My wife gave birth to a wonderful baby girl hours before “liberation day.” Early this morning, my newborn daughter was transferred by ambulance to another hospital and was immediately admitted to NICU (intensive care unit for newborns), where she currently remains in a potentially life-threatening, critical condition, though at latest given moment, she is toughing it out like a champ less than a day old. My wife herself, having undergone a highly labor-intense (no pun intended) delivery, is now in her own atypically difficult recovery - also like a champ. As such, I have been between two hospitals where my girls are.

I am sharing this uncharacteristically highly personal matter, because all of this has been occurring from Trump unveiling his charts of countries tariffed, and the immediate subsequent full, cross-asset global market response to America fighting everybody at once - starting as always at Asia AM market open, then to the respective European and US trading hours. I haven’t been able to follow the green and red blinking ticker behavior for this monumental moment in global macro, nor have I yet been able to dive into the deep and wide details of this new world by order - at least not sufficiently enough to thoroughly think things through, and publish worthy commentary. But that is why I am explaining why it is that my commentary on these major tariffs is absent for the moment. I hope that I have your understanding and patience, and I thank you in advance for granting me a moment to take care of a sudden, unexpectedly urgent, non-green & red blinking ticker personal matter.

That said, just some quick updates and thoughts from my end.

MUFG & JGB yields

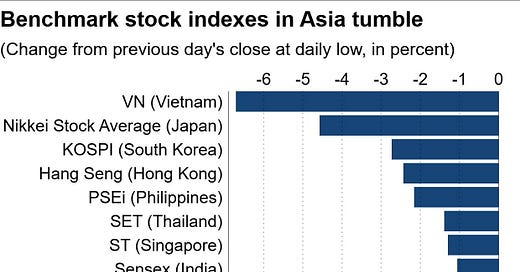

Japan was amongst the hardest hit from “liberation day.”

But as I explained when NKY dropped -4% intraday a few days ago that this was not an arbitrary pre-pricing in of “liberation day,” and instead, was more tied to Japan FY2024 year end (3/31).

From my quick glance around markets in the little time I had to do so today - that seems to indeed have been the case. Japan got hit harder than expected by US on the tariff front - but Japan equities performed worse on FY-end than they did today.

Furthermore - the most heavily traded megacap Japan single stock in today’s post-tariff announced session was:

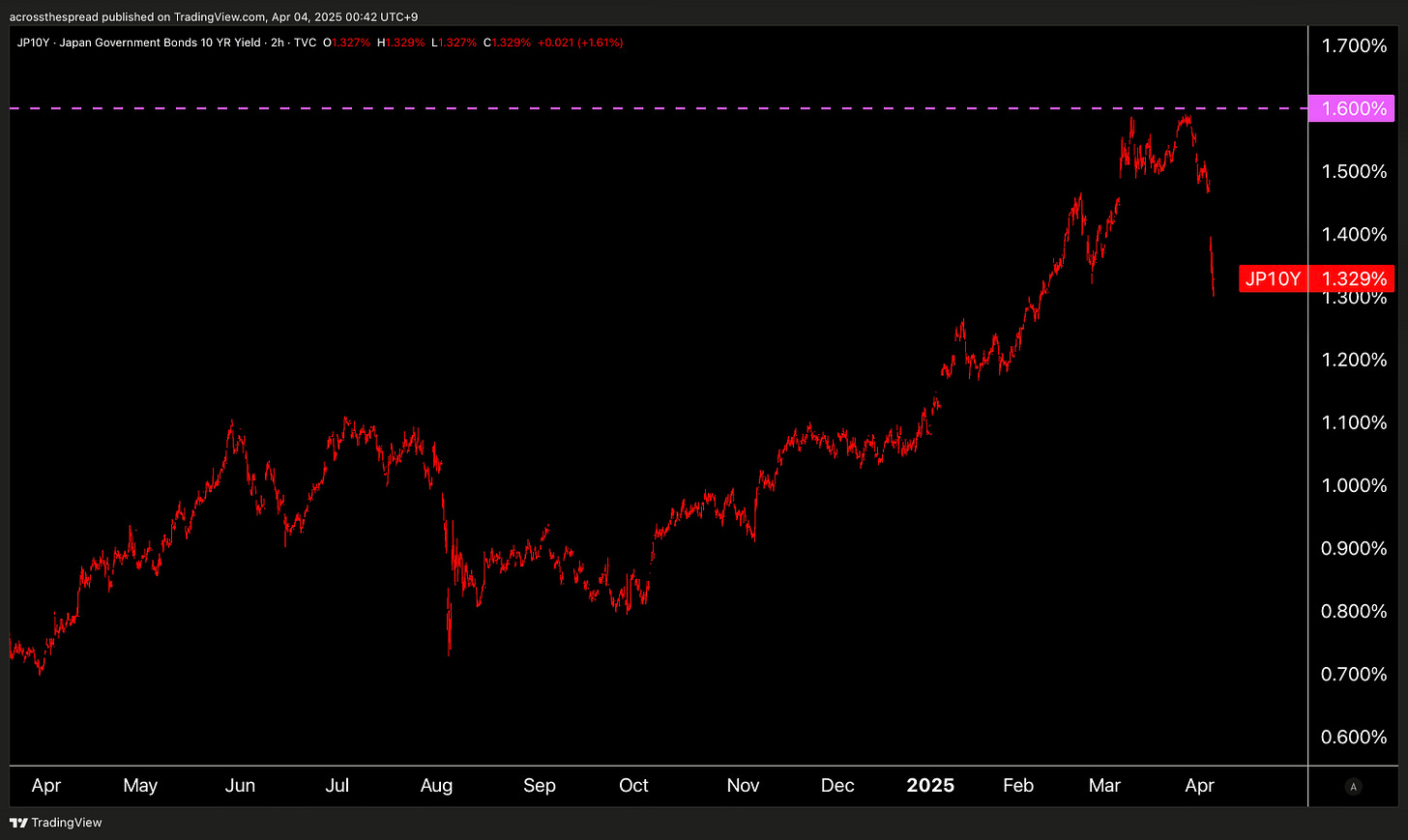

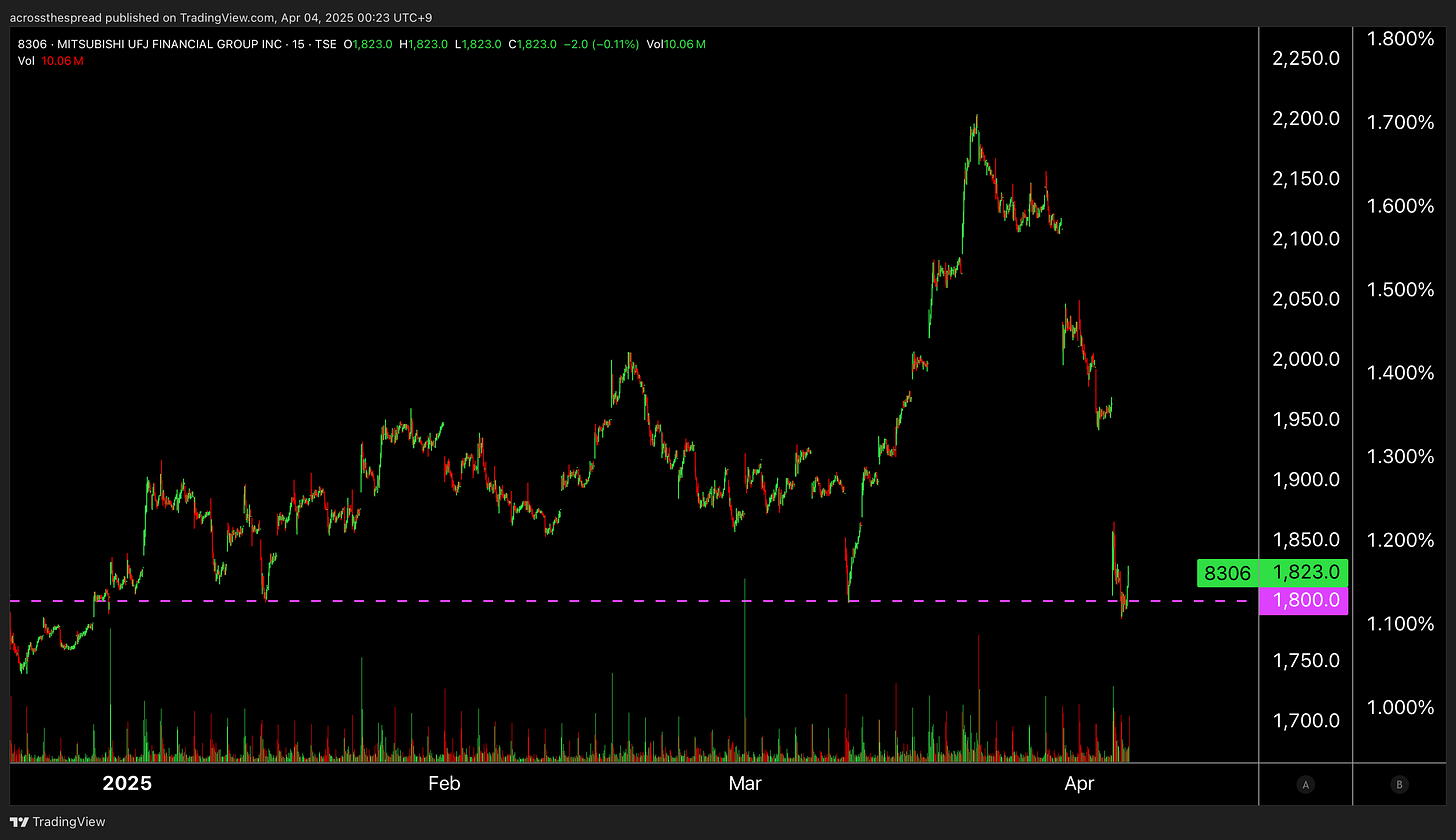

8306 Mitsubishi UFG (-7% on the day) - a / the bank stock that I had been flagging to go long, and more so, to use as a JGB yield proxy. More in value traded on MUFG single stock in Tokyo today than did the 1570 NKY Levered ETF:

Is MUFG, or any Japan bank stock really the most relevant to US trade tariffs levied on Japan? Even more so than Toyota, Komatsu, steel producers, food and ag, or electronics? No, bank stocks anywhere aren’t the biggest victims. Yet, look at the market activity.

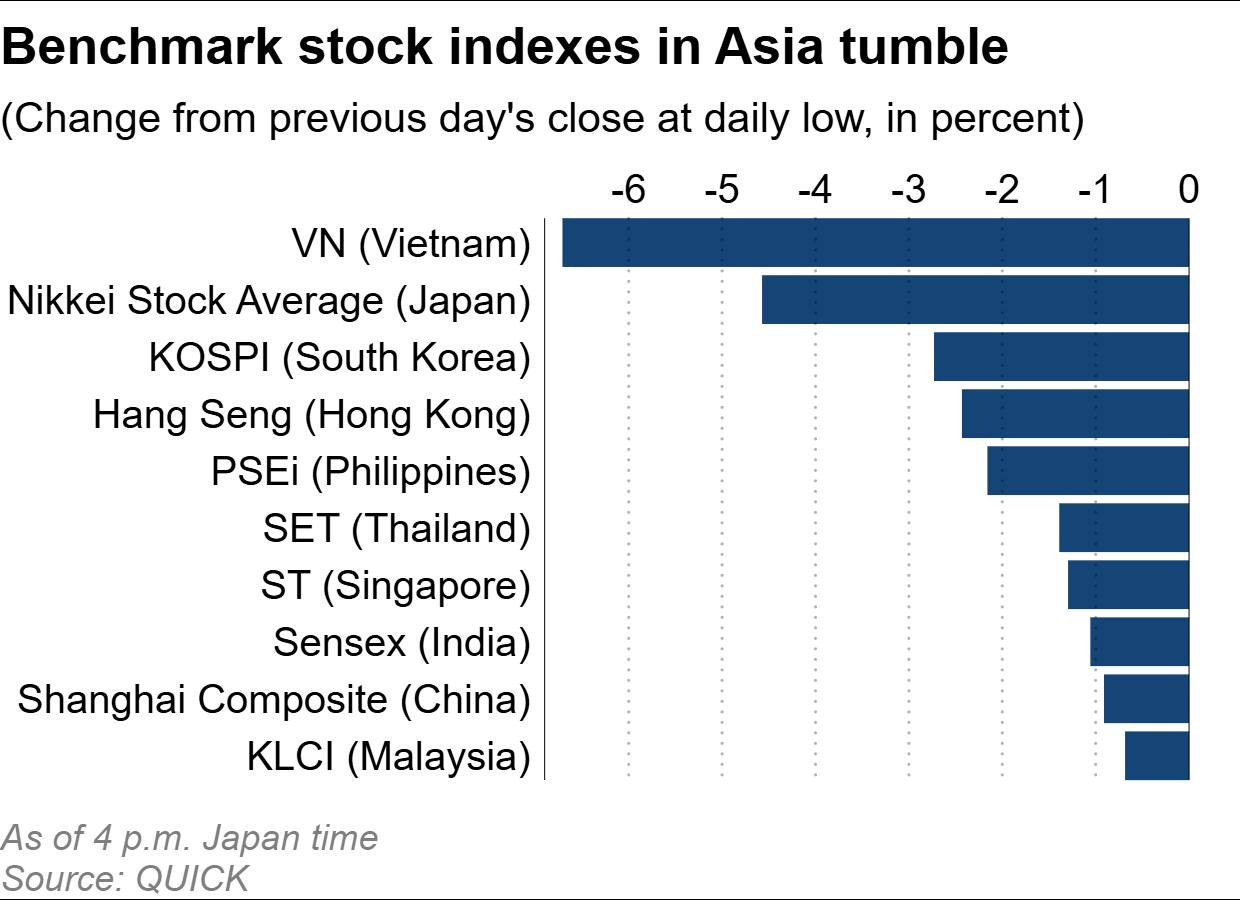

And as I’ve been discussing for the last few notes- what does MUFG green & red blinking tickers move with more than anything else, and regardless of tariffs? JGB yields - which accelerated their sharp collapse today…

…and why are JGB yield continuing to collapse in such a vicious manner?

Crowded shorts on JGB futures getting squeezed and force-exited.

And this collapse in JGB yields underway for a week have also been pulling UST and global DM yields down.

Take a look at the magnitude of the JGB yield move today- yields made a clear, wide open gap downward at Japan open - such a gap hasn’t been seen in quite some time (including from July - August 2024 yen-bomb).

So - post-“liberation day” - if MUFG is the most heavily traded stock in Japan, which thereby pulls TOPIX Banks down to be the worst of the worst performers…

…and this is due to a big short squeeze in JGB futures underway…

Then, this market actually isn’t some response to Trump tariffs as it is a yield move - a JGB yield move, or JGB forced short squeeze underway.

And this makes more sense than the markets as a whole moving “in response to Trump tariffs.” Again- we just started the first inning of these new trade wars - at this stage, people are more so force exiting open positions, and not putting new ones on with such partial information.

Further point on the chart above and my MUFG long- again, as long as shares keep tracking JGBs then the trade structure is correct, if the direction is (for now) not.

But MUFG has been gapping lower in the past week - just like the -20% single day drop on Black Monday August 2024, and is now back to finding a significant floor, one that it took off from recently:

So, my view on the MUFG trade remains the same - more so than prior. But if this last support level gets broken due to further JGB short squeezes/ cash JGB yields plunging in tandem- then we need to revisit the trade.

Lastly - I have long discussed and explained why it is that I don’t touch / trade Chinese equities. Here’s one of many many many instances in which I explain why I don’t:

And then, in my “Trading Trump” series of content and commentary released shortly after the US elections and Trump win, I warned of / pointed out the obvious yet hidden in plain sight from everyone notion that under a then-incoming Trump administration, we now have to treat / approach / trade US (and global DM) markets with the same approach as my philosophy on trading (or NOT trading) China. Because market behavior, at least for the foreseeable future of Trump’s presidency, is now based on a top-down, non-fundamental POLICY guessing game, and one that is a function of a handful of individual leaders and their respective interpersonal relationships. NOT on earnings or macro data (which is never the case anyway), and frankly not even on central bank policy expectations.

Nothing has validated that approach to markets more than yesterday’s White House unveiling, as well as the various global sovereign leadership responses that are now subsequently underway. (By the way - did you hear how much Trump had once again given his uncontrollable praise of “great, great man Shinzo Abe” mid-slapping tariffs on Japan?)

So, again - these are the market dynamics we must now deal with (and frankly, have been ever since I had initially flagged this approach). And again, it’s not about “Trading Trump” standalone, any more so than trading “the dollar” or “the yen” standalone when trading currencies - these are pair trades. You can perfectly and correctly nail the Trump vs (insert a major US economic trading partner) all you want - but you also need to nail whatever that other side’s countermeasure responses (should they exist) would be, otherwise you are trading on only half of the work necessary. Great- you predicted Trump’s move in the trade war game - you think it ends there? What’s Xi’s response (if any)? What’s Macron’s? Or Ishiba’s?

And note that global leaders who are seen as standing up for their respective countries by hitting back at Trump’s America enjoy an instant surge of some 30 points in their domestic approval ratings. And I assume those who don’t fight back will get replaced by the opposition who will aggressively campaign on anti-Americanism as it relates to trade. So if you think that “liberation day” is the short-volatility “sell the news” event - it is not. “Liberation day” are the first shots fired - the real battle now begins.

That said, it doesn’t mean escalating tariff wars will always be reflected in their respective markets, or maintain their degrees of market impact as this goes on either. Global cross asset markets traded off of Russia vs Ukraine with a monopoly over market moving headlines for only about a month or 2, before completely abandoning that factor.

Trading Trump (2) - Bond Markets

This is part of a broader analysis on the US elections and market implications through the perspective of Asia / Japan.

Thank you once again for your understanding during my trying times.

Weston

Weston - thank you for sharing your personal situation. Our thoughts & prayers are with you and your family. Hang in there, all will be well!

Weston - I'm so sorry this joyous event has turned into such a scary one. I'm sending lots of love and healing thoughts to you and the family. Keep your focus on them. It's all that matters right now. xoxo