Japan FY2024 Ends With A Crash

Overview of Japan-led global risk-off, the latest BOJ JGB buying schedule + alterations, and update on JGB yields & TOPIX Banks trade.

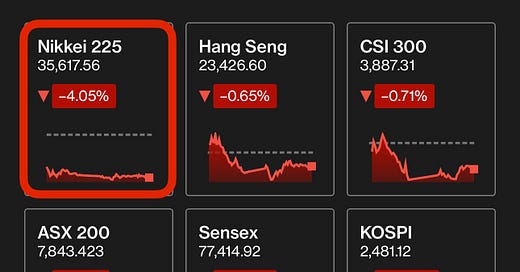

Asia regional equity market snapshot for Monday March 31 2025, or Japan 2024 Fiscal Year End:

US index futures at Japan cash close: SPX EMINIS -0.45%, NDX FUTURES -0.67%

Note that while the KOSPI is down -3% on the day, Korea lifted its ban on short selling that had been in place since November 2023 today as well.

So, the equity market that got hit the worst by a clear mile is: Japan.

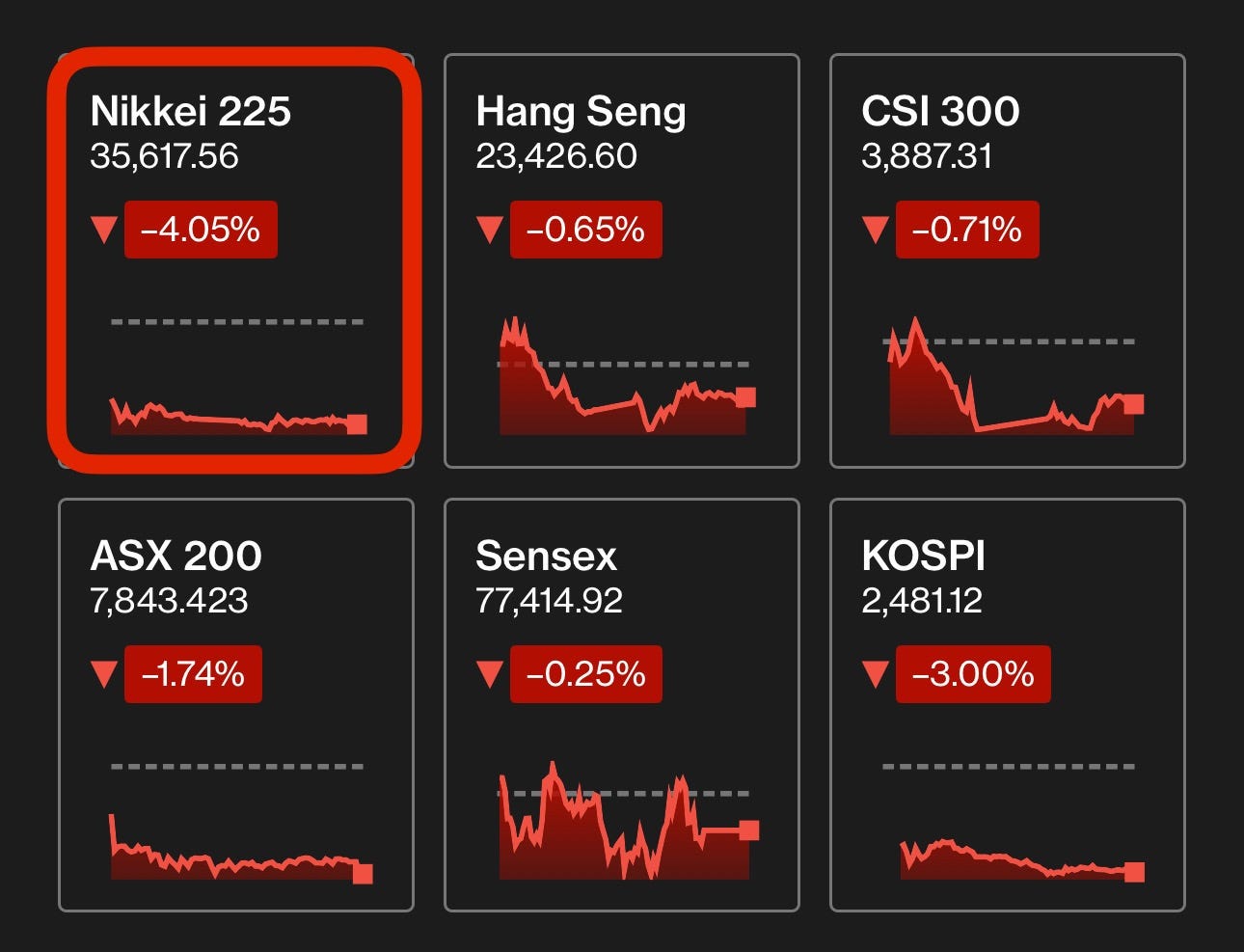

On Friday in my note “Stealth Yield Curve Control?” I wrote the following:

Do not forget about the two days prior to “liberation day” - Monday March 31st: Japan fiscal year 2024 end, and Tuesday April 1st: Japan fiscal year 2025 start. Japan FY end/start is when the world’s largest foreign investor and foreign subsidiary parent repatriates earnings and/or then redeploys for a massive capital migration that can not only move markets, but has also marked pivotal moments in global macro market direction.

“Stealth Yield Curve Control?”

JGB yields are surging in an alarming way. Here is a critical (non-tariff-engulfed) macro market observation, and a quick trade idea to play it.

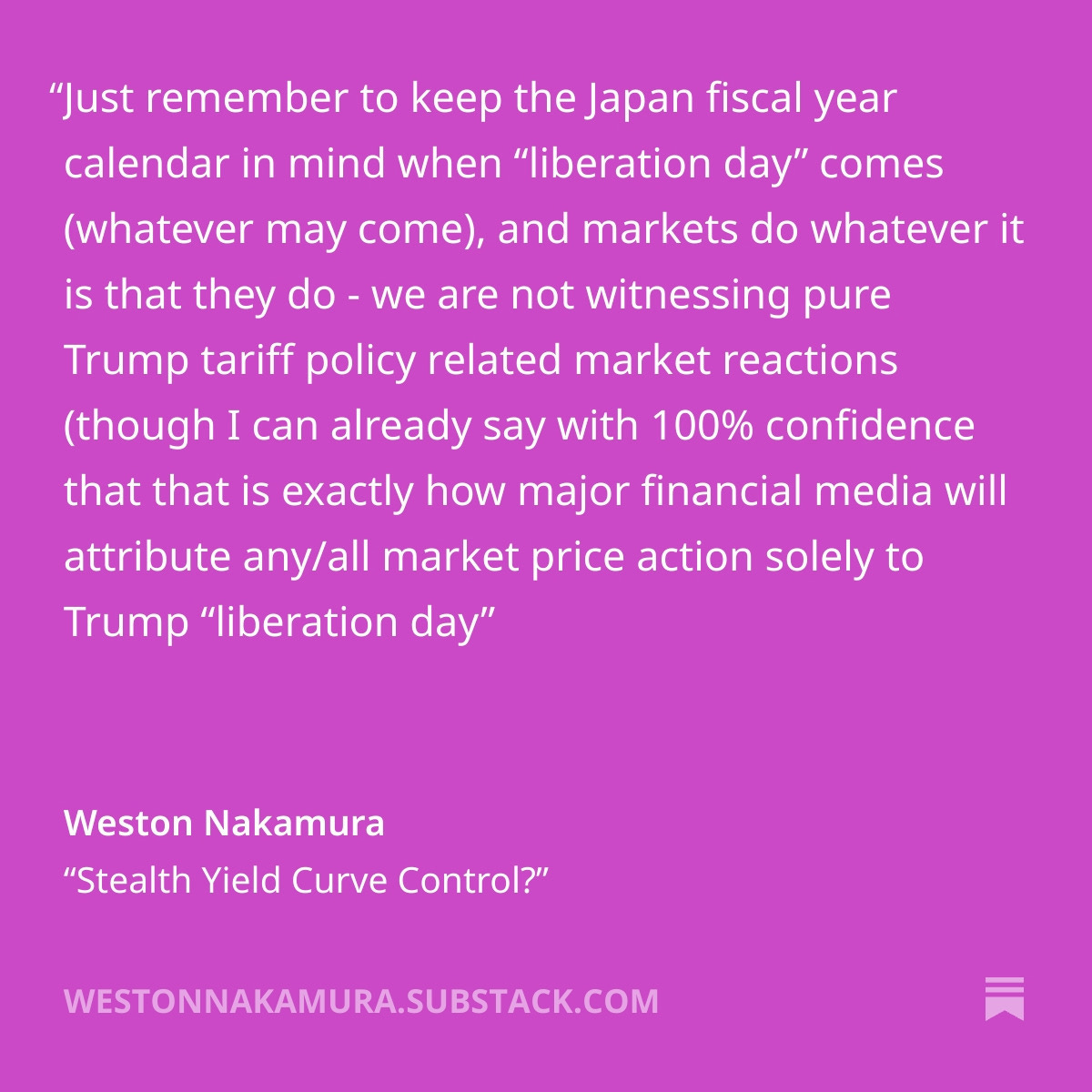

Headlines from today:

Let’s take a deeper look into Japan’s far-worse-than-peers equity market sell-off for the day.

Of the stocks on Japan Exchange’s Prime: 1,575 stocks (96%) were down, 52 stocks (3%) were up, and 10 stocks unchanged.

224 stocks of the NKY225 index were down (9843 Nitori Holdings, the “strong yen play” was +2.25%).

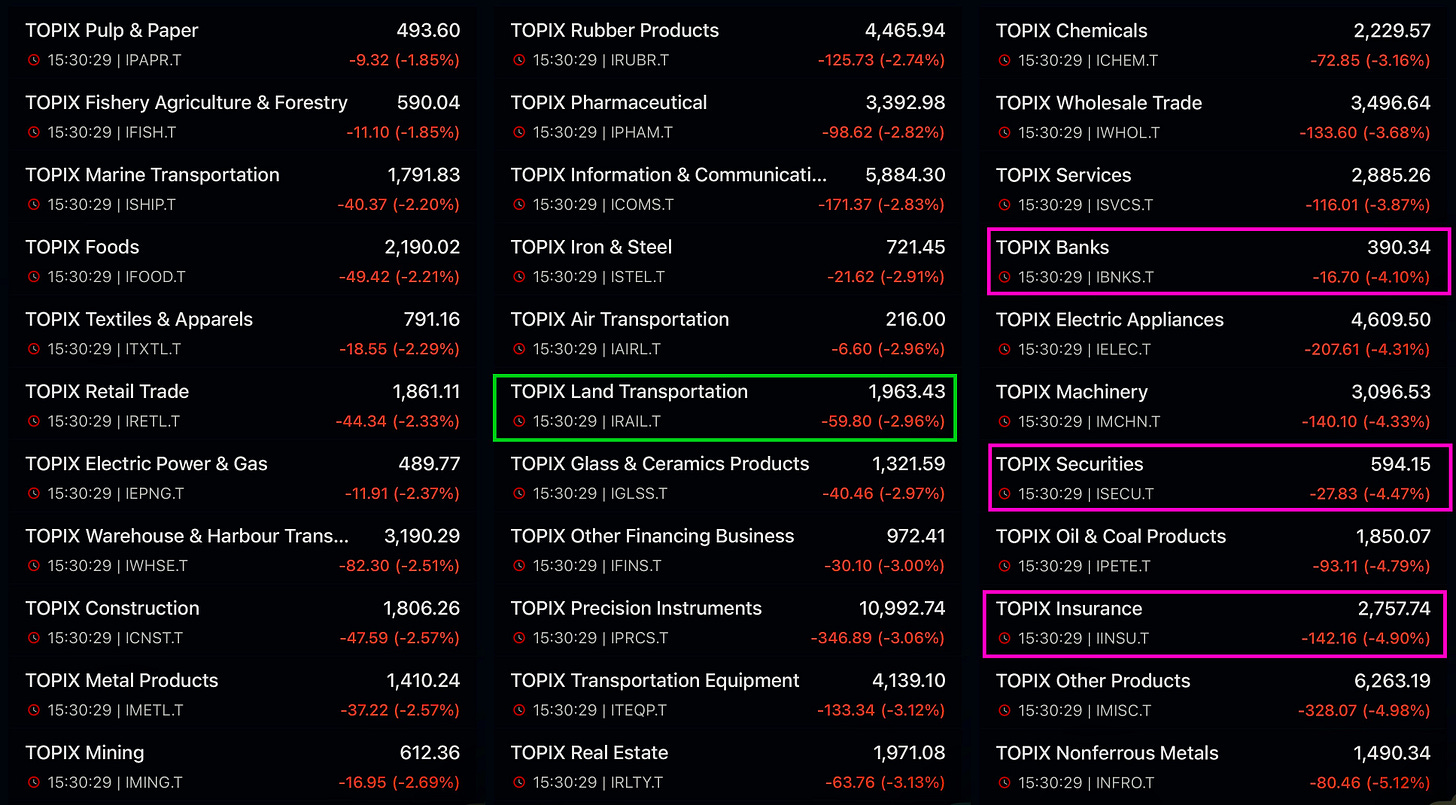

Every sector of the broad-based TOPIX index (which was -3.57% on the day) was down.

Note the following from the TOPIX sector performance breakdown. TOPIX Land Transportation & Automobiles (that which faces US tariff risks from multiple angles simultaneously, i.e. a US tariff on Japan autos hits Japan autos, as do US tariffs on Mexico, Canada and elsewhere hit Japan auto production) TPX Autos were -2.96% on the day, outperforming the broader TOPIX index. Meanwhile, among the worst performing sectors were Banks -4.1%, Securities -4.47% and Insurance -4.9%, deep under-performers - and these are the sectors that are most sensitive to JGB yield movements.

And what of those JGB yields? They plunged again for the final JGB cash trading session of FY 2024, with the 10Y JGB yield now back below 1.50% - a sharp reversal from its recent upward surge looking to crack 1.60% for new 2008 highs.

I will get back to JGBs in a moment - lets now look at equity trading volumes.

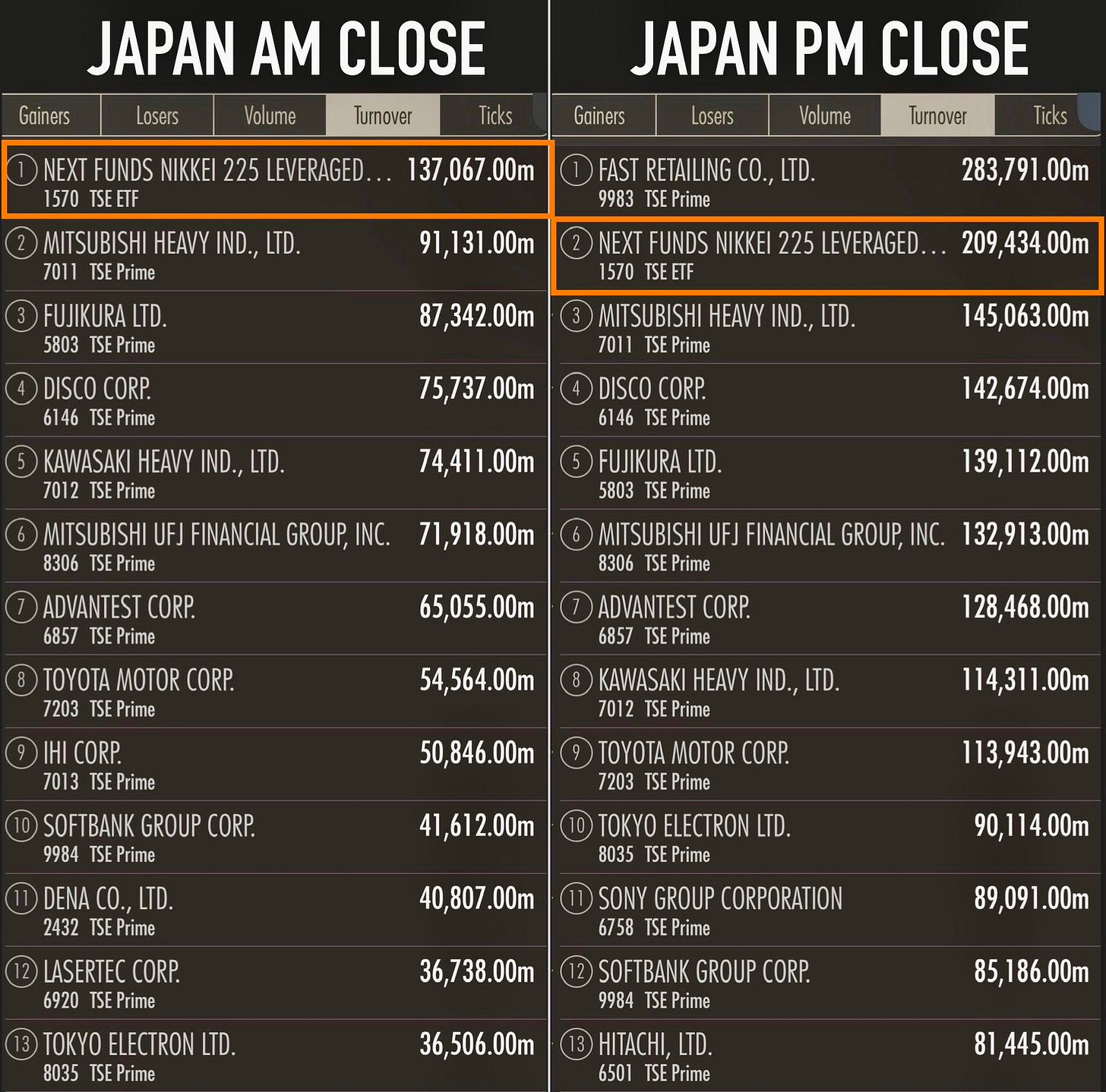

In terms of trading volume and activity, people are characterizing the Japan equity trading day as “futures driven” - given the broad based indiscriminate nature of the sell-off, and that overall cash equity trading volumes, despite being elevated, were actually lower today than last Friday’s. Meanwhile index futures volumes were robust - therefore, “futures driven.” I would say - not so fast. NKY and TOPIX futures trading volumes were heavy in the AM, lighter in the PM, and jumped at cash close. Take a look at the most heavily traded names in Japan cash equity markets for the AM and PM sessions respectively.

Notice 1570 NKY225 Leveraged ETF taking the clear lead in trading value for the AM session, and maintaining its high volume activity at day’s close. Those very popular levered in index ETFs, as well as the various inverse index ETFs, are comprised of index futures - that’s why this appears to be “futures driven” by volume and activity - but much of those futures are actually driven by ETF activity in the cash market. And again, cash equity turnover may be slightly below Friday’s volumes, but value traded for every day of last week are still well above trailing 3-month average daily volumes, and peaking on Friday and Monday.

All put together - does this look/sound like a “liberation day / Trump tariffs” equity market, or perhaps does it look more like something else? Such as - say, Japan fiscal year end?

“Liberation day” did not occur yet - it is an arbitrary 2 days away, and it has been extremely well-flagged since Trump took office in January. So, current markets either acted upon actual market-impacting seasonality currently underway in Japan, or they have somehow in unison decided to suddenly react in advance to US tariff policy 2 days prior to the unveil.

Asia (Japan) markets, which are spilling over into global DM markets, are not going risk-off because of a “liberation day” that has yet to occur. They are not even “going risk-off” as far as the last 2 trading days are concerned - they are sharply unwinding, repositioning, earnings widow-dressing, and engaging in various other non-fundamental activities.

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.