Why Bank of Japan Might Hike Rates Tomorrow

The case for a(nother) shock rate hike at the September Bank of Japan meeting

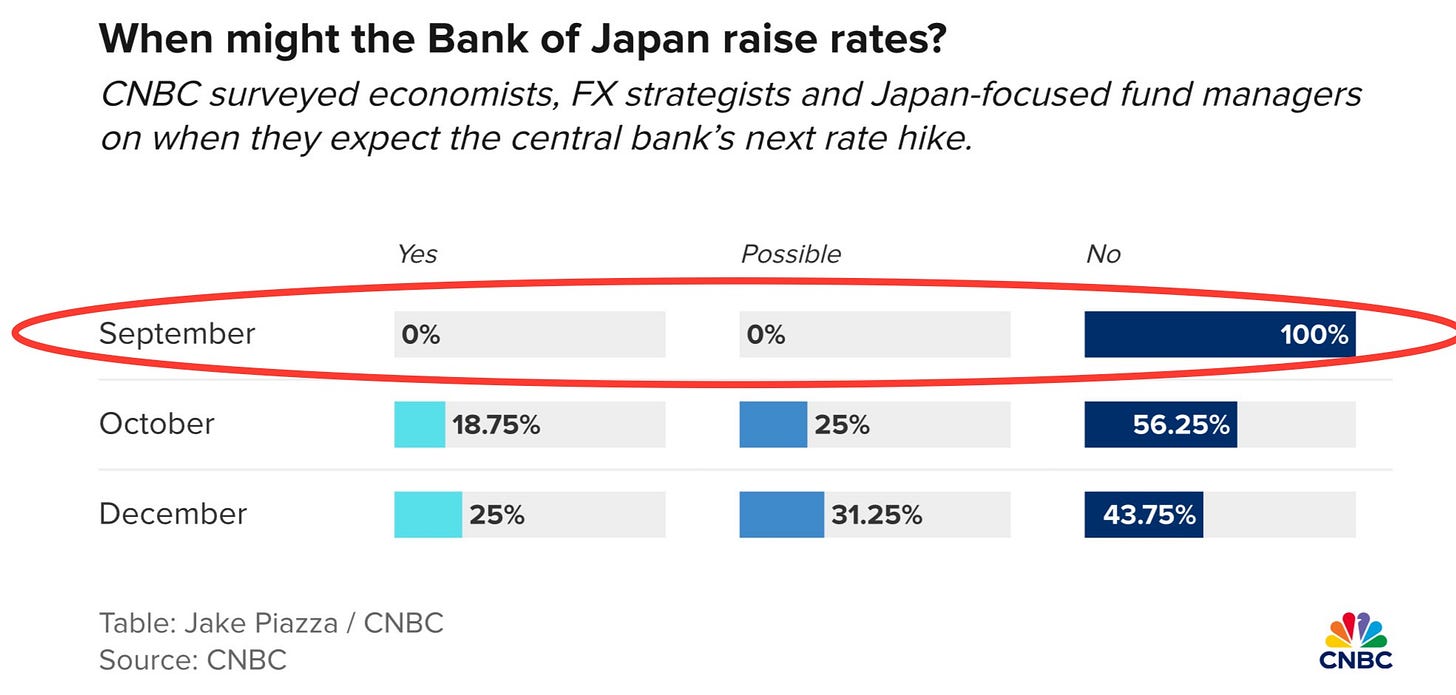

Nobody (within the community of arbitrary individuals surveyed by arbitrary financial media outlets) is expecting another shock rate hike out of the Bank of Japan on Friday.

This graphic seems absolutely ridiculous. It says that the unanimous consensus view is that it is quite literally impossible for BOJ to make a move in September.

Nothing is ever impossible, and certainly not when it comes to BOJ policy changes. Even if the September BOJ meeting results in no change - that doesn’t mean a unified “zero chance of anything happening” is somehow rational.

Really? Not even one of you thinks it’s even in the “possible” category? NONE of you people have ever seen what a Bank of Japan easing dissolution process looks like - yet, the “range” of opinions somehow follows some pre-existing pathway.

There is a rational explanation behind this irrationality- institutionalized thinking is a claustrophobic exercise that plays out in an echo chamber.

Before I even begin with my dispelling of the common reasons given for “zero chance September,” or lay out the case for why there is even a 1% chance that something may happen, I think it’s fair to say that we really need no other reason than- with the exception of the March’24 lift-out-of-negative meeting, every single BOJ meeting with a policy change under Governor Ueda’s 1 ½ year tenure had come as an unexpected shock move. (“Unexpected” within the context of “preannounced by Nikkei half a day prior.”)

July ‘23: Shock lift YCC upper band limit from 50bps → 1%

October ‘23: Shock rip the bandaid off of explicit YCC ceilings altogether

March ‘24: policy rate lifted out of negative territory (as mentioned, this wasn’t a “shock” in that every single financial media outlet, foreign and domestic, had telegraphed this - BUT, BOJ themselves never said a single word of official guidance about it)

June ‘24: the announcing of, but not “delivering on” a JGB buy-tapering plan that was very stupidly expected to somehow be “effective immediately” (this wasn’t supposed to be a surprise to markets, given that such a task wasn’t procedurally possible to take immediate effect - as I had called for prior to, and then re-explained when it happened).

July ‘24: shock rate hike off the zero-bound heading into Black Monday

BOJ only does shit when / because expectations are for no change. So again, just based on this “pattern” (standard procedure) alone - NONE of you ”experts” can fathom ANY change?

If the outcome of the September meeting is no change, you’re all still horrendously naive with your approach, and would be far from “correct” in principle.

Here are the reasons given for why a September BOJ policy change is apparently impossible:

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.