Live Discussion on JGB / Global Bond Markets With Gayed on X

X Spaces today at 🇯🇵11AM / 🇺🇸10PM (EST) - additional material

Live discussion with

soon.Last time was 🇯🇵 currency blowing up the world

This time it’s 🇯🇵 bond markets

Join us at 🇯🇵11AM / 🇺🇸10PM (EST)

👇

https://x.com/acrossthespread/status/1927161318756208787

Additional charts & reference material below:

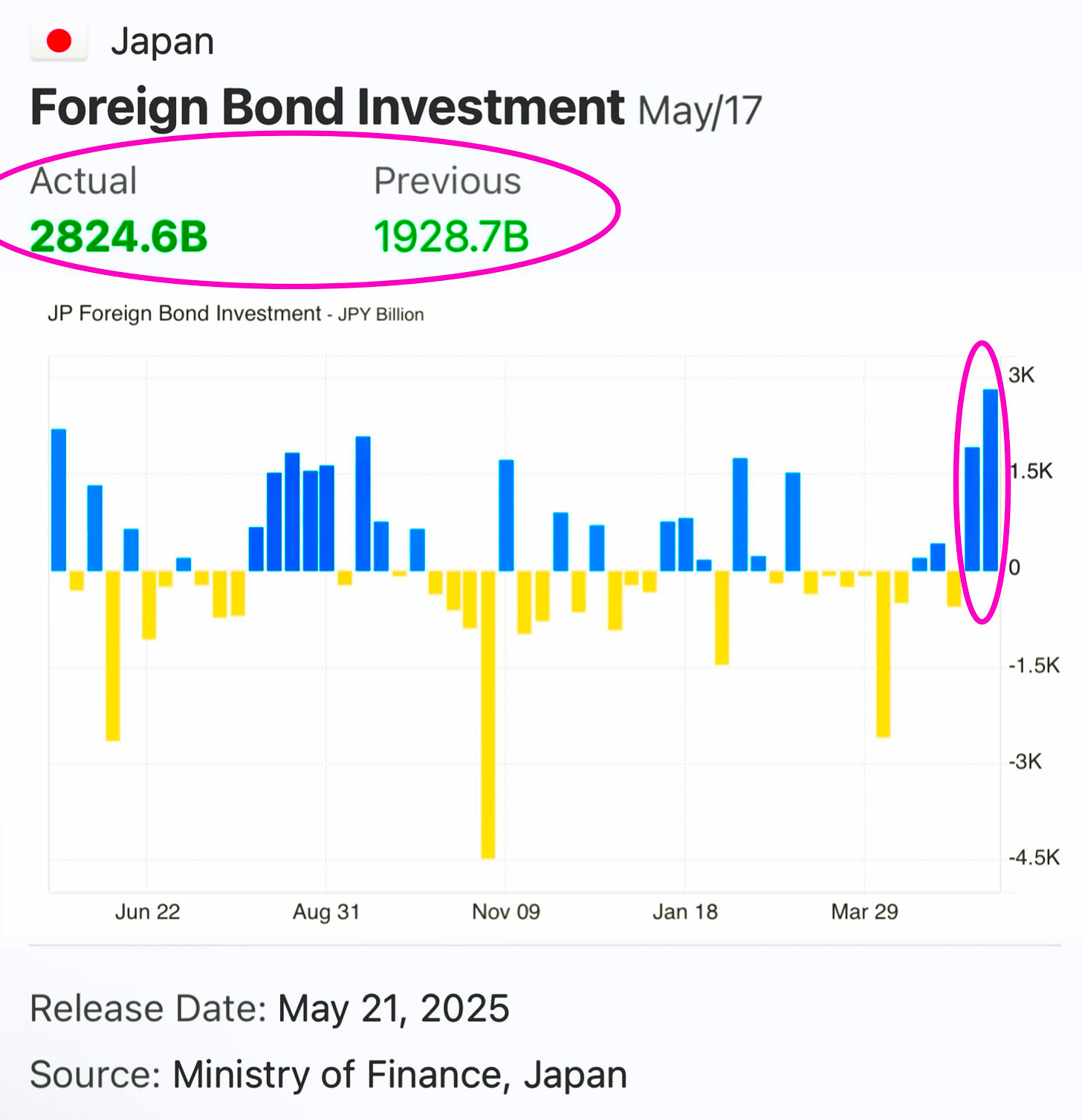

JGB Vigilantes

My quick comment from Monday regarding Moody’s downgrading US was really commentary on long dated JGB yields:

JGB 20Y Yield

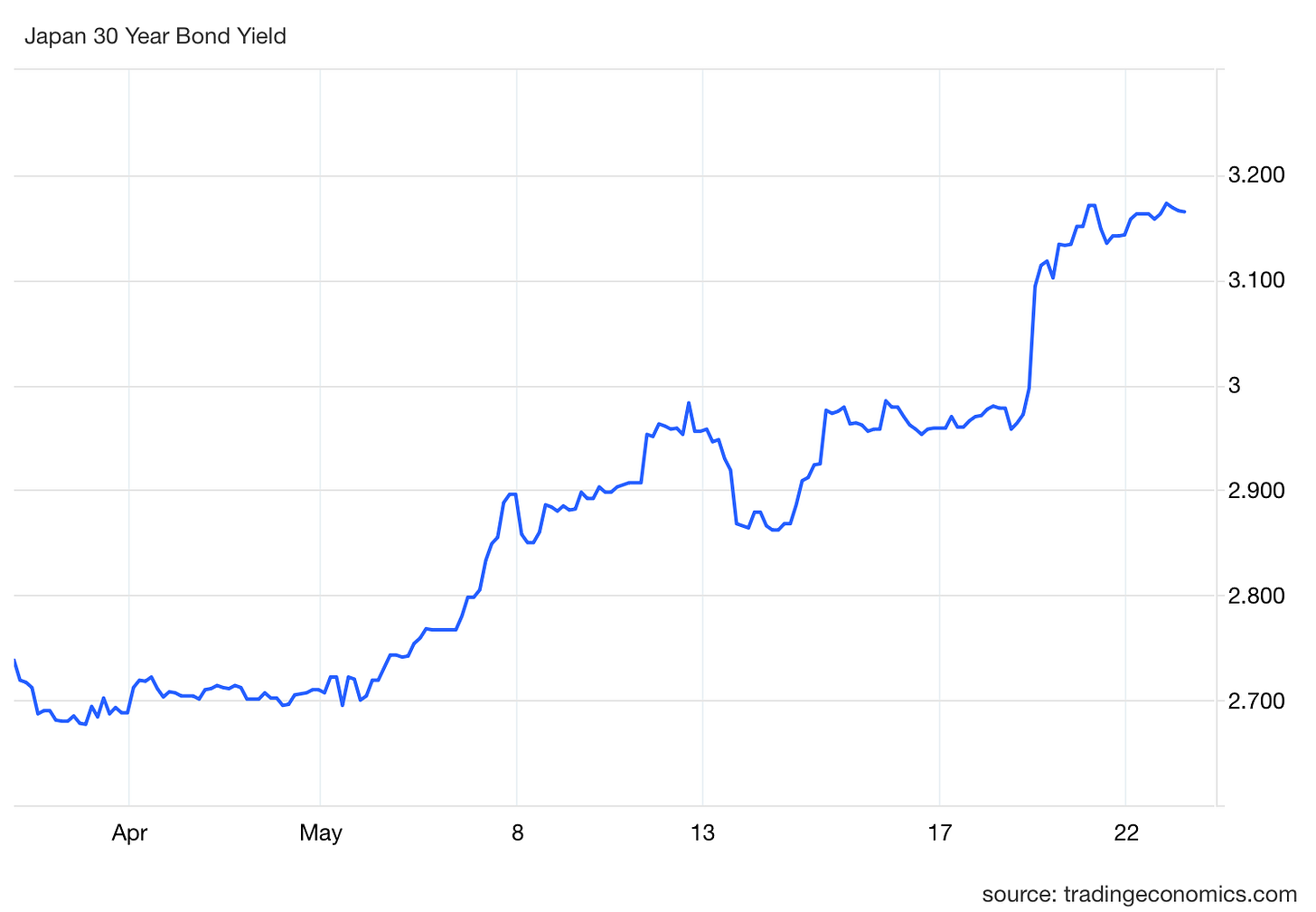

JGB 30Y Yield

JGB 40Y Yield

Benchmark JGB 10Y Yield

20Y JGB Auction reaction:

“One Big Japanese Budget”

NIKKEI: Japan backpedals on budget-balancing target despite fiscal worries

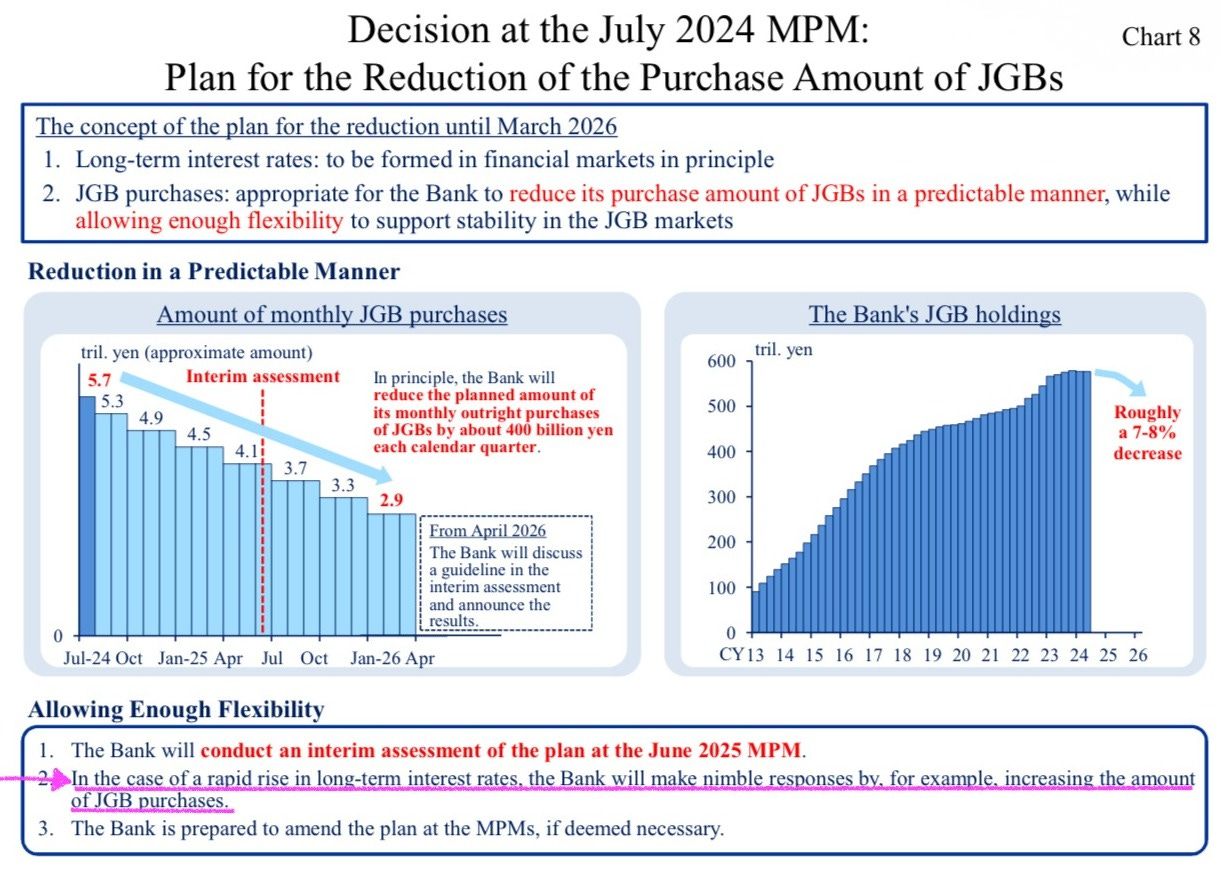

“One Big Beautiful Bank of Japan JGB Tapering”

May 22, 2025

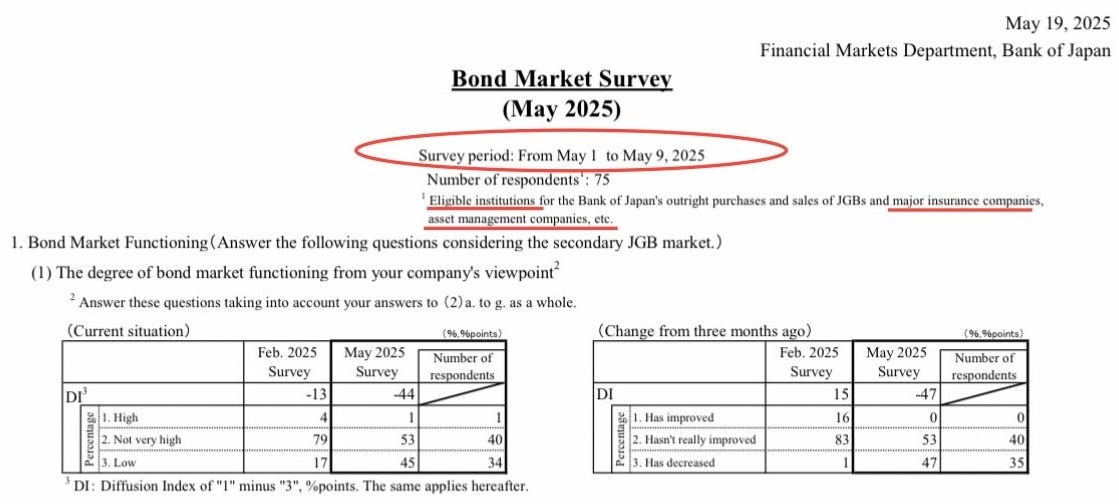

“Yields on 10-year JGBs surged to nearly 1.6 percent in March 2025, but I personally believe that this rise -- albeit rapid -- cannot be regarded as disruptive, as it seems to have mainly reflected expectations among market participants of a higher terminal policy rate, given Japan's higher-than-expected economic growth and upswings in prices.

At the June 2025 MPM, the Bank will conduct an interim assessment of the plan for the reduction of its purchase amount of JGBs decided in July 2024, and announce a new guideline for its purchases from April 2026. In my view, it is unnecessary at this point to make any major changes to the current plan; that said, the Bank will need to examine the reduction plan for April 2026 onward from a longer-term perspective. In any case, under the current policy regime, which is premised on ample reserve balances, the Bank is able to take sufficient time in reducing the size of the balance sheet. This is also desirable in terms of maintaining market stability.”

Bank of Japan Board Member Noguchi

Weston