Did Japan Market Just Fire Another Warning Shot Upon LDP Elections?

Live streaming during Japan AM trading session 🇯🇵Mon AM (🇺🇸Sun night) w/ Michael Gayed - and what you need to know heading into trading tomorrow.

I will be live streaming with

tomorrow (later today for U.S) at 🇯🇵Mon 9/30 11AM (🇺🇸Sun 9/29 10PM EST) - during Japan AM market hours again, on:We will be discussing the Friday’s (post-Japan cash equity market trading hours) massive NKY futures sell off and JPY surge that had occurred upon the outcome of Shigeru Ishiba’s stunning win in the LDP leadership election to become Japan’s latest prime minister, as well as the tsunami of China’s stimulus measures unleashed this past week.

And of course - the reason Michael and I are doing this, WHEN we are doing this (during live Japan trading hours) is because, well… there is once again real-time market mayhem - as per last time we went live steam, during 🇯🇵AM trading hours of Black Monday (←watch if you haven’t seen it- in addition to the market destroying JPY-surge and -13% NKY plunge underway, I cover BOJ and the shock rate hike, NISA impact and more - all of which remains relevant to this day).

And although I don’t expect another Black Monday at Japan cash equity market open, there will be sharp volatility.

NKY index logged a nearly +10% gain in the 6 trading days since FOMC cut -50 / BOJ dovish hold.

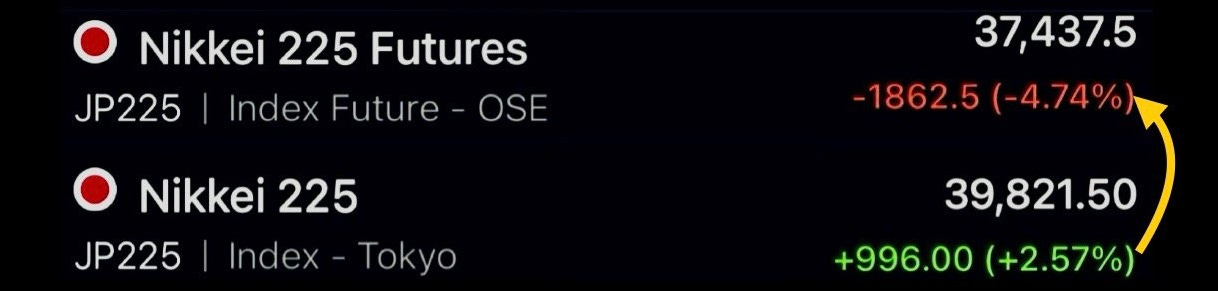

And here is how NKY index finished the week at 3pm cash close on Friday:

…and here is the Japan market picture (USDJPY, NKY futures and US listed Japan equity ETFs) later that day at US market close on Friday:

What happened on Friday between Japan cash equity market close at 3:00PM, and NKY futures re-open at 4:30PM?

That happened.

So, these two need to reconcile:

…and they will do so at Monday Japan AM open.

In the world of major global equity index futures, it is extremely rare to see such hugely idiosyncratic single-day performance (for both the upside as well as the downside) as this:

Same goes for such large moves in such an isolated manner of widespread JPY strength vs all else, without spillover into/among major pairs:

I don’t know what the reason for this very Japan specific cross-asset market is (yet). By which I mean - obviously, there was a Japan specific event that occurred- new PM elected, and a surprise one at that - my not-understanding is referring to how global macro markets ex-Japan were completely insulated from such a massive, cross-asset move out of Japan, regardless of what the catalyst is. After all, it was just last month (when Michael Gayed and I were live on Black Monday) that Japan blew up the rest of the world in blowing up itself.

Perhaps it may be a matter of the following:

Although Japan equity index futures were disastrously crushed (and that’s no embellishment, a -5% instantaneous and non-flash recovered drop in a major index is on par with an actual disaster, like a Japan earthquake + tsunami), Japan’s actual cash equity index (Tokyo Stock Exchange single stocks) were already closed and not trading - and so maybe we need actual Japanese equities to crater alongside, if not drive the futures markets downward, in order to trigger the otherwise typical synchronized global move. As despite NKY futures getting hammered -5% immediately upon 4:30PM reopen, and remaining down to close at session lows, as well as US listed Japan equity ETFs (EWJ and DXJ) and even the large and liquid Japan single stock ADRs (Toyota, Sony, MUFG etc) also getting hammered - the actual Japan stock market has yet to have a chance to react to a Prime Minister Ishiba and/or a +2% surge in JPY. After all, it’s the Japan NISA flows (which indeed do include domestic single stocks in addition to foreign/US equities) that have been a major contributor to the year to date JPY downside - overall single stock cash equity flows that impact not only index futures, but FX as well.

If Japan cash equities have a major catch-down move to reconcile this discrepancy…

…then those who were paying attention to the Japan move on Friday and sold non-Japan (US, European) equities into Friday’s strength may be immediately rewarded, as those regions have their respective delayed catch-down drops to follow NKY cash index -5%.

Conversely, if this NKY futures plunge was just purely systematically driven by non-human bots for no real fundamental reason (as I personally am leaning towards in my own view at the moment) - then a 9AM indiscriminate red-across-the-board moment may be a screaming long position entry point for a very short term (even intraday) trade to play a sharp rebound back to where things were before Japan selected Ishiba as its PM.

🇯🇵7011 Mitsubishi Heavy Industries is one such stock I am personally looking to go long if it gets hit amidst an indiscriminate drop at the open. 7011 MHI is a Japan military defense play, and under a PM Ishiba, former defense minister who campaigned on national security and is a China hawk, expectations of an increase in Japan’s military budget would uplift blinking tickers of MHI after a temporary mechanical sell-off (should it come to that). Shares broke another record high on Friday and are +166% YTD, and +17% above the July 11 global market destruction initiating yentervention highs for which NKY is still -5% off from recovering.

Either way - that is why the Monday Japan cash equity market trading session will be interesting, if not critical to watch - and why you therefore must tune in to Michael Gayed and I live-streaming in the Japan AM session.

Here is a bit more color and detail of the LDP leadership race and its potential market impact.

Overall, this is not so much about new PM Ishiba getting priced in as it is about election front-runnner Sanae Takaichi getting (sort of) shock-priced out, and suddenly so.

This election was for the leadership of the ruling LDP party. So although there was an atypically large number candidates running this cycle at 9 people, of which there were 2 women (Takaichi being one of those women), and 2 who were in their 40s (age) - at the end of the day, they are all LDP, and this leadership election itself wouldn’t result in some massive shift in the nation’s direction. The Japan political analysts and consultants will vehemently disagree with my previous sentence and label this it as blasphemous ignorance on my part (because that sentence basically implies that those people’s jobs don’t really serve any meaningful purpose, though not my messaging intent) - but the reason I say this is because what matters far more in terms of the direction of government and policy is the upcoming general election (so, relax, Japan politicos). But not too much from a purely green and red blinking ticker implication standpoint.

Except for one differentiating factor, which I had personally underestimated regarding market impact potential: Takaichi’s stance on Japan rate policy, which became evident into the last moments of election day.

In a prior note, I made the case for why the Bank of Japan assumed to be on hold going into the recent September meeting (for which it ultimately was indeed on hold) was by no means a 100% forgone conclusion, as was per unanimous consent and OIS market pricing. I went through the reasons given by consensus for why there was a 0% chance that BOJ would hike rates in September, and gave my counter-argument for each - and I addressed this LDP leadership election timing first - excerpt below from “Why Bank of Japan Might Hike Rates Tomorrow: The case for a(nother) shock rate hike at the September Bank of Japan meeting"

Here are the reasons given for why a September BOJ policy change is apparently impossible:

Macro data (CPI, wage increases etc) doesn’t support a September move- Oct/Dec is when data will justify the next rate hike

Japan LDP leadership elections to replace PM Kishida on September 27th- don’t want to rock the boat ahead of that (there are also those who point to a December rate hike so as to also avoid US elections in November)

BOJ’s July rate hike blew up the markets

Fed’s anticipated (and now delivered) rate cut will do the work of closing up the policy gap (+cuts from ECB, BOE etc)

Why these are each and all nonsensically empty reasons for “impossible September”

(I will address point #1 last)

Japan leadership elections in late September:

…and??? Look- I am the first to loudly point out BOJ’s complete horseshit “independence” - but what the hell does a BOJ rate hike up to a half percent (even with any assumed market chaos that may come of it) have anything to do with / alter the course of the election outcome? This isn’t like the US election, in which there are 2 parties vying for leadership power, one of which is the incumbent, and therefore would be harmed by some market Armageddon, or conversely helped by a ripping market - this is the ruling LDP leadership. Japan has been under one-party rule by the LDP for decades (except for a short stint in which they lost power and had a period of post-Brexit UK style single-serving PMs) - and this is the LDP leadership election that “four-eyes Kishida” (as he’s lovingly known here) is stepping down from - so you’re not blowing the market up on any LDP candidate. Nor do I buy the not rocking the boat for a potential snap election that could be called as early as end of October either - that’s not a set date, it’s up to the discretion of the new leadership.

Now, as I mentioned regarding this so called “central bank independence” that clearly doesn’t exist in the world’s most indebted nation who’s largest and vital creditor to the sovereign is said central bank - some of the candidates have been putting out their “positions” on BOJ policy, and for those who are doing so, they’re by and large in some form of pro-normalization camp, with the exception of Takaichi, who is basically a female and slightly more right wing Shinzo Abe in ideology, who isn’t a fan of the July rate hike and is a fan of the endless JGB buying. But again- so what? None of these people can just fire and replace Ueda upon taking office or whatever it is that people think makes the PM relevant to BOJ rate policy.

(Full article below)

And there above is my misread, or underestimation, of the growing influence of Takaichi's market impact potential.

Yes, I did acknowledge Takaichi differing from the rest of the candidate pool with her publicly stated support of Abenomics (endless JGB buying) during this September 2024 campaign cycle, as well as her expressed opposition to the July BOJ shock rate hike. And my broader point from the passage above was to dispel the "why BOJ won't hike / risk rocking the boat ahead of LDP elections” (for which I continue to believe is a nonsense factor that BOJ policy decisions are dependent upon) - which is not what we are currently discussing - because if anything, its now “LDP elections rocking the markets for/upon BOJ,” and not the other way around as the reasoning for “BOJ to stand pat before elections.” So my message itself as written above is basically fine as is.

Or- it WAS fine at the time of writing/publishing on Sept 20th, as I had also said this from the same assessment above:

I will say that the weak yen is a highly political matter - but obviously nobody is running on a platform of pro-yen-crushing.

3 days later…

“Some say a weak yen is terrible, but the merit of a weak yen is great.”

-Sanae Takaichi, Sept 23rd

Now I obviously couldn't have predicted she, or anyone would say such a thing, AND gain popularity (not because of, but regardless of such statements). So that's not where I may have messed up.

I believe I may have messed up regarding market analysis in hindsight was to more closely monitor the changing degree to which candidate Takaichi's opinion of BOJ as being “stupid to raise rates now” and “weak yen is great” and such, in combination with her growing likelihood of winning the election may have been impacting markets. Granted this is an impossible task to balance incoming rhetoric vs ever-changing win probabilities moment to moment, but still is something that I should not have been as caught off guard by.

Here is what I mean.

Markets on Election Day

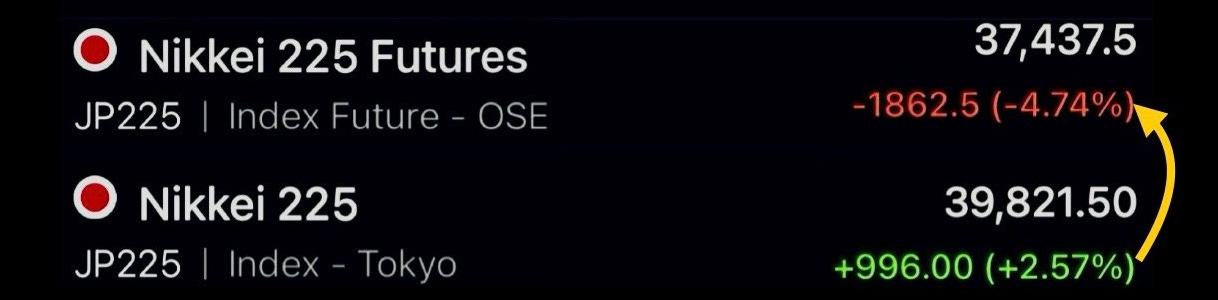

If we look at a chart of USDJPY from Friday during the election itself underway, we can clearly see the Takaichi effect and impact reflected in spot USDJPY price action.

Spot USDJPY starts the day sub-145, then ramps up shortly after 1PM when votes started casting, and rumors of strong support behind Takaichi started buzzing around. Shortly after 2PM, results showed Takaichi and Ishiba advancing to a second round runoff vote - but Takaichi taking the most votes (though not enough to outright win round 1), and USDJPY jumps to 146.50, +1% higher from the open.

NKY also follows USDJPY upwards into the close (NKY index futures close is at 3:15PM, shortly after 3PM cash close) - ramping alongside USDJPY upon the same catalysts, rumors and drivers - PM Takaichi potential is not only most probable, but higher than originally expected.

But in addition, a runoff between Takaichi vs Ishiba into Japan cash close is also quite the binary setup regarding equities.

Here is a survey taken by Japan financial data vendor QUICK of institutional market participants probably a week before election day, asking which of the LDP candidates running would be best for Japan equity markets. Results of the survey came in as follows-

BEST for equities: TAKAICHI at 29% of surveyed

But in addition, aside from those grouped into the “Others” category who essentially are too insignificant to count, of all people (within the top contenders) - ISHIBA, the guy who actually won, was seen as “least-good” (I don't want to say “worst”) for equity markets, at only 10% of surveyed.

So, when you have a day-of runoff between Takaichi vs Ishiba with less than an hour into Japan cash close for the weekend, knowing that results will likely come out AFTER cash close, then its a fairly binary matter of “buy Takaichi win” or “sell Ishiba win” - at least according to this survey of market participants.

So, Friday - or at least Friday's PM session, was clearly a market about Japan leadership: either we have a PM Takaichi, or not.

First round of voting suggests we likely do have a PM Takaichi, i.e. perception of “Abenomics revived” of sorts.

Approximately 20 minutes after cash close, and just 5 minutes after NKY futures close (for which they reopen at 4:30PM) - the second round of voting comes in with a stunning result: Shigeru Ishiba wins, or - Sanae Takaichi LOSES.

The only markets open to react in real time are illiquid JGBs (which saw 10Y yields jump +5bps to 0.85% after nearing a break into the 70bp handle upon the 2PM Takaichi victory assumption pricing in of a turn back towards a more dovish JGB gobbling BOJ), and of course FX markets for immediate reaction.

And the FX market reaction was indeed sharp and immediate:

Here again is my Note commentary from that moment:

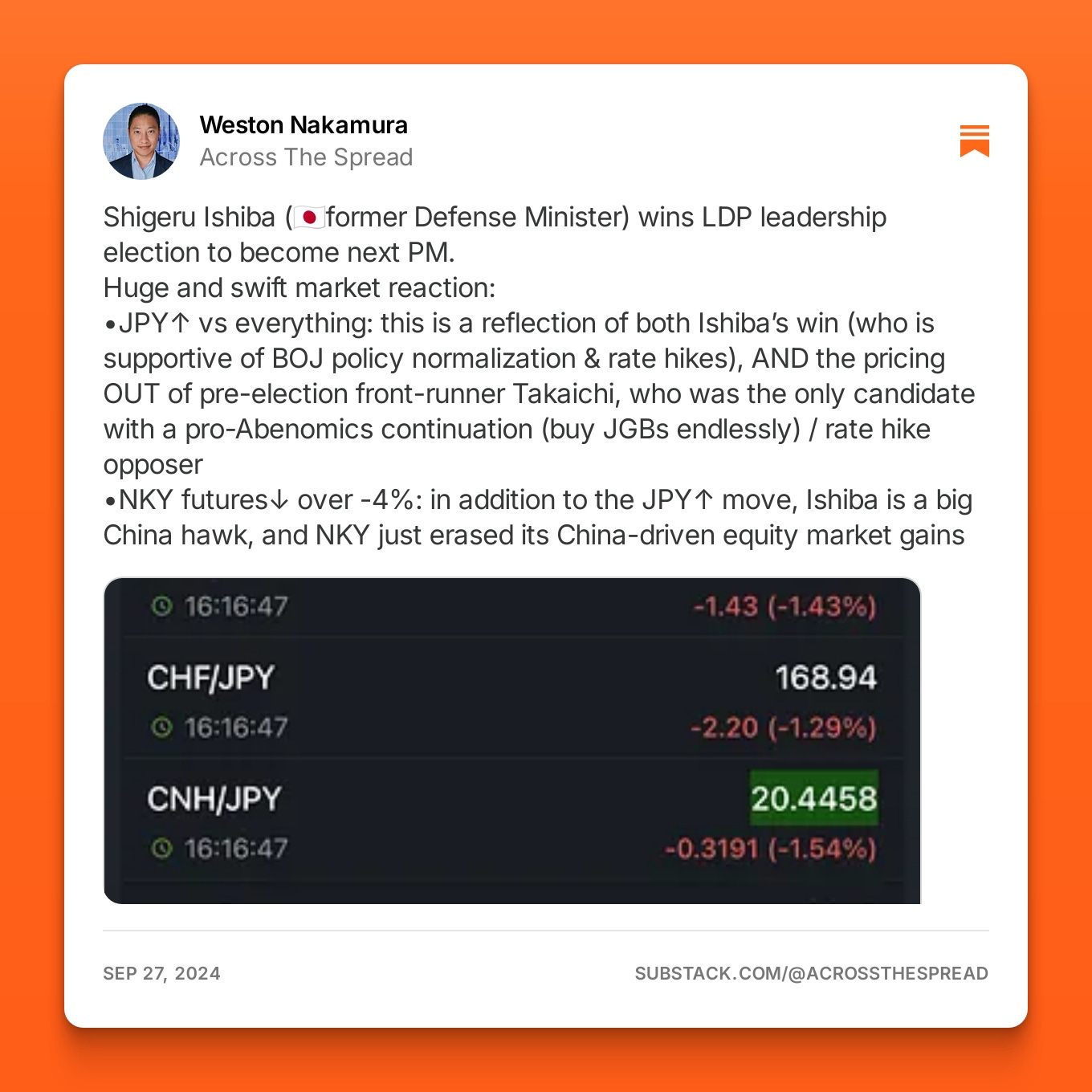

Shigeru Ishiba (🇯🇵former Defense Minister) wins LDP leadership election to become next PM.

Huge and swift market reaction:

•JPY↑ vs everything: this is a reflection of both Ishiba’s win (who is supportive of BOJ policy normalization & rate hikes), AND the pricing OUT of pre-election front-runner Takaichi, who was the only candidate with a pro-Abenomics continuation (buy JGBs endlessly) / rate hike opposer

•NKY futures↓ over -4%: in addition to the JPY↑ move, Ishiba is a big China hawk, and NKY just erased its China-driven equity market gains from/for the week

I also made a subsequent Note comment regarding potential yentervention at play:

Although my current leaning is towards “not likely” - I’m starting to consider if this massive rip higher in JPY may have actually been a (premeditated) 🇯🇵MOF yentervention…

(As per Gregg question)

By “premeditated” - I don’t necessarily even mean LDP election outcome (i.e. who may be winning) related, but even purely market behavior based. Over the last week+ (post FOMC & BOJ), USDJPY’s upside move has been that familiar “unconditional upside” drip-drip, and then heading into the LDP election, upside started to accelerate.

Then, boom: USDJPY plunges from > 146 → 142-handle (i.e. approximately in-line with prior yentervention increments of -¥4 to -¥5 drops), AND, without the counter-knee-jerk recovery thereafter.

The move downward started at 🇯🇵15:22, spot USDJPY 146.21 → 144.70, but the corresponding trading volume for Dec24 JPY futures ↑ move was only 6k contracts.

Then at 🇯🇵15:23, as spot USDJPY continued plunging down to 143.50, JPY futures volume traded 12k. And for the following 1 minute window at 15:24, futures volume traded 4.8k contracts.

So, when spot USDJPY initially made its move, only ½ the amount of futures volume traded vs the following minute, which MAY suggest this was spot-USDJPY-driven / futures-followed. (It may also just be a matter of when the market activity began vs arbitrary 60-second increments of time frame windows that are being snap-shotted).

If it were a yentervention, again, it wouldn’t necessarily be “in favor of” an election-based motivation or something, it may very well just be MOF finger on the blast-USD-trigger due to pure market-based behavior, with a potential (& then realized) catalyst of a leadership election overhanging.

Like I said, my current opinion leans towards NOT-yentervention, BUT, it is a possibility that is on my mind and will be exploring.

Otherwise, this would imply/show that apparently the FX markets respond far more to 🇯🇵fiscal/political outcomes than they do 🇺🇸FOMC + 🇯🇵BOJ policies, at least for this particular moment.

And I have yet to dismiss this potential scenario.

Technically, as PM Kishida goes, so goes his appointed cabinet - including those at MOF - the yenterveners: Finance Minister Suzuki. That said, it is not uncommon to just retain an incumbent Minister (of any department) - including and especially at Ministry of Finance during critical times.

I have a natural allergy against conspiracy theorizing. But I do think its entirely possible that the outgoing-unless-reappointed heads at Ministry of Finance may have smacked USD down 4 handles (as yenterventions go) to counter, or at least prevent an unfavorably embarrassing, if not damaging market reaction of what looked like an all too familiar bout of runaway momentum USDJPY upside upon the result of a Prime Minister Ishiba (or whoever the next boss is). What's the harm - you yentervene and may be replaced anyway (for unrelated reasons), or you fire shots at USD and as a result, win over reappointment.

IF this were a yentervention (which, again, I do not think is the likely case), then the reason for it would likely be what I had just outlined above - an act of self-serving career risk management, more so than anything “for the good of the country.”

My last chart and point is simple.

A dovish -50bp FOMC rate cut didn't drop USDJPY - rather, USDJPY moved higher after FOMC. A dovish BOJ on hold (rather than hike) saw basically the same subsequent move in USDJPY. An aggressive, multifaceted stimulus program out of PBOC / China had actually STRENGTHENED the yuan, with USDCNH printing into the 6-handle, but did NOT pull USDJPY down alongside it, as one would also expect based on prior directionally parallel JPY and CNH vs USD price behavior - in fact, the CNHJPY pair has strengthened by +3.6% since BOJ (as well as traded back above its Black Monday yen-ripping CNYJPY plunge), CNHJPY was +4.5% since FOMC rate cut, and was +2.6% since China's easing measures had been unleashed this week.

NONE of those things did anything to stop the weakening of, let alone strengthen, JPY.

But a Japan LDP leadership election result took out nearly -5 big figures off spot USDJPY.

See you all tomorrow (or later today) live with Michael Gayed:

Live streaming on Across the Spread YouTube and / or on X (Twitter)

Thanks as always,

Weston

I’m curious what your analysis will be on USDCNH as it relates to the yen volatility

Yikes! Nikkei down 1500+ at the open! Not a confidence-builder!