This is part of a broader analysis on the US elections and market implications through the perspective of Asia / Japan.

I have been in a quite hellish process of moving (within 🇯🇵Tokyo) - which is why I am filming these in random music recording studios (i.e. my “gym”). It’s also why these videos are not fully edited and choppy. At some point they will likely be compiled together and edited down for YouTube, but for now, these are the full pieces for subscribers that will be released individually, along with the charts and additional written commentary (where applicable).

The video for this release is an overview of the whole thing, but it looks like it will be about 5 separate releases - bonds/USTs, market price action from the “Trump Trade” on election day, non-US market impact (France OAT yields), and the biggest unknown risk - US-Japan relations under Trump & Ishiba.

Here is a further in depth preview from some charts / visuals used in the various coming episodes and topics :

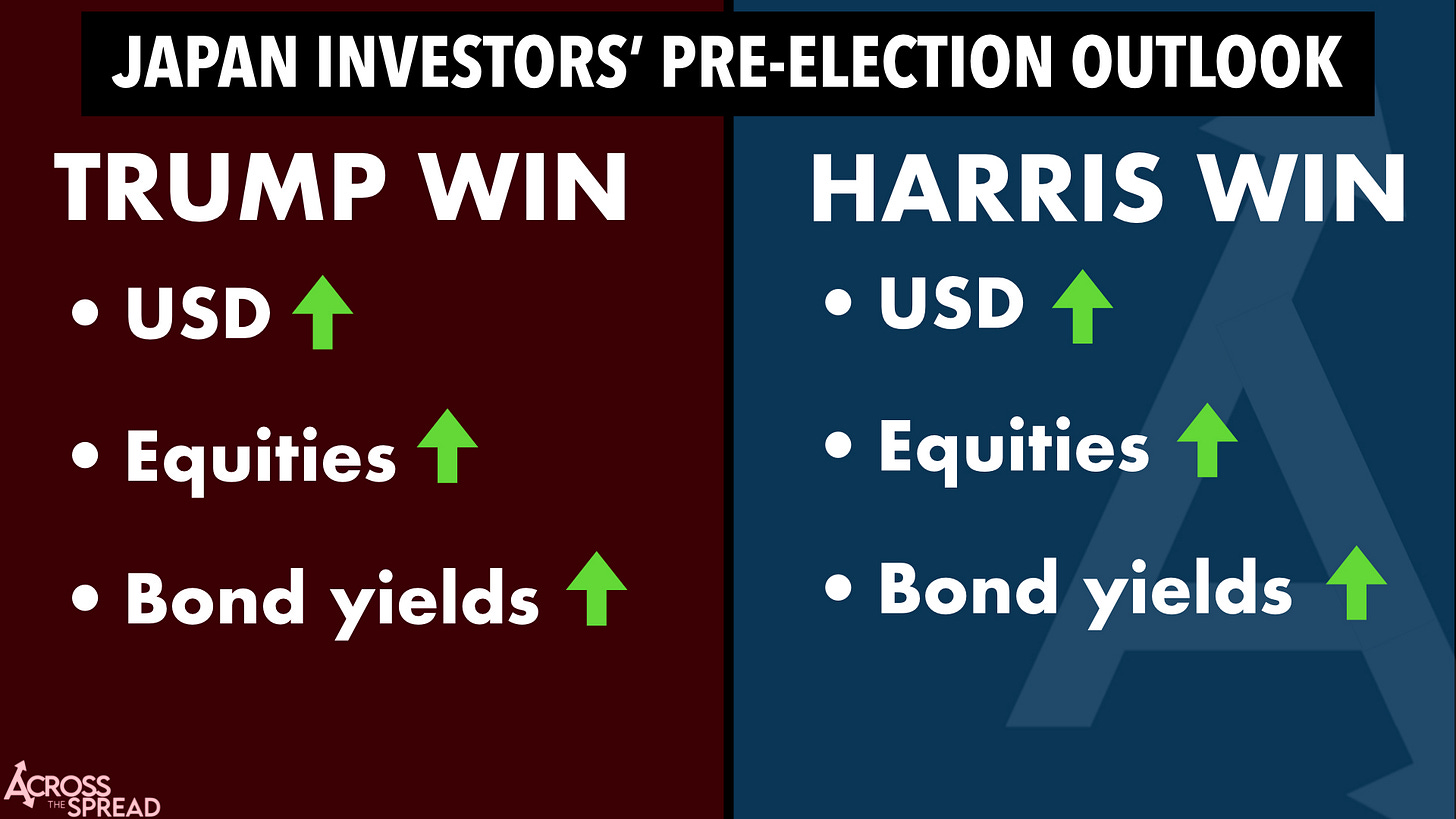

Consensus for Japan investors (and likely consensus globally) - unlike the election result itself, the market outcomes were not perceived to be binary and zero sum. What the graphic below implies is: if the market response is expected to be directionally aligned for either outcome, then that outcome will be priced in well before the non-catalyst election:

…and therefore, a very general, risk-on USD↑, US yields↑, US equities↑ market is at best a “US election trade,” but is absolutely not a “Trump (win) trade” (nor a “Harris lose trade”) by any means.

So, this notion of a “Trump Trade” existing in US macro markets in the first place, let alone currently playing out, is very much nonsense.

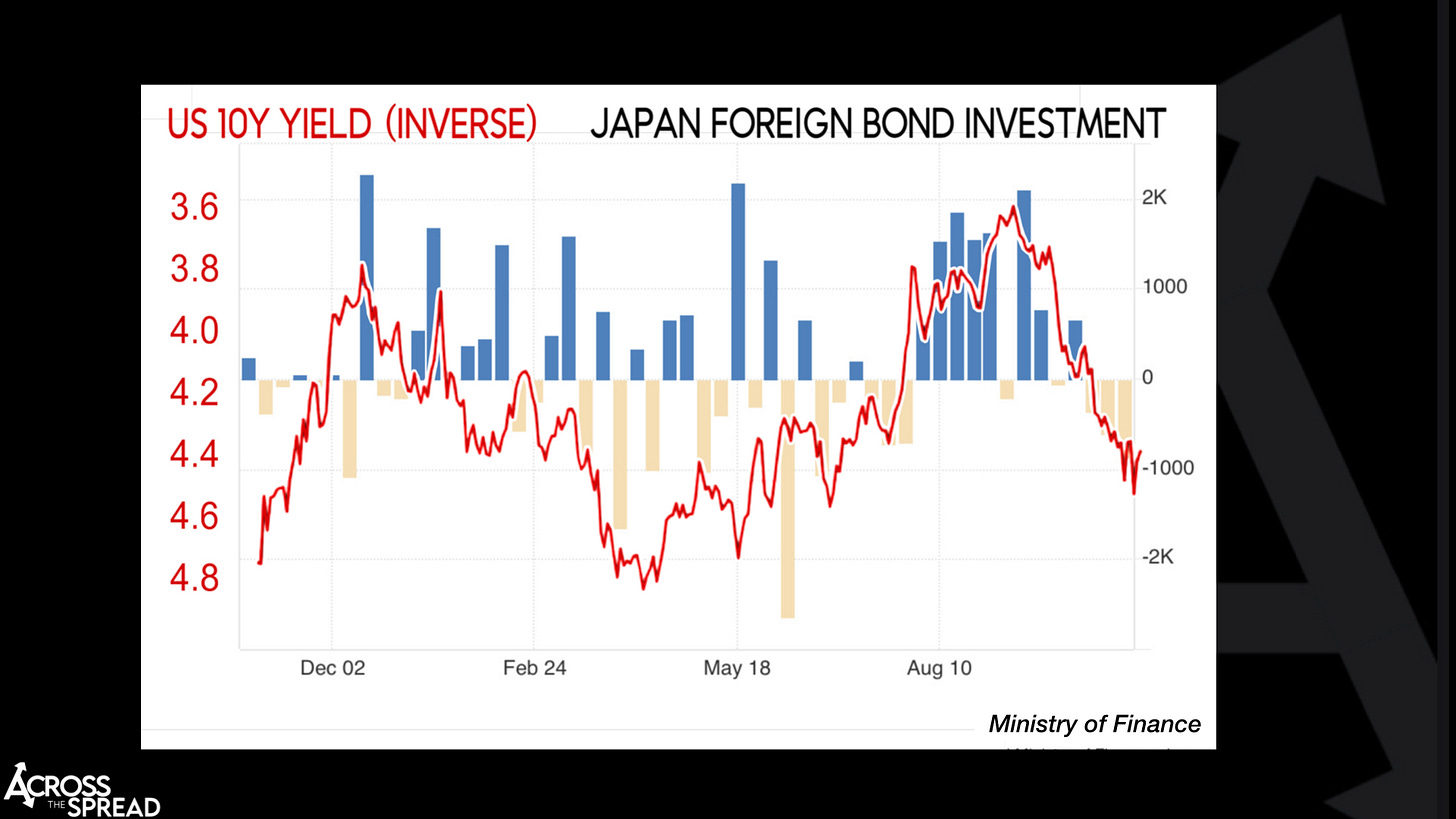

What has actually and visibly been impacting US yields? Japanese investors’ foreign bond flows.

For which, this past month of August was a record high for Japan foreign bond investment - when US 10Y yields dropped some 80bps.

Who/what was behind that record high month of foreign (UST) bond buying, and why?

Likely- 🇯🇵GPIF, world’s largest government pension fund (equivalent of $1.5 trillion in AUM), who were rebuilding their foreign bond allocations after getting decimated in the July ~ Sept quarter, from yenterventions, YenStrike 152, Black Monday etc.

Once the record buying spree that pushed overseas yields relentlessly downwards had finished up in Sept, bond yields rose, absent the prevailing Japan pensions’ price indiscriminate buying pressure. And US yields continued to follow Japan bond flows leading right up to US elections, as they went from heavy-buying, to suddenly not-buying, to outright selling…

…much of which had nothing to do with US elections whatsoever- it was portfolio rebalancing/rebuilding, despite (US) consensus looking at everything very blindly and incorrectly with a US election false-tie-in, resulting in a given assumption of “US yields ↑ = Trump Trade” over weeks prior to the election.

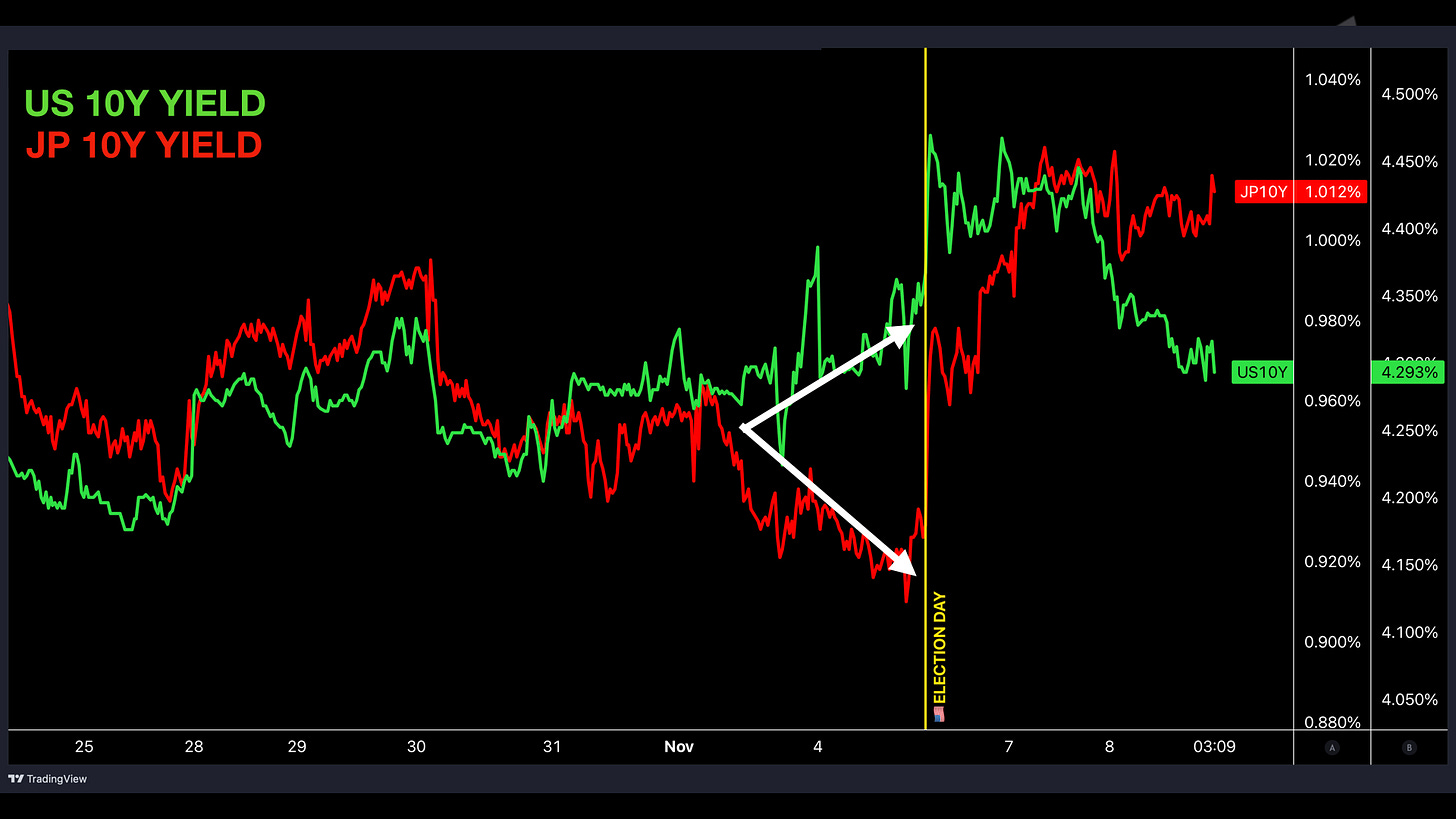

That said, the actual final week leading into US elections…

Massive foreign bond selling out of Japan.

Resulting in a divergence of US yields↑, JGB yields↓ heading into election day.

That was flipped around immediately following election day, as JGB yields surged while UST yields topped and fell.

Election Day Price Action Analysis: Asia Hours

Why did global cross asset markets begin to price in ANYTHING starting at 🇯🇵9AM (🇺🇸7PM EST), hours before any actual material election results came out?

Yes, 7PM EST / 9AM JST is when the first polls on US east coast close and some of the states’ electoral votes are called- but absolutely nothing outside of 100% expectations was out until some 2-3 hours later.

So, why did all global cross asset markets start to move at 🇯🇵9am, mind you- as some of the swings states were still open for voting, as if some new information had indeed been released?

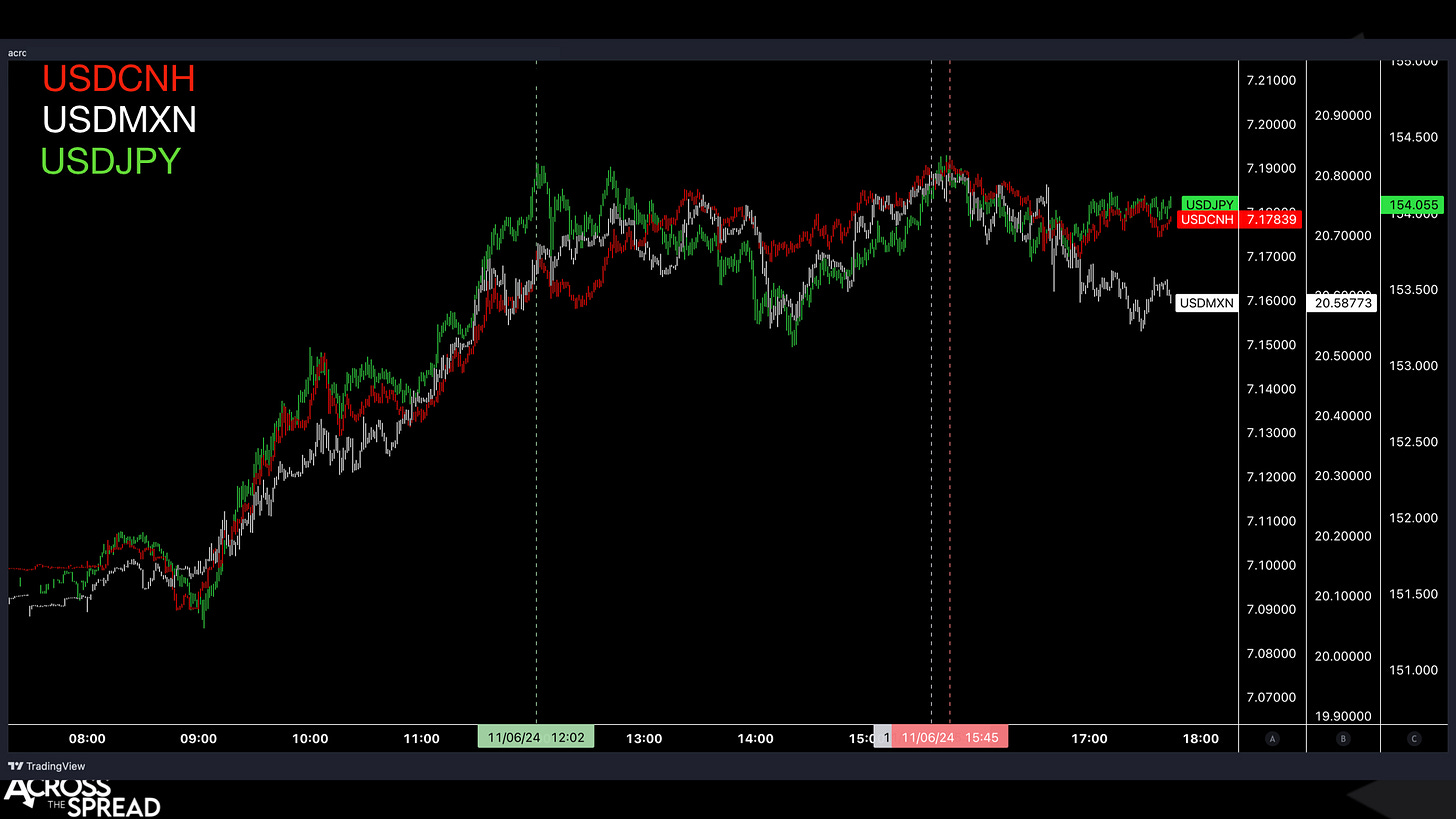

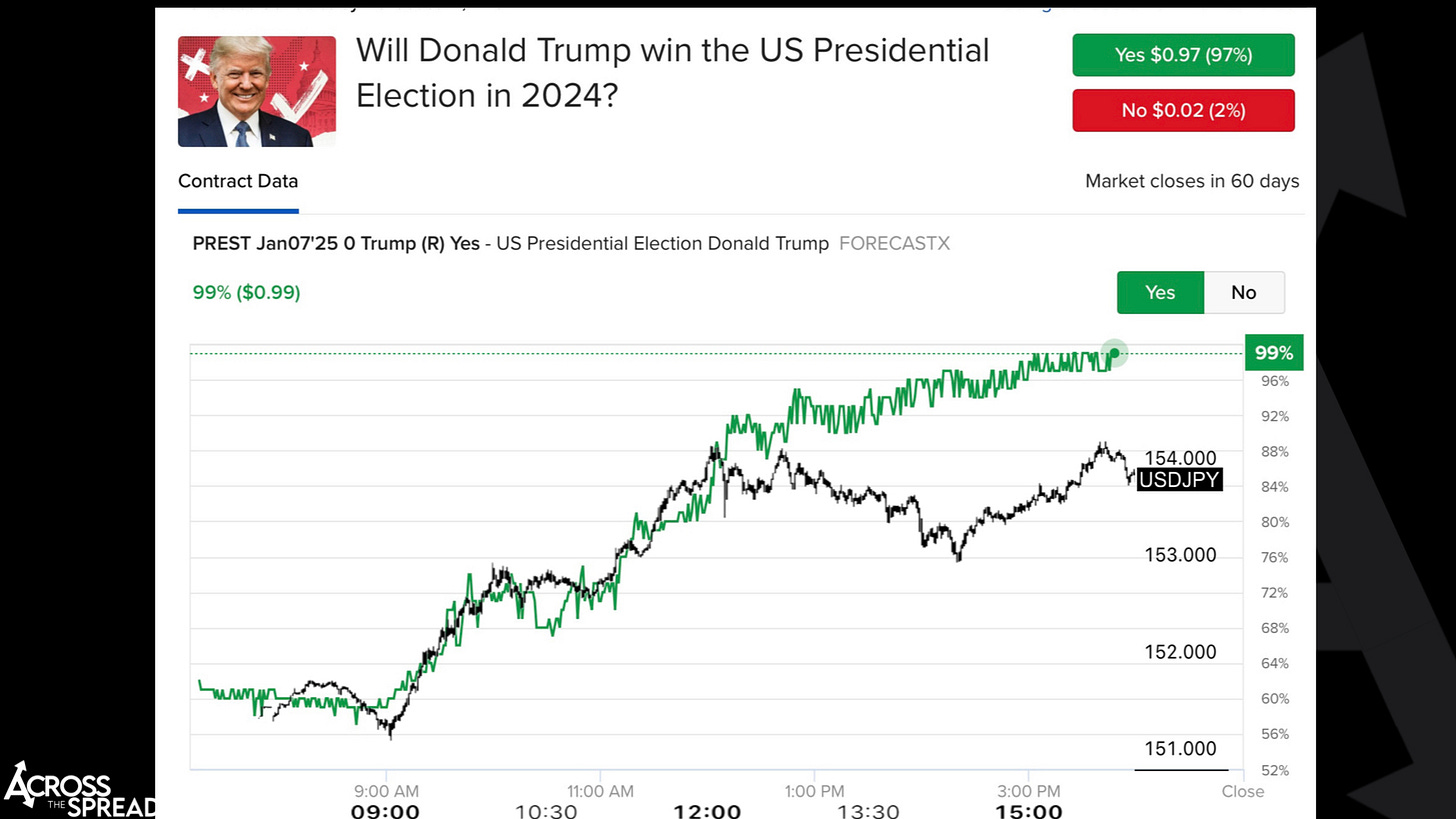

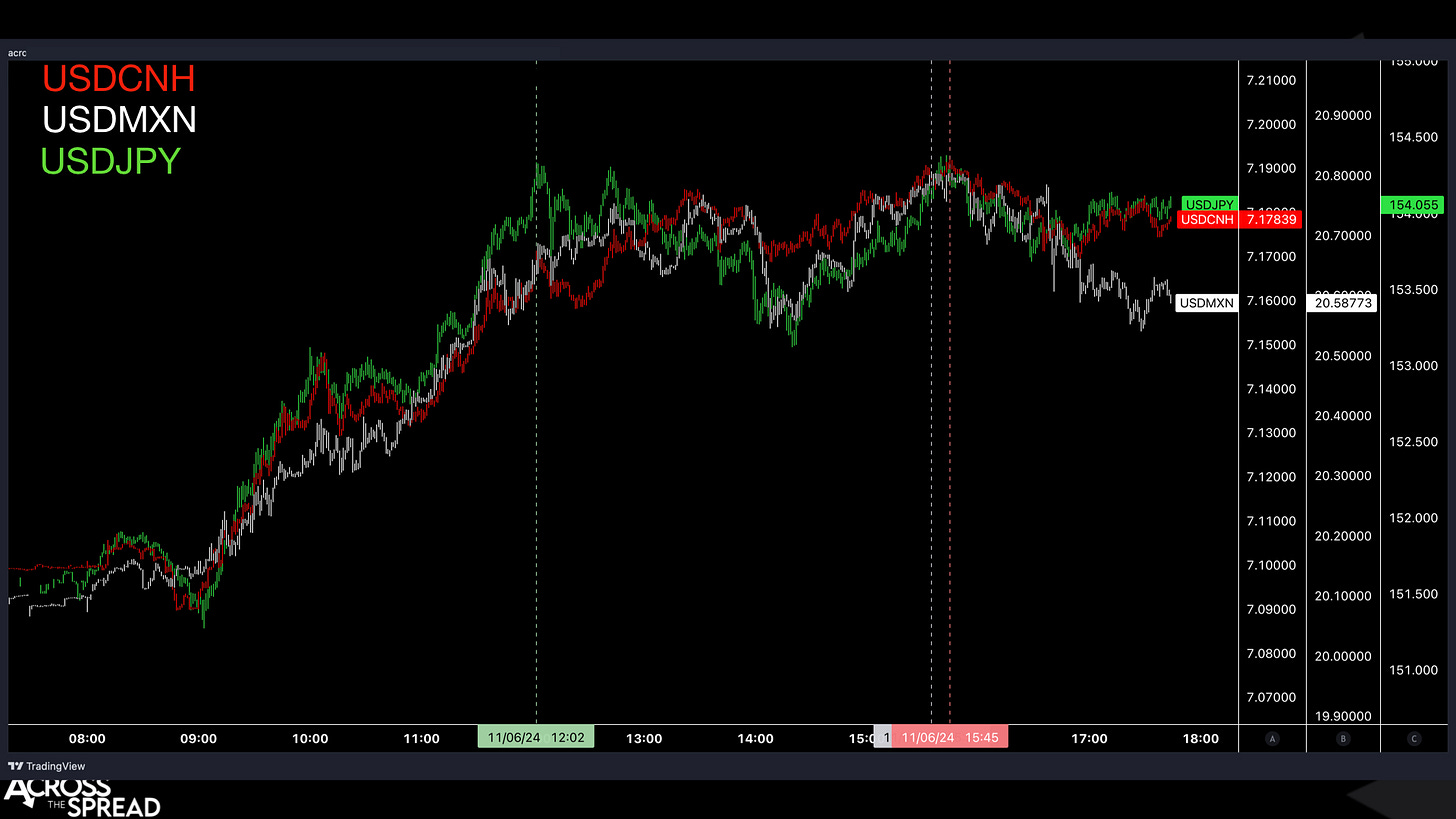

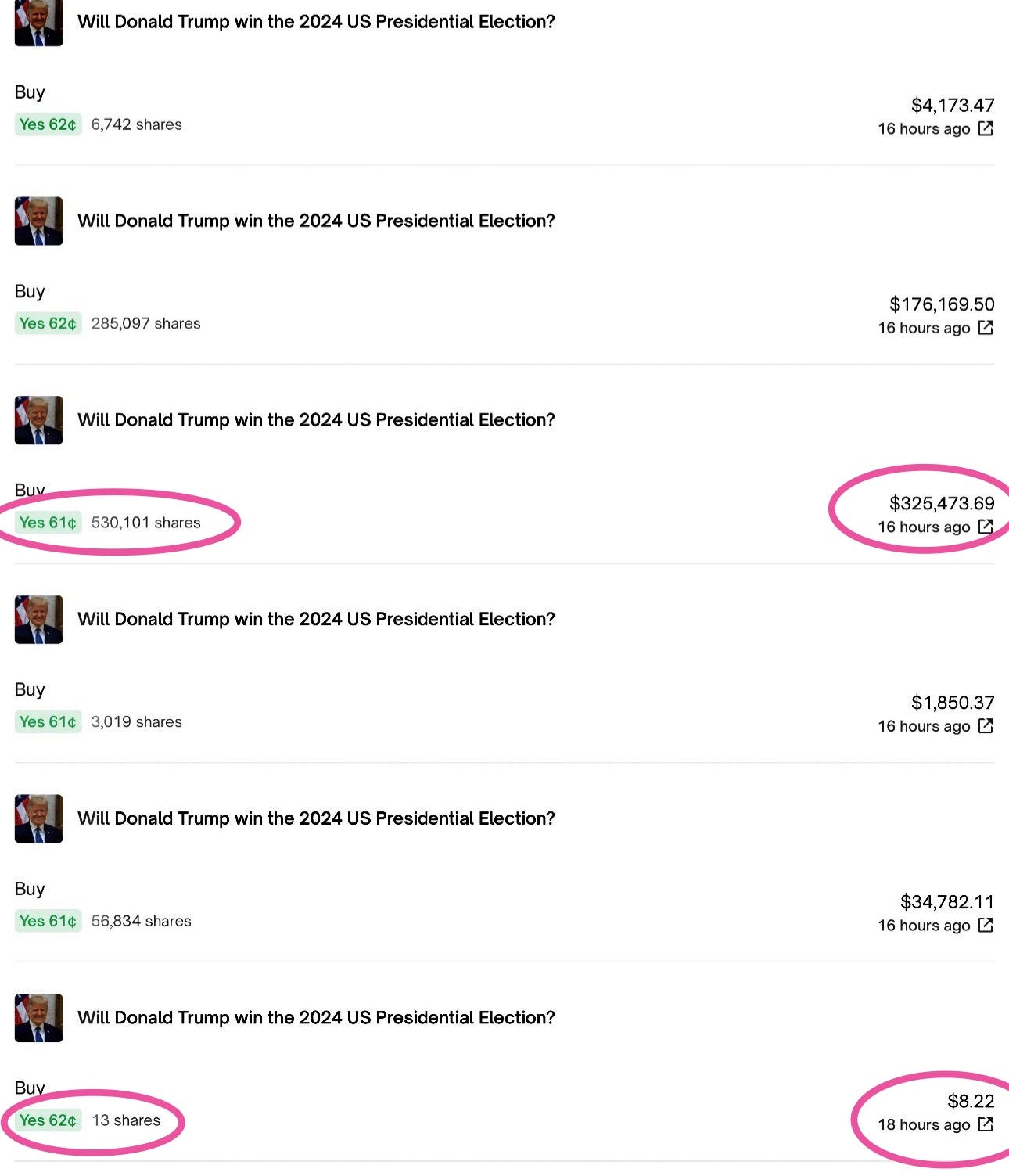

Because of the betting markets - which began to move upon first results, 2-3 minutes after 🇯🇵9:00:00. See the snapshot below, with spot USDJPY overlaid:

Why we’re betting markets moving then? I don’t know. Why were macro markets moving then? Because betting markets were. Why were macro markets moving to/with betting markets? Because macro markets are overrun by algo flows that are scanning, reading and pricing in market signals in real time - ANY market signals, including betting markets.

There were NO actual human fund managers who began to trade cross asset global markets at 7PM EST / 9AM JST - that was a period of absolute dead silence and waiting for human managers. Not a time for anyone to not only start trading non-existent election “results” - but trade them in enough size to actually move markets. This window of time belonged to bots, algos, systematics, and yes, Japan retail (i.e. intraday trend followers), while the rest of us watched.

Why is this significant? Because it means that the actual human being market activity was not one of new positions opened in “long equities, long USD, short bonds” to price in a Trump win (the so called “Trump Trade”) - at least nowhere near to the extent that everyone seems to believe is taking place.

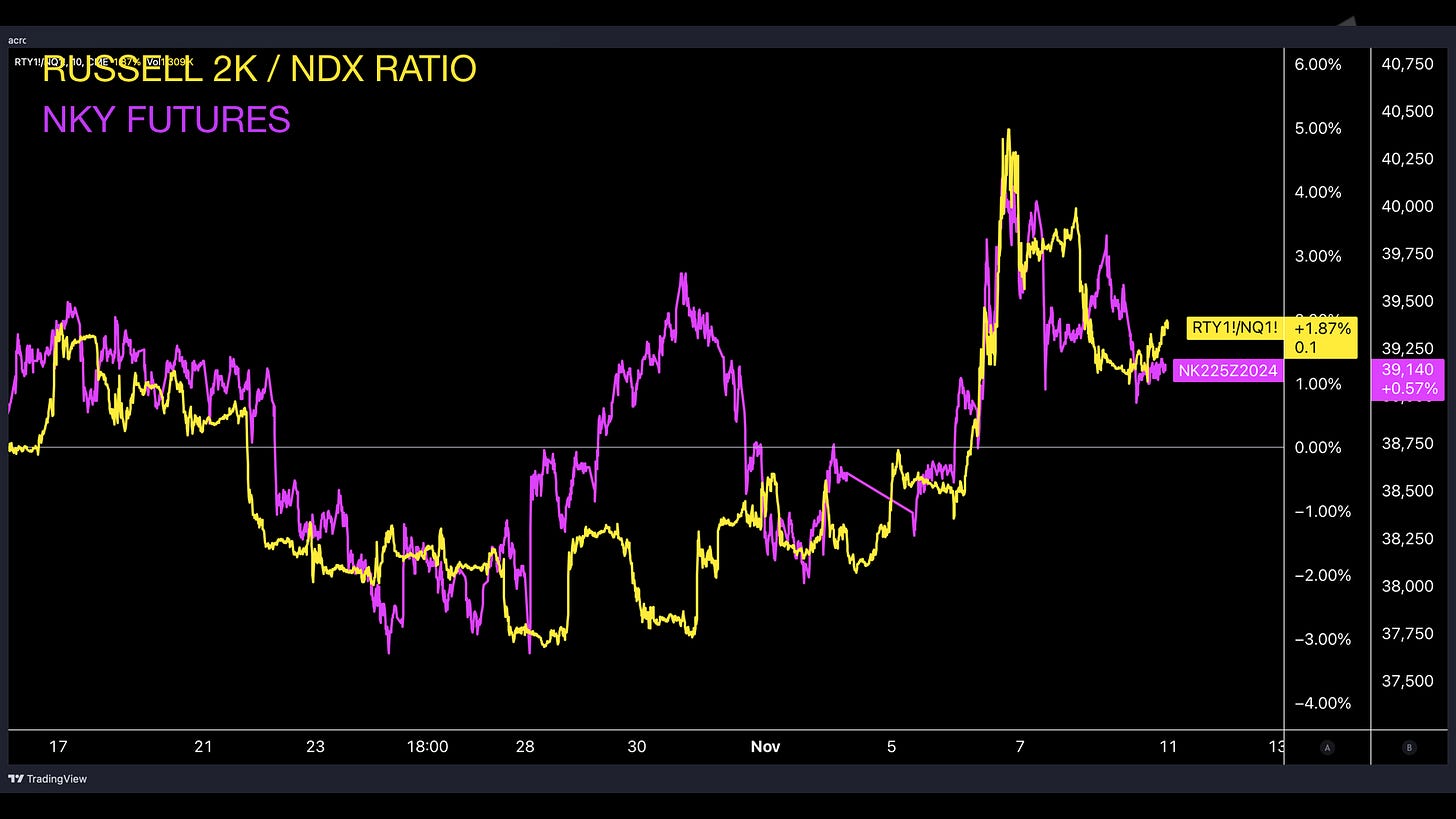

From 11/7 to current: SPX EMINIS are not even +1%. Russell 2000 is up a half-percent since election day. NKY futures, which were election day global outperformers, are down nearly 2% from election day. Long end US yields are flat. US 2Y yields are HIGHER from election day, despite a FOMC rate cut since. USDJPY, which made a +2% move in the Japan AM session of election night before anything real came out rising steadily from 151 at 9AM to nearly 155 at noon, had topped from that moment ~ current. So did the other election-prone FX pairs shortly thereafter: MXN and CNH (USDCNH has since moved higher, but that’s due to heavy policy activity, or, inactivity, out of Beijing since).

These are highly systematic and algo-flow-following-algo-flow behavioral markets.

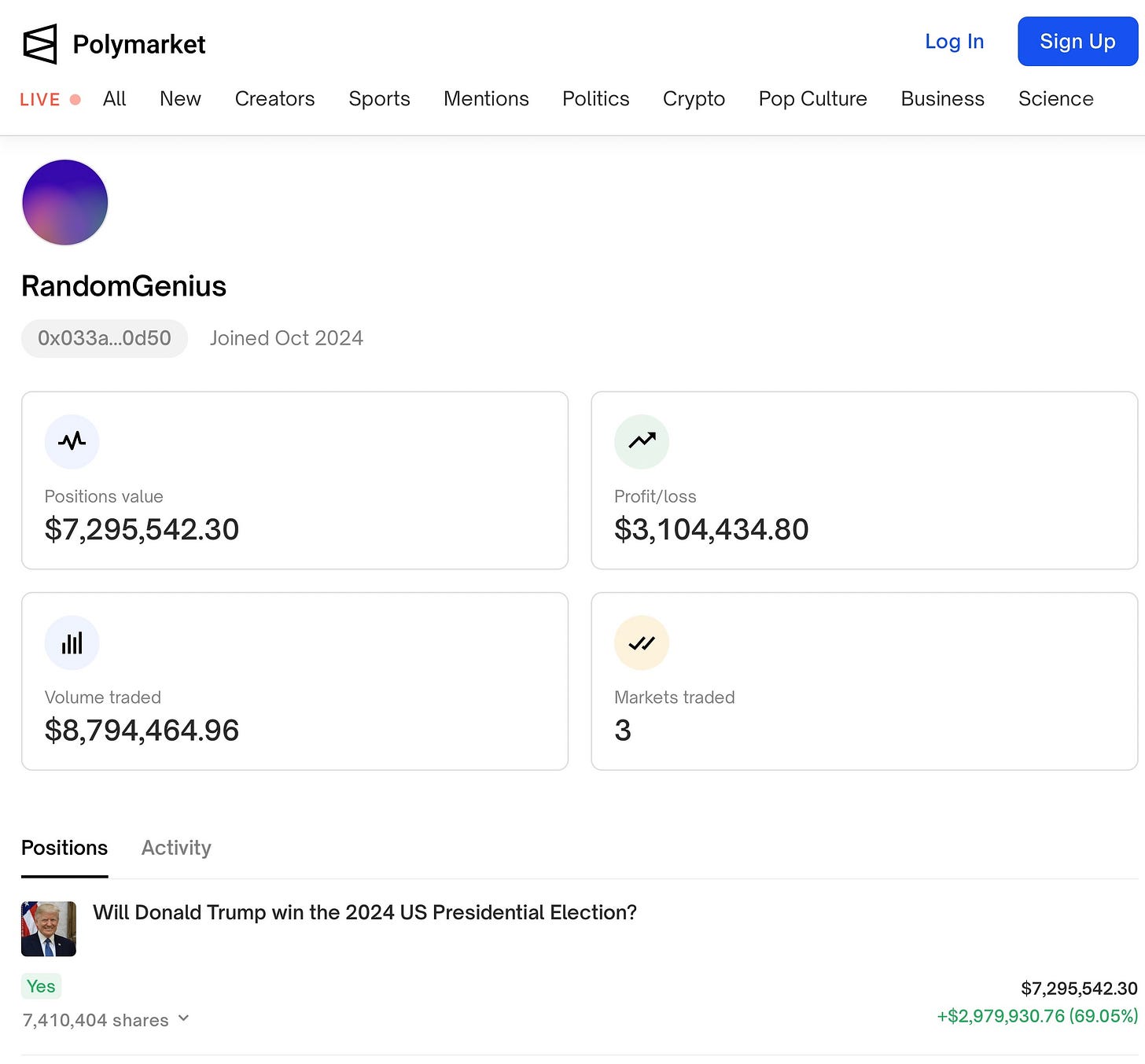

And as for betting markets - I looked into the activity of the large and now very profitable holders (potential single trader) of long Trump Win contracts on Polymarket, which is public on blockchain, and these appear to also be algo-flow dominated.

Here is a snapshot of one of the “whale” accounts betting on a Trump win - this was the third largest position holder of long “Trump Win” shares - the other two are in the tens of millions in USD size.

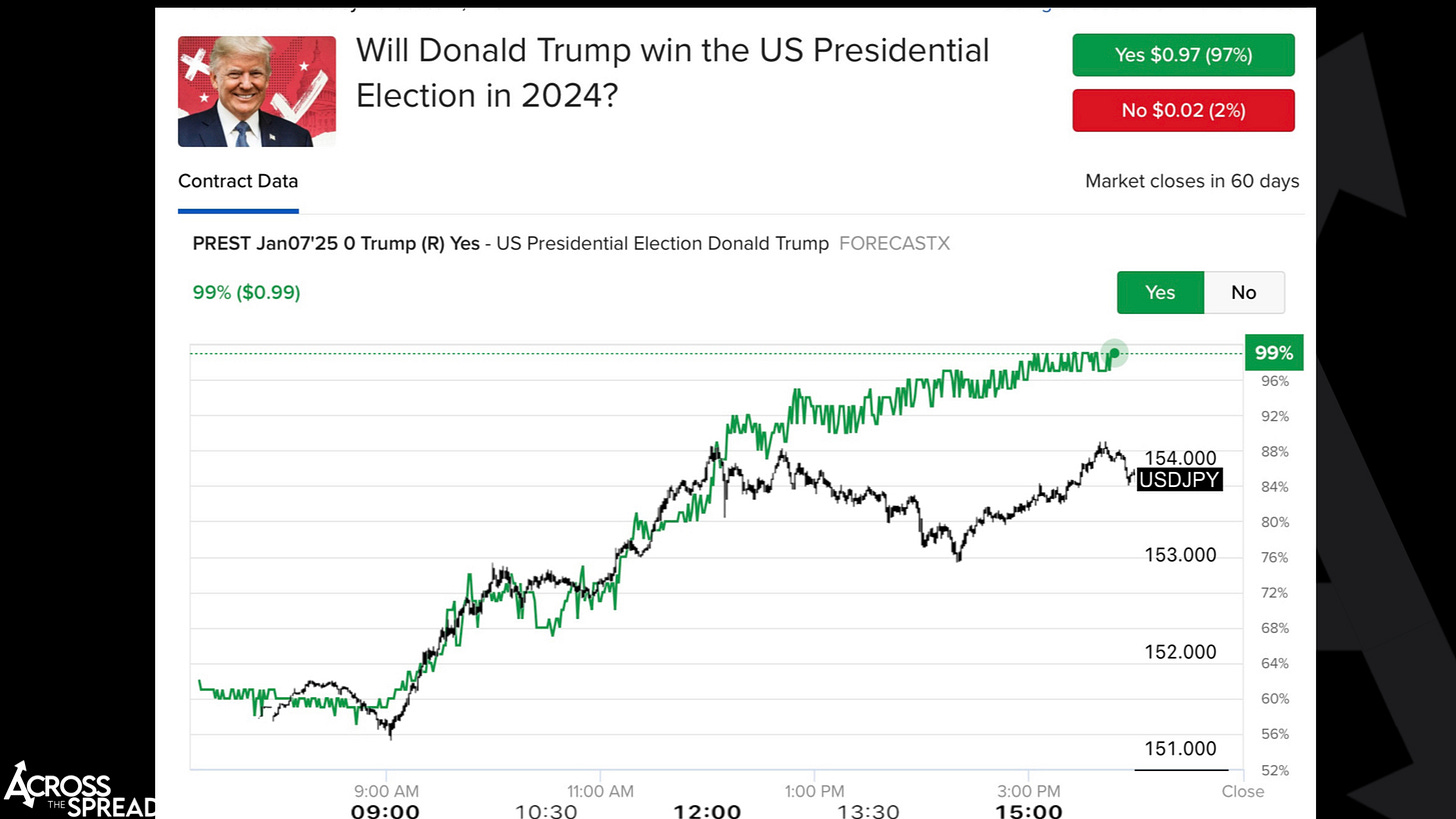

I personally scanned through hundreds (among what was likely to be many thousands) of trades executed by this one account - trades were done in quick succession, in widely erratic size, (spanning single-digit dollar amounts to over a quarter million USD or more per trade), and highly cognizant of fill price down to the penny:

It doesn’t take a quant to see that this type of trade execution style is very clearly not done manually - it is done systematically. As WSJ has been reporting - these accounts on Polymarket are run by some anonymous French dude with several years - decades of finance experience who is merely out to make a profit as he proclaims, and I don’t doubt that for a second. Note that in institutional finance, when it comes to quant and systematic trading - the French have been early leaders (Soc Gen, BNP Paribas etc.)

So, betting markets are also highly systematic flow oriented. Just like macro markets are.

Nobody (human) was/is trading US elections in macro markets.

And macro markets aren’t trading off of post-election fundamentals.

“What you’re likely seeing in markets is actually an absence of large, active managers, and therefore a greater presence of non-fundamentally based flows — such as that of quants, algos, and levered retail,” said Weston Nakamura, analyst and founder of Across The Spread

-Japan Times, Election Day

https://www.japantimes.co.jp/business/2024/11/06/markets/trump-victory-markets/

More slides from coming video segments - on Japan investors’ view of an ACTUAL Trump Trade:

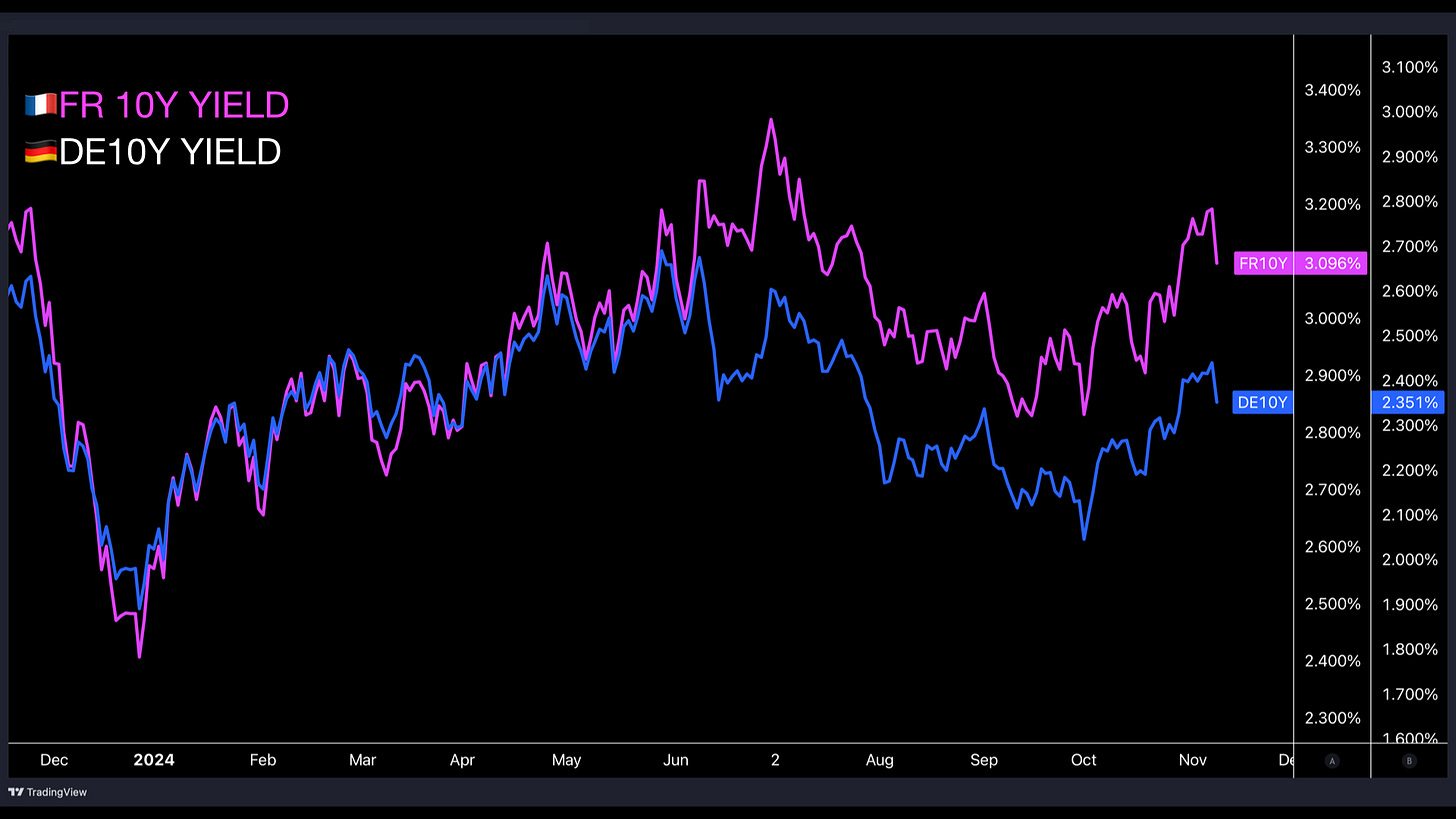

Trump presidency = French OAT yields ↑ (as a pullback in US military aid to Ukraine would mean EU countries would need to step up to fill the void, and therefore be a negative for EU sovereigns’ debt dynamics)

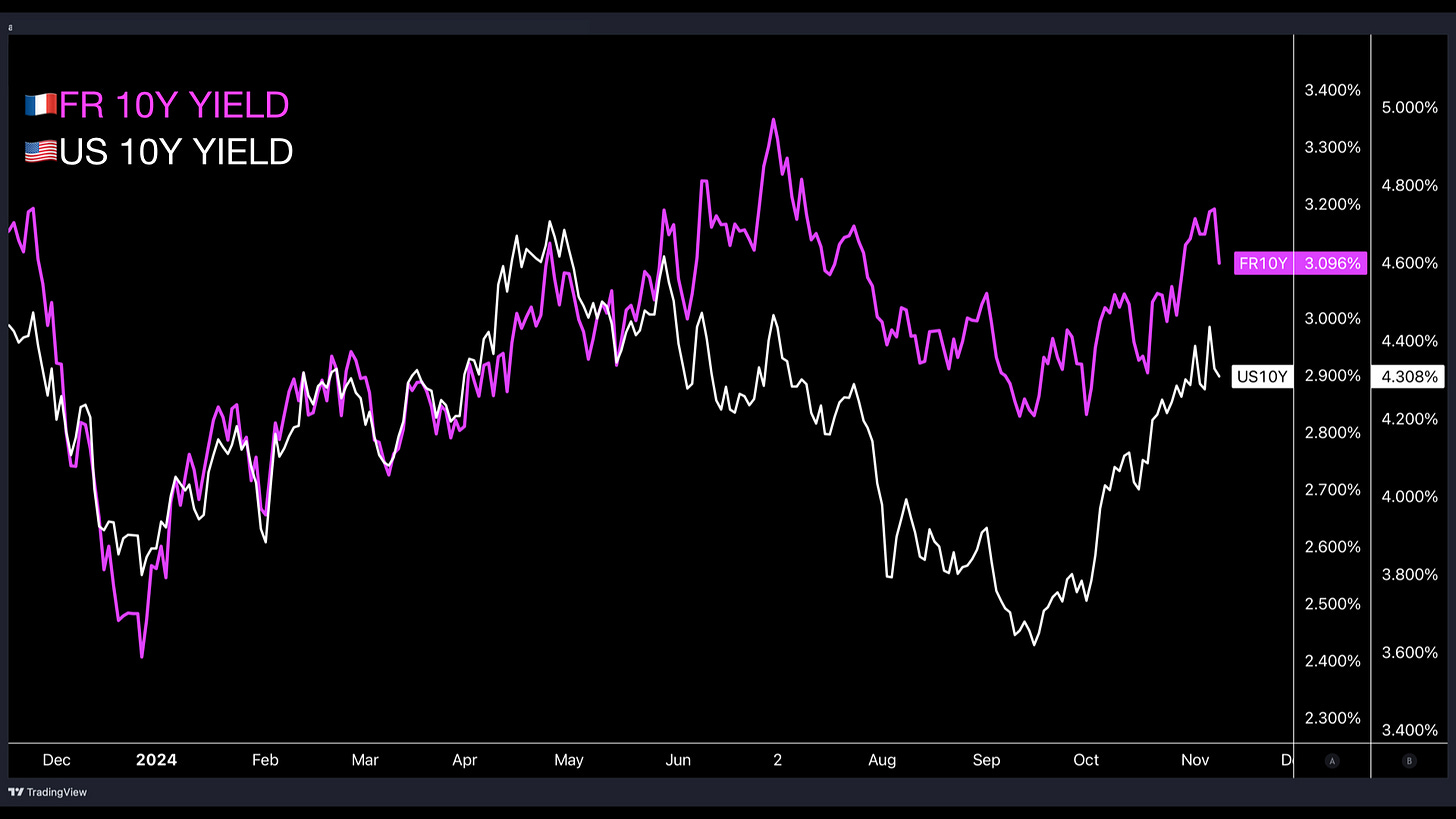

Ever since Macron’s sudden snap election call earlier this year, France OAT yields have been detached from other DM peer yields - namely German bunds and USTs:

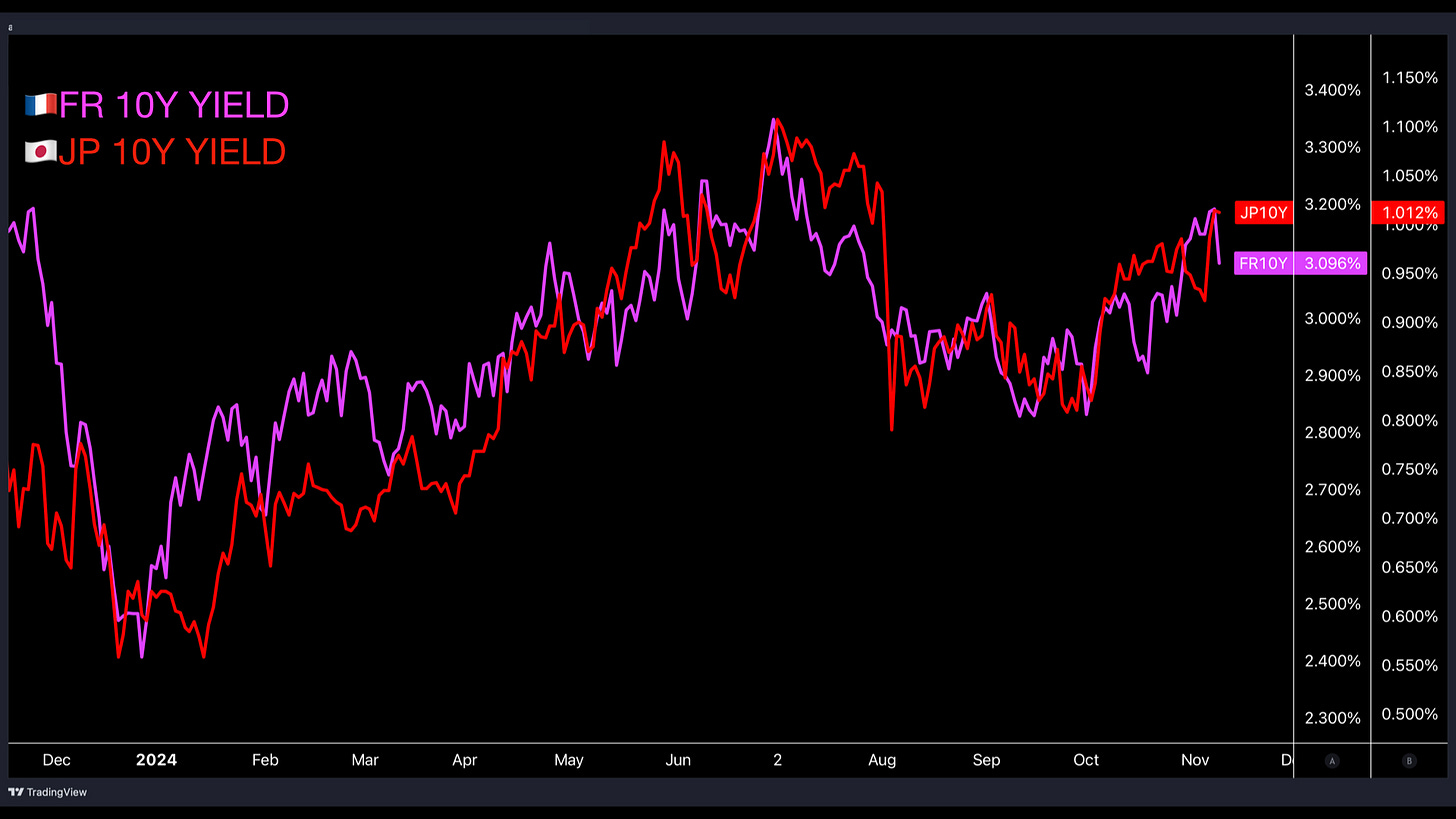

Meanwhile, French yields have remained tightly correlated to JGB yields:

Why? Because of the outsized presence of Japanese investors’ holdings in France / US / global DM bond markets, relative to other international investors.

So, how the Japanese investor community views election outcomes and the makeup of governments and administration policy shifts is highly consequential to their investment decisions, which means - what they think and do is highly consequential to global markets.

The biggest unknown risk that still remains is who will make up Trump’s cabinet. Bob Lighthizer, former trade chief under Trump term #1, is likely to be heavily involved - to where is the question. If he is named as Treasury Secretary (which he is on a shortlist for), then we’re looking at highly possible DOLLAR-YENTERVENTIONS.

And keep in mind that today’s Trump appointee may very well be tomorrow’s thrown-out book writer.

Stop looking at non-existent “Trump Trades.” Start looking at those who are trading Trump - and from an international view.

Watch Japan investors.

Keep an eye out for further releases.

Note: These upcoming videos will also likely be a running series as developments occur going forward. For now, the recordings that have been done will be released in no particular order (of importance), and more so based on what capabilities I have at the moment - just FYI.

Thanks as always,

Weston

Share this post