March 2025 Bank of Japan: JGB Buy-Tapering Risk

With unanimous consensus for no change to rate policy, markets and commentators are completely overlooking the risk of a global market moving change to BOJ's JGB tapering, as Japan yields surge.

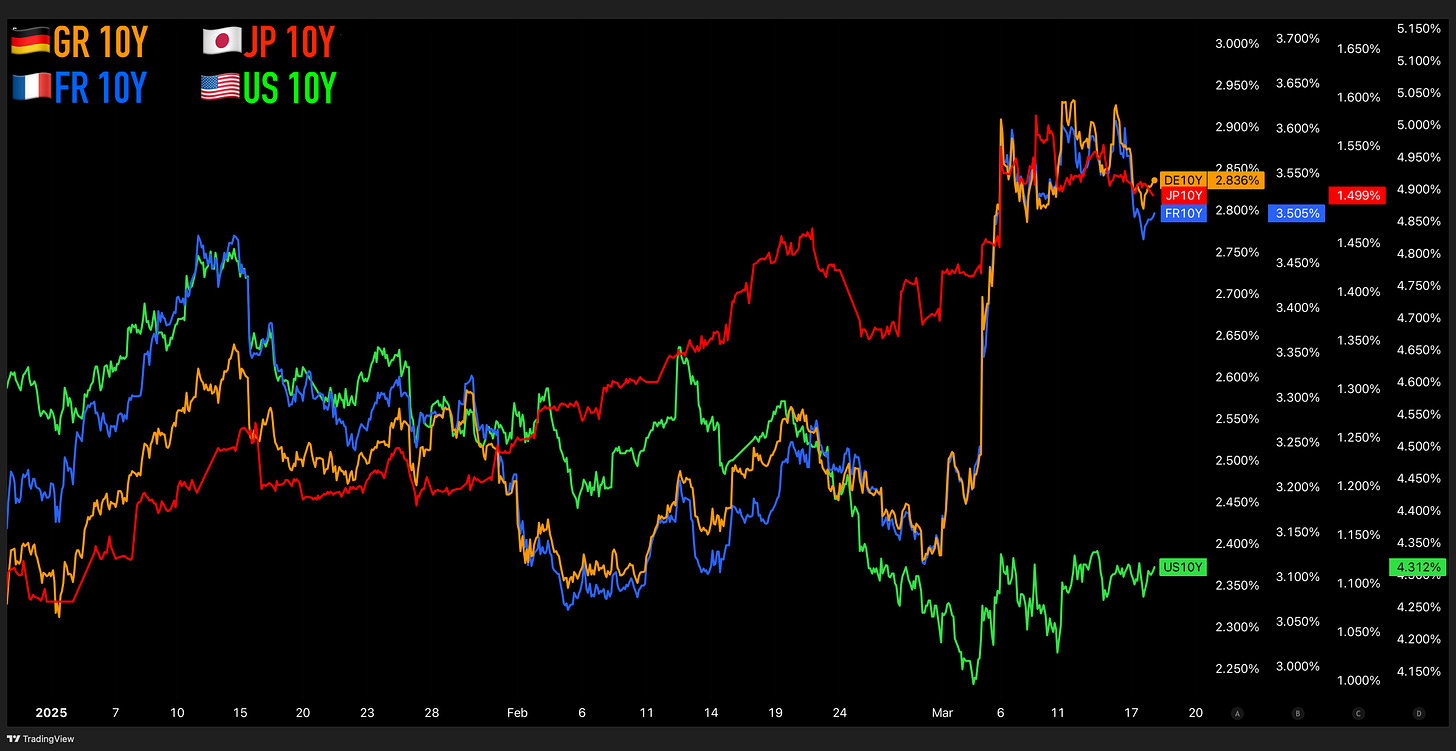

EU yields are in focus - as they should be. But so should JGBs - potentially for the immediate term heading into March 2025 Bank of Japan.

March 2025 Bank of Japan Meeting

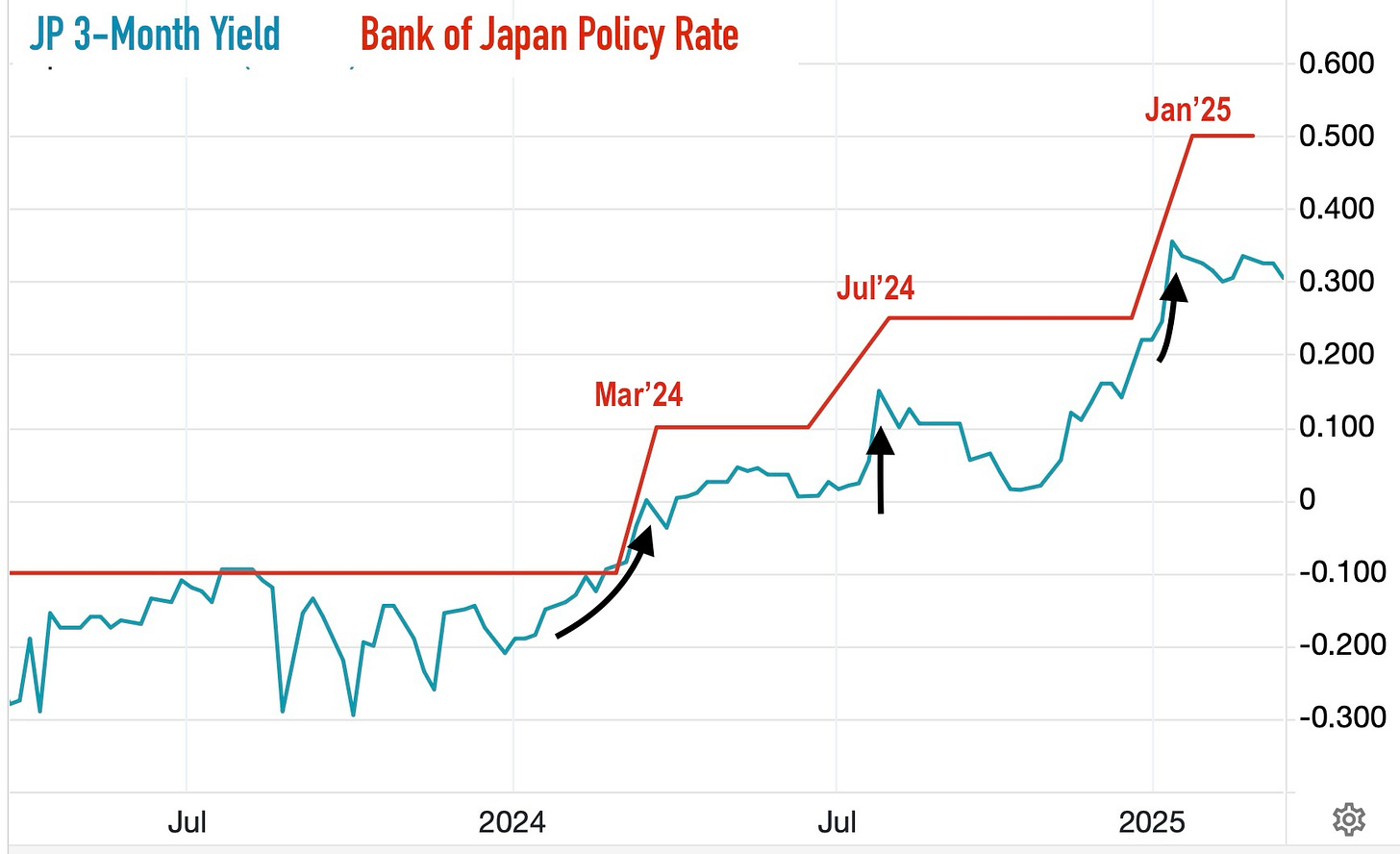

Surveyed economists have a unanimous view of no change to BOJ rate policy, which was lifted by +25bps to 0.50% at the last January meeting.

Markets are also by and large expecting no immediate change to the BOJ policy rate for the March meeting. Most look at the OIS (overnight index swap) rate to see what is priced in - and OIS rates have also been steady - no change for March expected.

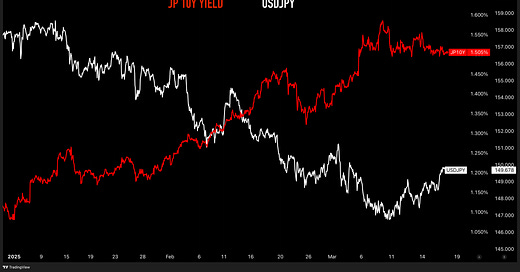

In addition to the OIS market - short term yields on Japan government bills (the very front-end of the JGB curve) naturally track the Bank of Japan policy rate (also known as the uncollateralized overnight call rate).

If we look at yields on relatively liquid 3-month bills, we will also see that there are no expectations for a change at the March’25 BOJ meeting. Note that in the three previous BOJ rate hikes - JP 3M yields had anticipated the well-telegraphed-in-advance initial March’24 hike out of negative with a gradual rise, were completely caught off guard for the next July’24 shock rate hike, and quickly priced in the latest Jan’25 rate hike in accordance to all of the prior media leaking.

Going into this coming March'25 meeting, front end yields are flat to down since the January rate hike.

And finally and most importantly, the Nikkei, BOJ’s official policy change preannouncement entity, has made the call for no change (at least as of this writing).

So, backed by Nikkei “confirmation,” the consensus among economists and short term rate markets are unanimously for no change in March, and have been of those expectations since the January meeting.

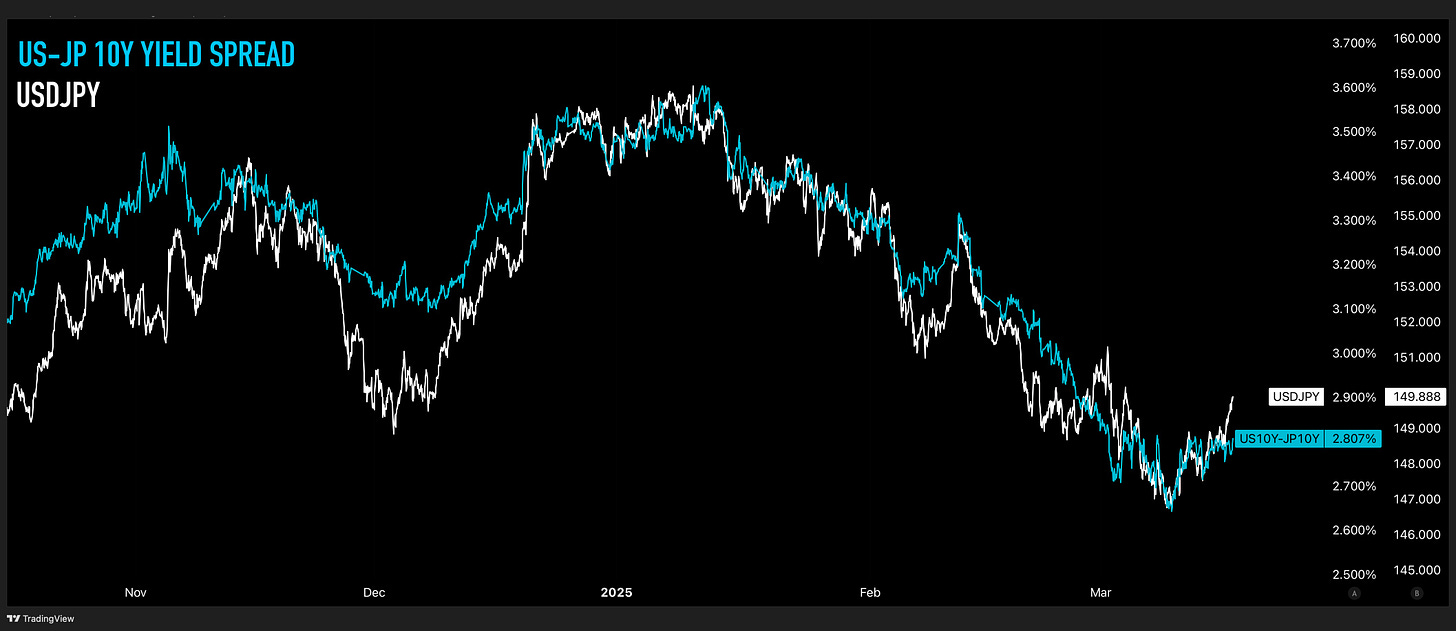

So then what’s up with the surge in longer term JGB yields to 2008 highs, and JPY strengthening nearly 6% vs USD since the last meeting?

Yes, markets are forward-looking, and these moves could therefore be simply explained by rate hike expectations for future BOJ meetings. Certainly the financial media regurgitation machine has been incessantly pointing to changing expectations of more (or sooner) Bank of Japan rate hikes to explain the surge in JPY and long term JGB yields.

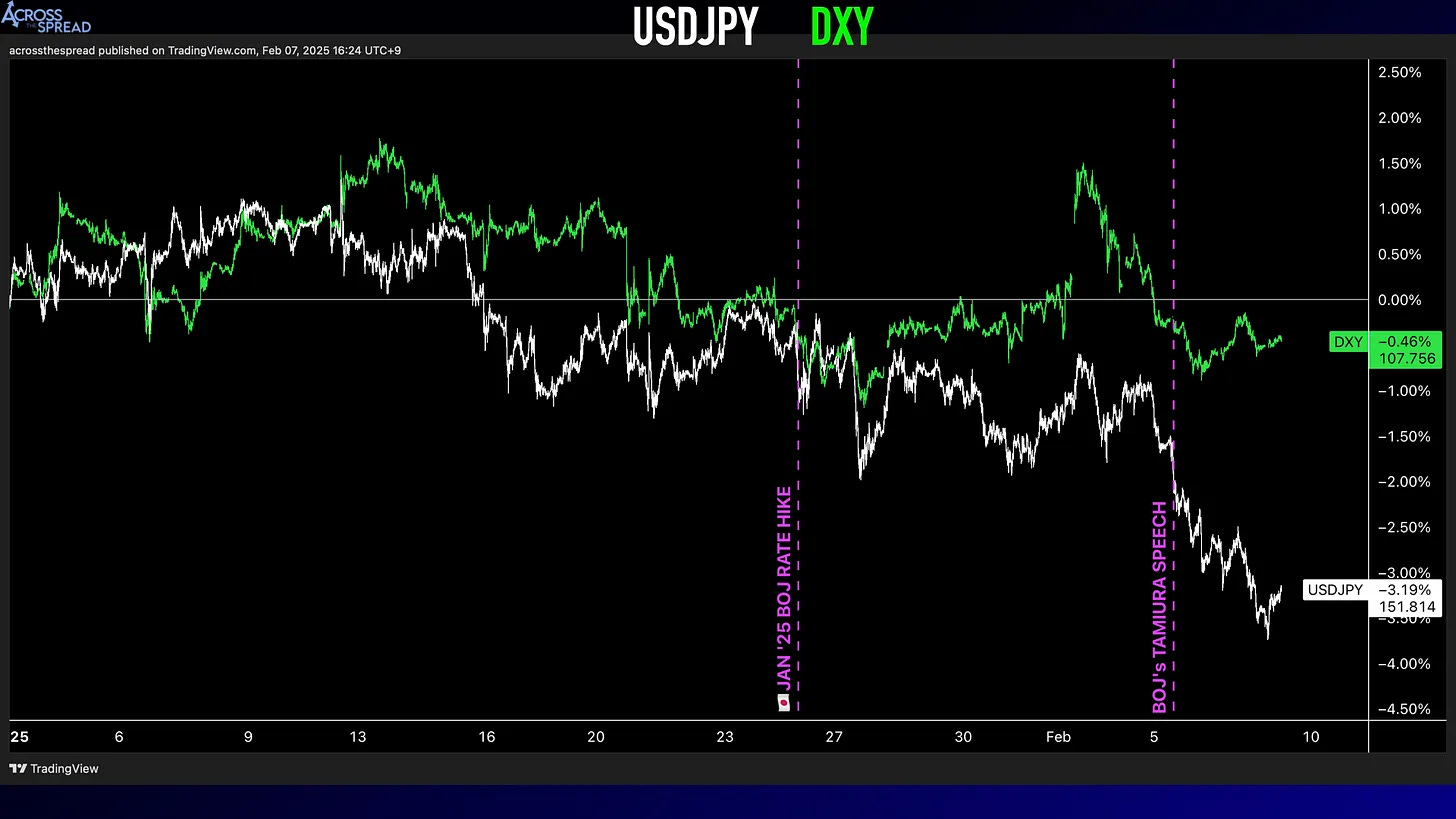

But again - short term rates markets and consensus opinions have by and large remained static relative to the magnitude of movements in JPY and JGBs over the same time period - and with the exception of hawkish board member Tamura’s early Feb commentary aimed at dispelling the “50bp BOJ ceiling” perception that I had discussed (chart below)…

…BOJ officials’ public rhetoric in aggregate has also been steady relative to how markets have been moving.

With all attention on FX and front end rate policy over the past year, the JGB market has been forgotten by many. Not just JGBs themselves, but the direct and significant impact that long term JGB yields can have on JPY, on USTs and global bond markets (and thereby indirectly on global equity markets), and even on Bank of Japan’s still very much ongoing and massively intrusive QE bond buying policy.

We need to take a look at the current state of the JGB markets and be highly vigilant as we head into Bank of Japan - not (just) for the March 2025 meeting, but for every day that markets are open for trading.

Before getting into JPY and JGBs and global rates, here is a quick snapshot of the Japan real economy heading into the March Bank of Japan meeting.

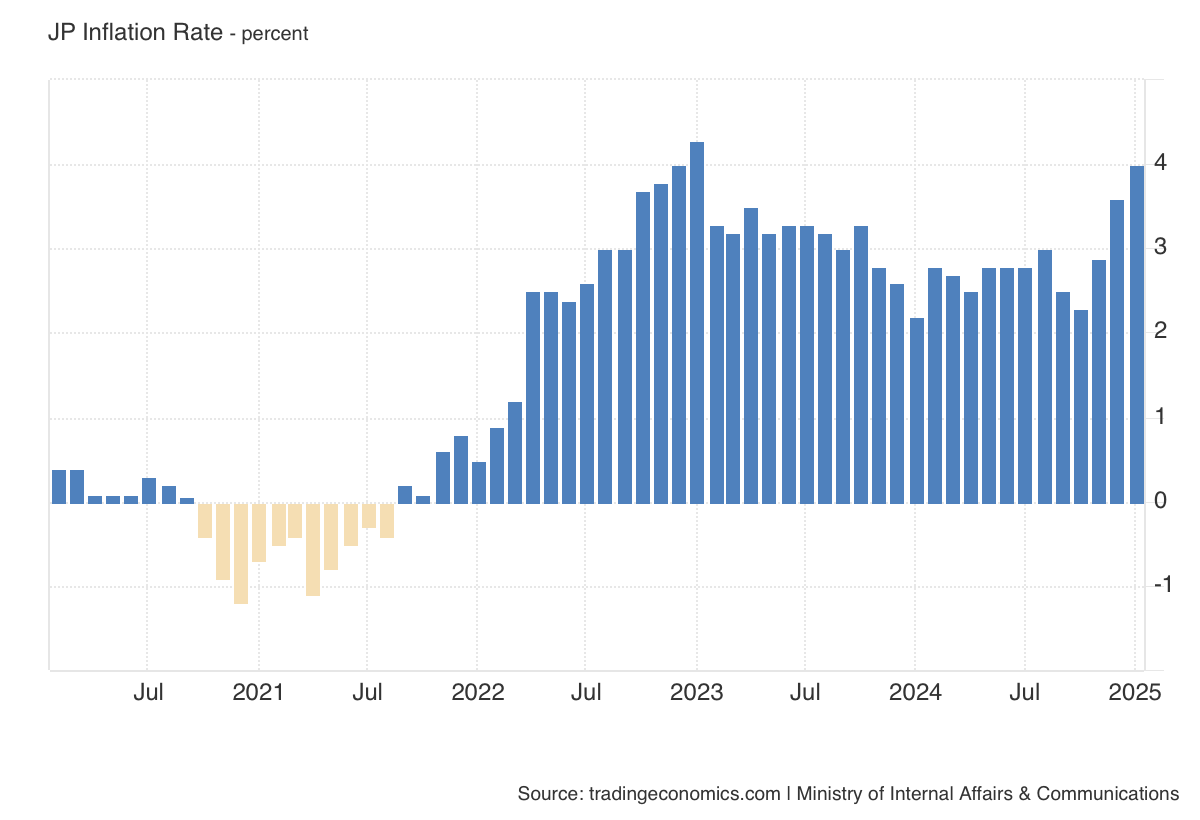

Japan CPI figures for February will be released after this BOJ meeting on 3/20. The latest headline inflation figures for January 2025 came in at a whopping 4%, levels not seen since January 2023, and continuing to diverge away from the US 2.8% headline CPI.

The sharp rate of change is largely being driven by month-on-month food prices skyrocketing +7.8%…

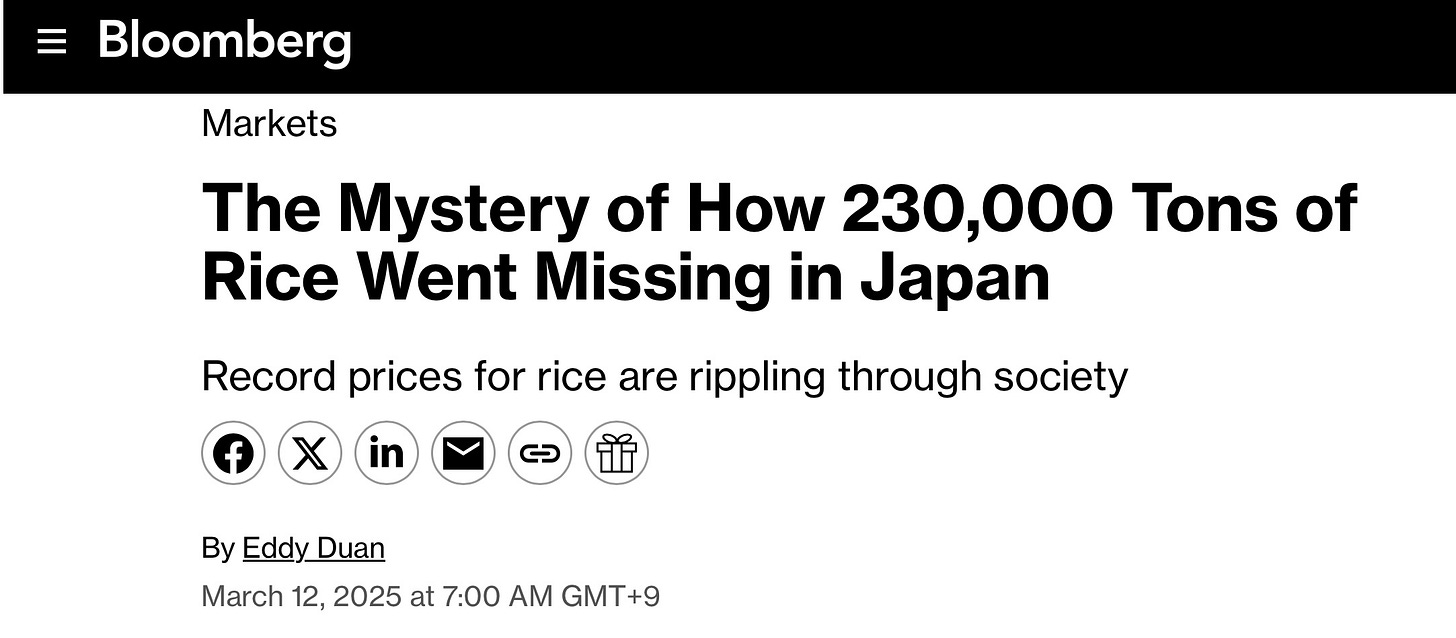

…as the price of rice continue to surge.

See the significance of rice and the BOJ’s “rice price rate hike” from January:

However, rice and food inflation aside - Japan Core CPI (CPI ex-fresh food) is still on the rise…

…as is Core-Core CPI (ex-fresh food and energy)…

And as many of you are likely (and correctly) saying to yourselves at this point - why mention all of this, as I’ve repeatedly said many times before that BOJ actual policy change decisions have little/nothing to do with the latest inflation and / or wages data?

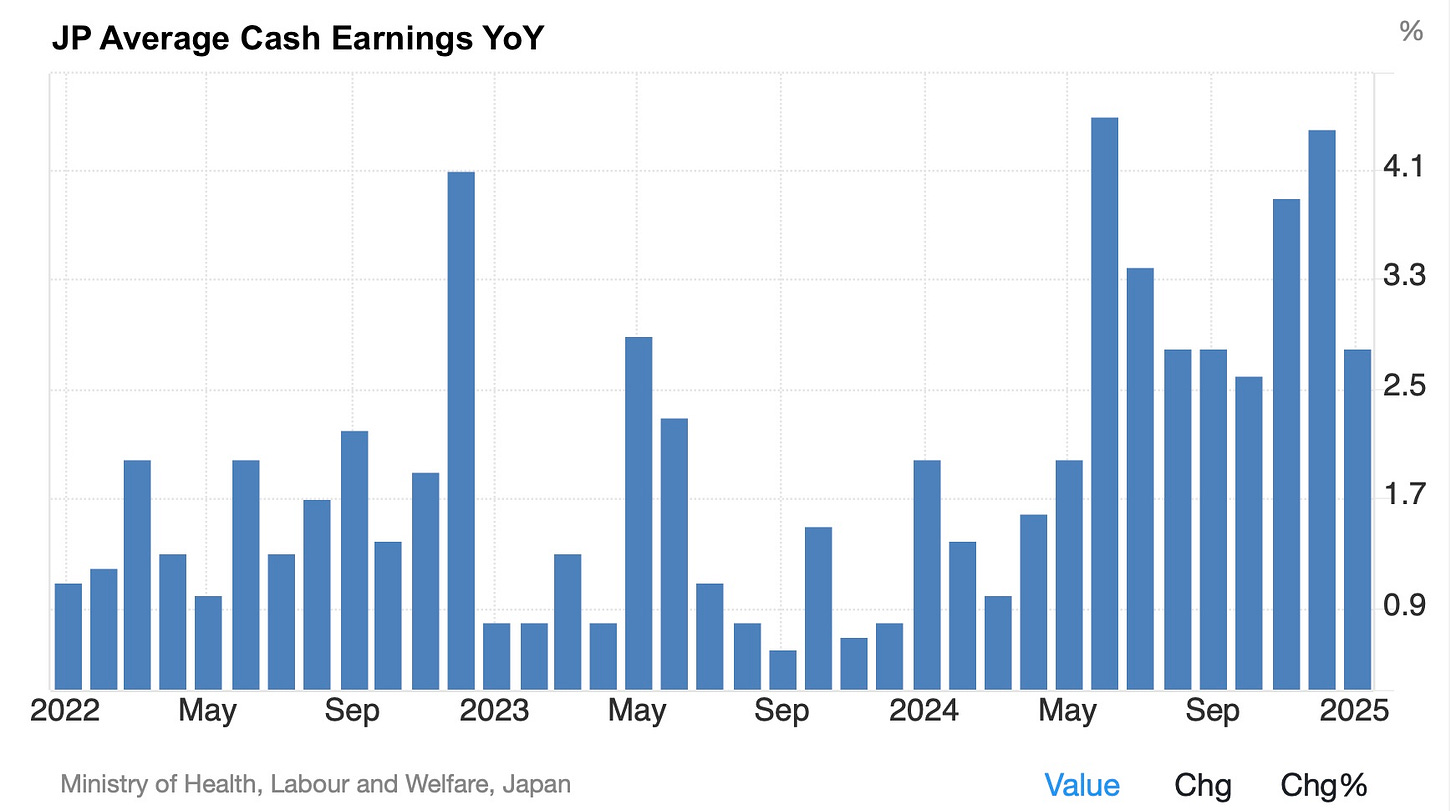

Because while those data points themselves have no consistent correlation to mapping out BOJ policy changes meeting-to-meeting, they do (sometimes) serve the purpose of BOJ/Governor Ueda justifying what BOJ has or hasn’t done with their policy actions, as well as getting market participants with firepower to move green and red blinking tickers. So with that said, the reason I am showing this re-acceleration in Japan inflation is to put this recent “major headline” of Japan corporate wage negotiations (“shunto”) getting a +5.4% wage hike (+18bps higher vs last year) into context.

“Hooray” - Japanese workers’ nominal wages are increasing (sort of).

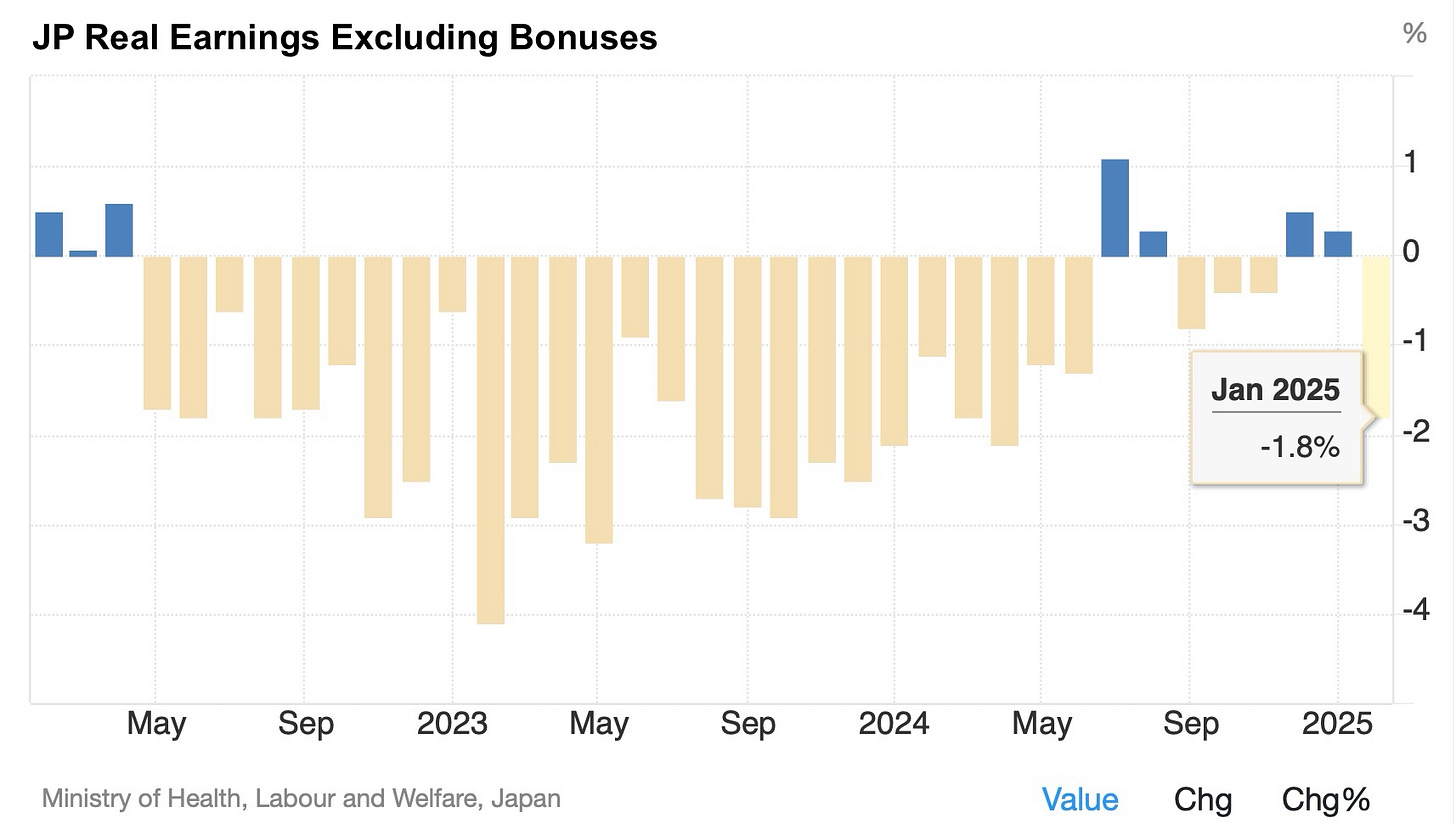

But with a 4% inflation rate eating away at these multi-decade-high wage gains, Japan real wages just plunged once again into negative territory, after 2 straight months of being (barely) positive.

So, if Bank of Japan is going to try and explain their intentions of further rate hikes coming, which is something they must still do in order to continue to dispel the “50bps ceiling” perception - then good luck justifying rate hikes based on rising wages when real wages remain deeply negative, due to soaring food costs that have absolutely nothing to do with loose monetary policy.

JPY & JGBs

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.