Greetings friends,

After much feedback and discussions, along with considerations of balancing time and resources, I am pleased to announce the return of video content to Across The Spread.

And as the video incessantly repeats - this will be done in an experimental, trial and error format for the following major themes and topics that have been in the works, and will be released shortly (below).

Now, if you watch the video, it is very obvious that this was recorded prior to Joe Biden's announcement of dropping out of the 2024 elections. This was actually a re-record itself - as the first iteration was talking as post-Biden horrendous CNN debate, and pre-Trump getting shot / nearly assassinated.

And since I explicitly say in this video that I will not knowingly publish non-current analysis in light of a major fundamental event - this video is that re-do, in light of a nearly assassinated Trump heading right into RNC week.

Of course, after this recording, Biden drops out - and I then went back to the drawing board once again. But I ended up purposely using this (I suppose hypocritical) version, just to illustrate a real (and real-time) example of the very issue I am talking about regarding major events that hit and change the entire environment in the midst of working off of a now-past reality - or, at the very least, a need for a pause and observation to see if the environment had changed or not.

Upcoming Content On Major Market Themes

Below are the major market themes mentioned in the video above that will incorporate video with written content.

Japan Has A New Yentevention Strategy - And It’s Working (For Now)

Elections, Politics, Green & Red Blinking Tickers - The Japanese Foreign Bond Investors’ Role

How the Bank of Japan Buys JGBs

A quick and simple overview how the world’s first, last, and most aggressive major central bank still running QE operates in markets - before they begin a historic reversal tapering.

All three themes above are not one-offs (of course) - they are detailed primers to lay the groundwork on these respective subjects - the background and history, the context, explainers, concepts and all of the necessary foundations to reference, as market developments occur.

Though the chronological order is flipped in this instance - below is an example of how the publishing structure and chronology would ideally go:

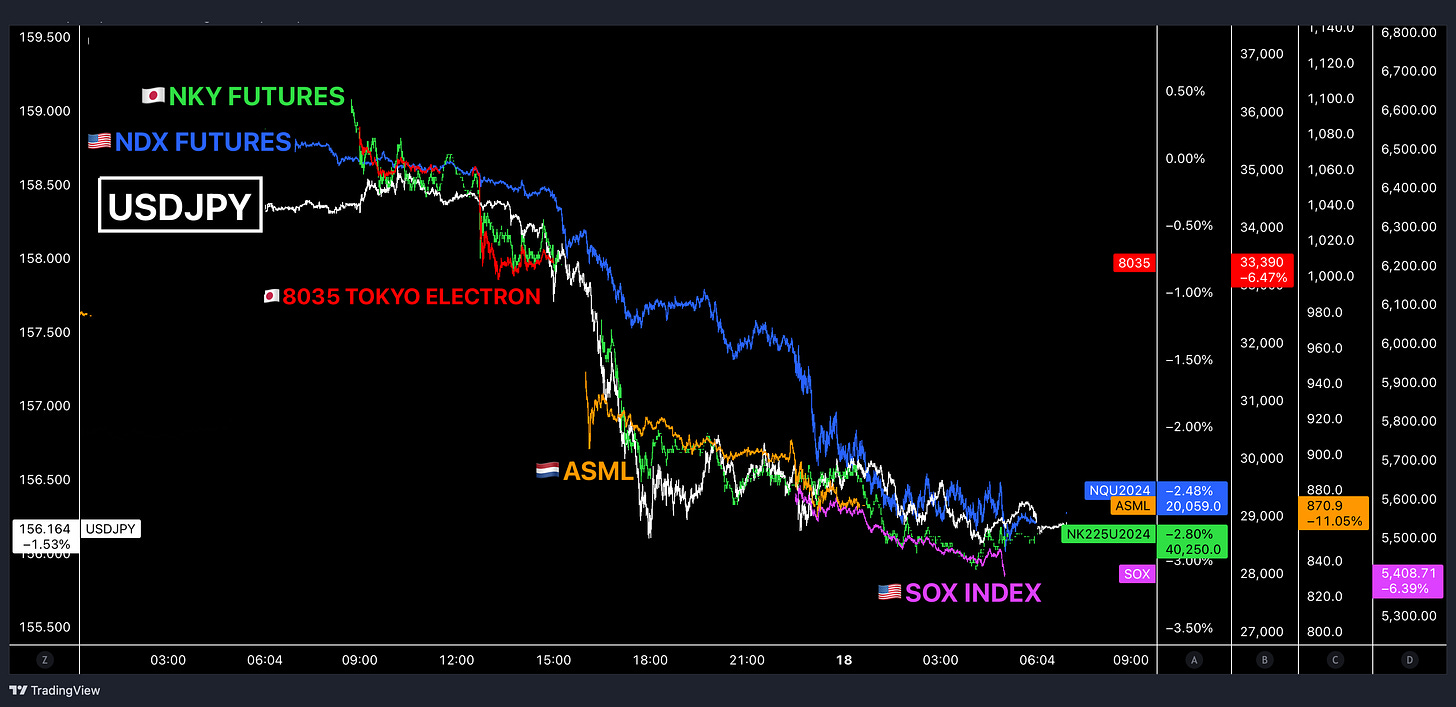

Big thematic piece publish: “Japan Has A New Yentevention Strategy - And It’s Working (For Now)” and sets the foundation for readers to be aware of and understand JPY strength under the new yentervention tactical regime - and the broader market tie-ins of a JPY carry trade forced-exiting, with global spill over effects (i.e. the “Why you should care” sections included in each article) via explanations, charts etc:

Follow up content as further developments occur (written or video) - As people start to attribute a JPY short cover and carry trade forced unwind to some non-existent “Trump Trade” (or whatever the regurgitated, blinder-wearing, US-centric explanation narrative is) - all we would need to do is to put out a quick market note and commentary addressing / dispelling the consensus major misread (like my article published yesterday below- unlocked) - and without having to re-explain the whole JPY carry trade forced unwind driven by yenterventions from scratch, as that initial foundation and framework has already been explained and established in depth and detail.

There Never Was A “Trump Trade” In July 2024 - It’s A JPY Trade

There are 3 separate and extensive pieces coming from Across The Spread, under the new format of combining written content with video (4 pieces, if counting the coming note + video on content overview). Japan Has A New Yentevention Strategy - And It’s Working (For Now)

Any further quick and real-time follow ups using Notes (as per below), or short articles:

BLOOMBERG:

“The cohort “aggressively unwound risk across their long and short books” for the week ending July 19, according to Goldman Sachs’s prime brokerage desk.

“Overall, the week was filled with painful unwinds and violent moves lower in semis, mega caps, AI momentum winners,” Goldman’s US shares sales trading team wrote in a note. “Wednesday felt like peak de-risking and fundamental long-short hedge funds pain. Most of the supply we saw was from generalists reducing exposure in year-to-date artificial intelligence winners.”

The funds’ long-short net leverage, which is often viewed as a barometer of risk appetite, fell to 49.8% last week — the lowest level since March 2023, according to Goldman’s prime brokerage desk. At a single stock level, the biggest unwinds came across information technology, health care, financials and energy.”

bloomberg.com/news/articles/2024-07-22/…

And at any point throughout the (hopefully long) shelf life of the big picture theme, you can always refer back to the original keynote piece for reference as these new, day-to-day developments occur. Such as Goldman’s prime brokerage commentary and observations cited in the Bloomberg article released earlier:

“Wednesday felt like peak de-risking and fundamental long-short hedge funds pain. Most of the supply we saw was from generalists reducing exposure in year-to-date artificial intelligence winners.”

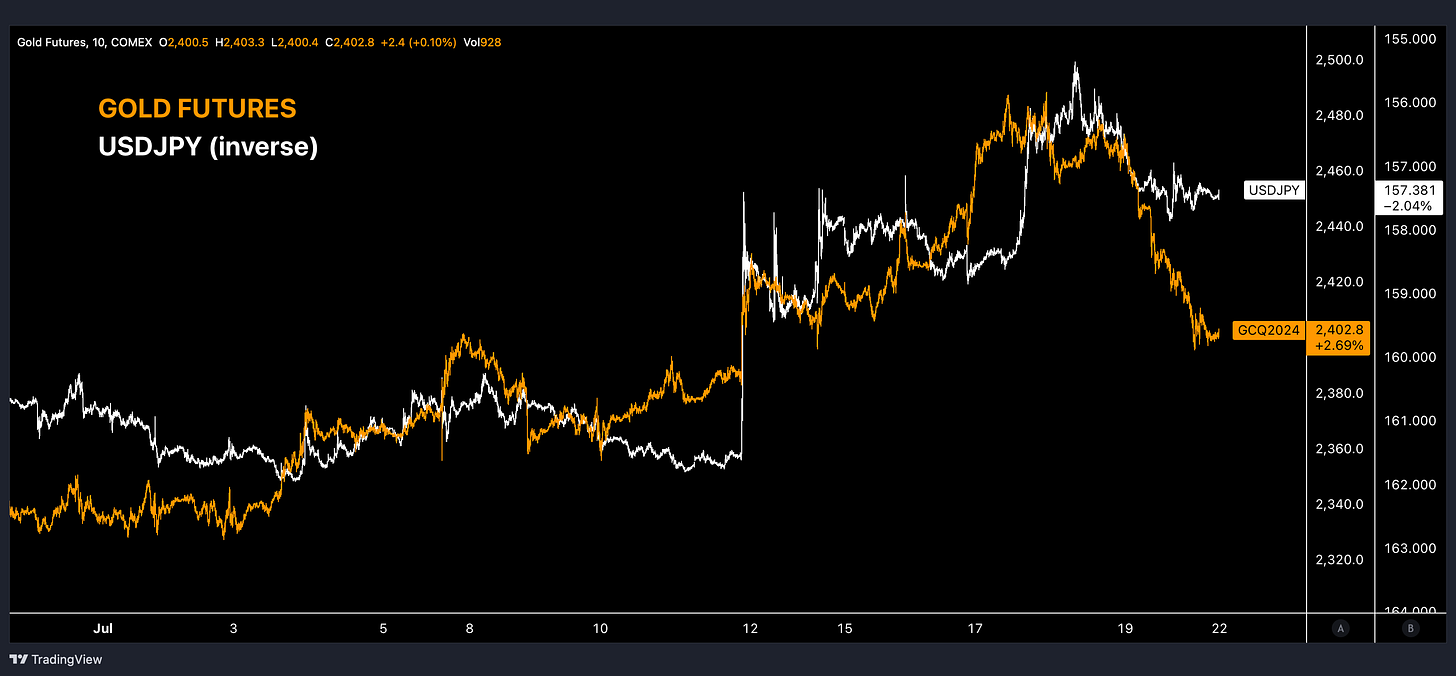

Chart below is also pulled from the original deep dive on the new yentervention strategy, which shows this “painful Wednesday of peak hedge fund de-risking / dumping YTD A.I. winners…” that the GS prime brokerage desk later confirms (but still not attributing / aware of JPY carry trade unwinding and yentervention strategy 2.0)

So, that’s the general idea of how the chronology and structure would ideally be, for now. And subject to change will definitely evolve going forward.

One last critical point on subscriptions - regarding the frequency and “publishing schedule” of Across The Spread:

There is no such thing as a publishing schedule.

In case you may not know me well - I am always in a non-stop state of market monitoring, exploration, deep-diving, researching, learning/finding out, and even participating / trading markets and related developments - as well as constantly reading and monitoring what the financial media community is saying, as well as what the investment community is publishing in terms of their own respective research and analysis. Yes, that’s why you’ll often see me awake during US market hours / middle of the night Tokyo - and publish commentary on 🇯🇵2AM day-of BOJ press leaks.

Just see how my former employer refers to me - publicly, from mid 2022 (and I 100% take this as a compliment / praise)

Damn right - markets crack addict. That’s not to be mistaken with some degenerate trader - “markets” as in - addict of trying to figure out the never ending, unsolvable, global jigsaw puzzle.

But seriously - it is only after I have satisfied my own high-bar criteria of having conducted adequately deep research and analysis, and truly believe that I have something that is worthy of flagging to a widely applicable audience, do I then put out my original proprietary thoughts, ideas, explanations, observations and opinions on markets.

Everything that I do starts and ends with being 100% market-based (green and red blinking tickers) and market developments - and I cannot control, much less know, what the hell will happen at any given time.

What this means is that if I am being genuine about flagging differentiated and overlooked but critical and widely applicable markets content, then there can be no regularity or “publishing schedule” - because markets / global events don’t operate on such a schedule. I have to follow what the world throws at me/us, despite “scheduling consistency and regularity” being the absolute critical formula for content creators to religiously follow and publish in accordance with, as per everything I see, hear and read about, and have even been directly told on multiple occasions in former content creating roles that that is a must-do. I don’t doubt for one moment that a publishing schedule will grow and retain my subscriber base, and doing so would frankly be far easier for me to do. And for anyone else who abides by those sure-fire rules - I wish nothing but success to them.

I will say - the one scheduled thing that you CAN always expect and count on commentary from me: Bank of Japan policy meetings.

But otherwise, I will not publish content based on an arbitrary time-interval. You will never see a “Weston Wednesdays” (or whatever) - because prioritizing a consistent schedule comes at the expense of consistent quality, and I will always and only commit to the latter, even if it means slower and lower growth prospects. If I’m doing “Weston Wednesdays” - well, not every Wednesday will have something of critical importance to discuss. And the Across The Spread audience will immediately recognize when there is some nonsense filler article published for a dead week. And I refuse to ever knowingly and purposely waste anyone’s never-refundable time - my own included.

So, you may hear from me 3 times in a day, or 3 times in a year (it won’t be 3/year - just making a point) - it depends solely on what the world is doing, and is out of my hands.

But - 100% of the time that you see me in your inbox, you better open and read/watch whatever it is that I have for you, in full. It wouldn’t be there if it weren’t critical.

So - if that’s not for you, that’s completely fine, no need to subscribe, and absolutely no worries - I wouldn’t want you to subscribe based on mistaken pretenses, and I am explicitly saying all of this to make sure we are on the same page, to avoid that very situation.

But if you do understand the unique value proposition of Across The Spread, and you see the massive importance and impact that the Asia region has upon the green and red blinking ticker markets that are important to you personally, and recognize how the vast majority of DM global market participants (primarily In U.S. and Europe) are absolutely clueless to this ⅓ of the planet and therefore can be exploited/front-run/info-arbed in these extremely inefficient markets, and would like to join the mission and at the same time directly contribute to the growth and never-ending pursuit of improvement of Across The Spread, please consider becoming a paid subscriber.

And those of you who are already on board, and have followed and supported my work, and are doing so because you have found it to be of genuine value to your understanding of markets you care about and applying my framework however you see fit - thank you, with true gratitude - you’ve made this possible.

Arigato friends!

Weston

Share this post