Update On JPY Strength Continuing Amidst Nervousness In Broader Markets + Preview of "Land Of The Sinking Yen"

Near term USDJPY→ low 140s, and how surging German & JGB yields, as well as JGB & JPY futures quarterly expiry ahead impacts JPY. Plus: a preview of "Land Of The Sinking Yen" -the case for USDJPY 180+

My immediate-short term view remains favoring USDJPY downside - I do think that we will indeed test that next ~141.50 support in the near term, for the short-term, as further JPY strengthening forces in addition to my previously published list have either emerged, or are on the horizon: German/EU bond yields surge, JGB yields surge, March’25 JGB futures quarterly expiry, March’25 JPY futures quarterly expiry, Japan corporate repatriation into March FY-end, and more.

I also include a preview for a coming deep-dive piece called “Land Of The Sinking Yen: An in-depth analysis of the dire, long-term structural weakness of JPY, and how we get to USDJPY 180+ in the coming year, and 200+ thereafter” at the end of this article.

In my last article above, I discuss the key forces behind JPY’s strength underway, as outlined below +latest respective developments:

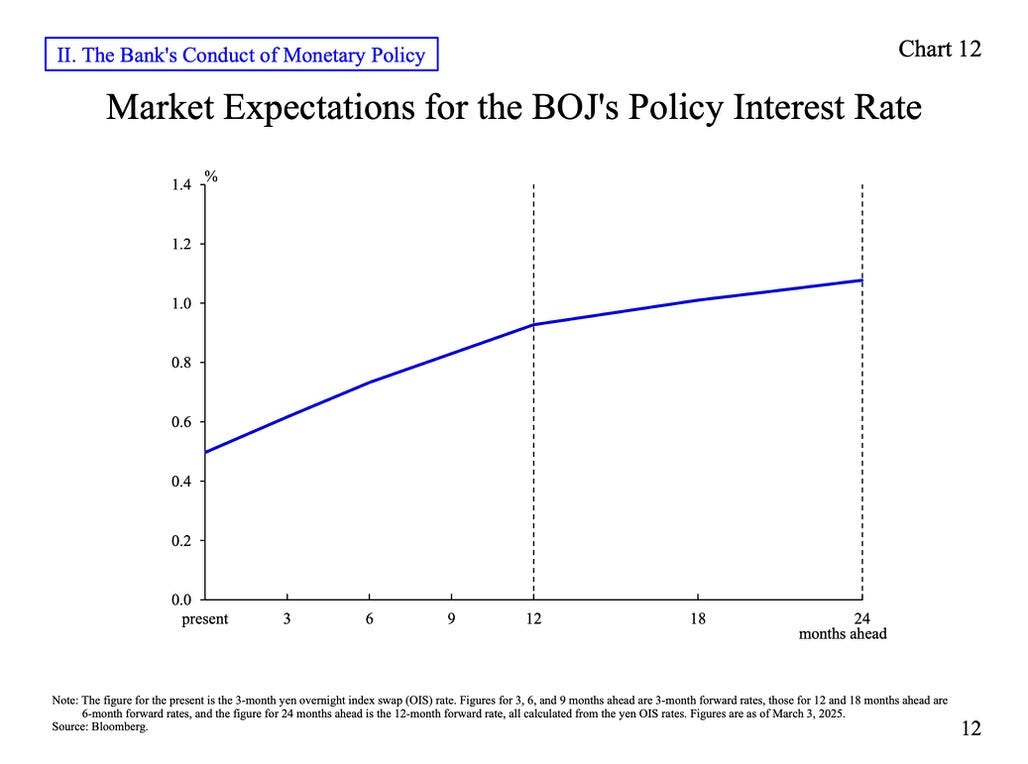

Shifting market expectations of BOJ rate policy: “50 bps ceiling” perception dispelled). Here’s a slide from BOJ Deputy Governor Uchida speech last week:

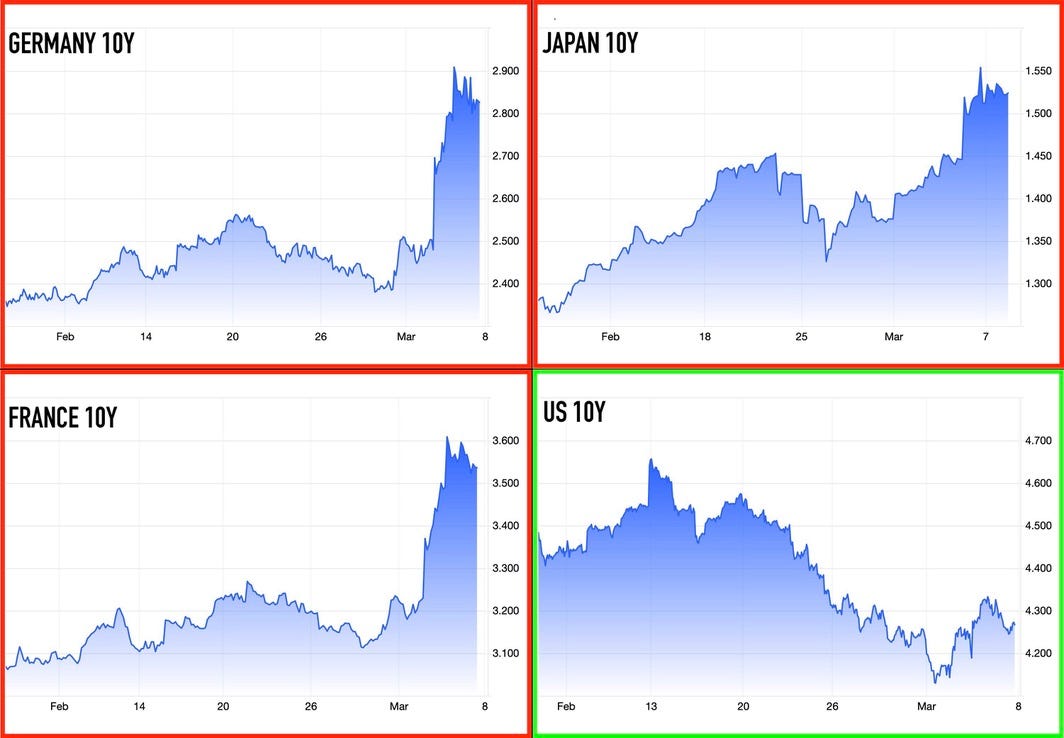

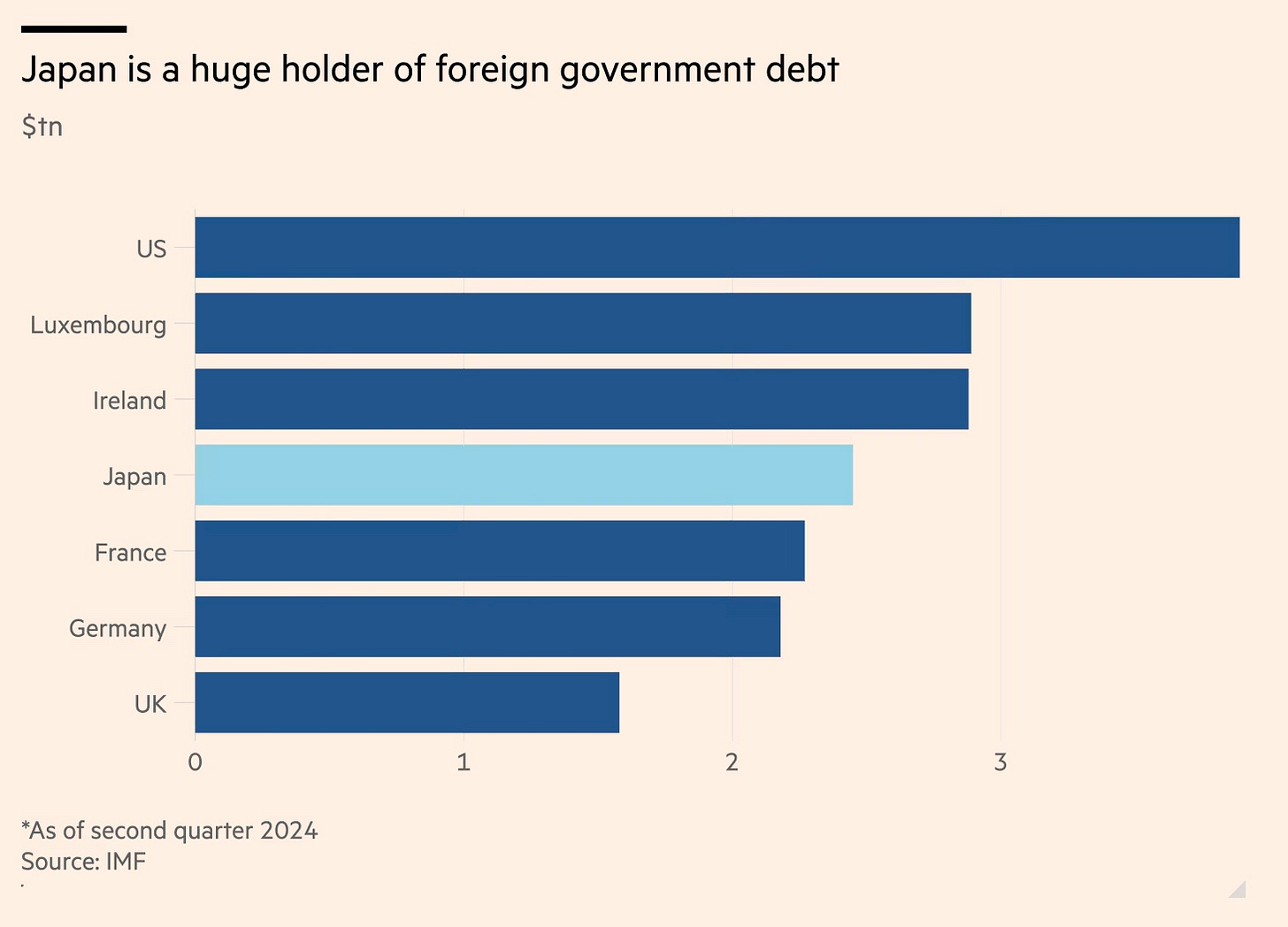

Yield spreads narrowing: not so much a UST yields factor than it is a matter of JGB yields continuing to surge. Also, yes indeed JGB yields jump alongside European bond yields (Germany) which blasted higher last week, but JGB yields have also already been on a relentless surge prior to German bunds blowing up

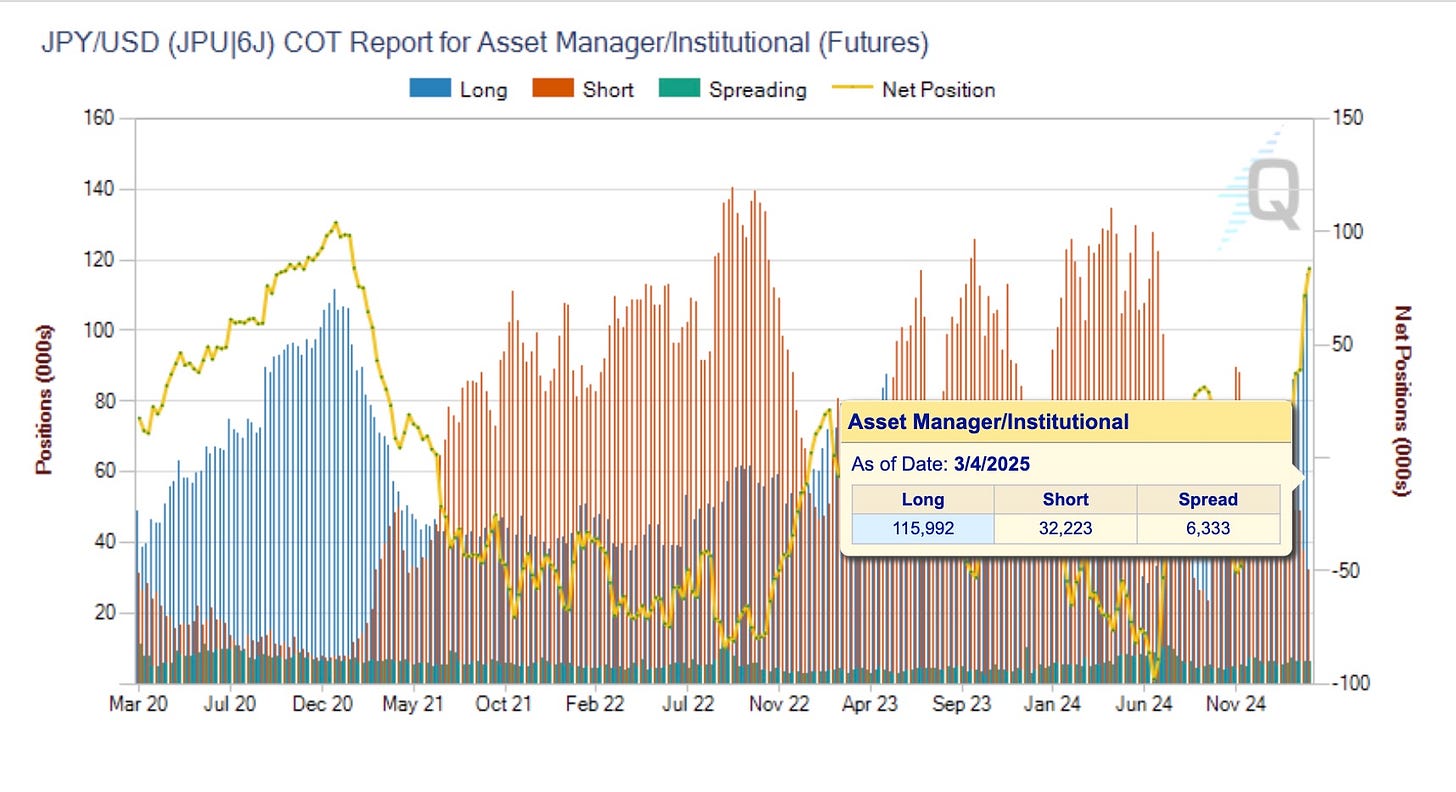

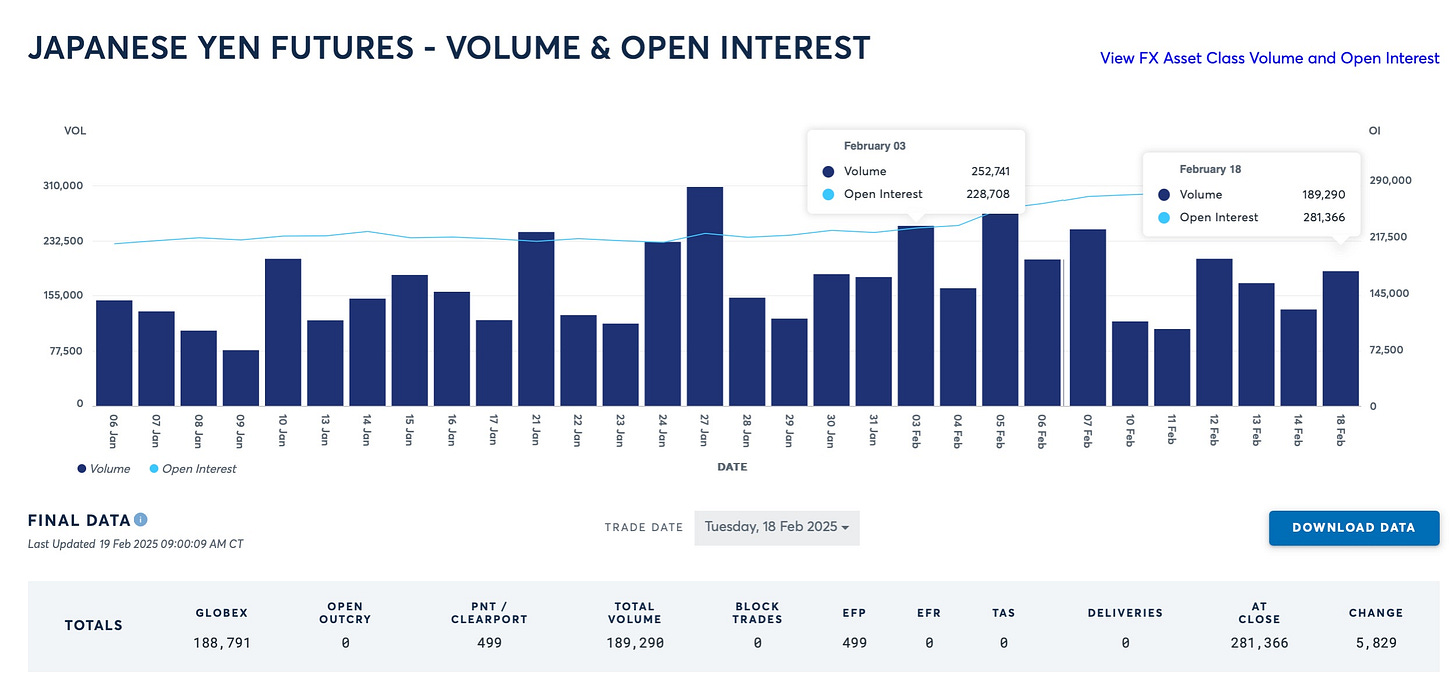

JPY futures: not just shorts exit/covering, but new JPY LONG positions opening - Asset Managers’ (gross) long position at record highs

CTAs/Systematic Trend Following Accounts: the steady pace in which JPY futures are rising YTD make for CTAs to be on the verge of flipping their now-very-unprofitable SHORT JPY trend trade → LONG JPY (if they haven’t done so already)

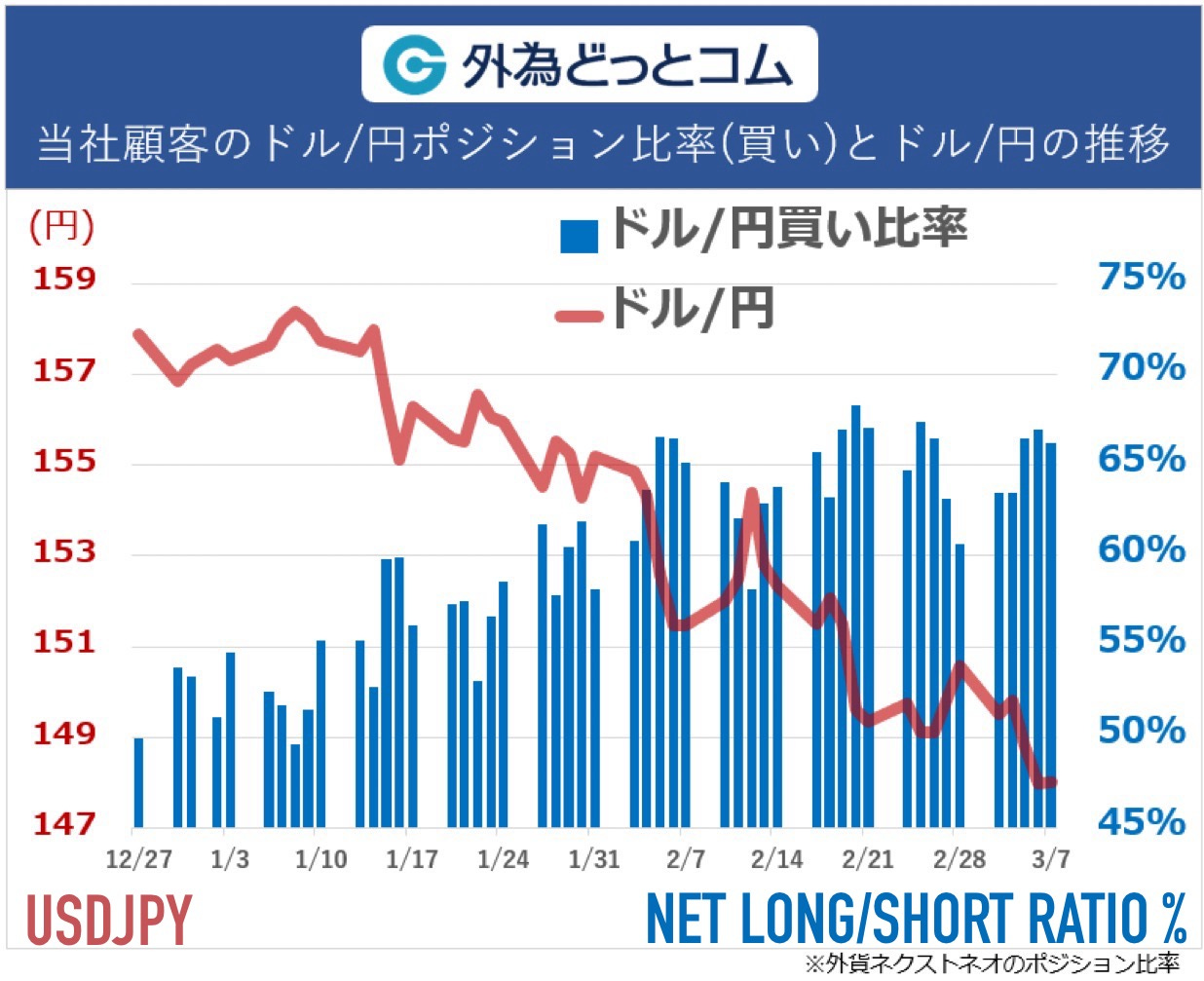

Japan levered retail FX traders: the purposeful and reliable contrarian (directionally wrong / market momentum fueling) flow remains net long USDJPY - which means continued daily margin calls and forced position exiting flows, in-line with existing downtrend

One more thing I will add to this list of forces strengthening the yen that I didn’t mention in my previous publishing:

There has been a trend occurring among Japan Inc in recent years - in which those with massive overseas operations have not been repatriating their foreign earnings back home (converting foreign earnings → JPY), and instead, have either reinvested abroad, or simply kept their earnings in foreign currency - either way, not buying JPY, and understandably so.

Recently there have been rumors that the Japanese government is working on offering some sort of tax incentives to these multinationals to repatriate (some) of their foreign earnings back to JPY - or that they already have offered some sort of corporate reprieve for repatriation.

While I certainly think this is highly possible, I have no actual proof that this is actually happening - this may very well be completely fictional. But, IF it is the case that Japan Inc has some sort of new incentive to repatriate overseas cash back home to JPY, to some/any/whatever extent, then they would be doing so over this Jan ~ March period of Japan fiscal year end (end of March). It would also align with the behavioral flow of JPY’s steady, non-erratic ascent underway (as opposed to sudden, massively volatile bursts of chaotic price action - associated with leverage/speculative flows).

And IF this Japan Inc. yen repatriation flow being underway is indeed the case, AND said flow has been impacting/driving markets with this slow but relentless bid for JPY, then that may very well be approaching its last legs of FY2024 at end of March - after which the corporate bid for JPY may suddenly disappear. Note that (many many) prior years have seen very notable macro market pivot points occur around/shortly after Japan fiscal year end / start (early April).

USDJPY to 141.50 near term

After publishing my article What’s Behind 2025's Best Performing Major Currency: JPY - in which I explained the various forces behind JPY strength, I put out a few follow-ups via Notes.

(Normally I do this type of quick / shorter term commentary on Substack Notes- but Notes only allows for up to 4 images/charts per - and if further commentary is needed I will write up in this format. Nonetheless - keep an eye on Notes for quick, article follow-up commentary and more https://substack.com/@acrossthespread )

Regarding this one:

Here come the JPY bulls.

USDJPY sharp drop ↓, now 0.50 away from breaking sub-150.

As I wrote previously, this is not (just) JPY short covering - new long positions have been added.

JPY +3% in Feb as JPY futures open interest ↑ +50k contracts (+25% increase)

Key support to watch (other than round figure 150)

USDJPY 148.50, then 142.50

And then JPY futures for the also prior flagged abnormally large open interest for Jun25 calls at 0.0070 & 0.0072

Potential immediate term cross-asset impact on DM indices↓, UST yields↓, gold↑

…I say:

“Key support to watch (other than round figure 150)

USDJPY 148.50, then 142.50”

I just realized that I had mis-typed the latter - it should be:

USDJPY key support levels of 148.50 (now broken), and 141.50 (not 142.50). Here is how I arrive at these levels - and as always, these aren’t precise levels down to the decimal point.

Many of you at this point are familiar with the following, but it’s nonetheless important and necessary to revisit via a quick chronology + corresponding articles from the last bout of what turned out to be a rather viciously scarring JPY strengthening, after having brushed off a round of yenterventions at the end of April - start of May, and USDJPY sitting comfortably north of 160.

USDJPY’s most recent top tick of 162 was put in on July 11th via yentervention round 2 of 2 for the year, and the last one since.

A Post-CPI Yentervention?

·The case for why the sharpest intraday drop on USDJPY since Oct’22 underway is yentervention - as well as why it is NOT, and why the distinction matters greatly for broad macro markets.

Following a softer than expected U.S. CPI print with a MoM decline…

After which, a sharp, one-sided plunge in USDJPY kicks off via JPY short covering / short squeeze, and closing out / forced exiting of JPY funded carry trades. JPY strength accelerates, USDJPY approaches the critical support level of 152.

USDJPY: 152 - The CrowdStrike of Global Markets

·(Video + Written) As JPY strength shakes up markets, USDJPY at 152 is the world’s most consequential green & red blinking ticker price level in the immediate term.

USDJPY 152 key support breaks on continued JPY upside momentum…

Warning For US & Europe - Japan Is Seriously Crashing Right Now

·Important heads up - equities are seriously crashing in Tokyo - NDX to follow (if not already underway). This is an impromptu, time urgent market flagging for investors/traders in DM markets globally.

And then Black Monday 2024 occurs on August 5th…

Black Monday 2024

·Japan equities worst day since Black Monday 1987 today: Black Monday 2024. Live stream video w/ Michael Gayed during Japan trading hours.

Japan stocks worst day since Black Monday 1987 today on Black Monday 2024.

At 15:00 Japan cash close:

🇯🇵NKY -13.5%

🇯🇵TOPIX -12.2% (Sector wise, best: Air Transports -6.7%, worst: Banks -17%, Insurance -17%. Most traded notional volume: 8306 MUFG -18%, Tokyo Electron -19%, Toyota -13%)

🇰🇷KOSPI -9.5%

🇦🇺ASX200 -3.7%

🇭🇰Hang Seng -2.37%

🇺🇸NDX Futures -5.6%

🇪🇺SX5E Futures -2.7%

🇯🇵10Y JGB Yield 0.83%

🇺🇸10Y UST Yield 3.62%

USDJPY -3.2%

MXNJPY -7.25%

AUDJPY -4.36%

CNHJPY -2.45%

BTCJPY -18%

Watch my live, mid-day discussion with

from earlier today on X and Youtube:

It is from this period of chaos that I have been / am currently pulling these particular levels of USDJPY 148.50 and USDJPY 141.50 support from:

~148.50 was a level in which the post-152 breakdown/blowup found immediate-short term upside resistance (initially held in August, then broke in early October), and went from being upside resistance → downside support thereafter. That type of dynamic typically signifies a price level of significance for market positioning and activity (for what specific reasons, I actually don’t care too much).

And that half-year-held support level has now been broken.

~141.50 is the next key level of downside support to watch - this is where the mid July to early August -11% plunge (-6.5% of which had occurred in 5 trading days as the bottom fell out below YenStrike USDJPY 152) had then hit bottom and sharply reversed.

Again, my immediate-short term view remains favoring USDJPY downside - I do think that we will indeed test that next ~141.50 support.

TEST is the key word - in the context of price action, to “test support/resistance” simply means that I think we hit those levels. It is not a call on whether we break those levels of support or not.

JPY & Global Yields

I also want to highlight the broader DM sovereign bond market picture, which is currently the leading asset class among the other majors: equities, FX, commodities.

Below is an excerpt from my prior article from February explaining the JPY strength underway on spot USDJPY and yield spreads correlations:

https://westonnakamura.substack.com/i/156591512/jpy-and-yields

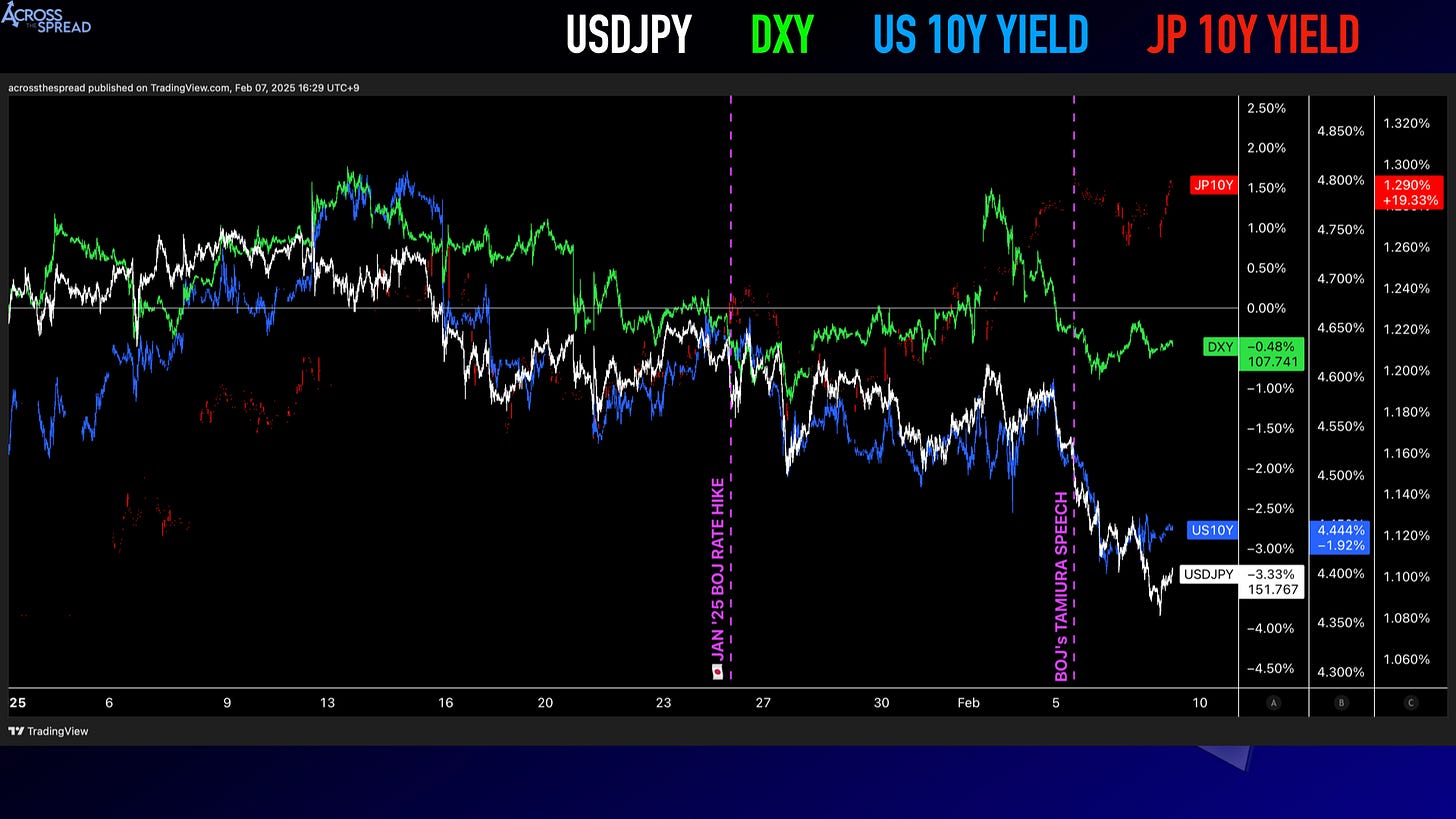

USDJPY has been moving very closely in-line with yields - US long-end yields, which have also been on a decline. 10Y US yield downside has been glued more so to USDJPY specifically, rather than other major USD-crosses, or broader USD index.

But it isn’t purely a US yield phenomenon. While global DM yields have been more or less in line with that of its UST counterparts, JGB yields have been breaking out to new multi-decade highs across the JGB curve.

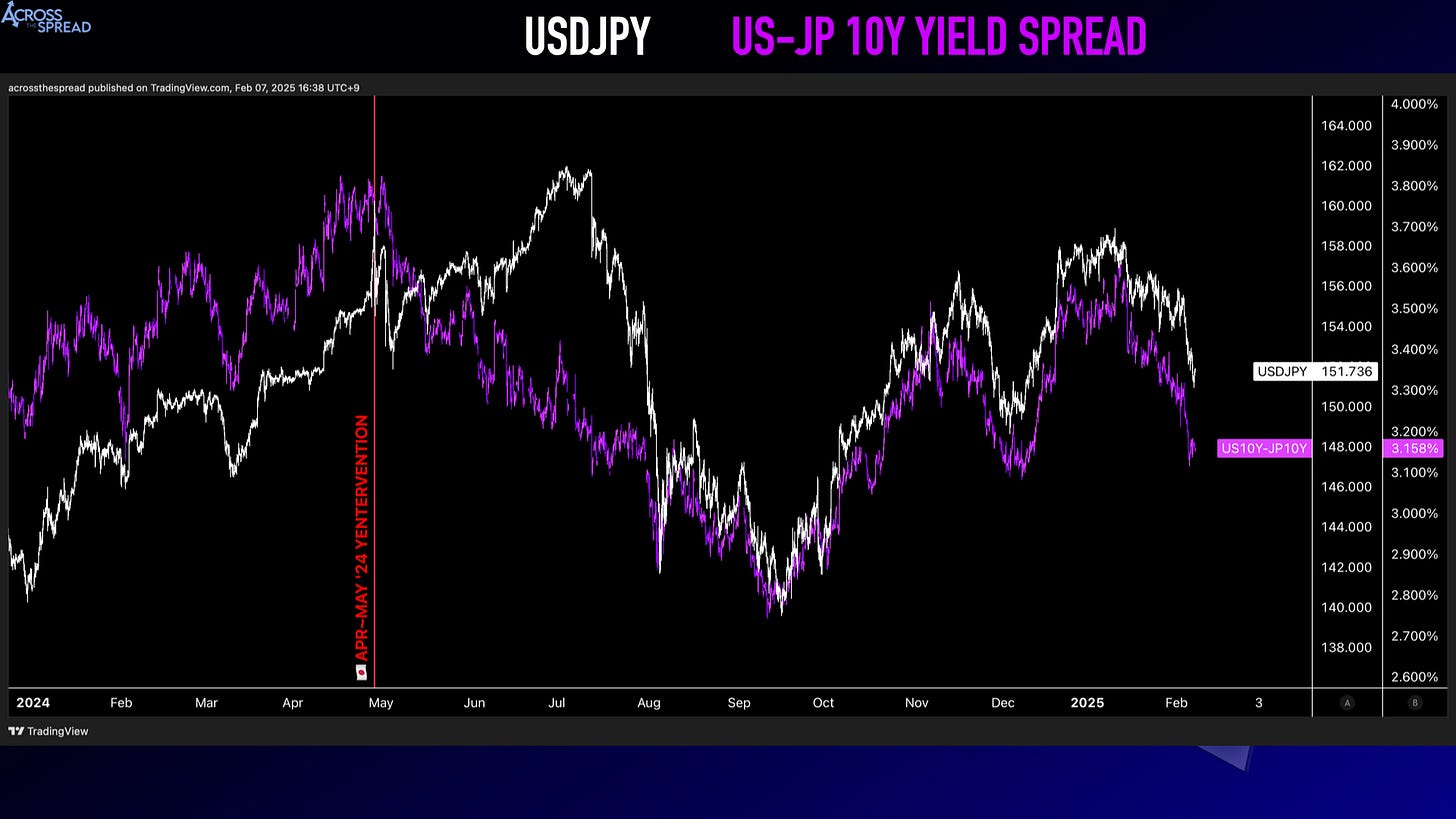

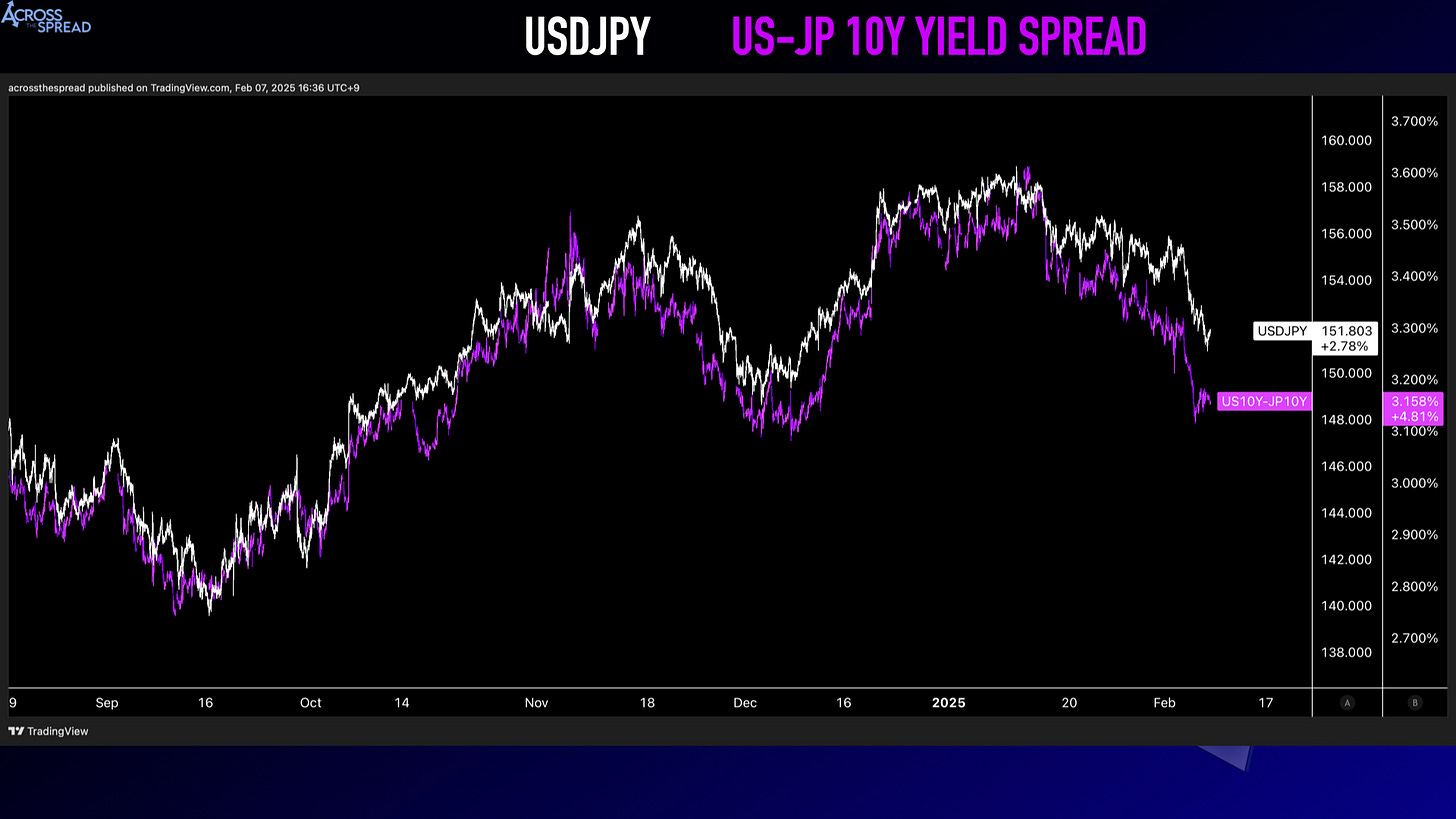

And thus - USDJPY price action is moving alongside UST-JGB yield spreads, driven by both sides of the spread: UST yields ↓ and JGB yields ↑.

And no - the above isn’t some extremely obvious and therefore no-value observation on yield spreads & FX moving together - as I then remind:

Recall last year following a round of yenterventions in late April ~ early May at USDJPY 160+. When Japan Ministry of Finance had done this very unnatural state-driven, non-economic market intervention of blasting some 40 billion USD down - it broke these conventional market dynamics. Indeed, those yenterventions put the top in and reversed US yields back downwards at the time but USDJPY recovered, and continued rising against falling US yields and more notably against narrowing US-JP yield spreads - as USDJPY’s rise had been occurring alongside JGB yields also on the rise. In other words, JPY and JGBs were both getting sold off simultaneously - and was a trend that had lasted for an uncomfortably long ~2 months. “Uncomfortable” (i.e. disastrous) because it meant that during that time frame, neither yenterventions (MOF), higher JGB yields (BOJ) or lower US yields (Fed/US) could do anything to stop USDJPY from rising.

So, just because USDJPY has now re-aligned with US-JGB yield spreads in terms of market price action, lets never forget that such relationships are never a given.

But for the moment, yields and FX are re-aligned.

What’s Behind 2025's Best Performing Major Currency: JPY

·Bank of Japan hiked rates 2 weeks ago. So why is JPY strength picking up now over the past few days?

Markets pricing out "BOJ policy rate 50bps ceiling" perception on aggressive BOJ rhetoric. A look at near term JPY strength.

And as it still remains the case where spot USDJPY and US-JP 10Y yield spreads are moving in near-lockstep, especially for this YTD yen strength move…

The 10Y UST - JGB yield difference has plunged back down to around 2.70% currently. The last time yield spreads were this narrow, spot USDJPY was around (or testing) 141.50 from the summer ‘24 JPY strength turmoil.

And now that we’ve broken below 148.50 support, we will likely test/see the next support levels of ~141.50, for the other reasons given in my last write up + their aforementioned respective developments.

Here is what else to be aware of in the yield space for the immediate to near-term that has been impacting JPY to the upside, and can further fuel, or potentially stop and reverse this current JPY strength.

EUR / German bund yields

I have a whole different piece on global DM rates in the pipeline - as what Germany is doing with its “debt brake” is a major shift in the global DM rates environment - one that can rival the Bank of Japan reversing decades of radical JGB / easing policy in its global, cross-asset significance.

If we want to understand JPY strength drivers at the moment, we also need to watch Europe, and on an intraday level. The euro may be ripping higher vs JPY (and everything else), but JPY has been strengthening vs USD at the same time. In fact - much of the USDJPY intraday downside has occurred during the Europe/London trading session (post-Asia close, pre-US open) - particularly during EU bond cash trading hours, during which JPY has been strengthening by nearly 1% vs USD, and in line with German bunds and French OATs price action selling off.

To get the simple and obvious out of the way - as skyrocketing German bund yields and French OAT yields rally the hell out of the euro, and EUR accounting for two-thirds of DXY index - that is crushing USD against EUR, and spilling out to dollar weakness more broadly.

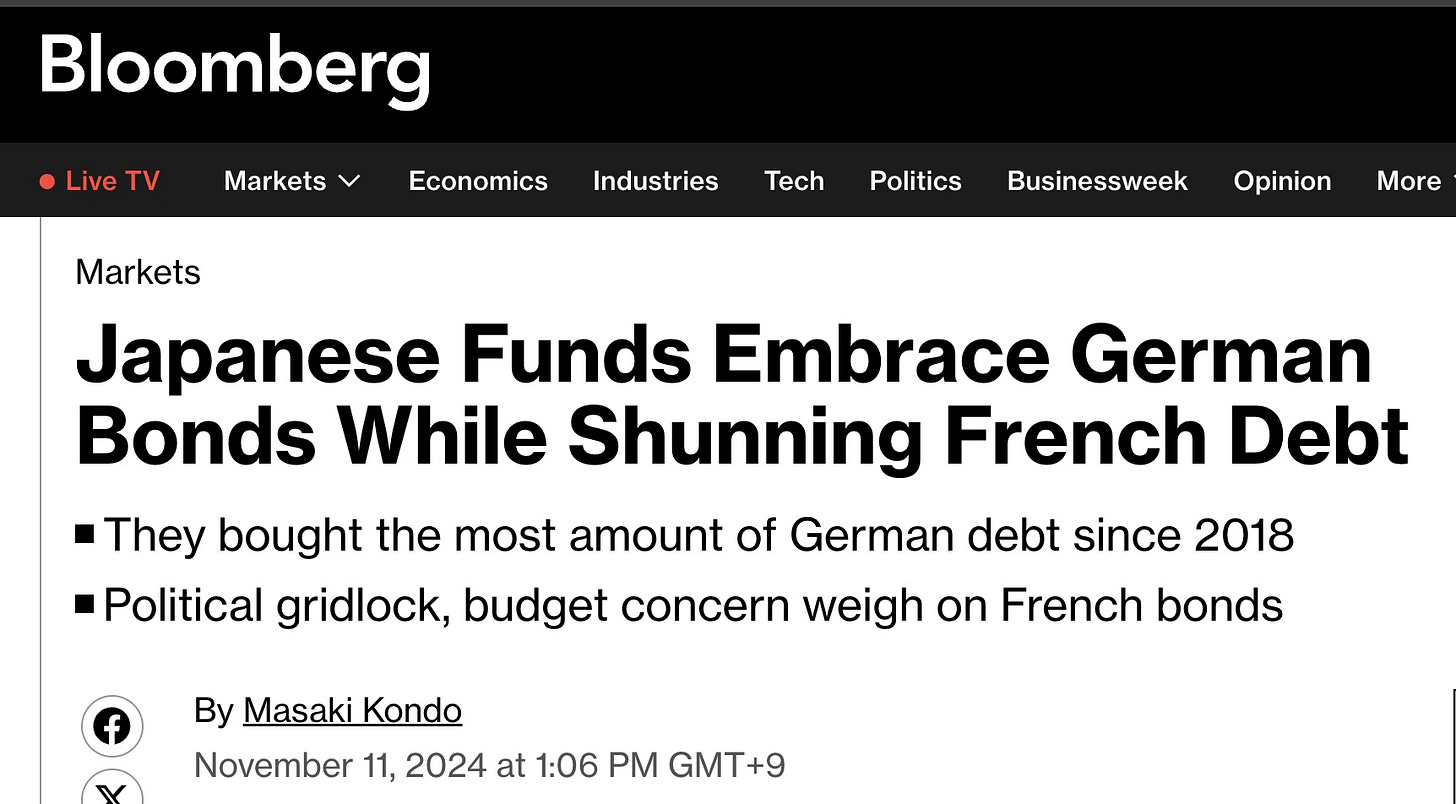

The far more significant and overlooked take is - once again, Japan is a major investor/holder of European sovereign bonds, very much including German bunds. Recall my coverage of how Japan investors fire-selling and spiking yields of French OATs upon President Macron’s sudden shock call for a snap election, as well as further commentary post-US elections.

Here’s a clip from Dec 4th 2024 - this is exactly what is unfolding as we speak:

Japan Holds Markets Together As France Crashes Its Government

Well, it seems that the government of a great country like France will collapse this week.

I will dive deep into this topic and these sudden and extremely significant developments in a separate article for subscribers - but basically - the historic move in German yields last week is largely at the hands of Japanese investors, who had been dumping their massive holdings of French debt upon both political and geopolitical risk, and reallocated into other DM bonds - including German bunds. And now, it is very likely that the Japanese institutions are once again behind fire-selling German debt and spiking the euro last week, when Germany was suddenly no longer the fiscally strict haven that it had long been.

Though, again as per the video clip above - Trump and JD Vance yelling at Zelenskyy, which then leads to this immediate European debt-financed increase in military spending - none of this was a surprise / all of this was exactly as expected by many Japan institutional investors.

FT: Japanese investors dump Eurozone bonds at fastest pace in a decade (Jan 26, 2025)

Japanese investment flows have been “a stable source of [European] government bond demand for a long time”, said Tomasz Wieladek, an economist at asset manager T Rowe Price. But markets are now “entering an era of bond vigilance” where “rapid and violent sell-offs” could happen more often.

Gareth Hill, a bond fund manager at Royal London Asset Management, said the scenario had “long been a concern for holders of European government bonds, given the historically high holdings [among] Japanese investors” and could put pressure on the market.

https://www.ft.com/content/7f6b6ed7-7c55-4a41-a068-67131922363c

So the question is - if German and French AND JGB yields are surging - then where is this Japanese yield-starved, income seeking capital going?

Some of it is coming home (strengthening JPY) - but this is capital that is supposed to be deployed into green and red blinking ticker fixed income assets, not cash. So, it is once again very likely that the destination for this refugee Japanese capital is: good ol’ United States Treasuries. Hence, long-end UST yields not really participating with the broader DM yield curve blow up underway.

Lower US yields + higher JGB yields + surging EUR → USDJPY downside contributor. So, watch Europe cash bond trading.

Also in case you haven’t noticed - yes, both JPY strength itself, and European yields spiking (i.e. non-US markets) are causing the US equity market sell off. Far more so than anything hitting equities from within the US during this month of March.

JPY potential impacting forces looking ahead over the next days to weeks:

JPY & JGB Futures Expiry

Current front-month and quarterly active March25 JPY futures are approaching expiry on March 17th (1 week, or 5 trading days from now).

And as discussed prior, JPY futures open interest has been increasing along with JPY futures prices - i.e. new long JPY positions. These new long positions are currently about ¼ of the way rolled out of soon-to-expire March futures contracts and into June futures.

If you look at CME’s pace of the roll tool (shows the progress of the front-month futures open interest that has rolled to the next month’s contracts) - you’ll see that open interest in the soon-to-expire March25 JPY futures is basically in between the average amount and the prior highs (going back 20 quarterly roll periods).

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.