Dec’24 Bank of Japan & FOMC Initial Commentary

2024’s most market consequential central banks release their respective policy decisions within hours of one another to end 2024. Initial commentary (pre-BOJ press conference).

🇺🇸2PM / 🇯🇵4AM: FOMC CUT -25bps, “hawkish” dot plots for 2025

🇯🇵11:52AM / 🇺🇸9:52PM: BOJ UNCHANGED, Policy Review released

(Currently awaiting Governor Ueda press conference at 🇯🇵3:30PM / 🇺🇸1:30AM)

I usually don’t make BOJ commentary at this time in between the policy release and the BOJ Governor press conference - but I do have to make a few quick points this time. And it’s not (just) because I happen to currently be in the U.S. visiting at the moment and having just arrived, making me both jet lagged and having to do the reverse time-of-day for this FOMC/BOJ double header - it’s because BOJ, though policy unchanged for this meeting, had also dropped a 200-page policy review document alongside the 2-page Dec’24 official policy statement (for fuck’s sake, Professor Ueda…)

I of course haven’t read through this whole thing yet- but I most certainly will be, and will be doing so already knowing how much of a waste of time it will likely be to do so, because 200 pages of BOJ’s self reflective research concludes nothing:

And so before this tactical tool that was just deployed in order to attempt to hijack the press conference and run out the clock does its thing, I just need to make some quick points on market price action following FOMC (as it relates to BOJ, or vice versa), and the policy unchanged itself - as my brain will no longer be of any functional use after Gov Ueda wraps up at 🇺🇸3AM, this is something that would require me to revisit and comb thoroughly through again anyway.

Markets

Regarding cross-asset market price action following FOMC’s expected -25bp rate cut, following a slightly more hawkish 2025 dot plot, and following a BOJ policy rate on hold announcement, and pre-BOJ Gov Ueda press conference in a few hours…

There are a bunch of superlatives out there regarding the broad based US equity market sell-off upon the Fed decision and announcement to cut rates by -25bps from earlier.

Worst FOMC-day sell off since 2001.

Biggest jump in vol since Aug’24 Black Monday, VIX, VVIX and NDX vol surge.

Biggest post-FOMC 10Y yield increase since…. 2020 or something (although this is a stupid one - because they’re going off of a “+10bps” move, which is far more a big move when US 10s were yielding in the 1~2% area vs the same +10bp move from 4.40% → 4.50%).

And I don’t know that anything regarding the Dow30 having a shitty consecutive run qualifies for any superlative, but I suppose that one too.

Ok, great.

Why is this market “reaction” happening? Yeah, apparently the dot plots took out a few rate cuts for 2025. But does that justify market movements reflected by the superlatives above? Or, is everyone (vast majority) actually surprised, and the coalescing around characterizing the sell off as one of “excessive?”

Clearly it the latter of the two.

So, how about - yet again - market movements are not all pure reflections of human being decisions and active capital sentiment, and the constant repricing of new info and realities. When markets make superlative-worthy moves, those are almost ALWAYS (if not literal 100% of the time ALWAYS) the product of price-indiscriminate trading execution: position exiting/closing.

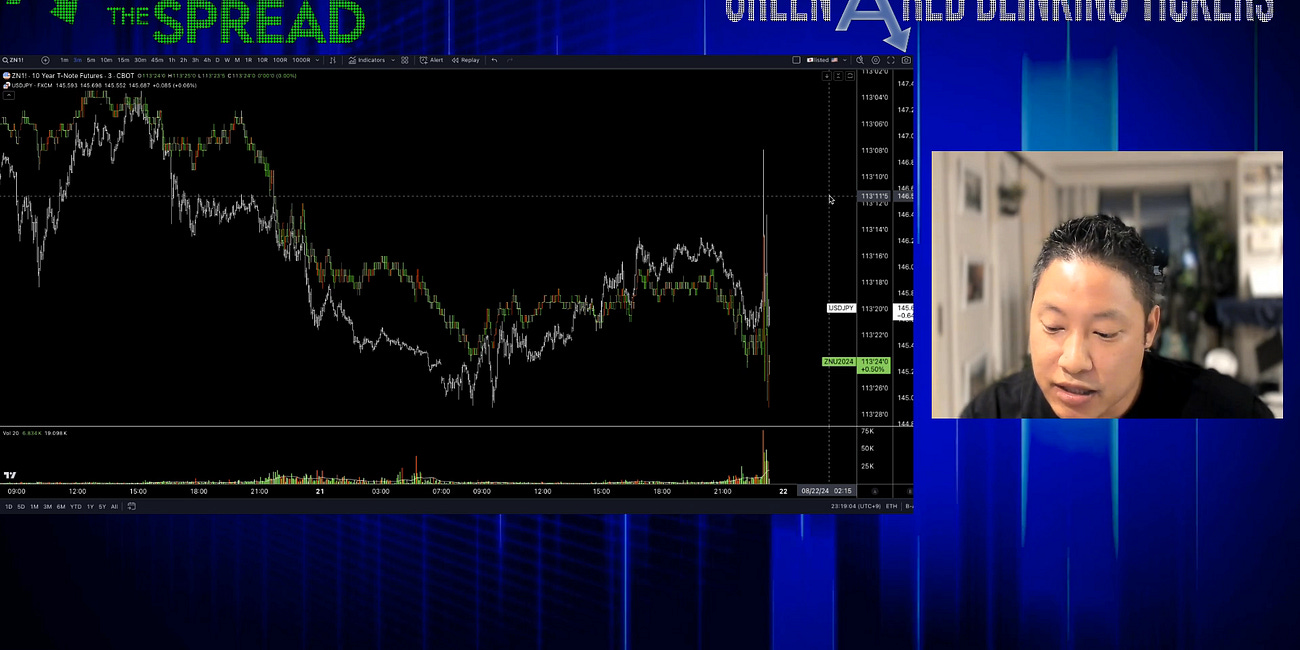

And then, how about what we saw on clear display on “BIS payroll data revisions day” - from earlier this year that I had live recorded for subscribers - where it was exposed that markets move because they’re pre-programmed to move upon a time of release, regardless of what that release may be (be it a data point or a Fed decision) - these algo-dominated markets move for absolutely zero fundamental reason. See below:

A Major Moment - Markets Just Lost Credibility

This is seriously concerning - which is why I am rushing out this unpolished, very raw video of my live market reaction to the BLS labor data revisions “release” for subscribers.

So, perhaps I’m just a simpleton but here’s what I see in markets “in response to” the 100% priced in FOMC, and “major dot plot shock.”

It’s year-end, and a year in which people (US institutional) really did not want to chase US indices higher - and while many didn’t at all, some did, and some did and bid up NDX/SPX heading into FOMC, so much so that U.S. equities, which were previously % for % with Nikkei following Trump’s win, had broken away from NKY and broken out. So, a -3.5% intraday drop on NDX is merely bringing it “back down to Earth” - in context of NKY futures as the benchmark:

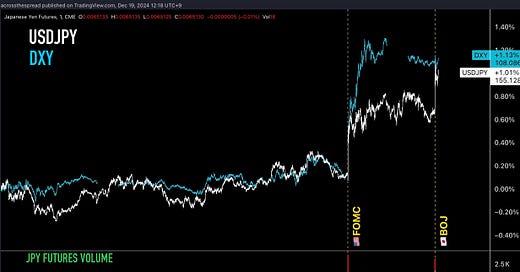

Here’s more post FOMC “catching down” - the yen.

DXY had a massive rally intraday of more than +1%. The FOMC USD was crushing everything- EXCEPT for JPY, USDJPY was dead flat unchanged when every other USD pair was moving 1% or more. And that’s because JPY still had BOJ coming in a few hours after FOMC.

So, when BOJ’s (split opinion/positioning) decision of unchanged was released, USDJPY caught up to DXY.

I guess that yes, media is technically “correct” to say “JPY weakens on BOJ decision” - but not accurate in context. So far (pre-Ueda press conference), JPY has been an FOMC reaction, pausing to confirm no immediate policy change from BOJ.

But anything else from BOJ is not yet in JPY- keep that in mind as we listen to Ueda dodge questions for an hour.

The December FOMC was the “last catalyst for the calendar year” for many (many algo trading systems), and it was merely a premeditated time to take long equity profit regardless of FOMC/Powell. But not for all - those who are sticking around for BOJ (and BoE) are now the predominant market impacting forces, should they choose to impact.

BOJ

Last point on the BOJ meeting itself- board member Tamura-san was the lone 8-1 dissent vote- he wanted to hike to 50bps.

Tamura is the “hawk” of BOJ, and is the only one who has actually put out a neutral rate figure of ~1% for BOJ policy rate.

He stated this as recently as late September.

So, Tamura has to vote for a hike, even/especially if alone.

If he didn’t, then that’s a 9-0 unanimous very dovish BOJ. And that’s way too much clarity for BOJ to offer to the world.

Will come back with more.

Weston

Thanks Weston. Another potential catalyst - Options and Futures expiry today on the ASX - the US markets/exchanges 19th and 20th Dec also heavy for the same. I think I remember a similar "coincidence" with the same setup years ago (but Sept expiry). Get some sleep.... Cheers.