My highly unusual background in/into finance (how I got onto the Goldman trading desk at age 28 with no prior experience or academic credentials)

My personal framework and approach to trading/investing in markets

Career advice for the finance industry in an era of perpetual disruption and change

And as you can imagine, none of this is your typical message that would be delivered to this (or any) cohort, because it’s coming from: yours truly. My motives here are really no different from my market content and commentary that I publish- I accepted/did this (and was thrilled and honored to do so) only because I had a highly unique take and differentiated message on fact-based reality to convey, and was critically important to convey it - “controversial” or unorthodox as it may be. In fact, that’s what (in part) makes it of value to the audience.

The clip I’m sharing here is the second of the three topics - my framework and approach to trading/investing in markets, as it’s the most broadly relevant to Across The Spread, given that much of my subscriber base are those already working in institutional finance, or self-directed high-net worth individuals, or other forms of professional, full-time market practitioners.

That said, topic #1 on my extremely unconventional background is actually/probably most relevant to the Across The Spread community - as even though I’ve discussed this on many occasions and other podcasts previously, in my 1-on-1 discussions with long-time supporters turned paid subscribers, I found that many didn’t know my story (and much to my surprise). Which is why I’ll probably end up releasing the full presentation at some point- I just need to somehow fix the audio quality which is very messed up for the first few minutes.

This is the audio recording of my presentation (didn’t film this event on video), but in presenting to the room, I used a slide deck alongside the presentation, which I included over the audio track - and hence this being in video format (rough edit).

And also on that note, I include a 1 min video clip of Charlie Rose from 2014 interviewing Lloyd Blankfein, then-CEO/Chair of Goldman - which pops up seemingly randomly and out of sequence, as I kicked off the speech with this clip. But due to the aforementioned initial audio quality issues, I left out the setup explanation leading into the Rose/Blankfein clip in this video - so here is the just of it:

I watched this interview in full when it first aired in 2014 (well before I myself joined Goldman) - and re-watched many times since. This particular clip of what Blankfien says about what GS aspires to do had immediately stuck with me and left a deep impression - such that I have since used and referenced it over and over again with every single intern or new grad hire that I had personally encountered during my institutional days, as well as everyone I’ve ever mentored in markets thereafter. And now, a decade later, I am still doing so, given the profound impact it has had on me. So that’s the context.

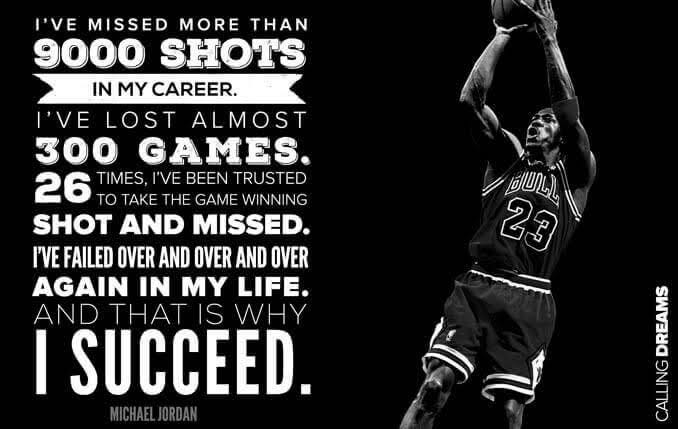

And final point I forgot to touch on regarding “Trading Losses” (though I’ve also discussed this on many occasions previously)-

Market Losses vs Market Tuition

PnL losses in trading are not actually losses IF you can have a takeaway or pull a lesson to learn from it - if you can do that, then monetary losses aren’t losses at all- it’s tuition. But if you don’t learn anything new or have any takeaway, then you’re just left with the monetary PnL loss - and therefore it is a pure and simple loss. So- ALWAYS try to find some sort of lesson, or a mistake, or discover a personal flaw to not repeat (or improve upon) - find SOMETHING to make your red & green (or in this case, just red) blinking ticker loss worth it - and never pay that tuition again (or pay less in tuition upon cognizant incremental improvement). By that approach, it’s entirely possible for one to never actually have a trading loss. Market losses are not only inevitable, but they are critically necessary. Nobody is immune from a market spanking, and the best traders with solid consistent and sustained track records who are still around after years ~ decades have taken more PnL losses (in both quantity and % or notional size) than the rest of us - but they turn it into tuition - and that’s why they’re survivors and become killers.

Any thoughts/criticisms are welcome as always - just remember, this isn’t iron-clad (nothing is), nor is it supposed to be some lecture for Paul Tudor Jones and any serious market participants who have their own processes and approach to markets (though this is definitely something that way too many on the institutional buyside is in need of hearing/practicing). This is a simple, broad, first-principles framework that I am laying out to young aspiring investors - but don’t conflate “general” with “for amateurs / not for me” - this is core to everyone.

If anyone has any interest in seeing the rest of my presentation - please leave a comment, message me, or like.

Thanks as always, and thank you to Temple University Japan investment club!

NOTE: Starting Monday April 1st, Across The Spread subscription prices will increase to $20/month, $200/year - as per much feedback received on “fair value price discovery” (though windows of discounts will likely come from time to time). So, if you find any value in the work done here and want full content access going forward, lock in your subscription at current rates $10/month, $100/year now, and become a voice in shaping the platform- as I simply only (and extremely seriously) care about / answer to / owe everything to my fellow stakeholders and genuine supporters for which this platform was built for, and built by.

With gratitude,

Weston