Japan’s Paranoia Of Imminent Dollar-Yentervention

Domestic media is fueling a widespread, manufactured obsession among Japanese market players of “imminent JPY strength” at the hands of US, and what Sec. Bessent really means by "USD strength."

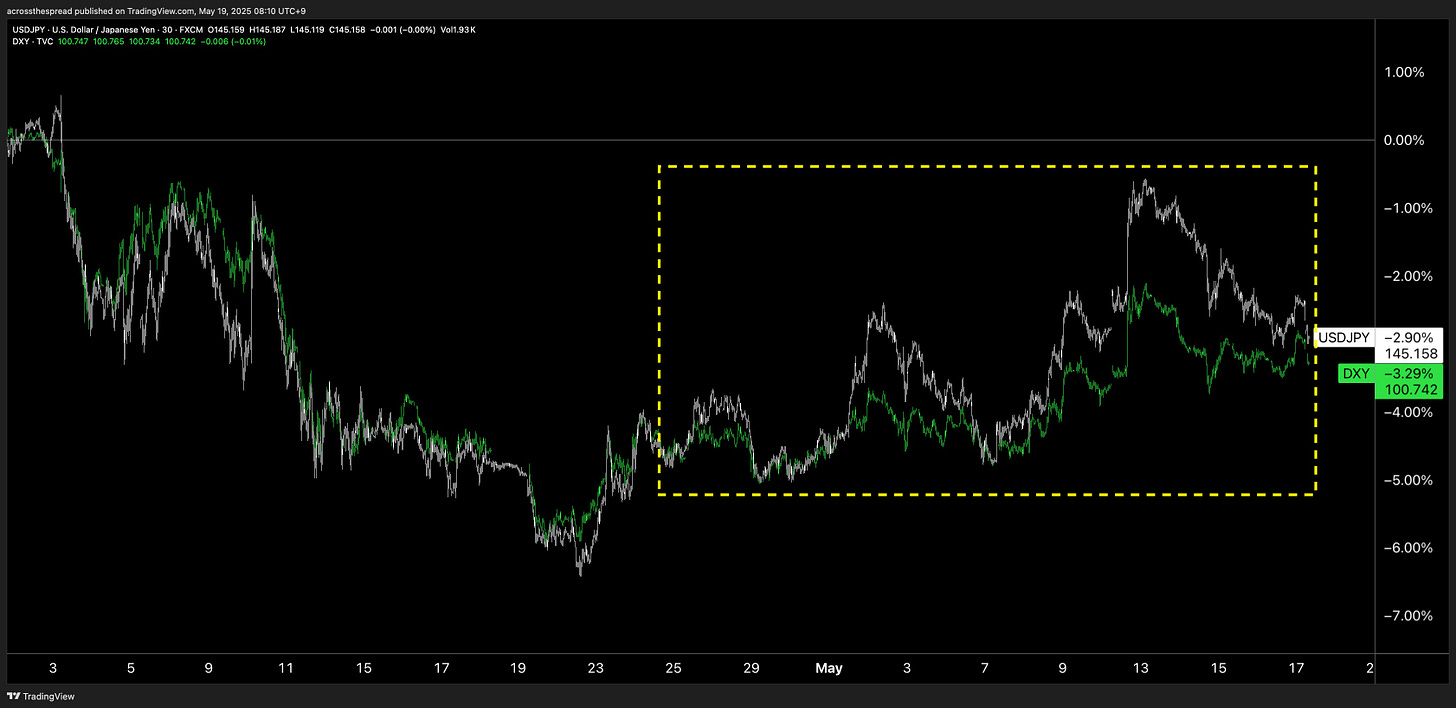

In the era of Liberation (since trade date April 2nd), USDJPY’s trading range has been 140 support to 148.50 resistance as discussed in previous writings, and remains so.

But there is currently quite an extraordinary phenomenon underway - in which there is a rare and fascinating, if not outright tradable JPY-narrative-arb that exists between Japan market players vs the rest of the world - and neither side is aware of these two split realities.

Basically, on-the-ground Japanese consensus is one of a paranoia, if not an obsession, over this genuine belief that the US administration is about to step into markets and reset JPY stronger vs USD - by way of direct dollar-yentervention, or even as far as via Bessent pushing Bank of Japan to hike rates, in order to strengthen JPY. This is a narrative that Japanese media has essentially conjured up, and then subsequently has gone full-blown maximum rogue in detaching their reporting of facts from reality. And why has this been allowed to happen? Because Japanese market players, institutional and individual, are becoming completely immersed in it.

Yes, this is real, and yes, this is increasingly becoming consensus belief here in Japan. And it' is increasingly showing up in actual market impact.

This article will walk you through what those outside Japan wouldn’t know about in terms of consensus beliefs, and what those within Japan wouldn’t know is a fringe, far cry from what the rest of the world’s perceived reality and expectations are around the US administration and currency policy. And I will wrap up with what Secretary Bessent actually means when he refers to a “strong dollar policy” - and it has nothing to do with the price level or direction of USD.

Let’s start out with the relentless decline in USDJPY in 2025, which, as I’ve discussed in previous articles, has been almost entirely a function of broad based USD downside, and not JPY strength. That said - there are moments of JPY strength, and increasingly so post-Liberation day, and those JPY strength moments are highly significant and not to be glossed over.

The first episode of this occurred at the end of January.

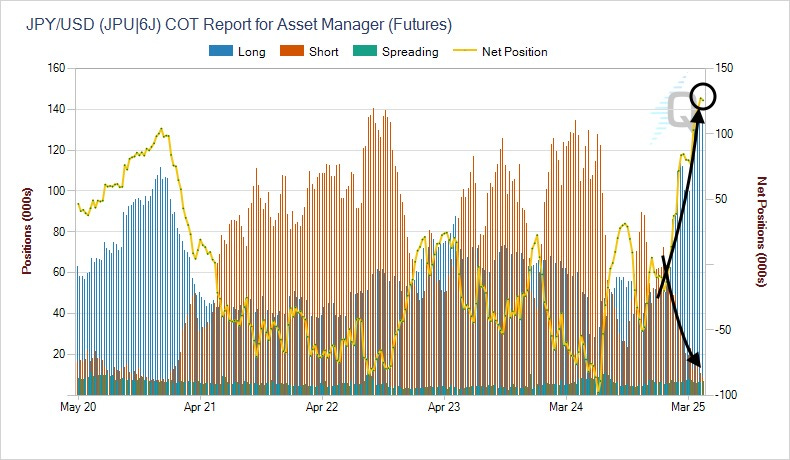

In a previous article, I attributed this non-passive, purposeful JPY buying strength to BOJ’s January rate hike and its attempt to dispel the “50 bps ceiling” perception - with Asset Managers opening new JPY futures longs to the most on record:

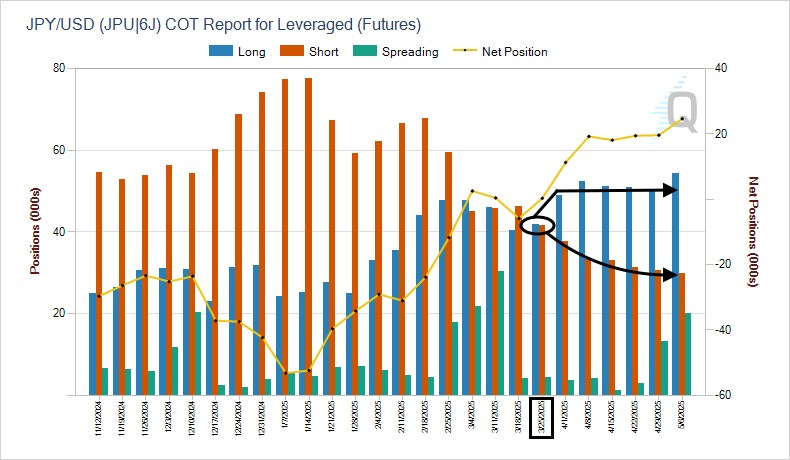

Regarding positioning in JPY futures - the Levered traders category (which blew up the then-short JPY crowded trade in July - August 2024) isn’t really the overhanging crowded long positioning at the moment.

Yes, levered traders are net long JPY - but that’s because they’ve merely been exiting their short positions, while their long positions remain flat:

But on the asset managers side- we see long positioning, both NET long (longs - shorts) AND outright long positions at multi year highs.

Asset managers were net flat earlier this year - but began to get rapidly net long via both closing out shorts AND opening longs, which began with Jan BOJ rate hike to 50bps.

So there is that reason for JPY strength on top of prevailing broad USD downside - hawkish BOJ bets.

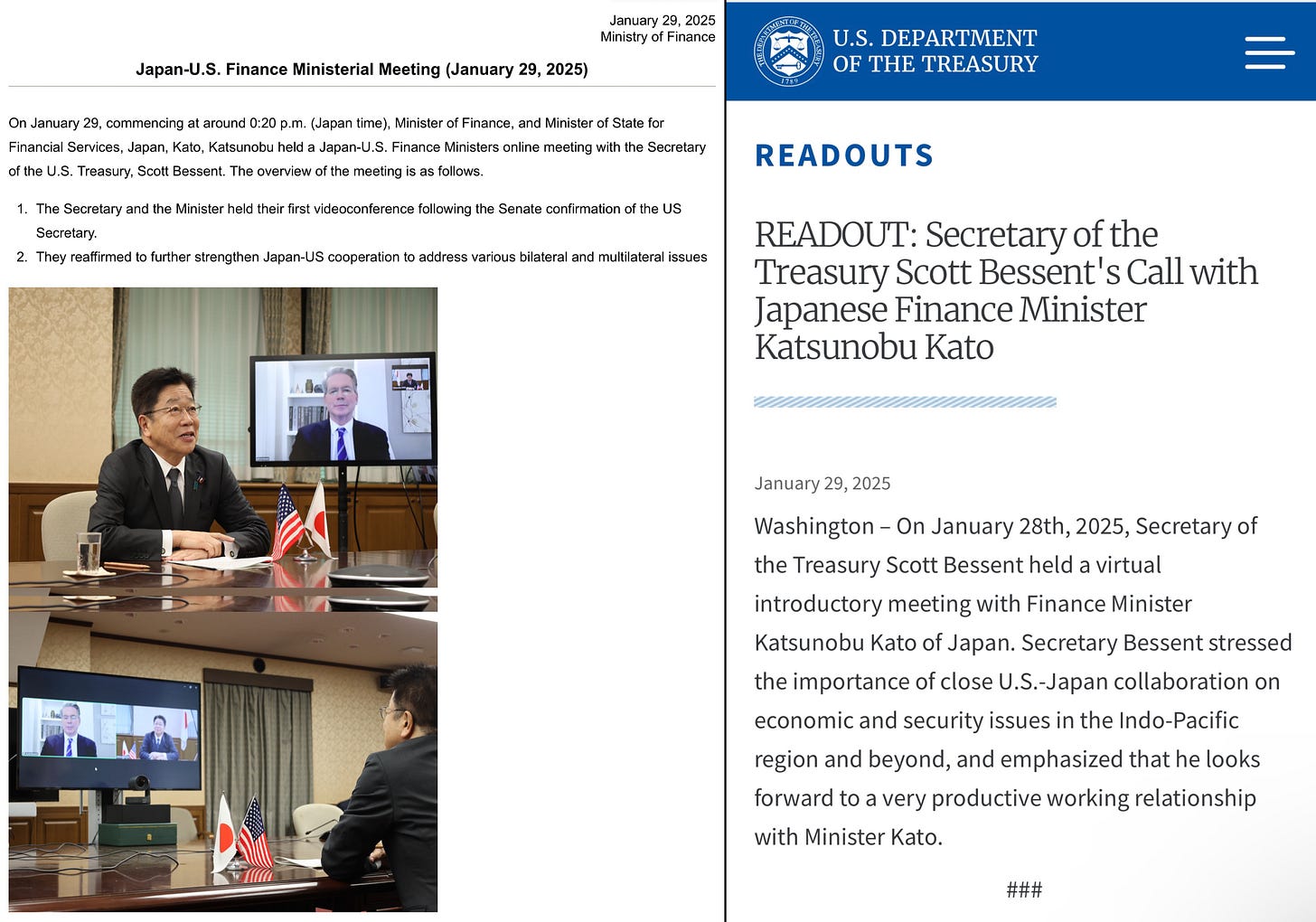

But, there was also something else that contributed to JPY strength at the end of January, which continues to this day - the very first introductory video call between newly Senate-confirmed US Treasury Secretary Bessent and also new (3 months on the job) Japan Finance Minister Kato that had taken place on January 29th. This brief formality and exchange of standards should be (and was) a non-event - nothing was discussed in terms of any sort of policy, as you can see via releases from both Japan MOF and UST Department:

So then why did JPY take an additional leg of strengthening (other than BOJ-related long JPY bets)?

Because, those aforementioned plain-vanilla readouts on Bessent and Kato’s meeting from MOF and UST somehow led to sensationalized, if not completely manufactured press headlines like this:

And that had not only kicked off extra JPY strengthening vs USD…

…but it had also kicked off what has become a full-blown Japan media and Japanese market participant narrative of a coming “US-Japan to fix USDJPY exchange rate lower as part of trade relationship restructuring” - one that has grown ever louder within Japan market chatter.

You wouldn’t know this if you were outside of Japan - but this narrative has taken a life of its own to incredible lengths of speculation far beyond how this initial January meeting between US and Japan’s financial authorities was sensationalized. Not only has the story strayed far from reality, particularly after Liberation Day, but it has captured the domestic consensus mindset - such that it has become visible in market price action.

To be fair - Trump himself did (once again) complain about trading partners who keep their currencies unfairly weak vs the dollar in March, citing specifically Japan and China, and Bessent also mentions “currency manipulation” when listing off things that other countries do to take advantage of the US in trade.

But as of late - particularly following Liberation Day, Trump hasn’t been talking about currencies at all. And more importantly - Bessent and his counterparts in Japan and even in China have all explicitly stated in unison that “currency was not discussed” in every single meeting follow-up statement, press conference, interview, and media interaction. Every single one of them.

And yet - this narrative that an official dollar-yentervention is right around the corner remains as strong as ever.

Why?

Because the Japanese media machine has been saying so, and Japanese market players are eating it up, in a feedback loop.

The US-Japan Trade Negotiation Timeline

Following April 2nd Liberation Day, Japan was named by both Trump himself, as well as Bessent who was assigned to lead the US-Japan negotiations, as first priority nation to make a deal.

Japan PM Ishiba names Economic Revitalization Minister Akazawa as Japan’s lead negotiator on behalf of Japan - despite Akazawa being an unheard-of nobody within Ishiba’s highly disapproved cabinet, with self-proclaimed zero experience conducting such measures, and with zero pre-existing relationships with any of US officials he would interface with.

Nonetheless, Akazawa and the Japanese delegation fly to Washington to hold the first round of negotiations on April 17th - not just the first US-Japan discussions, but the first among the 90+ nations eagerly awaiting their respective turns to also do so. Akazawa was scheduled to meet in person with Secretary Bessent, Commerce Secretary Lutnick, and US Trade Representative Jamieson Greer.

BUT - before the official meeting, United States President Donald Trump himself decided to also hold an unscheduled impromptu meeting with Akazawa in the Oval for some 75 minutes.

That’s a hell of an agenda change to walk into for rookie Akazawa - Trump, Bessent, Lutnick and Greer as a sudden “warm up.” Notice Chief of Staff Susie Wiles on the left side who, I’m assuming, is moving around Trump’s very busy schedule to accommodate for this.

And after this…

…came this…

…notice Akazawa’s new memorabilia on the table.

This second-first meeting was also over an hour long. And when Akazawa finally emerged after hours of direct discussions with the highest levels of the administration to an eagerly awaiting Japan traveling press corps - he gave nothing of substance or detail, other than one thing that he said definitively:

“We did not discuss currency matters.”

He actually repeated this twice.

Which means one of two things:

They absolutely discussed currency matters (at the very least, they discussed coordinating “we did not discuss currency matters” press messaging).

They really didn’t discuss currency matters throughout that entire time.

The latter was seen as the likely reality, given that in less than a week, Japan Finance Minister Kato, who’s remit is matters of currency more so than a tariff negotiator, would also be in Washington himself to attend the G20 World Bank IMF meetings - for which Kato and Bessent were to be scheduled to meet on the sidelines.

Either way, USDJPY jumped higher when Akazawa spoke to the Japanese press and stated that currency was not discussed - but then USDJPY subsequently fell in the days following, leading up to the Bessent - Kato meeting, because the media and talking heads narrative back in Tokyo began their runaway tales of “resetting USDJPY lower” were taking hold.

And it wasn’t just about this “dollar yentervention coming” narrative that was being circulated - it went as far as:

“Bessent is going to get Bank of Japan to hike rates in order to strengthen JPY.”

I kid you not.

Note that this “US Treasury Secretary controls BOJ” narrative had begun even before the first Akawaza meeting.

April 10, 2025 BLOOMBERG: Bessent Brushes Off Stronger Yen Ahead of Trade Talks With Japan

US Treasury Secretary Scott Bessent suggested he’s not concerned about the yen’s recent appreciation against the dollar, a sign that past interventions to strengthen the yen by Japan’s authorities won’t impede forthcoming trade talks between the two nations.

“In Japan, the yen has been strong, but that is the result of very strong Japanese economic growth, rising inflation expectations,” Bessent told Fox Business on Wednesday. As a result of the stronger domestic data “the Bank of Japan is raising rates, so all that’s natural,” he added.

The remarks came as the yen traded around a six-month high, before a sudden reversal as news broke on President Donald Trump’s tariff climbdown. Bessent’s comments also indicate little frustration at the BOJ, which has raised rates three times since March of last year.

“It almost feels like a foreshadowing of meddling in Japan’s monetary policy,” said Ayako Sera, a market strategist at Sumitomo Mitsui Trust Bank Ltd. in Tokyo. “It sounds like he’s indirectly telling the BOJ to raise interest rates and reverse weakness in the yen.”

Seriously? What the fuck kind of enormous leap to a such a ridiculously paranoid conclusion is that to give publicly, you SMBC Trust “market strategist” clown?

Well, the reason any sane institutional talking head would be comfortable throwing that out there in print is if such a narrative weren’t so fringe - and it wasn’t, as I keep saying.

That’s how far and wide this narrative has come, and how widely accepted it is, still to this day.

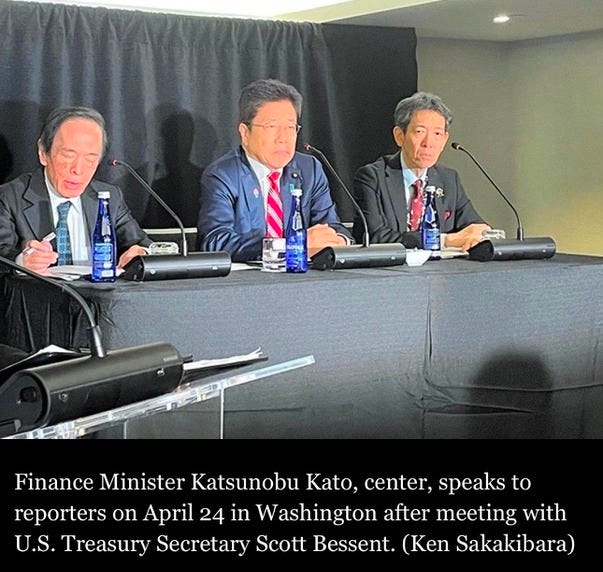

April 24th - as Bessent hosts G20 Finance Ministers and Central Bankers in D.C. - Japan Finance Minister Kato meets Secretary Bessent in person for this nail-biting face to face meeting.

And what came out of it?

“Currency was not discussed.”

Here’s a shot of the press conference following the Kato-Bessent hour-long talk about not-currencies.

That’s Finance Minister Kato in the middle. Recognize the dude to his right (our left)? Yep, that’s BOJ Governor Ueda also in attendance. And the lanky man on Kato’s left side? That’s Atsushi Mimura, Ministry of Finance Vice Minister of International Affairs - or as I call the role, Vice Minister of FX meddling. He’s the (new) guy who would be executing yenterventions if need be. So if you look at that roster, you can see how suspicions of a US administration puppet-mastering JPY, either by direct currency intervention, or by central bank policy rate hiking, can be exasperated back in the homeland. Ridiculous as it still is.

Here’s a screen shot I took of a simple Google search for “Kato Bessent meeting” following the Kato-Bessent meeting - take a look at how much intense focus there was/is around expectations of US forcing Japan to strengthen JPY at this/these meetings:

Pretty crazy right? Well, it gets better. As in, worse.

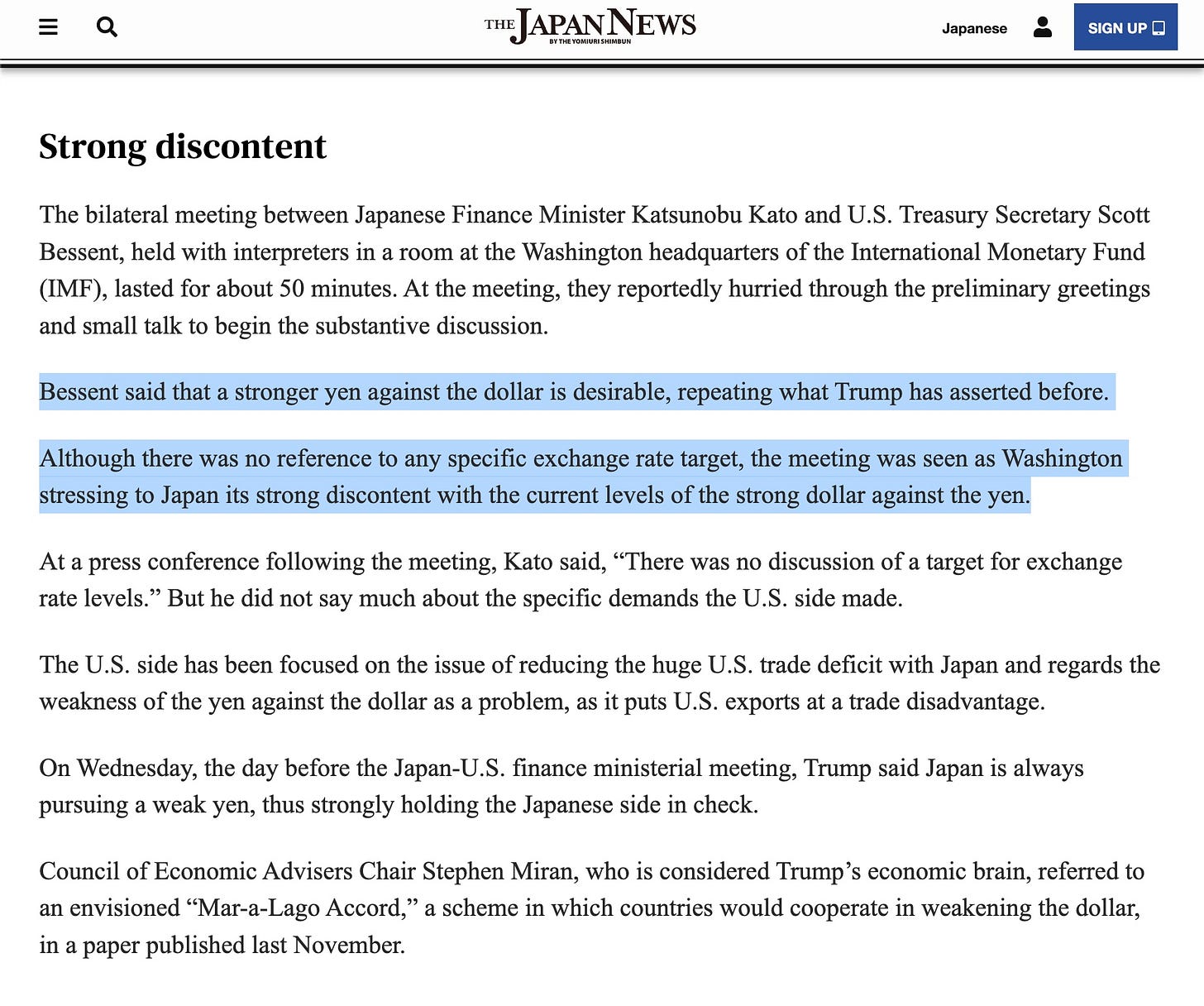

The Friday ending the week of the Bessent-Kato “no currency discussion” discussion, Yomiuri Shimbun (a general news media conglomerate akin to a CNN or NYTimes of Japan, and not a financial media outlet like Nikkei) publishes this article - in which they “quote” Bessent and his “desire for a stronger JPY.”

YOMIURI (JAPAN NEWS): U.S. Holds Fire Over Yen Exchange Rate Targets; Bessent Said to Understand Negative Impact on Markets

https://japannews.yomiuri.co.jp/business/economy/20250426-251242/

This was/is completely false horseshit. As in, this didn’t happen - Bessent didn’t say this. I would say “…at least not publicly…” - but, no, Bessent didn’t say this.

Here’s the response from Japan officials - Kato, and Vice Minister of FX Meddling Mimura in light of Yomiuri’s made-up nonsense:

JIJI PRESS: (Update) Japan Denies Bessent's Reported Remark about Yen

Tokyo, April 28 (Jiji Press)--Japanese Vice Finance Minister for International Affairs Atsushi Mimura on Monday denied a newspaper report that U.S. Treasury Secretary Scott Bessent called for a stronger yen against the dollar.

The report is totally groundless, the top currency diplomat said, criticizing it as "fake news."

The Yomiuri Shimbun daily said in its Saturday morning edition that Bessent seems to have shown a strong concern on exchange rate levels and said that a weaker dollar and a stronger yen are desirable.

"This is completely different from the fact, and I am very surprised," Finance Minister Katsunobu Kato said on X, formerly known as Twitter.

Kato and Bessent had a meeting in Washington on Thursday. At a press conference after that, Kato said there were no requests from the U.S. government about an exchange rate target or a currency management framework.

Why am I saying Yomiuri is full of shit, and Bessent/Kato/Mimura are not? Because, especially as it relates to Mimura - this guy’s “job” is to yentervene and smack USDJPY down 5 handles by blasting tens of billions of USD at market in order to attempt to keep USDJPY upside from running away higher. So, if he, and his superior Finance Minister, are outright calling this “fake news” and “completely different from fact at a surprising level” rather than just letting it float out there and have Yomiuri hit USDJPY down a few pegs for free, then it must be bullshit on Yomiuri’s part.

Now, it could be that behind the scenes, there actually is a very vigorous debate going on between US and Japan fiscal and monetary authorities to strengthen the yen and weaken the dollar - and that they don’t need or want the press to interfere in careful orchestration of some Plaza Accord 2.0. I did give this serious thought. But my general conclusion is - Scott Bessent is keenly aware of this global narrative underway in which USD is getting dumped by foreigners around the world, in addition to USTs and US equities - and whether or not Bessent actually secretly believes there is a real “sell America” trend underway, he doesn’t need to introduce any further USD downside at this delicate moment in US assets. And so, he goes with the standard US Treasury Department line of “currencies not discussed” - as in the G7 protocol of “currencies should be determined by market forces.”

And if it isn’t actually true that Bessent discussed his desire for a stronger yen and weaker dollar to Japanese officials during these trade negotiations, then it means Yomiuri is full of shit - and indeed they are. And that’s the level of how wild this Japan media fueled narrative has gone.

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.