USDJPY Flirts With Breaking 150 (And Has Nothing To Do With Tokyo CPI)

Global rates and equity market implications for the immediate term.

Happy Thanksgiving to my fellow 🇺🇸🍗

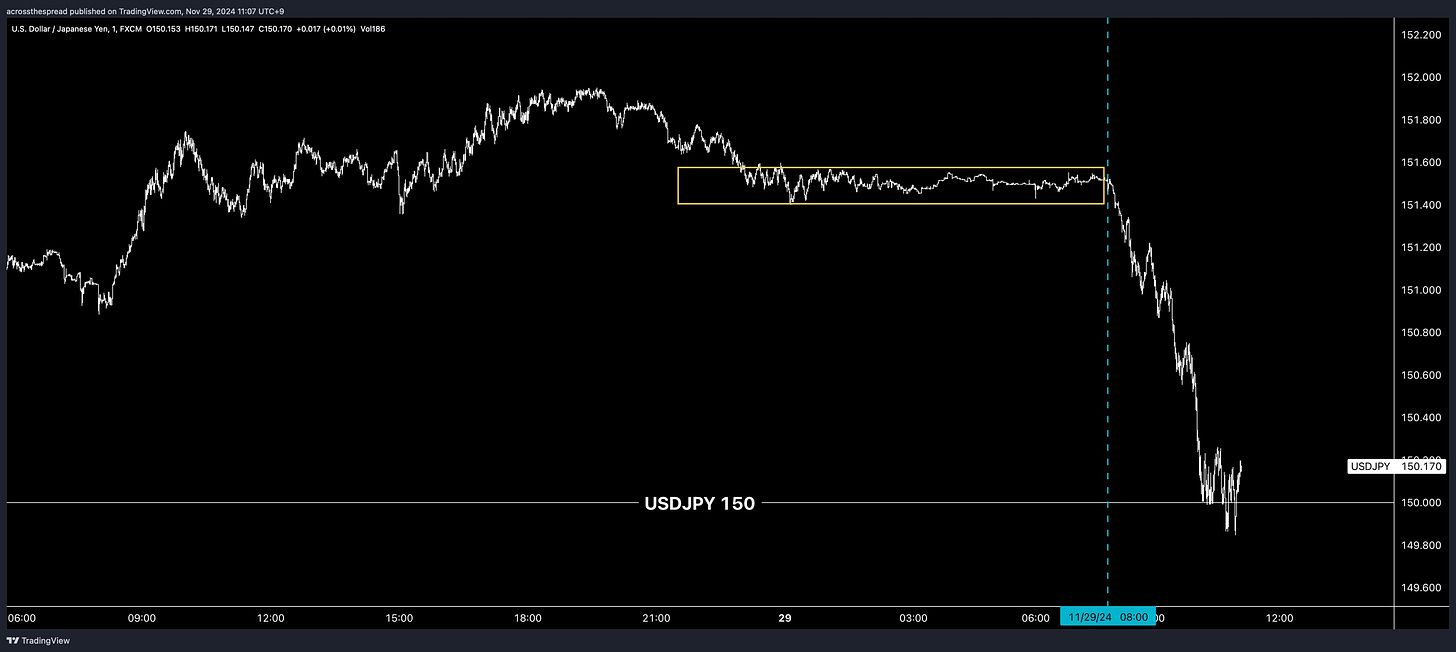

🇯🇵AM trading session saw USDJPY drop -1% from 151.50 to printing sub-150.

This move followed a dead-flat ±0.1% “trading range” in the overnight US session on holiday.

This move did NOT follow the hotter than expected Tokyo CPI data release (Tokyo headline CPI: 2.6% vs 2.2% estimates, Tokyo Core CPI: 2.2% vs 2.0% estimates) - contrary to the broader narrative currently being regurgitated out there.

Tokyo CPI data release time was 8:30AM. USDJPY selloff began around 8:00AM. So… market literally did not FOLLOW Tokyo CPI data - in other words, market is not “in reaction to” any such macro data.

Not to sound like a broken record but… markets - as in global cross-asset macro markets, are by and large moving to algorithmic flows, not fundamental active managers. Particularly on Thanksgiving night’s dead trading activity - the more absent the human active flows are, the more that systematic and algo flows’ market impact proportion becomes visible.

This is not a USD move- this is JPY strength.

I say that because the post-US election move higher on USDJPY from 151.30 to 156.74 was not necessarily due to a weak JPY - rather, the move has largely been a dollar rally. If you look at JPY vs other major FX pairs since election day, we’ve actually been seeing JPY strength ex-USD:

…and indeed, one can also look at the same chart above and say that this is EUR, GBP, AUD weakness rather than JPY strength - and indeed, they’re weakening because of a surging USD, which is spilling over into a relatively stable JPY.

USDJPY 150 Support & Cross Asset Impact

The USDJPY 150 level is notable in the immediate ~ near term, because 150 was a prior and recent level of upside resistance (as relatively short-lived and flimsy of a ceiling as it was), that’s now turned to downside support.

And I’d expect this support level to be similarly temporary and flimsy to hold in the immediate term ~ next few days.

Here’s why that matters to broader markets.

UST Yields

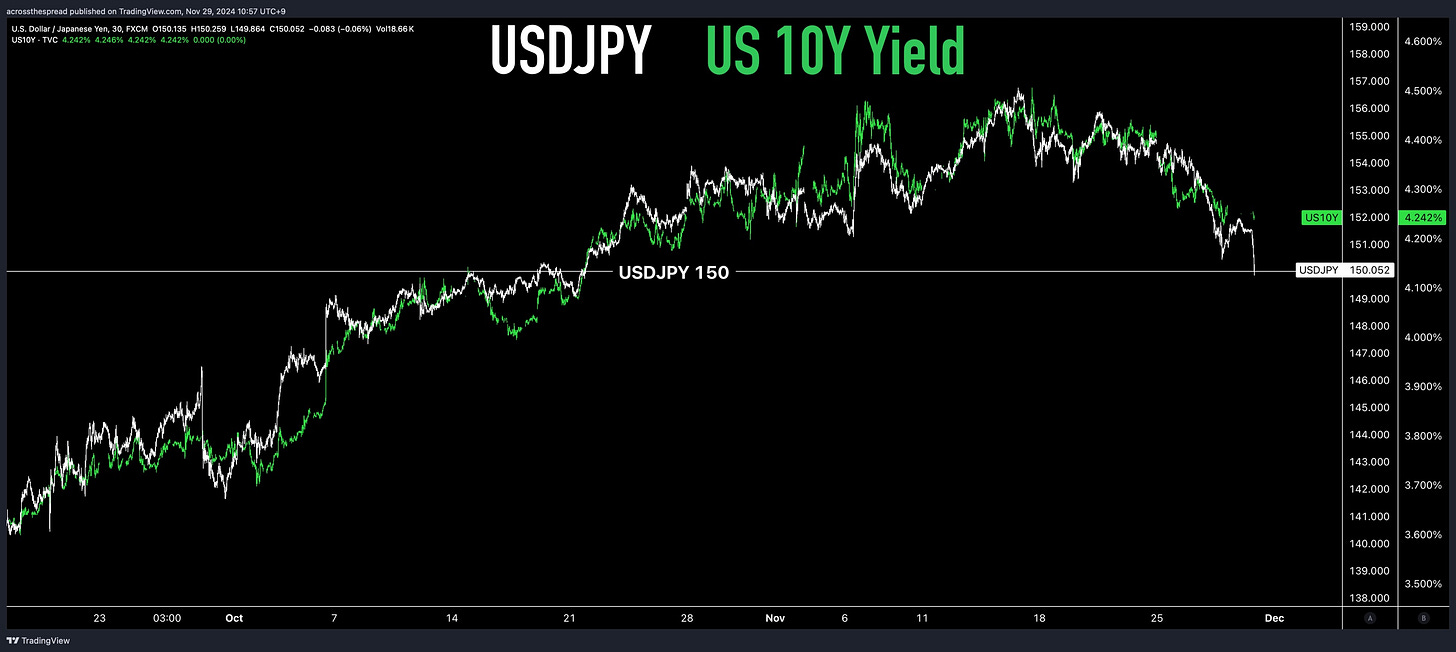

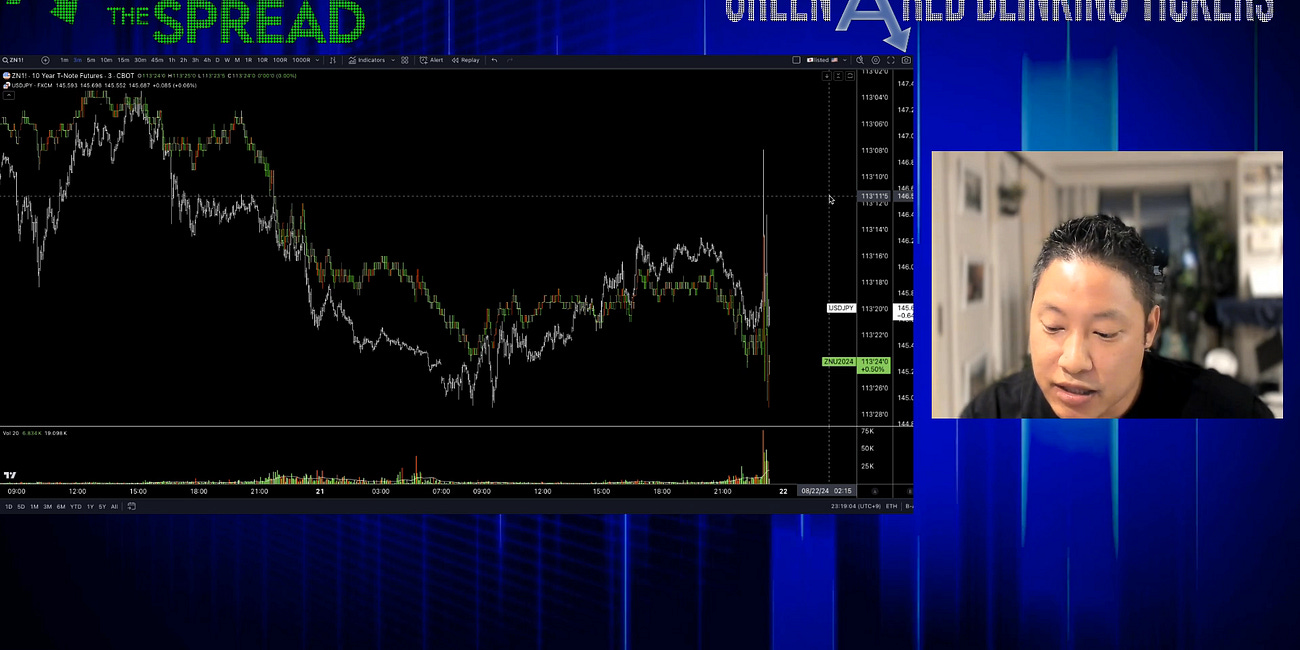

USDJPY and UST yields are once again trading in lockstep. And when it comes to the question of which is driving / following which - bond market, or currency, of the two, it appears to be FX driven price action over yields.

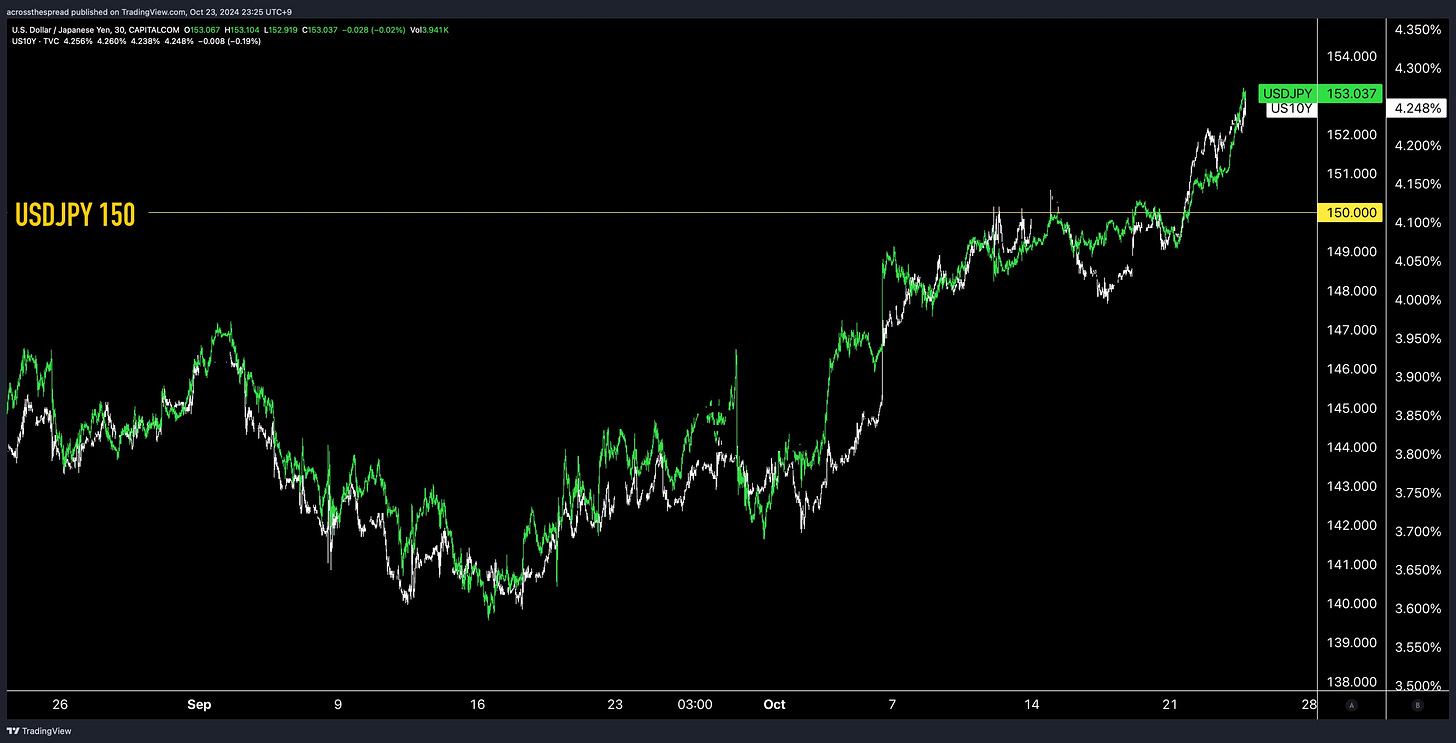

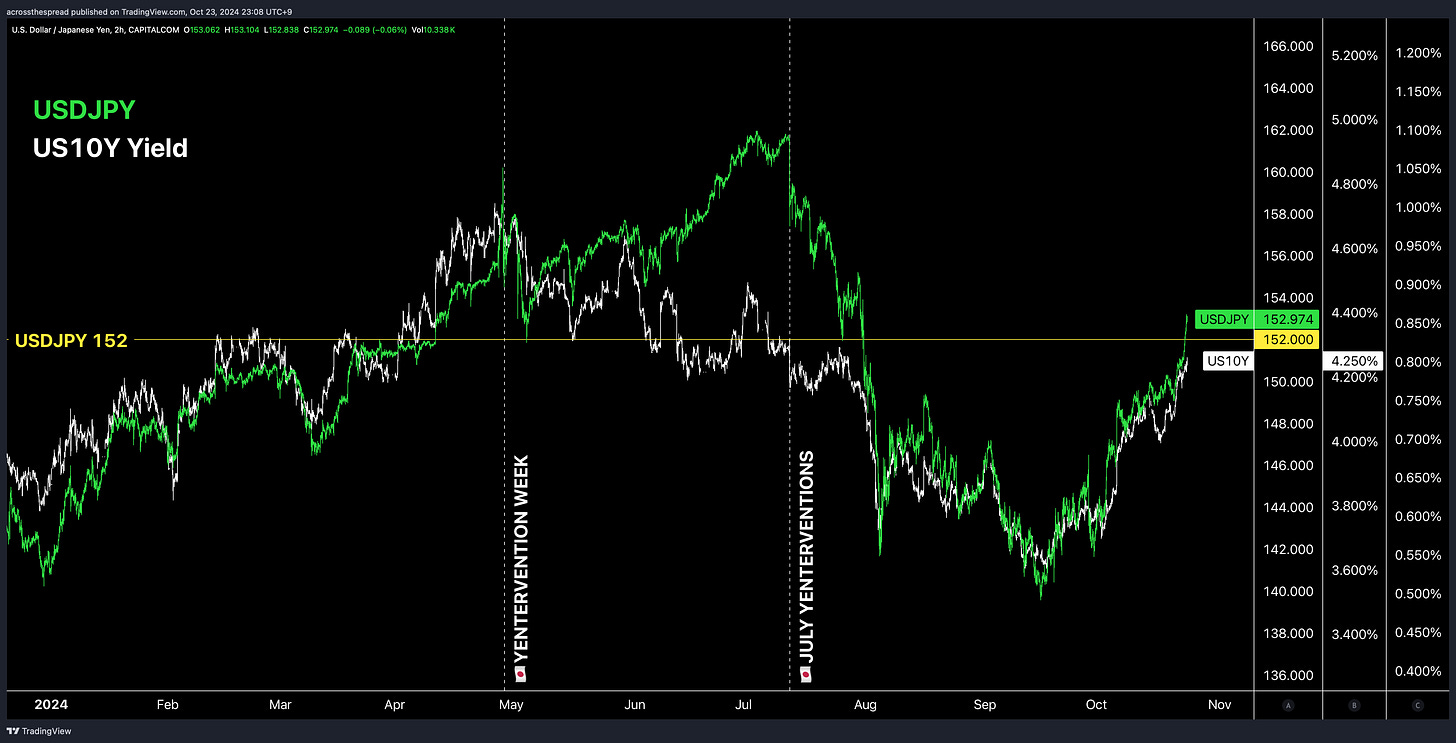

And as I’ve explained in my previous notes, the reason I have been saying FX moves yields and not the other way around is because if you simply look at price action during this recent leg of simultaneous mirror-image-upside moves on USDJPY and 10Y UST yields from September ~ late October, both are rising, and then find momentum to stall and trade sideways, and then both break out and resume upside.

That occurred at USDJPY’s resistance level of 150, capping, then relinquishing upside for both.

Rather than stop/starting price action based on any US yield level.

This has also been the case for basically all of 2024- certainly during the first quarter, where once again, USDJPY and US yields move up together in tandem, and once again, it’s USDJPY’s resistance level (later to become YenStrike 152) that caps upside on US yields, not the other way around.

So, should we break meaningfully below USDJPY 150 - and I suspect we may, then US yields have more falling to do as well, after momentarily pausing downside at ~150 on USDJPY.

US Equities

As I’ve discussed in my previous videos - this so called “Trump Trade” as it’s being widely defined (“USD ↑, US yields ↑, US equities ↑”) is not a thing.

Watch them if you’d like a further in depth explanation as to why (links below) - but as it relates to major equity market indices, the short answer is once again: these are programmatic algo flow driven market behaviors with cross-asset impact on display, and not a “Trump fundamental” reason. If you just remove this whole premeditated mindset of looking at everything through a Trump/election lens, the picture becomes clearer.

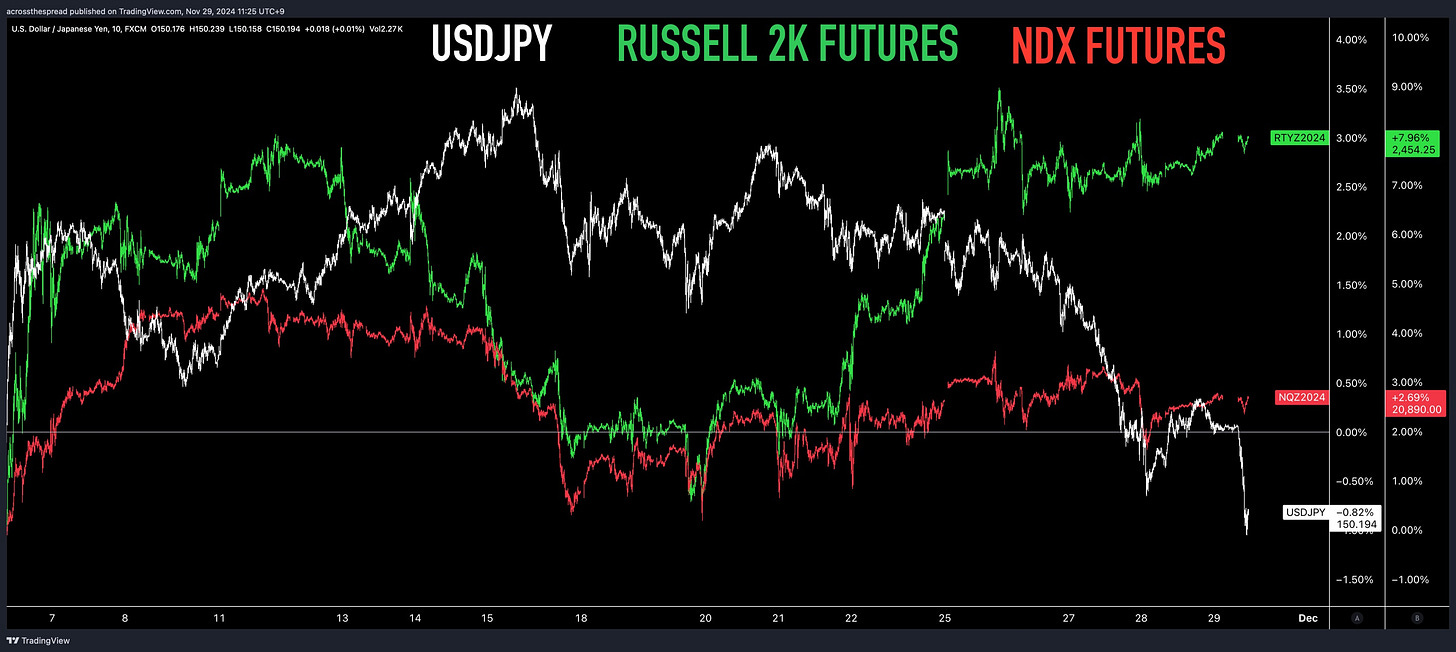

Take the Russell 2000 small cap index, which has not only been rallying, but more importantly, outperforming other U.S. indices - namely NDX100 since election day, as such:

And this is supposedly due to fundamentals of a Trump presidency being a greater positive for small(er) cap stocks (heavily US domestic exposed businesses) - despite so much of that very commentary followed by “…but puzzling that small caps are doing so well when yields are also rising…”

Remove the “Trump” reasoning, replace with systematic algo flow behavior. Russell 2000 outperformance vs NDX (or, NDX underperformance vs Russell), as expressed via NDX / Russell futures ratio (i.e. long NDX / short R2K) is merely moving directionally along with JPY post-election.

And so, if we see USDJPY make a sharp and meaningful break below 150, then we can expect in the shorter term alongside:

Long end US yields to decline.

NDX underperformance vs Russell 2000 trend to stop and reverse. This doesn’t necessarily mean a broad based U.S. equity index sell off (though obviously possible, if not probable) - it just means that in either scenario of markets up or down, NDX will outperform the Russell to the upside, or the Russell will underperform NDX to the downside.

Regardless of what Trump does or doesn’t do.

Reminder - he isn’t the U.S. president yet, and the current administration isn’t just sitting on their hands in their last days either.

And it’s end of year holidays.

Add all that up and what do you get? Likely - very inactive market participant activity for the next few weeks. Which means - people will be over-scrutinizing random programmatic algo flows as reflections of human market participants’ views expressed in markets.

Don’t be one of them- start with the premise that human managers aren’t the driving force behind every directional tick of macro markets - especially in FX and rates.

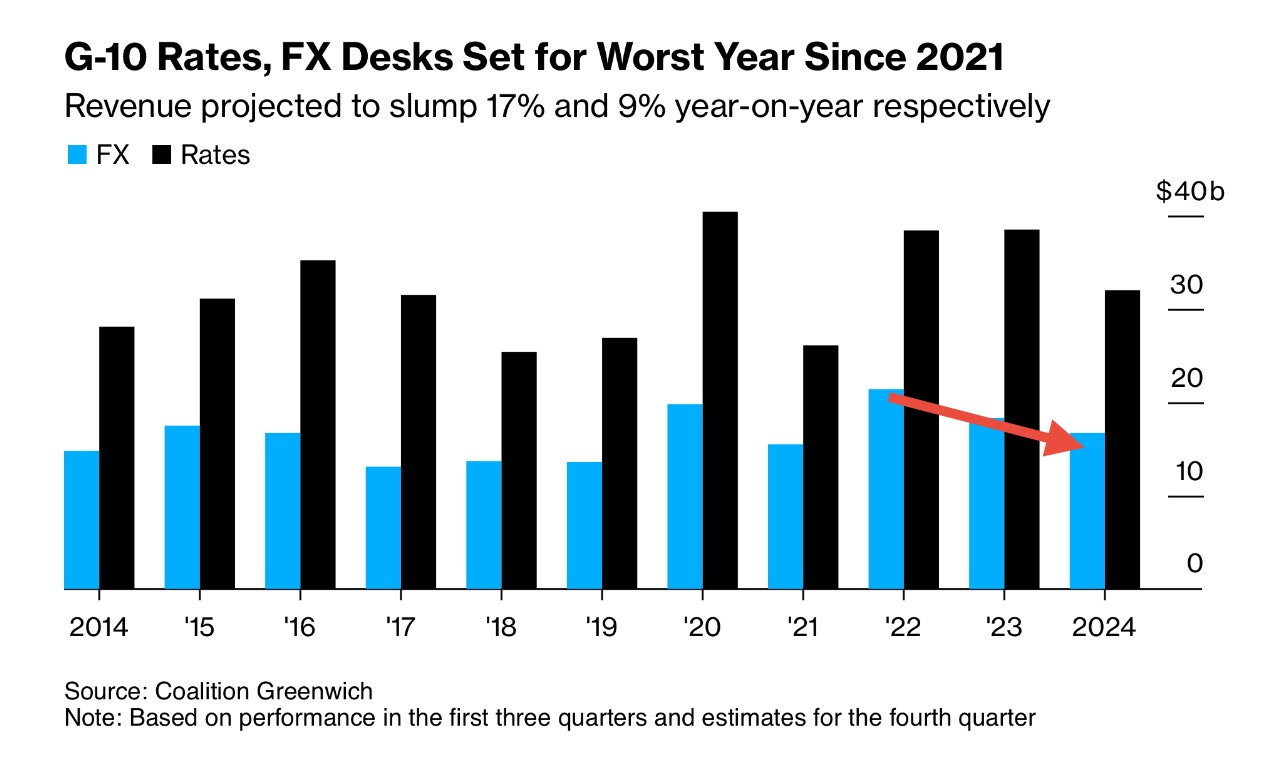

Here is an article from Bloomberg published just before I set out writing this (and very amusing how this was published alongside the regurgitation of “JPY strengthens on Tokyo CPI”)

Bloomberg: Wall Street Macro Traders Head for Worst Year Since the Pandemic

Investor confidence in making big macro calls dwindled this year as economic data surprises whiplashed bets on interest-rate cuts from the world’s major central banks. A seemingly too-close-to-call US presidential election and the unwind of once-popular yen-funded carry trades also rattled markets.

“2024 has been a year of sitting and waiting on the sidelines,” said Angad Chhatwal, head of global macro markets at Coalition Greenwich. “Hedge funds have come into the market sporadically around data points and events but they’ve not been as active on a continuous basis compared to previous years.”

https://www.bloomberg.com/news/articles/2024-11-29/wall-street-macro-traders-head-for-worst-year-since-the-pandemic

So, basically what I’ve been saying all along.

Watch this if you haven’t seen it yet- this is the moment where markets revealed themselves to be “full of shit” unconditional and random algo flow driven-

A Major Moment - Markets Just Lost Credibility

This is seriously concerning - which is why I am rushing out this unpolished, very raw video of my live market reaction to the BLS labor data revisions “release” for subscribers.

Trading Trump (1) - America’s Largest Foreign Investors And The “Trump Trade”

This is part of a broader analysis on the US elections and market implications through the perspective of Asia/Japan.

A very general, risk-on USD↑, US yields↑, US equities↑ market is at best a “US election trade,” but is absolutely not a “Trump (win) trade” (nor a “Harris lose trade”) by any means.

Thanks as always,

Weston