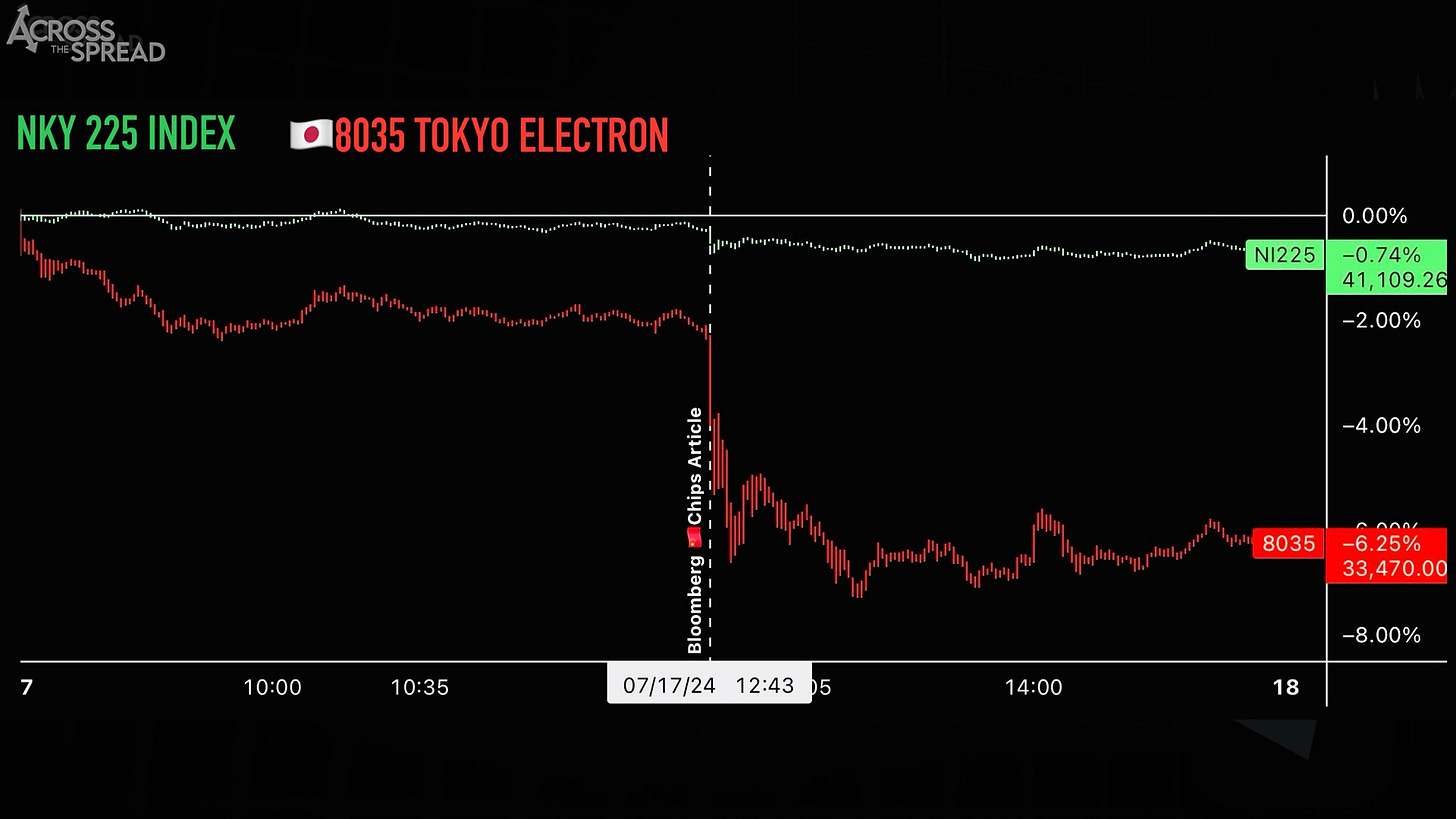

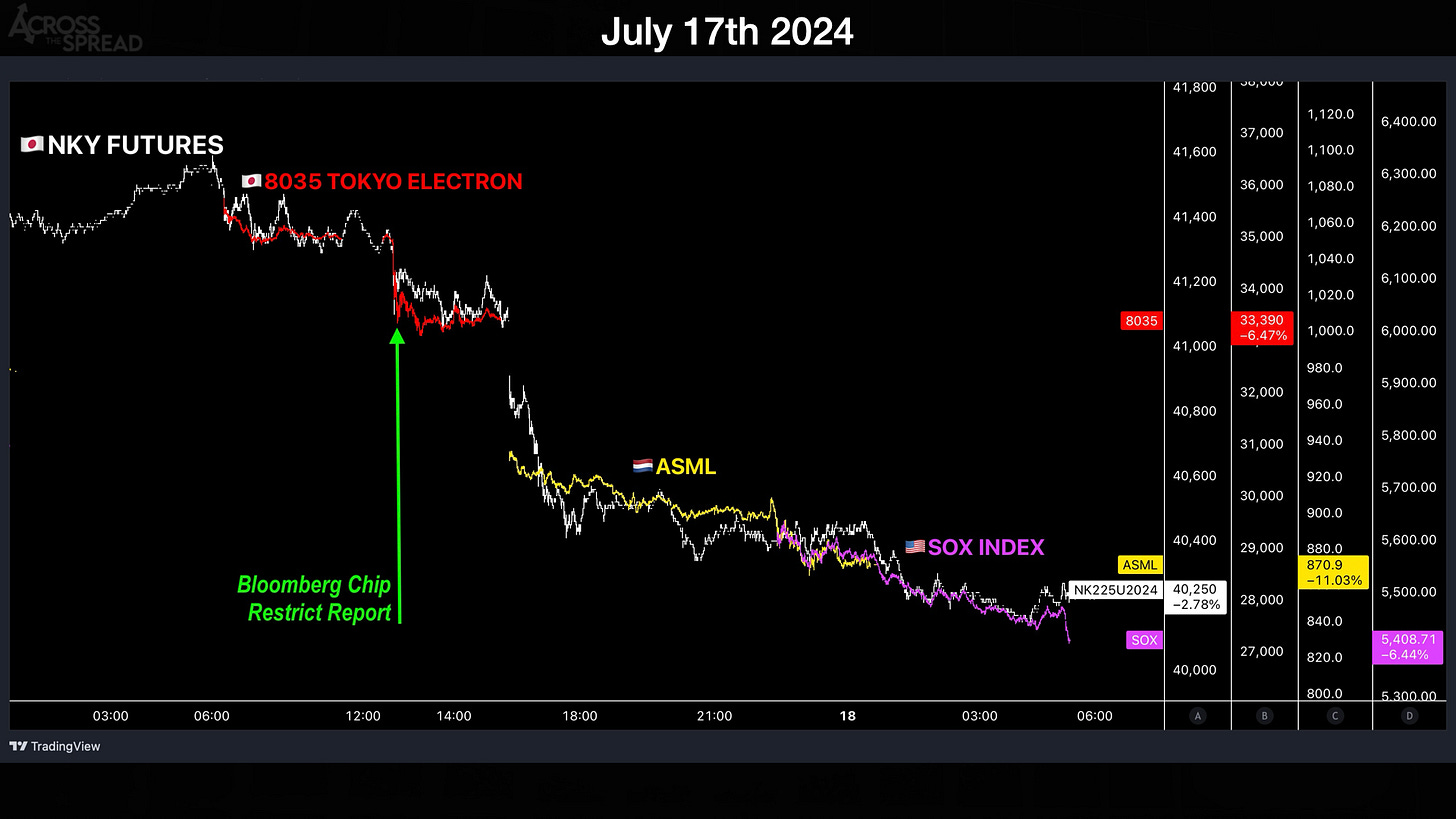

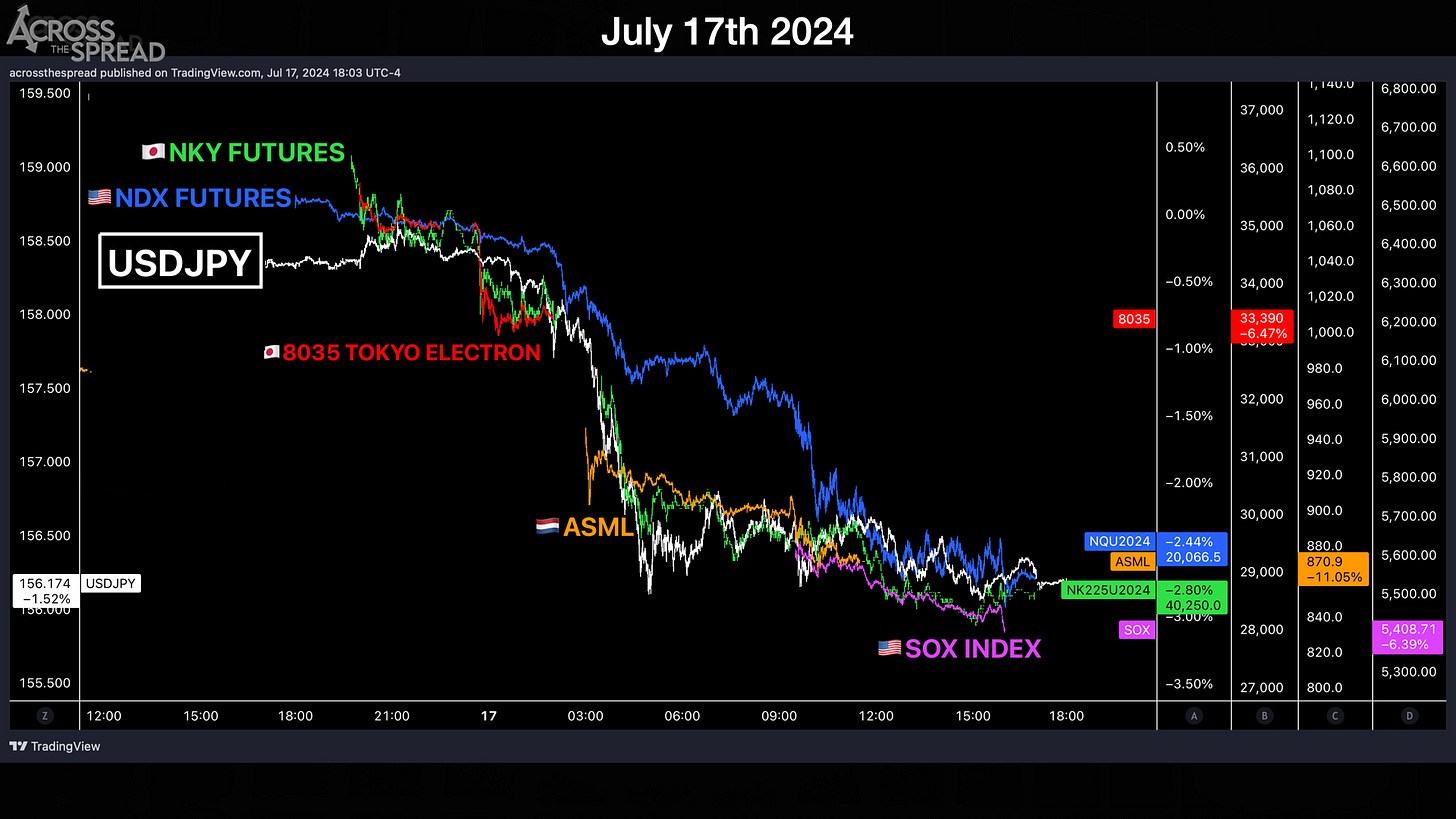

For those who don't know, less than 2 weeks prior on July 17th, US was talking about imposing further rules on US ALLIES to further ban chip exports and chip manufacturing / servicing to China, and specifically naming Tokyo Electron and ASML of Amsterdam in doing so.

That hit the tape at 12:42PM Japan time - and crushed Tokyo Electron shares.

Tokyo Electron gets crushed into market close. Then shortly afterwards as Europe open, ASML gets crushed over -10% for its worst day since March '20. And that then overlaps into US open, where the SOX semiconductor index was down over -6%.

The above full-global equity trading day was also accompanied by another sharp leg of JPY strength.

And all of this activity had smashed NDX futures down -2% even before US markets had a chance to open - NDX was predestined to have a shitty day, and it did.

Ok - fast forward back to July 31 post-BOJ policy release, 30 minutes until Japan cash close.

Reuters drops this headline - saying that aforementioned chip export to China rule would exempt - and again mentioned by name: Tokyo Electron and ASML. And Tokyo Electron ripped the NKY and NDX higher in the last 30 minutes of Japan cash trading (but meanwhile, Reuters article leaving others in ambiguity - including Taiwan - which is why it wasn't a global chip-wide move).

What was really happening was a Tokyo Electron-led short cover into Japan close (the green line blow-off-top on July 31st below) - but also, JPY having broken below 152 as well.

And as I mentioned in my last note/video - breaking of 152 flipped the NDX vs USDJPY relationship polarity temporarily. That seems to have occurred here as well.

But again - equities (via Japan, which is foreign capital) were getting liquidated. And they REALLY are now.

And so, with all these market forces pointing in one direction, NDX in the immediate / near term doesn't belong in its momentum squeezed elevated position. Again, the broad based TOPIX index is down nearly -6%. This is like Japan 8.0 mag earthquake type of a move.

Am I saying go all out and short NDX and NKY (as I have already done) ? Aboslutely not - and I'm also not saying “don't do it” either - we're all adults here, and if you're reading this, you're likely sophisticated enough to know yourself and what actions to take or not take, if you're even listening at all (and perfectly fine if not). And for all I know, NDX might once again be the beneficiary inflow recipient of a fast and mass Japan liquidation, and long NDX/short NKY might play out. Who knows.

But what's happening in Japan equities right now is at least worth flagging- that’s all I'm doing.

Here are some JPY carry trade and short-unwind levels to be aware of:

MXNJPY already broke below 7

Other DMs:

USDJPY: 148.50, then 146

AUDJPY: 94

EURJPY: 158

GBPJPY: 190 (right there), 180

Also - JGB front end yields are soaring (from a shock rate hike)

…while JGB longer end yields are getting crushed to sub 1% on 10s - despite the reduction of JGB buying unveiled.

As I said last 2 notes - fast and dramatically moving markets while mid-writing/filming/analysis makes it very difficult to publish, but there will absolutely be a Bank of Japan overview, because its highly necessary for global green and red blinking tickers (as you can see) - appreciate your patience and understanding in the meantime, and will update on further market developments should they come.

Watch JPY.

Weston

Very simply, did the BoJ break The World today via the massive HF yen carry trade unwind?

Thank you Wes, your message allowed me get in front of this move.

Hope you cashed in bigly today.