What’s Behind 2025's Best Performing Major Currency: JPY

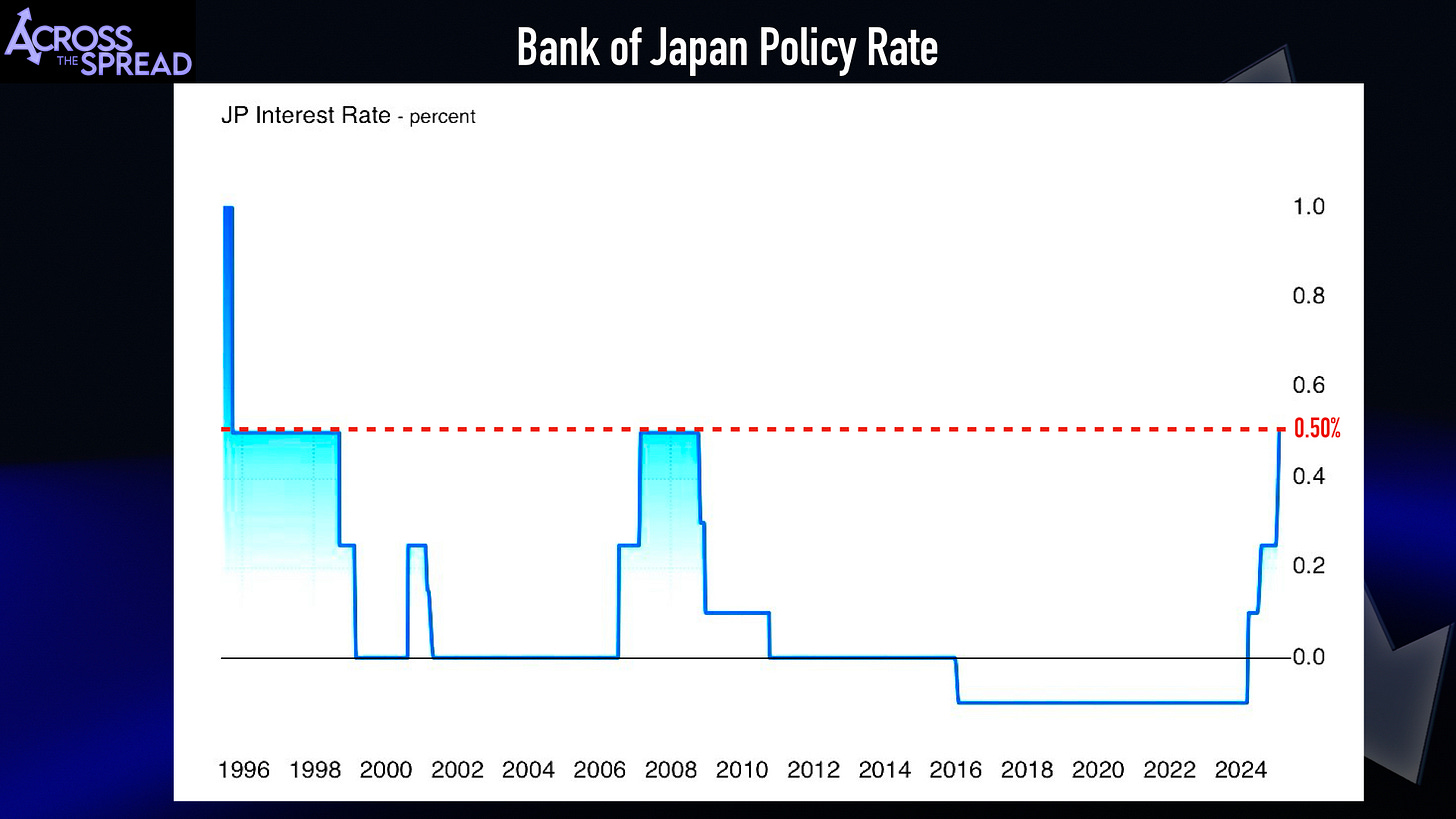

Markets pricing out "BOJ policy rate 50bps ceiling" perception on aggressive BOJ rhetoric. A look at near term JPY strength.

Bank of Japan hiked rates 2 weeks ago. So why is JPY strength picking up now over the past few days?

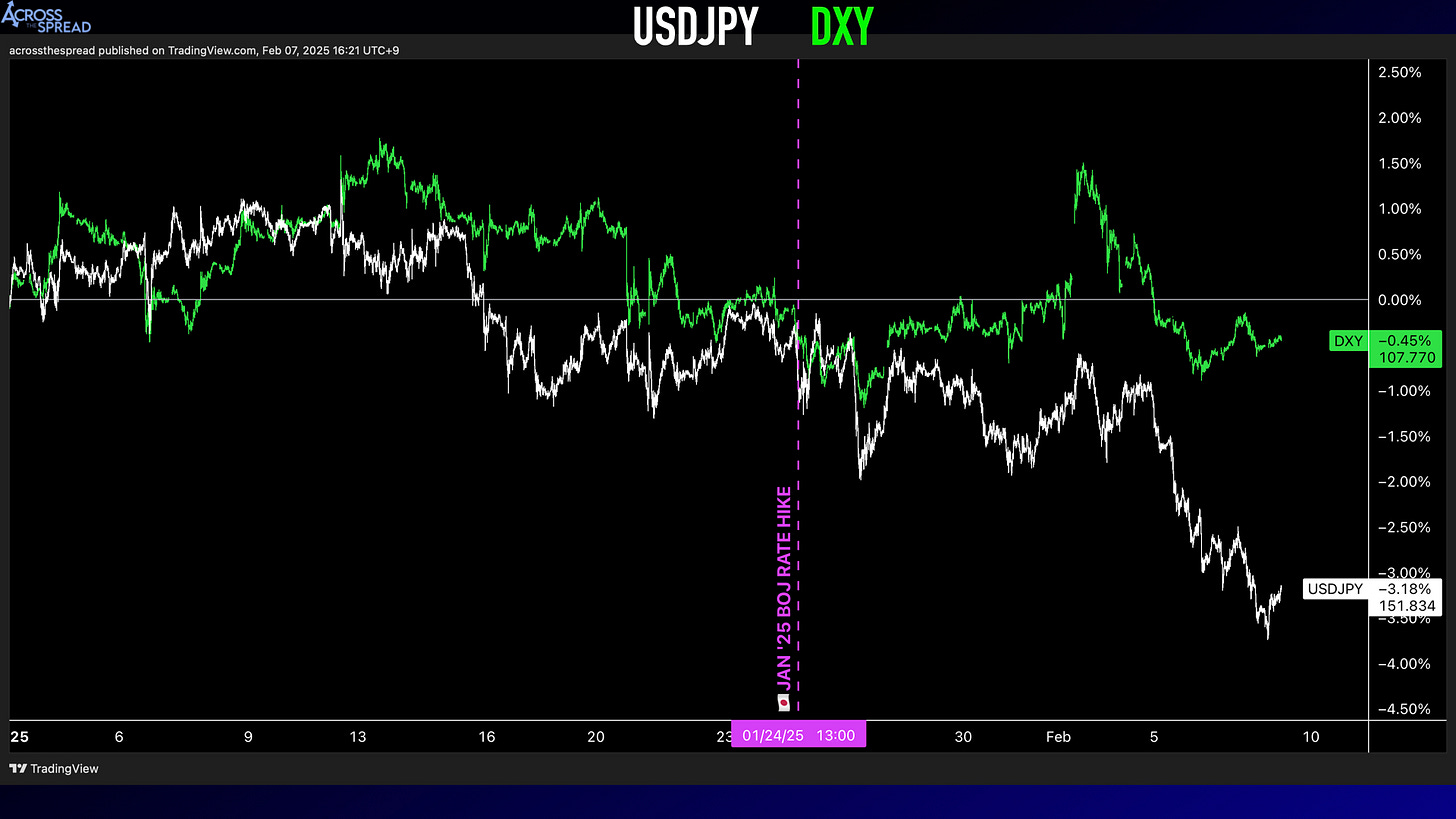

On the USD-side, postponing tariffs on Canada and Mexico have liquidated some of the nervous dollar buying that had been bracing for a more fierce tariff stance from the Trump administration.

Indeed DXY is down on a YTD basis, but it isn’t dollar-selling that accounts for USDJPY’s notably sharp downward move - it’s JPY strength.

JPY is now 2025’s best performing major currency - and not (just) because CAD and EUR had gotten crushed from their own respective tariff selloffs (both of which have since recovered) - it’s actual JPY buying.

Why is JPY buying occurring? Because of BOJ rate hike expectations getting priced in.

And back to the original question - why now, as opposed to late January when BOJ actually hiked rates?

Because, unlike then, markets are now actually pricing OUT and abandoning the BOJ “50 bps ceiling” perception discussed in my previous video.

https://westonnakamura.substack.com/p/bank-of-japan-jan25-rate-hike-video

Yes indeed, the 50bps ceiling perception was (is) a real thing that translates to real market implications.

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.