Heads Up: USDJPY Quickly Approaching 140 Support

Immediate term implications on further USD downside, gold upside, US yields and more.

Quick mid-Asia trading hours market note.

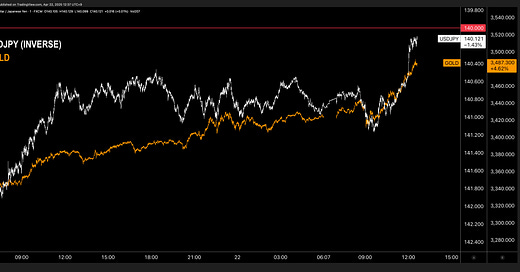

USDJPY taking a sudden, sharp leg down and closing in on ~140 support - to then either bounce off of and reverse trend, or break thru into the 130s.

This week (Mon and today/now), the broad based USD selling has been occurring during Asia hours - mostly in the AM.

Reason I mention the Asia trading sessions from yesterday and today - what I am pointing out isn’t just that the USD sell off has been occurring during Asia hours, but also that it wasn’t carried over into the London/European session - and I suspect this may be due to European markets being closed yesterday for holiday. So, let’s see if Europe traders come in in a bit and take the baton to further crush USD into the NY session.

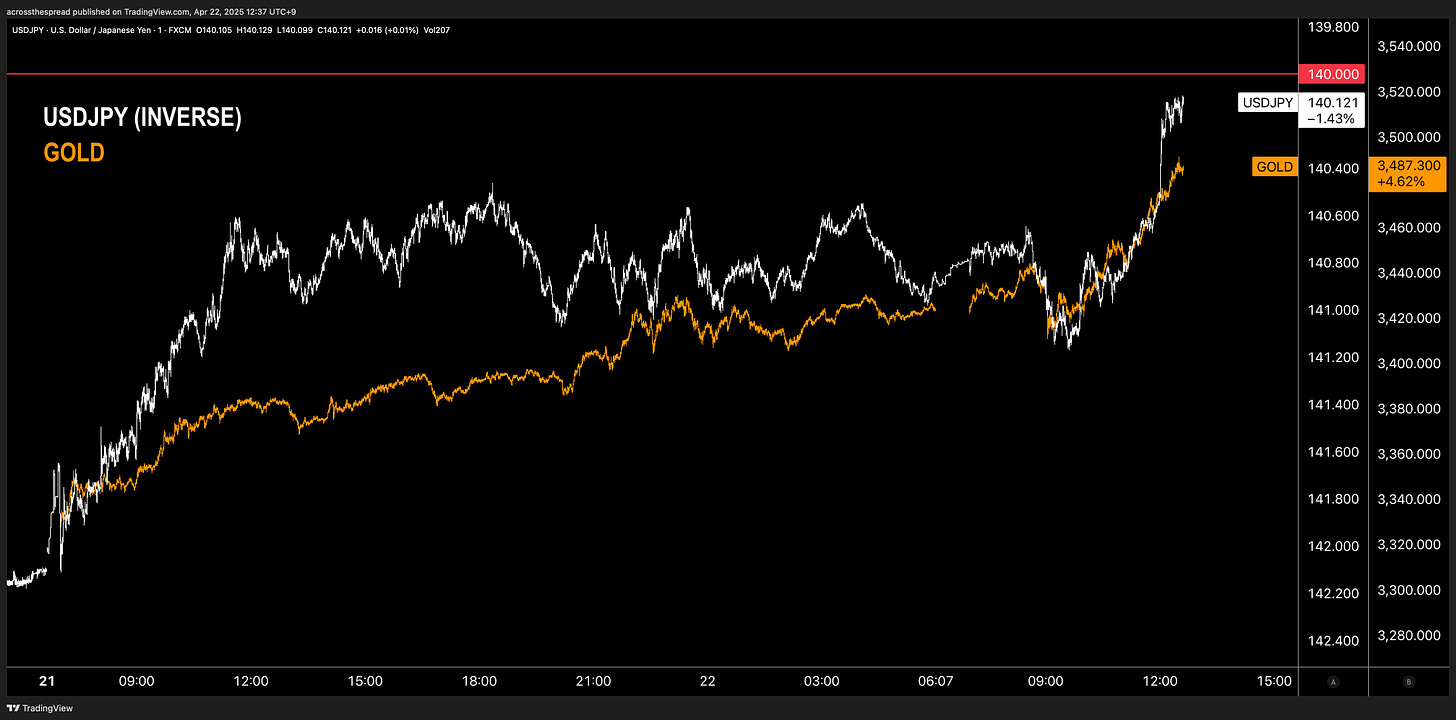

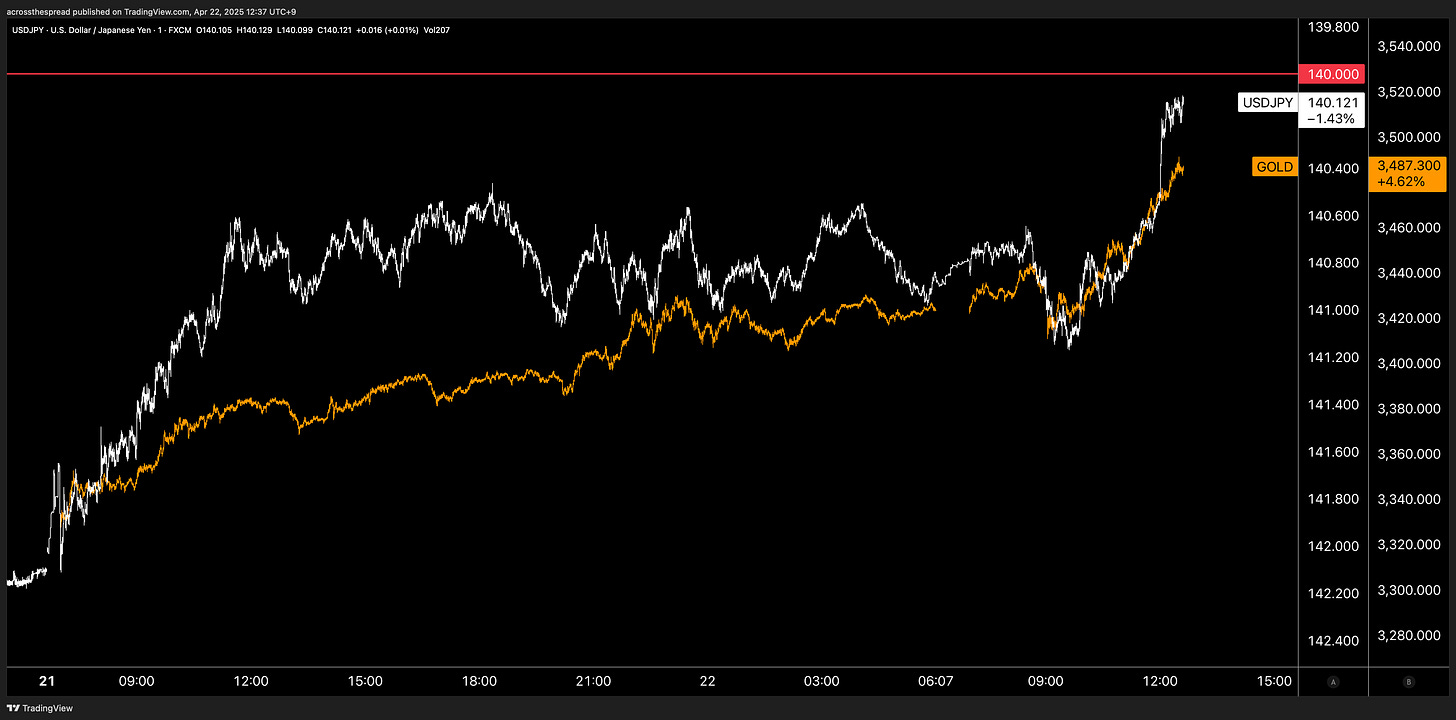

Gold +2% on the day continues to rally alongside JPY as USDJPY 140 approaches.

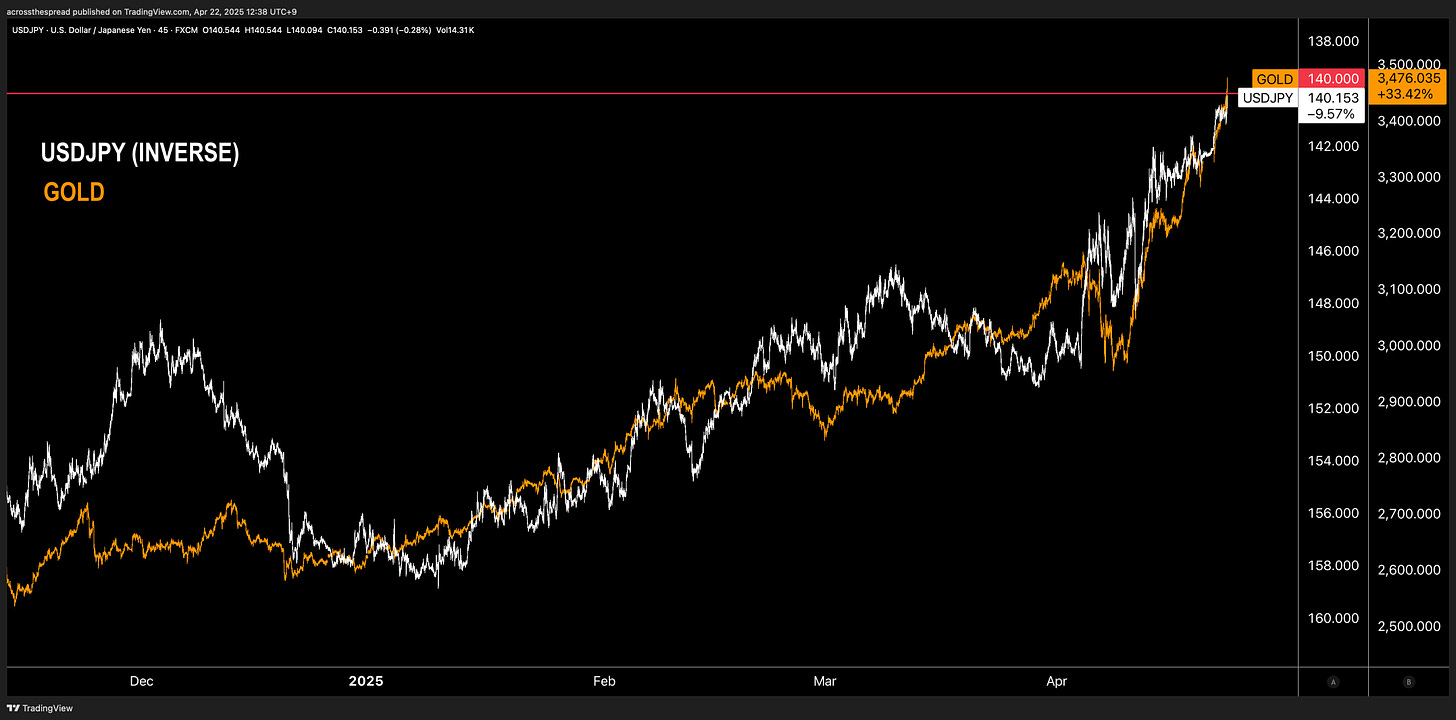

FYI - if you’re wondering what’s up with gold’s relentless YTD rally, spot gold has re-correlated to JPY in 2025.

So, if USDJPY breaks meaningfully down thru the 140 level (sub-139~138) in the immediate to near term, that may very well further add fuel to spot gold upside momentum. Conversely, if USDJPY 140 support holds and reverses higher, that can trigger a sharp round of profit-taking-begetting-profit-taking on gold in the near term.

Asia FX pairs USDJPY and USDCNH diverge intraday: yen strengthens as yuan weakens.

Quick excerpt from my prior note How Asia Is Guiding Trump Tariff Policy & Markets - Japan & China: tariffs, and selling US Treasuries. The great JGB short squeeze that kicked off UST volatility.

It’s clear that there are two broad categorizations that the Trump administration is filing each tariffed country under, and it’s not the traditionally grouped “allies” and “adversaries” of the United States - it’s:

1) Everyone ex-China

2) China

Japan:

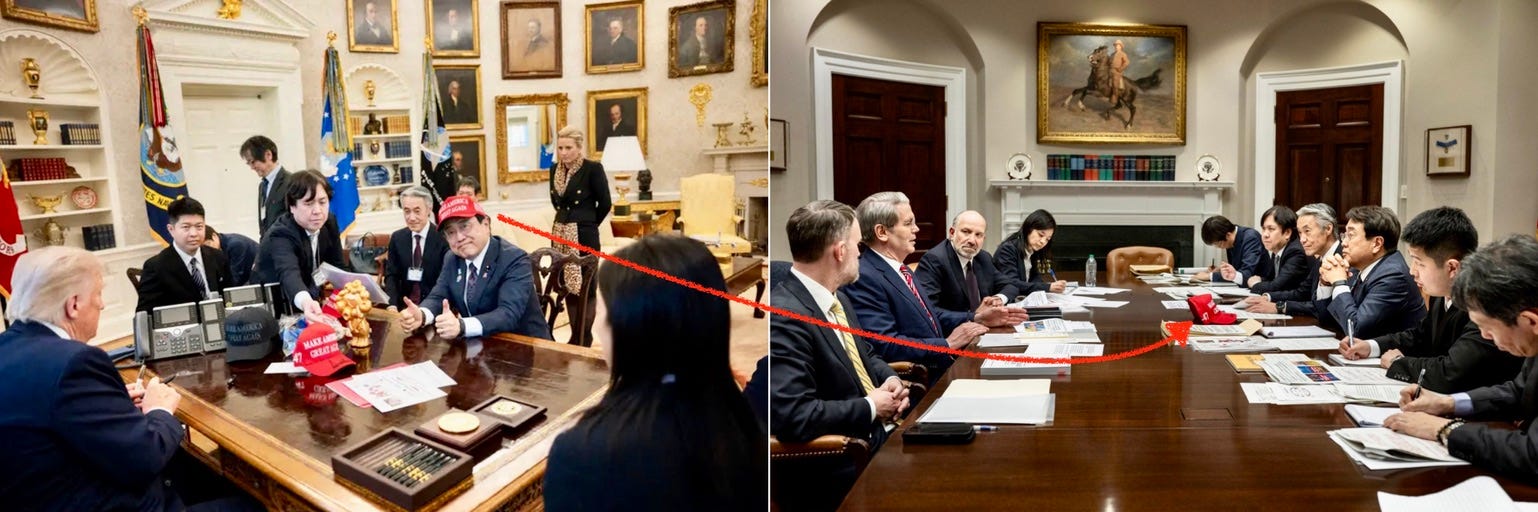

Among the 80-something non-China countries who now have 90 days and counting to work out some sort of new “trade deal” with the US, Japan is at the very front of the negotiation queue - those are the exact words of Treasury Secretary Bessent that he’s been repeating enthusiastically all over media. Speaking of the United States Department of Treasury, the world‘s most powerful fiscal authority, Secretary Bessent is personally taking the helm for the US’ head counterpart to Japan’s trade negotiation team, led by Minister Akazawa.

Basically, China will be made an example of for those who proceed with economic relations to the US in an adversarial manner, and Japan will be the example of countries who act in a cooperative manner with the US on economic matters. And since China is in its own category, Japan matters because it essentially sets the tone for the rest of the world in relation to the US.

I was mid-working on a cross asset market note that had to be interrupted due to this sudden leg of JPY strength vs USD ahead of EU re-open- below are parts of the FX commentary.

FX

USDJPY 140 support matters in context of my explanations for prior key USDJPY support levels from my mid-March note on 2025’s JPY strength:

~148.50 was a level in which the post-152 breakdown/blowup found immediate-short term upside resistance (initially held in August, then broke in early October), and went from being upside resistance → downside support thereafter. That type of dynamic typically signifies a price level of significance for market positioning and activity (for what specific reasons, I actually don’t care too much).

And that half-year-held support level has now been broken.

~141.50 is the next key level of downside support to watch - this is where the mid July to early August -11% plunge (-6.5% of which had occurred in 5 trading days as the bottom fell out below YenStrike USDJPY 152) had then hit bottom and sharply reversed.

Again, my immediate-short term view remains favoring USDJPY downside - I do think that we will indeed test that next ~141.50 support.

And based on the above, I was updating on USDJPY downside as that 141.50 level was broken yesterday, and then accelerated broad USD downside upon doing so.

Shorter term chart capturing pre-post Liberation Day shows that indeed 148.50 and 141.50 were properly identified as the key levels of make or break support:

And as the 141.50 support broke, I was going to then flag the next key levels on USDJPY downside: 140, and 137.

140 (approximate) was bottom from the 162 peak prior to the July ~ August 2024 JPY mass short squeeze that blew up the world.

137 (approximate) was also a shock-BOJ related policy move from a year prior in 2023, when BOJ suddenly lifted then-YCC upper limit caps on 10Y JGB yields from 0.50% → 1.0% at the end of July, kicking off a steady +100bp rise in 10Y UST yields from 4% → 5%.

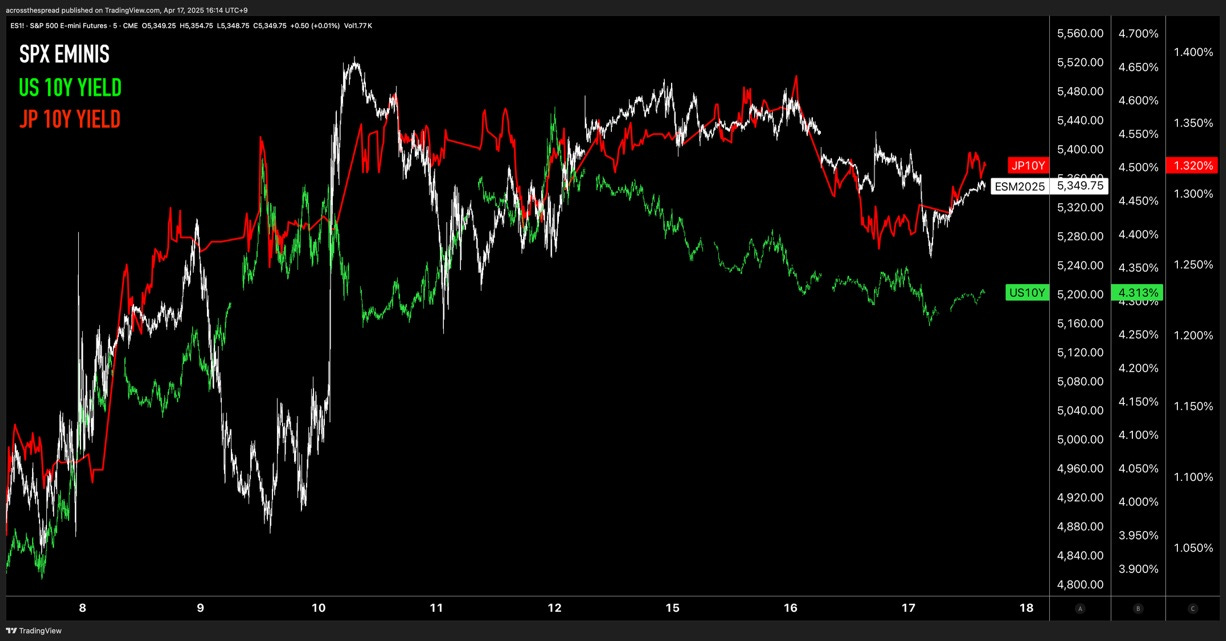

So, watch those levels next - and potential cross asset ripple effects - namely on bond yields, which then impact equities.

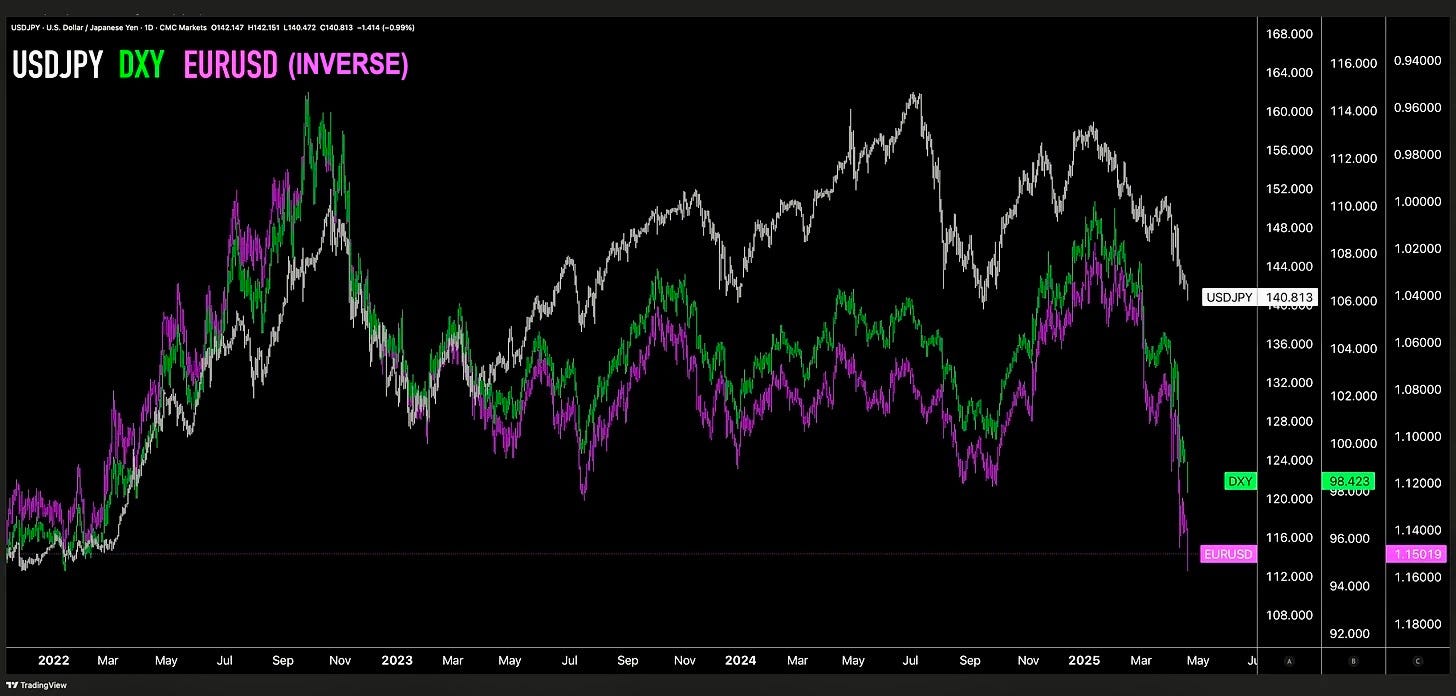

Also note that this USDJPY downside since liberation day has been almost entirely USD-sell-driven.

If you look at the other major crosses - EURJPY in particular has been more or less dead flat.

So, JPY has not been the “safe haven” flows - but 🇨🇭CHF is:

USD has (obviously) not been any sort of haven - but when that happens and broad based dollar selling ensues, it “crowns” other currencies as the relative “havens” simply by the nature of FX being relative pair trades - you need to sell one in order to buy another (and vice versa).

Why is Swiss franc outperforming these other "safe havens FROM USD” - and by such a wide margin?

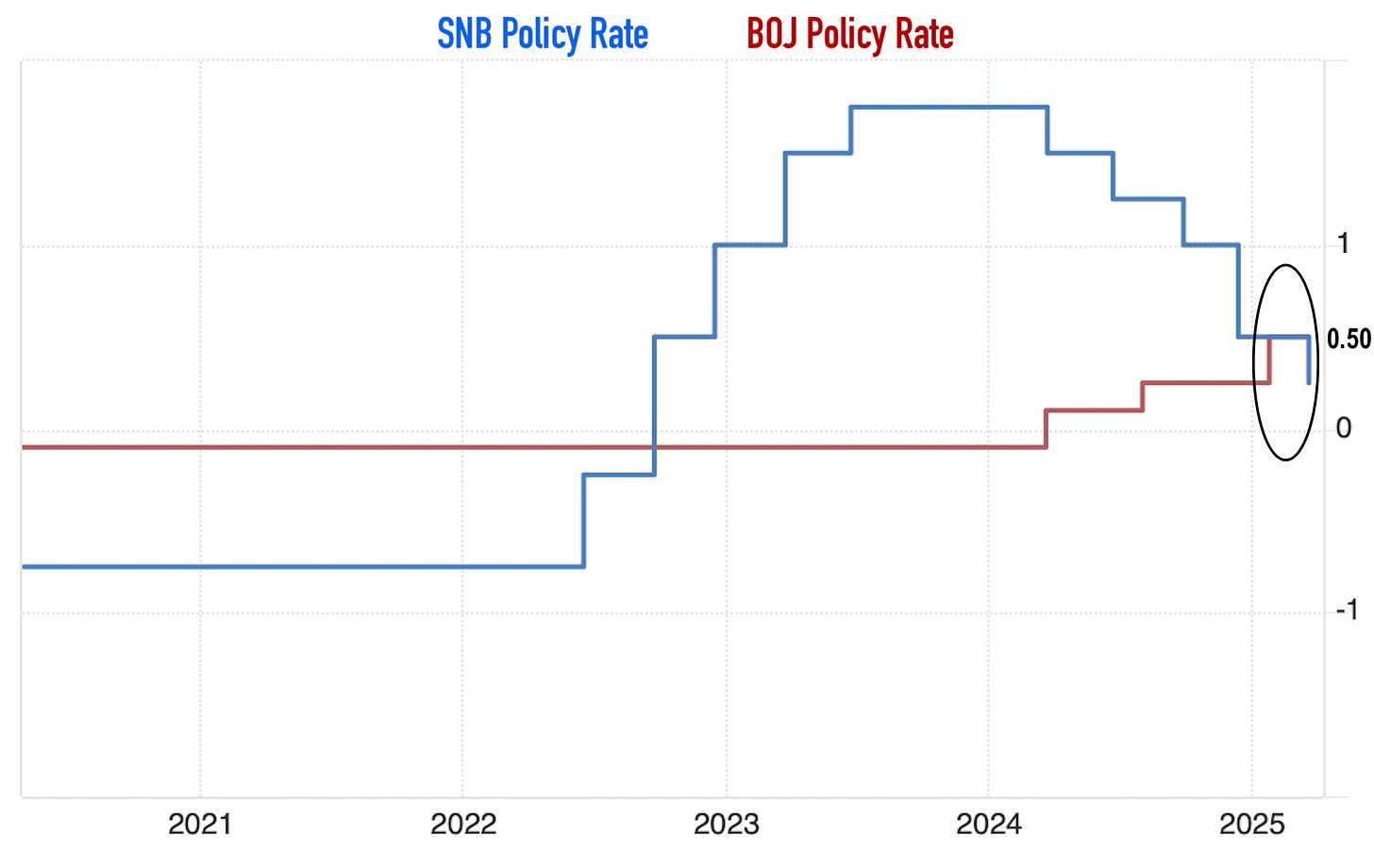

Because of what I had been flagging since end of 2024 - due to 🇨🇭SNB’s aggressive rate cutting cycle that has been underway, as well as BOJ’s very not-aggressive rate hiking “cycle” also underway, SNB cuts and BOJ hikes saw their respective policy rates meet one another at the same level of 0.50% at the time I was discussing.

CHF had once been a “competing” currency for the short leg of the JPY carry trade back when SNB had kept its front-end policy rates even further negative than BOJ’s. But when global central banks ex-BOJ ripped their policy rates higher from 2022, that left JPY rates as the only one of the majors with a policy rate still in negative territory, and thereby had a “monopoly” on the currency of choice to short/borrow in order to fund a carry trade.

But now, SNB policy rates are back below that of BOJ’s, which thereby now gives another option besides shorting JPY for carry traders, if not the preferable option - as: 1) the two central bank’s rate policies are moving in opposite directions (SNB ↓, BOJ ↑), and 2) Japan’s multiple acts of sudden market yenterventions have all but made traders completely forget about the time when SNB shock-removed CHF’s upper limit vs EUR back in Jan 2015 and completely nuked franc shorts.

(For SNB/Swiss franc carry trade explanation, see video from 24:40 if it doesn’t auto-start from there)

That’s why I had been saying over the past few months and in the video above that the JPY carry trade isn’t really as much of an issue as it was in summer ‘24 - because CHF carry trade allows for less one-sided overcrowding into shorting one currency. And if you take that a step further - basically what is happening now is that the CHF carry trade is “blowing up” (getting force-exited), leading to CHF’s outlier strength during this USD selling. Swiss franc is not “more safe” of a haven vs the other majors - it is just another major macro trade unwind underway.

Last chart for now, and speaking of the 2022 global central banks ex-BOJ ripping rates to the moon era - the recent dollar selling (forced position exiting) is now erasing all of the dollar gains from this inflationary tightening era starting in 2022.

As of the past 2 trading days, USD has given up all of its post-2022 Fed rate hiking and “American exceptionalism” (“European un-exceptionalism”) gains against EUR:

Will follow up with more on my takeaways from the latest developments on US-Japan trade negotiations that had kicked off (and no, they’re actually not going well at all, despite US and Japan officials + media portrayal of “positive progress”), as well as JGB long-end yields and their overlooked but very significant global cross asset market impact, and more.

⬇︎

⬇︎

⬇︎

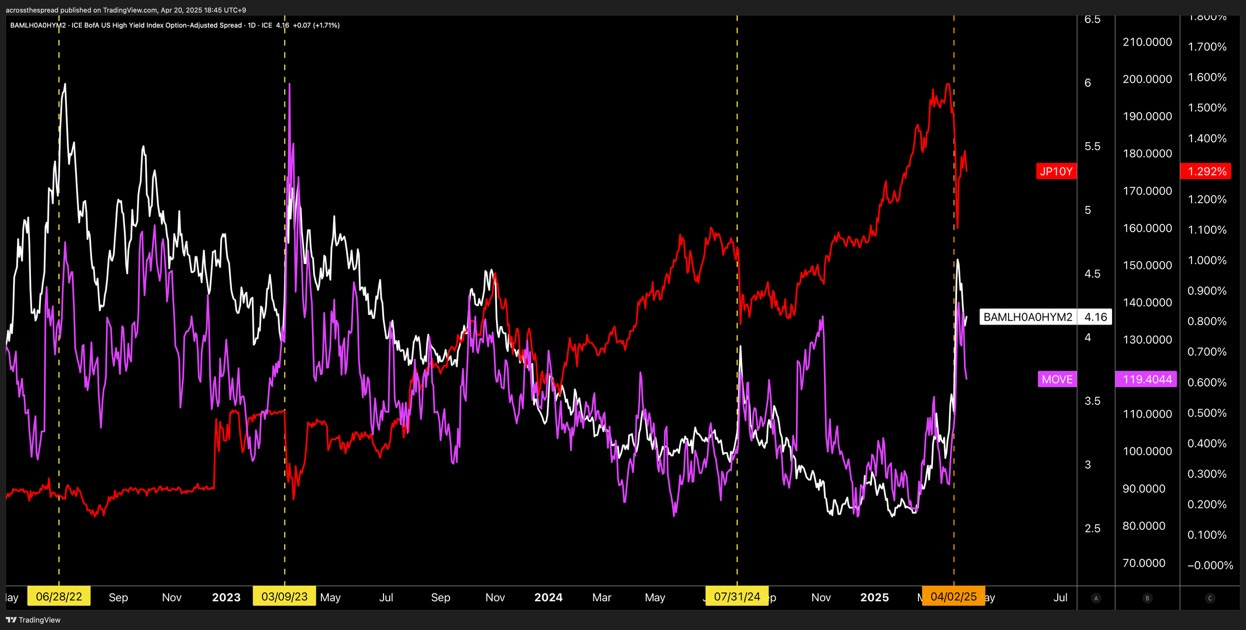

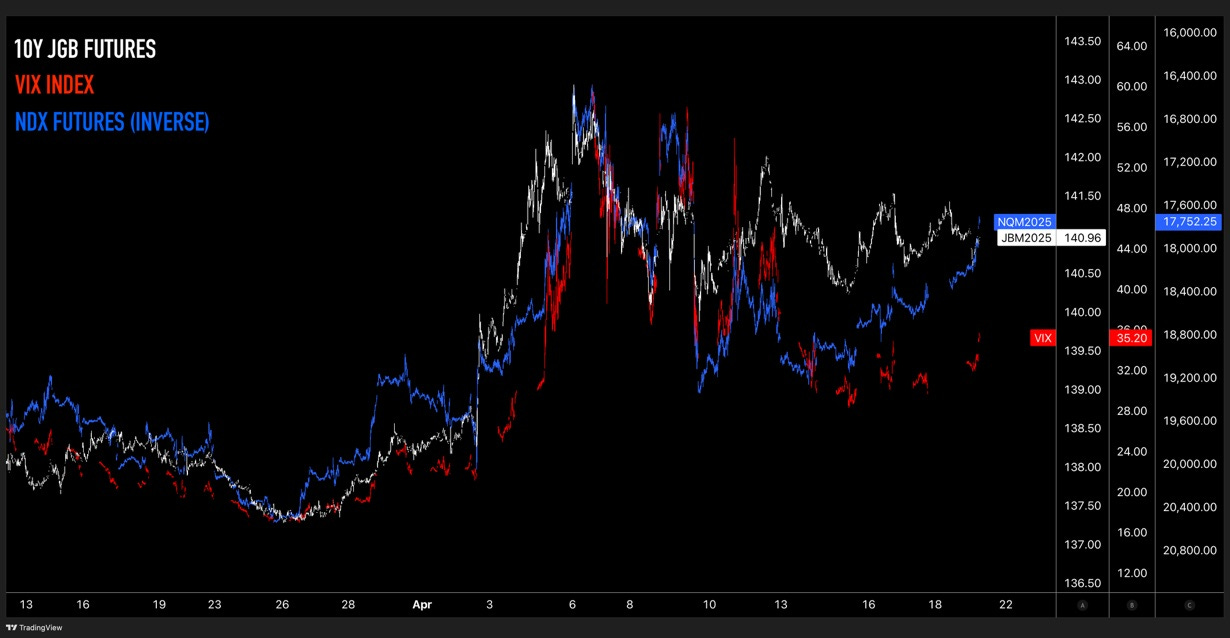

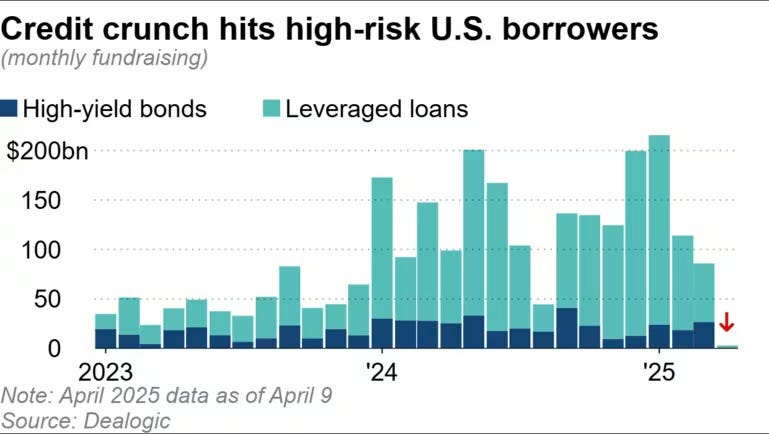

JGBs vs USD high yield credit after Liberation Day:

JGB market dysfunction and complete lack of trading liquidity / outstanding supply (because BOJ has bought up and holds SO many fucking JGBs and issuance float percentage) can trigger extremely sharp collapses and swings in JGB yields, which then ripples out to global DM sovereign rates market mayhem.

ICE BofA Option-Adjusted Spreads OAS (USD credit spreads), vs MOVE Index (“VIX” of bond market), vs JGB yields

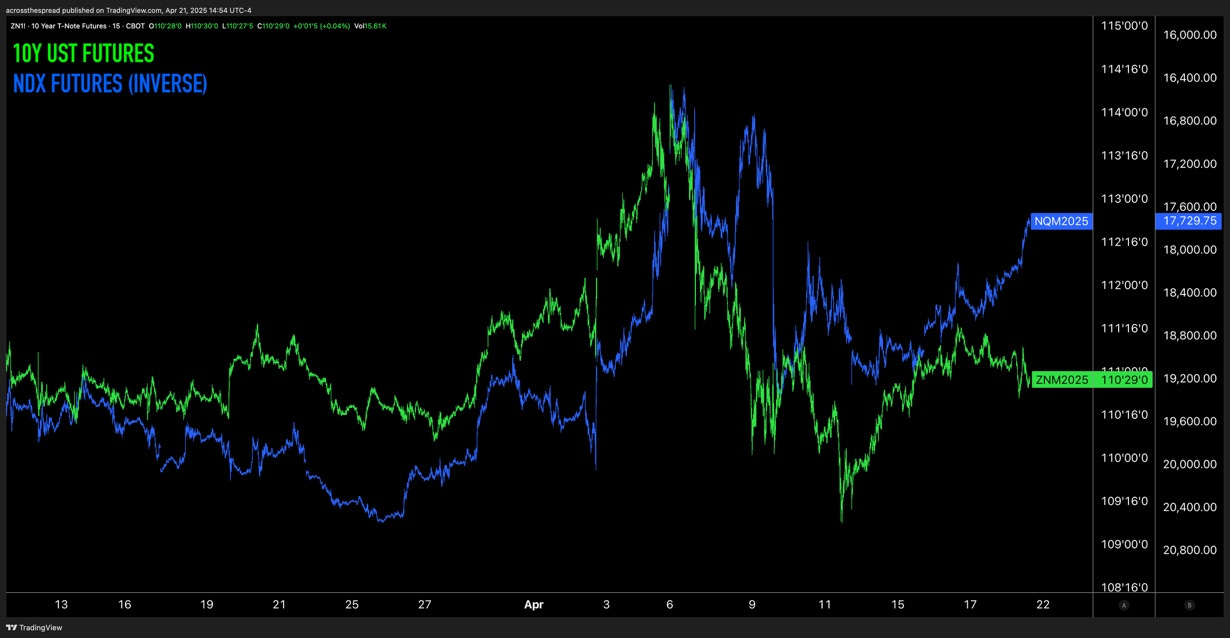

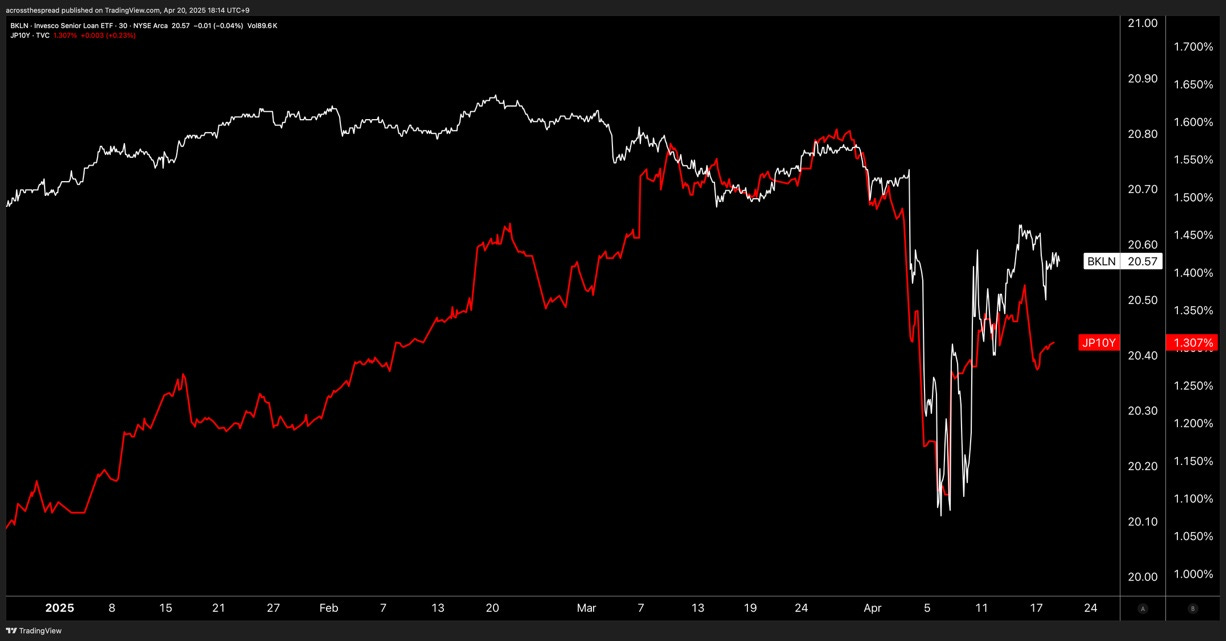

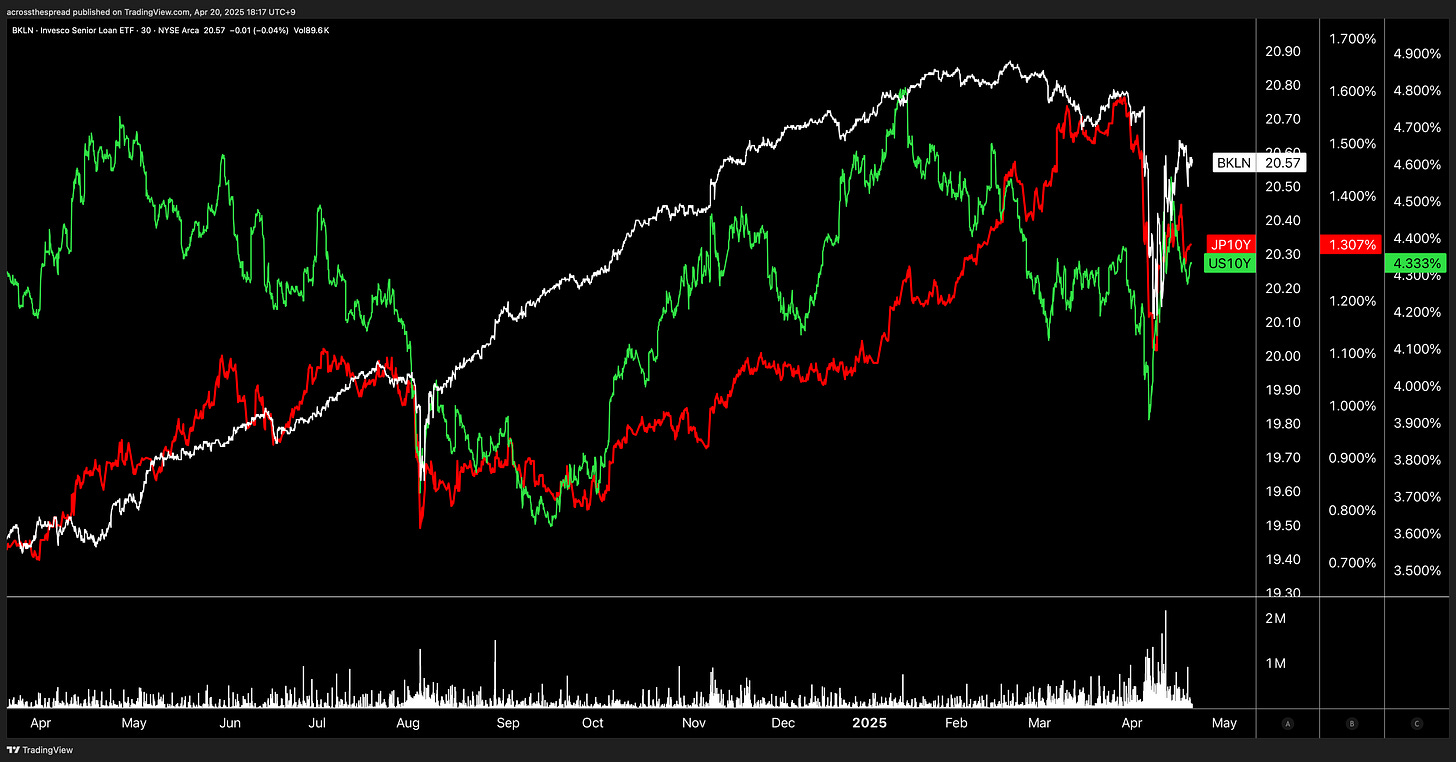

USD Leveraged Loans ETF (BKLN) vs UST yields - not much in correlation, even amidst Liberation Day / flip flop moments:

But- USD Leveraged Loans (BKLN) FAR more correlated vs JGB yields:

This USD leveraged loans tight correlation to JGB yield volatility suppression / blowups has been longstanding:

Stay tuned, and watch USDJPY 140.

Thanks as always,

Weston

Timely as usual. Thanks.

Thanks mate. Hope the family is well. Thank you once more Nakamura san 🙏🏻