How USDJPY 140 Reversed Global Markets: USD, Equities, US Yields, Gold - A Deep Dive Into April ‘25 Market Behavior

Forget all of the nonsense headline narratives that markets are NOT trading off of, and just look at markets themselves.

As we wrap up this most significant month in global cross-assert markets since March 2020 - this is an overview and analysis of what, or WHO is NOT moving markets, and what IS.

•HEADLINES: The most embarrassing week of day-to-day “market explanation” attempts circulating broad consensus narratives this year (so far).

•NOBODY (human active capital) is trading.

•MARKETS: USDJPY 140 support level holds and reverses prevailing cross-asset market sell-momentum as USD, USTs & US equities rally, while gold sharply plunges.

A Week of Ridiculous “Market Explaining” Headlines

Here is what is NOT driving market behavior: consensus-accepted fundamental macro narratives and Trump-related headlines, as always. Here are the latest - which are among the most ridiculous in attributing to day-to-day market behavior, particularly as it relates to equities and risk-assets.

“Trump is going to fire Fed Chair Powell” - Markets: Risk-Off

This is so stupid on two fronts: the narrative itself, and the attributing of corresponding market behavior to it.

You know this whole non-realized “Trump put,” as well as this “Powell put?” Those haven’t been exercised, let alone currently even exist in financial markets. As I explain in a prior note “How Asia Is Guiding Trump Tariff Policy & Markets”

And so what was it that made Trump “cave” or flip on tariffs? It clearly wasn’t equity markets - why would he draw an an arbitrary line at some % level down on indices only to attempt to reverse trillions in market cap destruction that had already taken place. And it wasn’t bond yields themselves- 10Y USTs were recently well above 4.50%, far higher than they were when they started “spiking” last week - so its not those levels either. Bessent had clearly been aware of basis trade unwinds and VaR shock liquidations, and had likely told Trump about these dislocations occurring in green and red blinking ticker markets - but those unwinds are now underway and are happening regardless of any policy “reversal” or what have you. And again, Trump doesn’t know enough about the dynamics of the UST markets.

I honestly think what made the difference was Jamie Dimon on Fox Business with Maria Bartiromo- talking directly to President Trump.

“Don’t let this go on too much longer,” “recession and inflation likely” etc.

Lets not forget - Trump wanted Jamie Dimon as his Treasury Secretary. Not that he’s unhappy with Scott Bessent. But he did want Dimon, and had he had Dimon, this is what “Secretary Dimon” would be saying to President Trump right now. Dimon knows this, which is why he did this interview - and it worked.

No offense, (not Treasury) Secretary Lutnick, but Trump is going to listen to the guy who runs JP Morgan Chase over Cantor Fitzgerald 100% of the time.

I know that WSJ has since published an exclusive article detailing how Bessent and Lutnick tricked economic clown Peter Navarro into being distracted so that they can have time alone with Trump and get him to announce the 90-day tariff pause from the Oval: WSJ: Trump Advisers Took Advantage of Navarro’s Absence to Push for Tariff Pause - which, (if true) still doesn’t mean that “Treasury Secretary” Dimon’s message didn’t also resonate with or have influence on Trump’s 90-day reversal decision, nor that Lutnick’s presence alongside Bessent in this Oval Office tariff policy “coup” had any impact on Trump’s decision (as Lutnick would essentially be pleading the case that went against his entire public demeanor that was directly in-line with Navarro’s). Either way, what this article does validate is that indeed, Trump didn’t make this tariff flip based on UST markets, or any markets - he did so because those he feels are credible authorities on the matter (Bessent, Dimon) told him to do so. So again, there was no market-based “Trump put” exercised.

Back to stupid headlines and the whole Trump firing Powell thing - the “put” that has been exercised is: Powell himself - as POWELL is TRUMP’s put.

Unlike any other US economic downside that can and has been blamed on the “lingering aftermath of the disastrous” Biden economy (justified or not) - President Trump owns 100% of the tariff policy and its consequences, for better or worse. He knows this, everybody knows this, and he knows that everybody knows this.

Trump will not prematurely fire Powell - in fact, Trump actually wants and needs Powell to not only stay, he also needs Powell to continue touting “Fed independence,” and to not “cooperate” with Trump’s rate cut demands - because if and when the US economy hits his base harder than they had signed up for and they turn on him, Trump needs an institutionalized deep-state Powell to then blame for ruining what would otherwise be his glorious, tariffed economy. So, Powell isn’t going anywhere until his tenure ends, and until his tenure ends, Trump will never shut up about how late and terrible Powell is for the rest of Powell’s miserable days at the Fed.

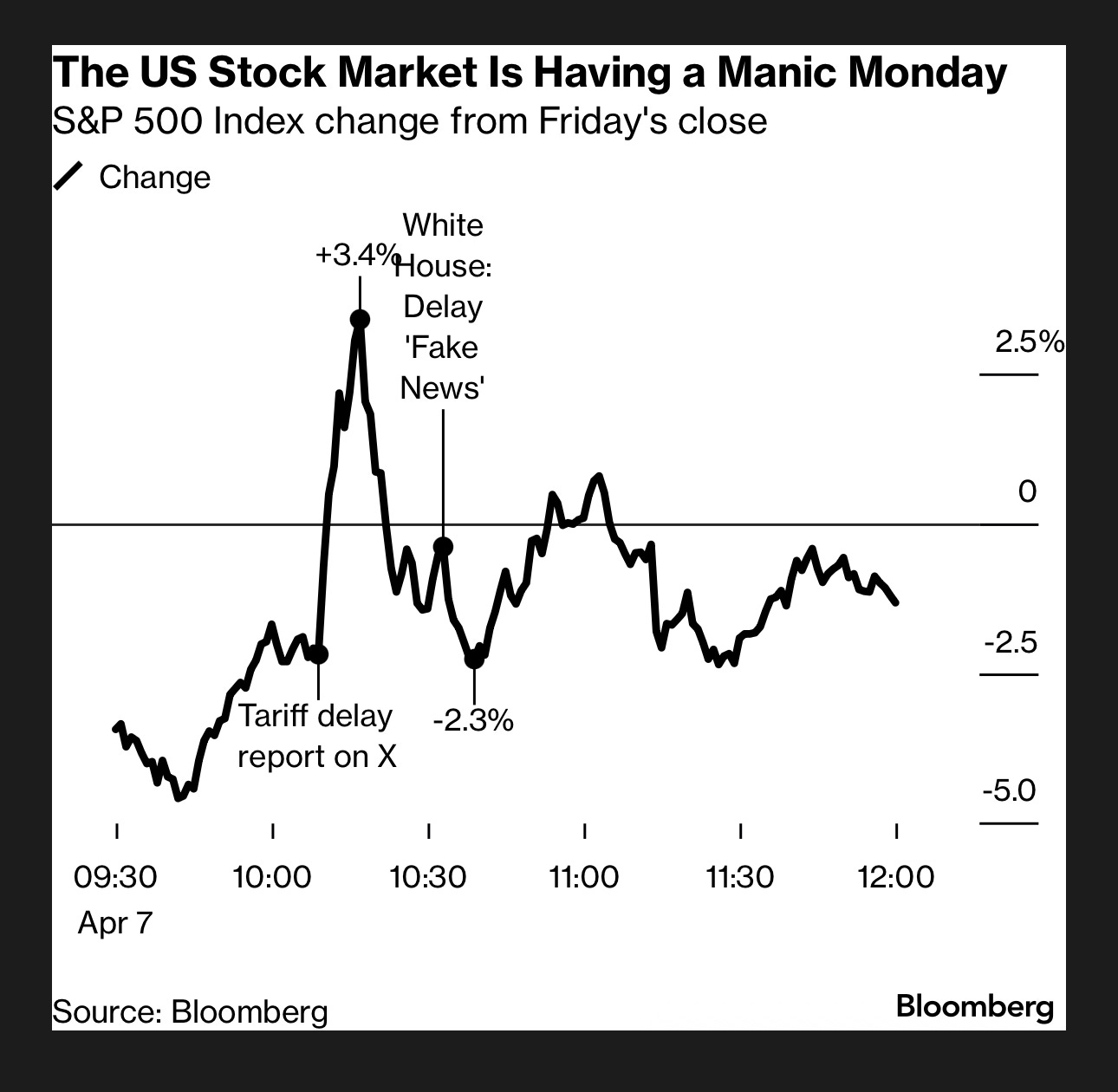

This is also incredibly stupid in terms of being the explanation for Monday’s market downside. If you recall, the rest of the narrative went: “Trump fires Powell (bad) → the end of Fed independence (more bad).”

Forget Trump specifically - if any US president somehow skirted the law and successfully manages to fire a sitting Fed chair only a year left until his tenure ends for no just cause, and thereby marks the historic end of the world’s most vital central bank’s credibility - do people seriously think that’s an SPX -2.3% type of day? SPX had a -3.5% day, a -4.8% day and a -6% day since liberation day alone - but somehow the notion of Federal Reserve losing its independence overnight was the 4th worst day. Yeah, I’m sure that’s why markets “crashed” on Monday (because they had been doing so well leading up to this), and subsequently “recovered” Tuesday as per financial media regurgitation machine. Seriously ridiculous “market read,” even for these clowns.

“Bessent says the China tariff levels are ‘unsustainable’ at a private JP Morgan event” - Markets: Risk-On

And this had rallied SPX +2.5% - because Bessent characterizing 145% US tariffs on China and 125% China tariffs as “unsustainable” was some unanimously adopted interpretation that “market participants” around the world had agreed upon in its interpretation - “unsustainable” = tariffs will be walked back imminently. So, risk-on.

“Unsustainable” is 1) beyond extremely obvious - are we really to believe that market participants everywhere were of the belief that triple digit tariffs suddenly imposed in a heat-of-the-moment manner between the world’s two largest economies that would effectively end trade between them was somehow cool in Bessent’s view, and that this “unsustainable” remark was a sudden and unexpected shift in markets’ prevailing perception? 2) “Unsustainable” can just as easily be interpreted as extremely negative - the Treasury Secretary is embarking on a policy that he himself knows/says is unsustainable, but for some disturbing reason, is forging ahead with it anyway, while contradicting every public utterance he’s made along the way.

This “market explanation,” if believed, would also imply that had Bessent instead said current tariff levels amidst a China trade war were “sustainable” - then conversely, it would be unanimously agreed upon as deeply market-negative and expressed via a decisive one directional market plunge in reaction. Yes, of course such a statement could be taken as risk-off due to a perceived elusively clueless Treasury Secretary, but it could also just as easily be perceived as market-positive - as the lucid “adult in the room” is exuding bold confidence in the strength of the US economy and its ability to withstand this controlled operation. I’m not saying “unsustainable” or “sustainable” is neither market-positive nor negative - what I’m saying is that this one word is by no means some broad-based, indisputably understood message to then clear the way for an indiscriminate one-way market reaction in either direction.

The “unsustainable” headline is far more of a nothing than the “end of Fed independence” one - and so I suppose that if these are what moved markets accordingly, then given Trump’s simultaneous “I won’t fire Powell” headline from the same day as Bessent’s “unsustainable,” SPX’s +2.5% move thereafter was erasing the prior day’s -2.3% end-of-Fed move, while Bessent’s “unsustainable” would account for the additional +0.2% of the combined +2.5% gain. Or - both are nonsense market explanations that have nothing to do with green and red blinking ticker behaviors.

“Trump says he will ‘play nice’ with China, and that China has been calling D.C. to make a deal, while China vehemently denies any such reaching out has taken place” - Markets: Risk-On

Do I really need to dispel this one as "what moved markets higher?” I don’t care if government minions on either side of this moronic Trump vs Xi economic dick measuring contest are allegedly walking back some of the tariffs quietly behind the scenes - because the top brass aren’t even publicly on the same page on whether or not they even conversed. I thought it was bad a few days ago when I wrote about Trump and Xi’s staring at their phones while awaiting the other side to call - but at least they were on the same page about their outgoing/incoming call logs at the time. Trump, Xi - one of you, if not both of you two clowns are lying, and I frankly don’t care who it is - it’s absolutely insane that this is how the heads of the two most powerful economies are behaving during this period of extreme global fragility. But for market-reading, how it is that this “Trump said vs Xi said” clown show is somehow less of a clarity destroyer than “unsustainable” is a certainty provider, and net-net “market positive” is simply beyond me - even with any supposed tariff carve-outs and exceptions included. But yeah- let’s go with: markets are up on the day / week, due to “signs of US-China making progress.”

Nobody Is Actively Trading

I will repeat what I have been saying for years prior to, and since Liberation Day:

NOBODY human is actively trading markets at all.

That means - PEOPLE with firepower are NOT deploying their actively managed capital based on ANY of these moment to moment, day to day headlines in enough size to impact and move them amidst the algo-dominated flow activity. It is the headline scanning bots, algos and computerized flows, combined with headline-irrelevant, fundamentally detached, market-mechanical flows that are moving green and red blinking tickers directionally in the post-Liberation Day era. Are there some human institutional managers and retail accounts that are buying and selling based on these moment-to-moment headlines accordingly? Yes, that tiny minority of headline-chasing risk takers are always there. Are those trickles of human trading activities large enough to attribute to the enormous swings in major DM equity indices and government bond markets that we see on-screen? Of course not.

To also repeat: businesses of all shapes and sizes around the world are on hold while all of this shit plays out - on hold for new orders placed and taken, on hold for new hires or capex expansions, on hold in giving forward guidance, on hold for IPO listings. And clearly understandable in doing so amidst extreme, immediate-term uncertainty. This is why uncertainty is worse for business than bad news is - because “bad” news is at least a pathway, whereas in uncertainty - everyone goes hands-off, and freezes in place.

So, why wouldn’t those who’s job it is to actively deploy and manage enormous sums of capital and firepower enough to actually move green and red blinking tickers with time horizons longer than 12 hours also not be hands-off? They would be, and they are. And so, nobody is trading these markets - how could they?

And finally to repeat - those human beings who are active in markets are only active because they are forced to be. And forced activity is that which is done to de-risk (nobody is forced to open new positions when markets make huge swings as they are forced to close existing positions) - and that means price-indiscriminate position exiting and moving to the sidelines, whether they like it or not. Position exiting and moving to the sidelines playing out in markets due to risk-limits, stop losses, margin calls, hedging activity and the like - none of these things are reflecting capital deployment - so again, nobody is actually proactively and purposefully/willingly trading.

And if human managed capital is hands-off and awaiting certainty, then that means less market participants, and therefore thinner market depth - i.e. less amount of capital needed to move on-screen price action. So, the absence of human trading participation means an ever larger proportion of the non-human fundamental capital (the systematic algo-driven computerized flows) trading activity in increasingly illiquid markets to have ever greater market price impact. And that is by and large what we have been seeing in global cross-asset markets throughout April.

Financial media and the vast majority of financial market commentary is SO incredibly imbedded with this notion that PEOPLE are ALWAYS and ONLY behind market price action behavior. I might be sympathetic to this, if not for the fact that every aspect of our lives is increasingly automated, and that the days of pit trading has died long ago - so no, just get with the fucking program. PEOPLE are NOT, and HAVE NOT BEEN the dominant participants in listed markets during normal times - why in the hell would so called professional money managers NOW be what is behind the swings in United States Treasury markets and mega-cap US equities, and are deploying their dry powder chasing headlines of Bessent “unsustainable” or Trump and Xi’s inability to verify their missed calls?

I know I say this seemingly every single time I make market commentary - but if this past week’s headline attribution to market price action doesn’t underscore the fact that NOBODY HUMAN is actually trading these markets, at least in enough size to impact and move them amidst the algo-dominated flow activity, then I don’t know how else to convince you. You can just believe that indeed human being fund managers are deploying and liquidating directional positions day to day, based on no more Powell, no more Fed, Bessent thinks triple digit tariffs between US and China aren’t sustainable and Trump will play nice, if only Xi would admit to calling.

Most importantly - what this “nobody is trading” means is that IF there is some tangibly concrete policy certainty that develops, then it is absolutely not priced in - as the real, human-controlled capital on the sidelines awaiting uncertainty to clear will THEN be deployed, or liquidated by CHOICE, or rebalanced, in order to reflect the new reality accordingly. And yes, I’m aware that it is earnings season and that some fundamental capital may be deployed - but if and only if C-suite delivers certainty on earnings calls - and they won’t be as long as the current status remains.

Until then - here is what is moving markets: markets themselves. (No shit, right? Right.) Here is a deep cross-asset analysis on macro market behavior in April 2025.

Global Market Impact from USDJPY 140 Support Held: USD crosses↑, US Yields ↓, US Equities↑, Gold↓

I had opened my last note: “Heads Up: USDJPY Quickly Approaching 140 Support” - with the following:

“USDJPY taking a sudden, sharp leg down and closing in on ~140 support - to then either bounce off of and reverse trend, or break thru into the 130s.”

The key here is identifying 140 as a support level - meaning (as explicitly written) - it is the market level that will either act as a pivot point of reversal if support is held, or will accelerate the prevailing downside if support is broken. And either way, will have other global macro markets to also reverse or accelerate, accordingly.

Let’s see what has transpired in markets, and beyond just USDJPY as USDJPY 140 support held and about-faced. And only after we flip through what had empirically happened in global markets will address all of the “coinciding” Trump headlines that are being unanimously attributed to explaining the market behavior into the end of this week.

USDJPY

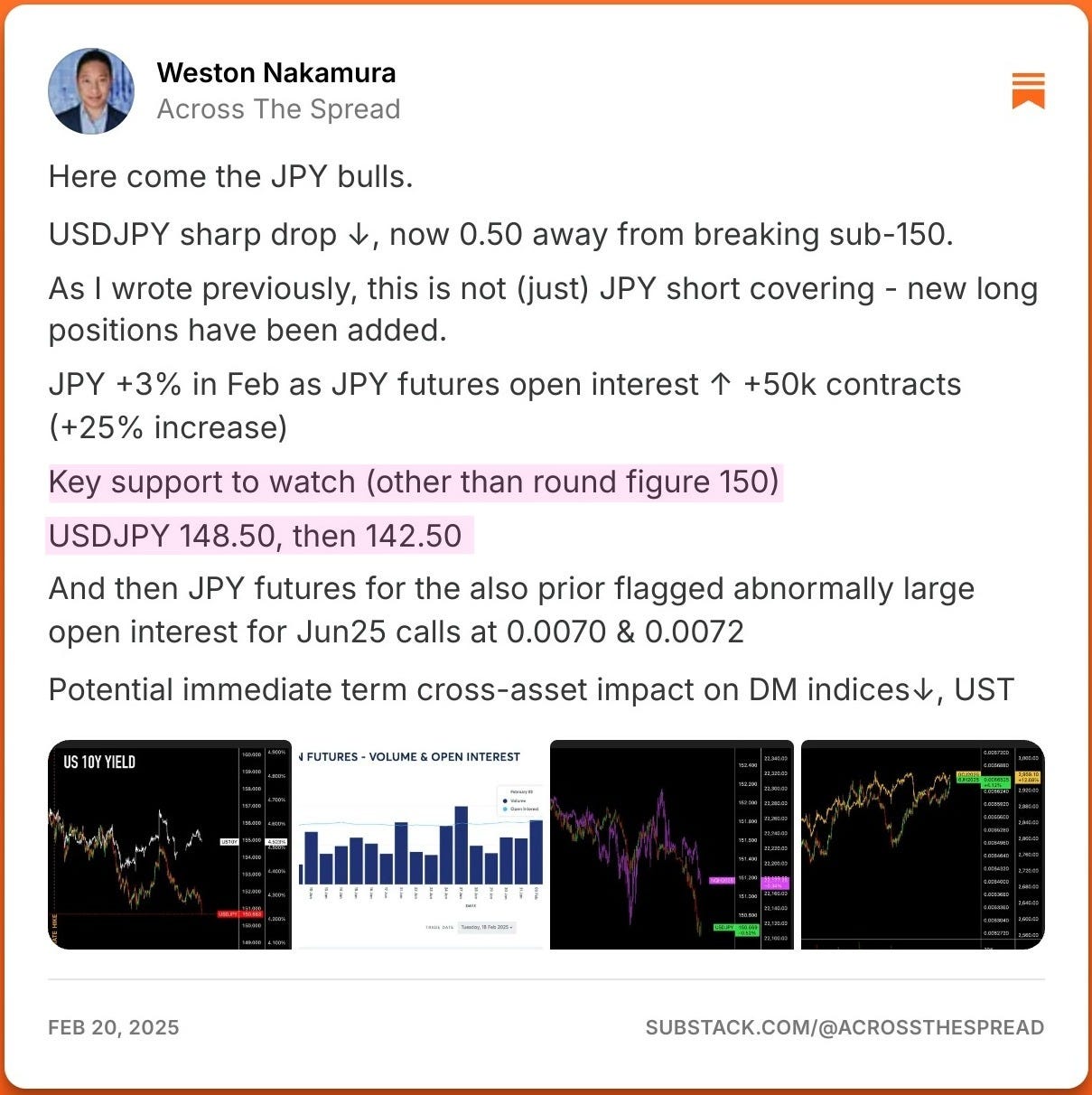

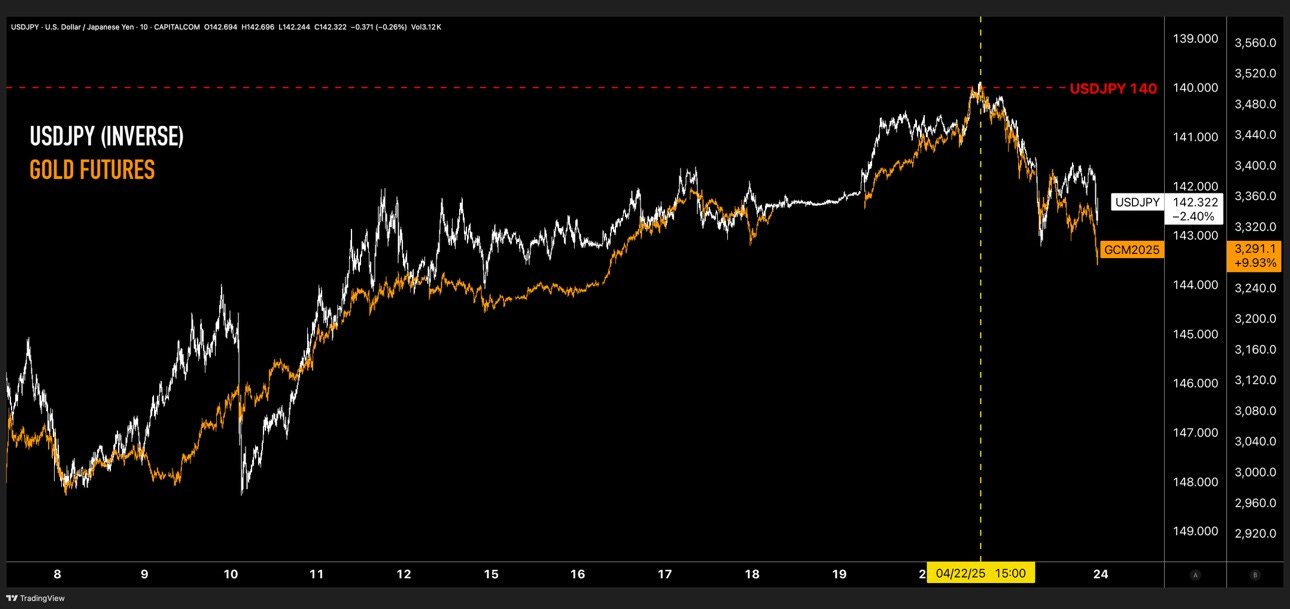

USDJPY ~140 was indeed a key support level that was properly identified, and unlike 148.50 and 141.50 that I had also identified as key support levels, 140 was a support level that didn’t break (yet). Perhaps this was in part saved by the bell - as spot USDJPY hit lows of 139.92 right at 15:00 Japan cash equity market close on April 22nd (shortly after publishing my intraday mid-Asia trading session note), and immediately began to reverse higher by +2.75% thereafter.

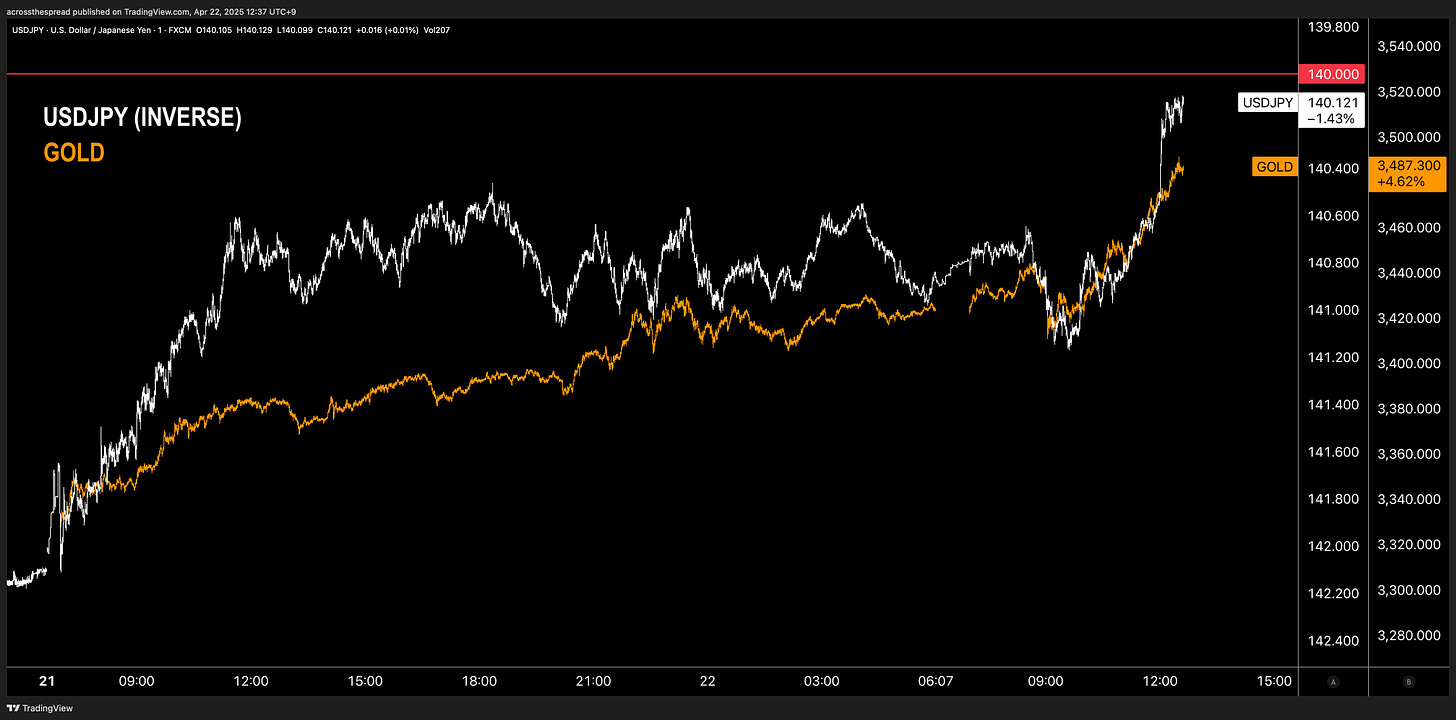

And for anyone who is currently muttering “yeah big round figure 140 - no shit…” - putting aside every other key support level in USDJPY that I had previously flagged over many years prior with near-pinpoint accuracy (as well as NOT flagging / misidentifying levels that turned out to be of no market consequence), here is once again a reminder of the other key levels USDJPY 148.50 and 141.50 that I’ve flagged during this current period of USDJPY downside that I had started to discuss back in February when USDJPY was still above 150:

I had to correct myself in my March 10th note for the typo in the note above, but then explain where those 148.50 and 142.50 support levels came from:

“Key support to watch (other than round figure 150)USDJPY 148.50, then 142.50”

I just realized that I had mis-typed the latter - it should be:

USDJPY key support levels of 148.50 (now broken), and 141.50 (not 142.50). Here is how I arrive at these levels - and as always, these aren’t precise levels down to the decimal point.

~148.50 was a level in which the post-152 breakdown/blowup found immediate-short term upside resistance (initially held in August, then broke in early October), and went from being upside resistance → downside support thereafter. That type of dynamic typically signifies a price level of significance for market positioning and activity (for what specific reasons, I actually don’t care too much).

And that half-year-held support level has now been broken.

~141.50 is the next key level of downside support to watch - this is where the mid July to early August -11% plunge (-6.5% of which had occurred in 5 trading days as the bottom fell out below YenStrike USDJPY 152) had then hit bottom and sharply reversed.

Again, my immediate-short term view remains favoring USDJPY downside - I do think that we will indeed test that next ~141.50 support.

If you read my last note, you’ll know the first two were indeed levels of support, both of which broke to the downside (148.50 - once broken clear through, then became upside resistance)

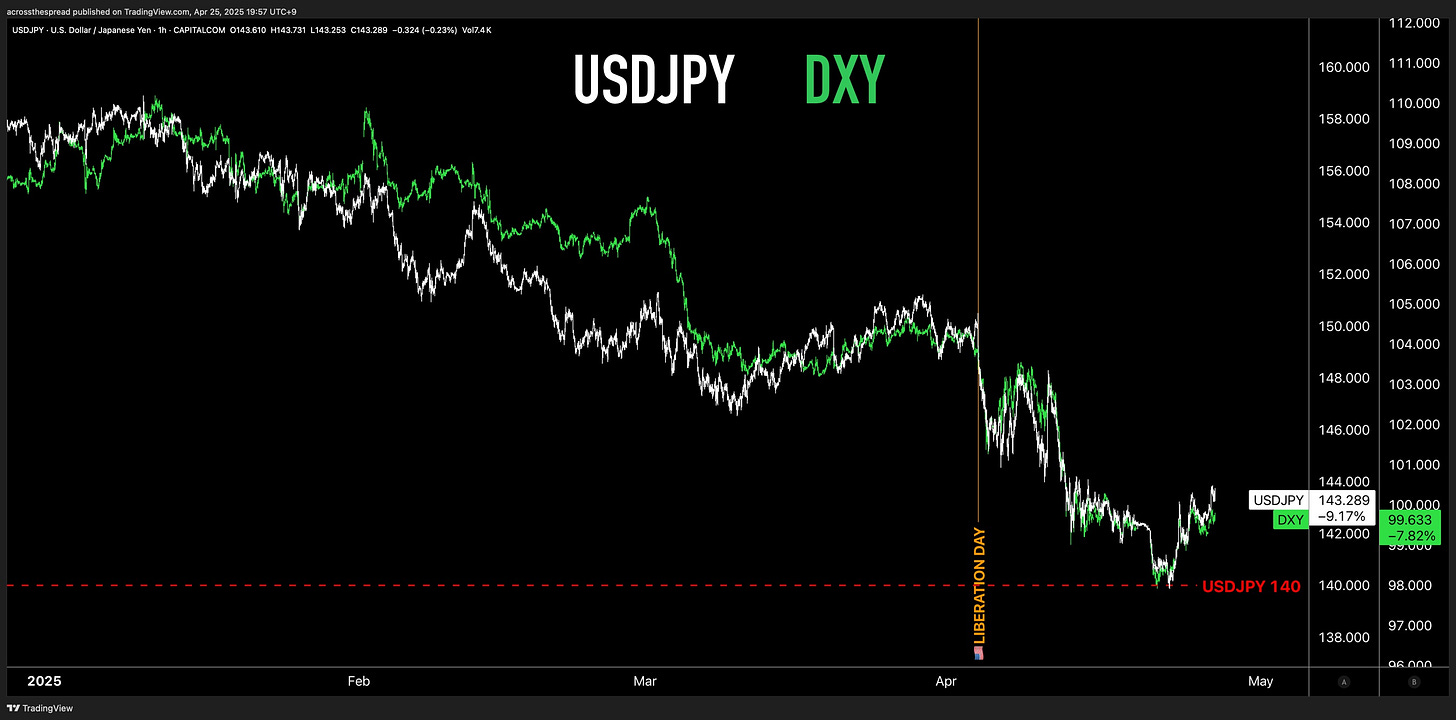

And once again - here is USDJPY 140 support, which did not break (yet), and instead had not only reversed USDJPY’s -6% plunge since liberation day, but also did the same for the broader dollar complex via DXY index.

Note that within DXY, JPY only has a 13% weighting in the index - EUR on the other hand commands 60% weighting of DXY. In other words - yes, USDJPY support at 140 had also reversed and dropped the euro directionally as well by -2%.

And no, it wasn’t some arbitrary EURUSD 115.46 “resistance” level that turned EURUSD around - in fact, EURUSD had already hit its highs a day prior, when USDJPY was still above 140.50 - but didn’t go anywhere until JPY strength reversed and rallied USD, for everyone.

What else did USDJPY bouncing off of 140 support then reverse in markets?

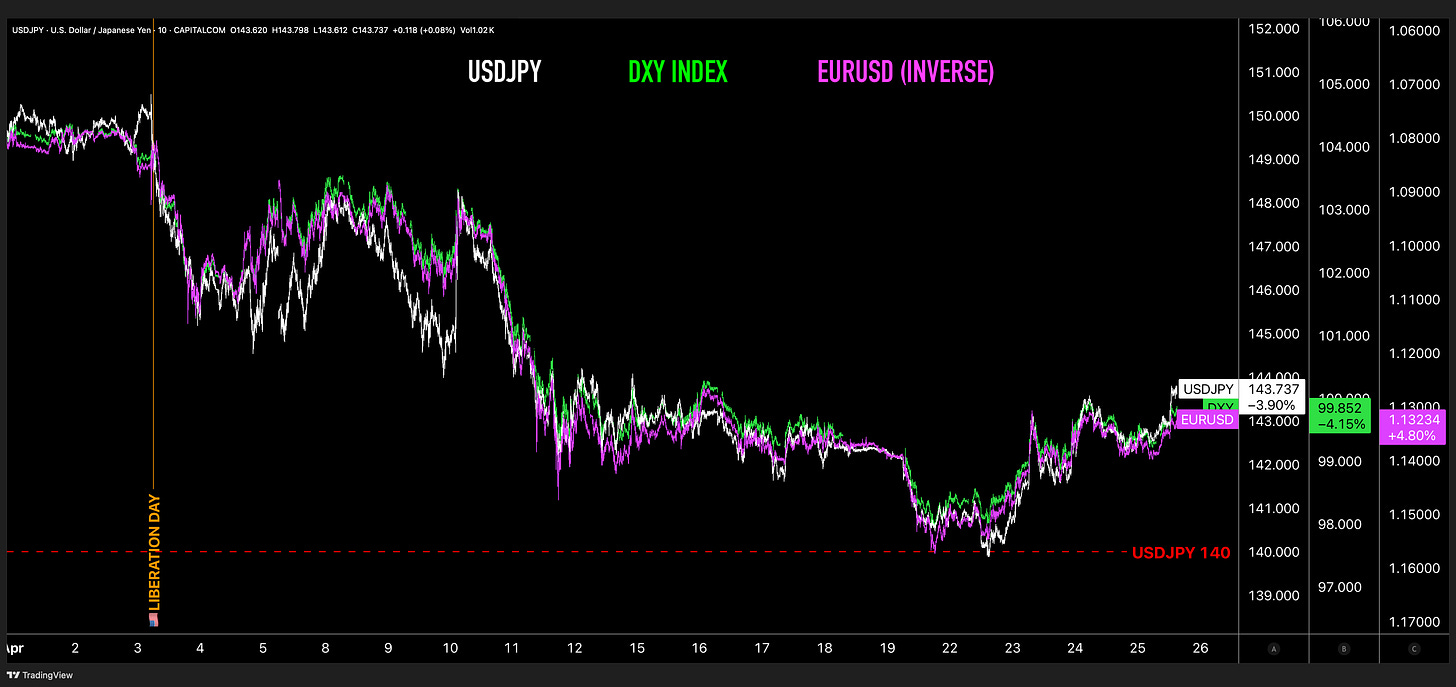

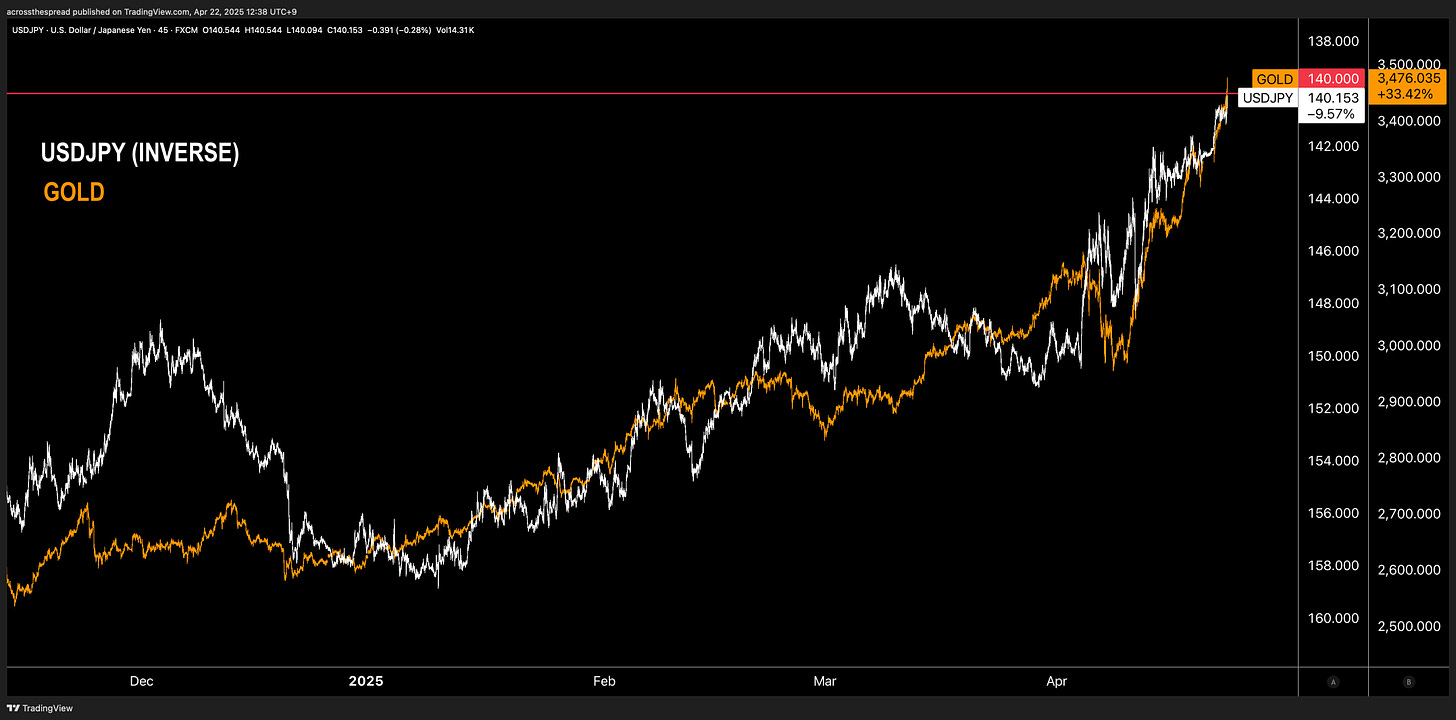

Gold - as I had also discussed in my prior note flagging USDJPY nearing 140 support, as per below:

Gold +2% on the day continues to rally alongside JPY as USDJPY 140 approaches.

FYI - if you’re wondering what’s up with gold’s relentless YTD rally, spot gold has re-correlated to JPY in 2025.

So, if USDJPY breaks meaningfully down thru the 140 level (sub-139~138) in the immediate to near term, that may very well further add fuel to spot gold upside momentum. Conversely, if USDJPY 140 support holds and reverses higher, that can trigger a sharp round of profit-taking-begetting-profit-taking on gold in the near term.

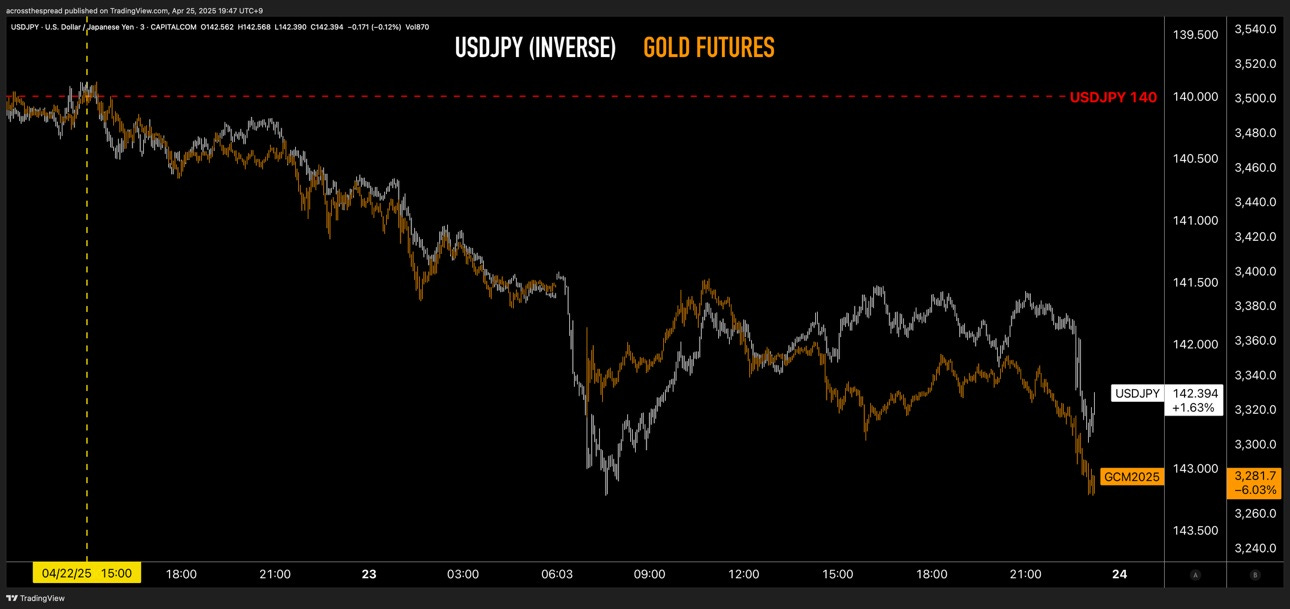

And indeed, as USDJPY 140 support held and reversed, so did the relentless gold rally, reversing the very moment USDJPY bounced off 140 and sharply falling thereafter:

That’s a -6% drop in gold futures in a little over 1 trading day. Mind you that prior to USDJPY → 140, gold was rallying to break new record highs at +33% YTD, +50% in a year, and +14% in just the last 14 trading sessions post-Liberation Day.

So yeah, JPY upside hitting its 140 ceiling vs USD had indeed triggered a sharp round of profit-taking-begetting-profit taking on the otherwise bulletproof gold rally.

JPY & US Yields

I realized after publishing my prior note that I had forgotten to address the JPY vs UST price action - so here it is.

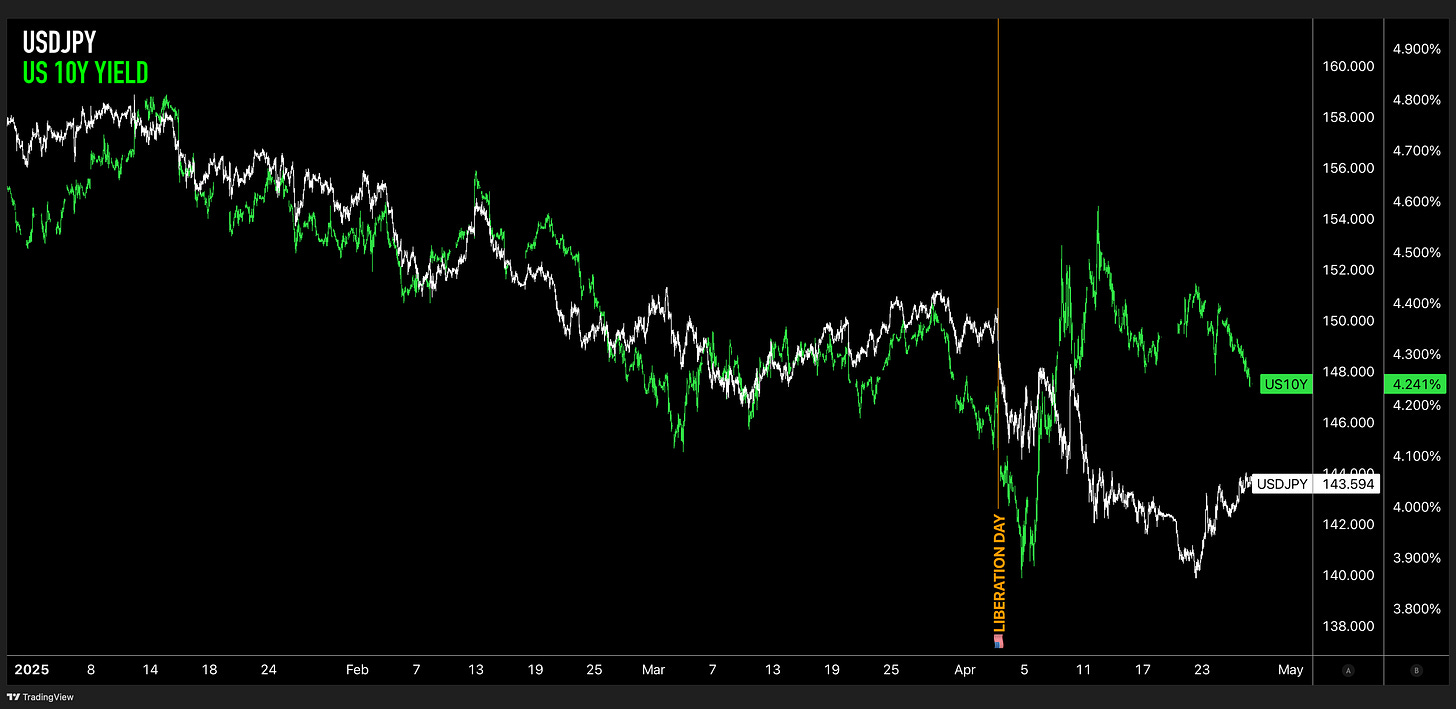

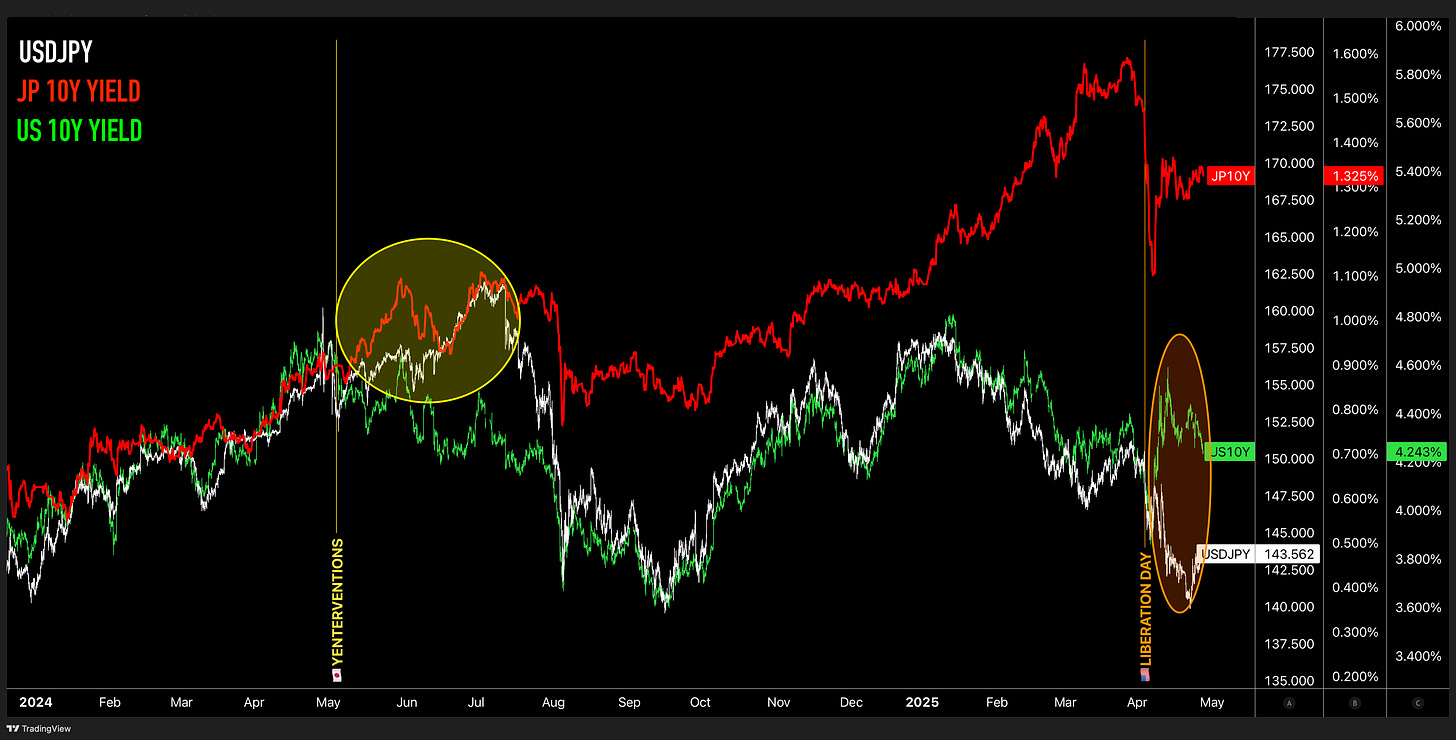

USDJPY and 10Y UST yields had been moving in lockstep for the past several months - or rather, USDJPY downside and narrowing US-JP yield spreads have traded in tandem, with JGB yields surging while UST yields fall.

But in this post-Liberation Day era, the USDJPY vs US yields correlation has blown apart.

As I have discussed and commented on countless times throughout, the USDJPY vs US yields / US-JP yield spreads lockstep correlation has not been a simple law of physics by any means in the past 12 months. Recall almost one year ago to the day when USDJPY finally broke through its once-hard-stop 152 ceiling and quickly jumped into the 160s, forcing Ministry of Finance to yentervene twice at the end of April ~ start of May 2024, and the months immediately following which saw USDJPY completely unresponsive to falling UST yields, rising JGB yields, and narrowing US-JP yield spreads. 2024 Japan yentervention round 1 was the last time USDJPY and US yields had completely decoupled - until Liberation Day 2025.

Another way to potentially look at it:

In 2024, when the Japanese government suddenly forced its non-economic, interventionist hands upon international markets, Japanese government bonds and currency were both sold off together - causing JGB yields to rise and JPY to simultaneously fall.

In 2025, when the US government suddenly forced its non-economic, interventionist hands upon international markets, US government bonds and currency were both sold off together - causing US yields to rise and USD to simultaneously fall.

Let’s even add in the often-touted and still-misunderstood “Liz Truss Moment” - when long-duration UK government bonds and currency were both sold off together - causing UK yields to rise and GBP to simultaneously fall.

Now - while all this makes for a very nicely streamlined and sexy narrative - the reality is that all three of these incidents with Japan, UK and US respective government bonds + currencies being simultaneously sold off are more so coincidental and idiosyncratic occurrences than they are a consistent "punishment of the sovereign” being enacted by broader market forces. I’m sorry to disappoint those looking for a simple and salacious narrative, but it is my duty to point out reality, particularly when it flies in the face of stories.

In Japan’s April~May ‘24 post-yentervention case of simultaneous upside in JGB yields and USDJPY was indeed markets dumping Japan sovereign assets writ large out of a loss of trust - but not necessarily a loss of trust in the solvency of the sovereign, but rather a loss of trust in the sovereign’s hands-off stance and allowing for freely functioning market pricing mechanisms. Or, at least as “freely” as Japan’s markets had usually traded until then - when JGBs were under the heavy hand of the state and JPY was left alone, to then becoming JGBs “left alone” via end of YCC and JPY intervened upon. And having this “market punishment” happening in large enough size and scale to break the traditional mechanics of yields vs currencies’ relative price behaviors.

In the UK’s case, the so-called “Liz Truss Moment” should really be referred to as the “UK LDI Moment.” While it may have been theTruss/Kwartang mini-budget unveil that had initially triggered a sudden sell-off in long dated UK gilts, the enormous spike in yields from 3.5% to 5% and GBP plunging -10% over the course of a few days was not due to some fundamental repricing of UK solvency by international markets occurring - it was a mechanical, forced liquidation event, where UK pensions’ strategy of Liability-Driven Investment (LDI) that incorporated leverage on long term UK bonds in an attempt to match assets vs liabilities had been suddenly hit and forced to fire-sell UK gilts, triggering further fire-selling, in a self-feedback loop. It was this mechanical, price- indiscriminate selling-begetting-selling phenomenon underway that had (quite ironically) then forced the Bank of England to step in and offer to buy unlimited UK gilts (emergency YCC) - which they did in order put an otherwise non-existent bid into long dated UK gilts and neutralize the runaway momentum. In other words, BOE’s temporary YCC wasn’t being enacted to backstop the Truss government, it was enacted to backstop the UK corporate pension system and its leveraged portfolio structure - which is basically the polar opposite of Japan 2024 of BOJ NOT-enacting YCC and allowing for long dated JGB yields to rise - so, not at all the same thing of some fundamental market repricing “punishment” that happened consistently across UK and Japan.

Also note that the divergence in UK gilt yields vs GBP was not some “loss of faith in the sovereign” phenomenon that had suddenly been triggered by the Truss mini-budget - while it had indeed sharply accelerated, the divergence between UK’s long dated bond yields and GBP had already been underway from the start of 2023. And again, the sharp acceleration of the UK gilt vs GBP divergence was a market-mechanical phenomenon catalyzed by a sudden and outsized price move - as also seen in the midst of the March 2020 global market mayhem.

In the US April 2025 case of US yields diverging from USD, or long-dated Treasuries and the dollar selling off in tandem - this too is more so a phenomenon of market-mechanics, rather than a fundamentally driven, sudden “loss of US global reserve status” by the international markets community’s desire to flee US markets due to Trump’s global tariff unveiling on Liberation Day - as per the widely accepted narrative.

What matters here is WHY there is selling, more so than speculating on WHO is selling, and then attaching the WHY accordingly, and thereafter.

Currently, the narrative is that US assets have lost their appeal among international investors due to Trump’s tariffs - and this narrative was hastily concluded because long-dated USTs and USD had been in decline together for a few days. That is a lot of domino-effect assumptions and givens being taken at liberty. Even if the conclusion that international investors are purposely and willingly exiting their long-term US investment holdings ends up being the case (and I am not saying this is not the case) - the analytical approach and market-reading logic being applied to arrive at that conclusion itself is what needs to be seriously reconsidered.

It doesn’t matter WHO is selling US assets (foreign investors or otherwise) if we don’t even start from the WHY US assets are being sold in such a manner, and it can lead to a dangerous flawed misreading of the fundamental situation. In other words - if the reason behind the rapid, market-moving sell-off was due to say- a forced position unwinding, which implies selling activity being taken against the actual will and desires of investment holders who are being arm-twisted by market mechanics to do so (like domestic UK pensions amidst the 2023 UK gilt crisis) - then who cares if the party being forced to do this originates from Japan or China or Europe or the United States? It isn’t being done out of fundamental intent, in such a case, and therefore, the premise of “foreign investors are selling US assets” has absolutely no tie to “…because of a loss of faith, confidence, attractiveness of US assets.” This is why the WHY matters first and foremost, and certainly before the WHO, and should never be the other way around to then mis-construct a narrative.

And in this early immediate aftermath of Trump’s liberation day tariff unveiling, it seems to once again be far more of a series of market-mechanical, cross-asset forced position unwinds underway, much of which is occurring at the hands of non-human actors (algos, bots, systematic accounts etc), rather than the entire global markets community abruptly agreeing upon ending the post-war international framework of US economic dominance - and I will explain and show why that is the case. But even if ends up not being the case of a series of rapid, forced liquidations dominated by by computerized flow activities - at the core:

It is absolutely ridiculous for us market participants, observers and commentators to hastily and seriously jump to such a massively consequential, history-jarring conclusion of a global downgrading in the relative and absolute status and role of US Treasury bonds, the US dollar, and overall global standing of the United States economic power - something that not one person in the world who is currently involved in any corner of global financial markets has seen in their careers or lifetimes - all from Donald Trump holding up a few Kinkos-printed poster-boards on the White House lawn, and a few days of misreading green and red blinking tickers and attaching arbitrary fundamental motives to them. Let alone doing so without any concrete, material evidence of market-intent, or the fact that this whole Trump tariff thing had been extremely well-flagged prior to, and is still very much an ongoing, moment-to-moment matter that is far from being settled.

So, here is a very simple and straight forward overview of what has occurred / is happening in markets, along with observations based on indisputable realities of said markets.

After US cash equity market close on April 2nd Liberation Day, as Trump unveiled his Kinkos printed posterboards of countries and tariff rates…

…the immediate market reaction was: long-dated US Treasury yields down, and USD down. This US yields↓ + USD↓ market held for three full trading days thereafter - but for some reason, is never discussed. I (seriously) don’t know why its never discussed - but I suspect its because the “selling of US assets in reaction to Trump tariffs” narrative doesn’t work unless you omit those first few days of market reaction following Trump tariffs announced.

After Kinkos-posterboard day, UST yields and USD prices remained tightly correlated to both directions. As discussed in length in my article “How Asia Is Guiding Trump Tariff Policy & Markets” - USD vs USTs divergence began to occur in markets after the NEC Director Hassett’s 90-day tariff halt “fake news” headline:

The most significant market event that had occurred in this whole “Liberation Day” saga to date wasn’t Liberation day itself, nor was it the reversal - it was the Monday after Liberation day - when a “fake news” headline of NEC Director Kevin Hassett saying there would be a 90-day halt in tariffs hit the tape, and SPX surged +7% within a half hour - only to then be shot down by the White House as “fake news” and saw markets plunge - only to then turn out not to be fake news after all later that week.

…as after that (non) fake news moment was when USD and USTs directional alignment had blown apart:

And in the subsequent official (this time) non-fake news announcement of the 90-day tariff postponement period, the divergence in USD and UST yields that was already underway had just maintained.

From here forward, I will use the USDJPY cross instead of the DXY Index in charting out USD price direction relative to US 10Y yields, as USDJPY is far more closely correlated and consequential to US yields than this stupid “dollar index” (which I truly hate and find to generally be useless in most situations).

Let’s take a closer look at market behavior throughout the rest of April, when this supposed conscious flight out of US assets by foreigners had been underway.

Keep reading with a 7-day free trial

Subscribe to Across The Spread to keep reading this post and get 7 days of free access to the full post archives.